KSE 100 Index Freefall: Operation Sindoor And The Market's Reaction

Table of Contents

Understanding Operation Sindoor and its Implications

Operation Sindoor represents a significant regulatory crackdown by the Securities and Exchange Commission of Pakistan (SECP) aimed at curbing illegal trading activities and market manipulation within the KSE 100 Index and broader Pakistani stock market. The operation targets insider trading, artificial inflation of stock prices, and other forms of market manipulation that undermine fair trading practices.

- Aims and Targets: Operation Sindoor aims to restore investor confidence by ensuring a level playing field and punishing those who engage in unethical practices. Its targets include individuals and entities suspected of manipulating the market for personal gain.

- SECP Involvement and Regulatory Actions: The SECP is actively investigating suspected entities and individuals, leading to suspensions of trading, investigations, and potential legal repercussions. This assertive regulatory action is intended to deter future malpractice and enhance market integrity.

- Short-Term and Long-Term Consequences: The short-term consequence is evident in the KSE 100 Index's decline. The long-term implications depend on the effectiveness of Operation Sindoor in cleaning up the market and restoring confidence. Successful prosecution could lead to greater stability and attract more foreign investment.

- Potential for Further Regulatory Changes: The operation may trigger further regulatory changes to strengthen oversight and enhance transparency within the Pakistani stock market. These changes could include stricter penalties for market manipulation and improved surveillance mechanisms.

Immediate Market Reactions to Operation Sindoor

The immediate reaction to Operation Sindoor was a sharp decline in the KSE 100 Index. The market experienced significant volatility, with a substantial percentage drop in a relatively short period.

- Percentage Drop and Speed of Decline: The speed and magnitude of the drop reflected the extent of investor concern and panic selling. Precise figures will vary depending on the timeframe considered.

- Trading Volumes and Investor Behavior: Trading volumes surged initially as investors reacted to the news, with a significant portion of this activity likely being panic selling.

- Impact on Specific Sectors: The impact wasn't uniform across all sectors within the KSE 100. Sectors perceived as more vulnerable to manipulation experienced more pronounced declines.

- Investor Sentiment and Panic Selling: Negative investor sentiment and panic selling amplified the initial drop, creating a feedback loop that exacerbated the market's decline.

Analyzing the Contributing Factors to the KSE 100 Freefall

While Operation Sindoor played a significant role, other factors contributed to the KSE 100 Index freefall. Understanding these interconnected elements provides a more comprehensive view of the situation.

- Macroeconomic Factors: Macroeconomic instability, including high inflation rates, fluctuating currency values, and rising interest rates, impacted investor confidence and contributed to the market's overall weakness.

- Political Instability: Political uncertainty and instability can significantly impact investor sentiment and foreign investment, leading to capital flight and market declines. Any perceived political risk can exacerbate existing market vulnerabilities.

- Global Market Trends: Global market trends, such as shifts in international investor sentiment or geopolitical events, can also affect emerging markets like Pakistan's, influencing capital flows and market performance.

- Other Contributing Events: Other news and events, both domestic and international, may have played a contributing role, compounding the negative impact on investor confidence.

Strategies for Navigating the KSE 100 Market Volatility

Navigating the current market volatility requires a cautious and strategic approach. Investors should consider the following:

- Risk Management Techniques: Employing effective risk management techniques, such as setting stop-loss orders and diversifying investments, is crucial during periods of high volatility.

- Portfolio Diversification: Diversifying investments across different asset classes and sectors reduces the overall impact of market fluctuations on a portfolio.

- Long-Term Investment Strategy: A long-term investment strategy that focuses on fundamental analysis and ignores short-term market swings is essential for weathering such periods.

- Portfolio Optimization: Regularly reviewing and optimizing investment portfolios based on market conditions and personal risk tolerance is vital.

- Professional Financial Advice: Seeking advice from qualified financial professionals can provide personalized guidance and support during times of market uncertainty.

Conclusion

The KSE 100 Index freefall, largely influenced by Operation Sindoor and other contributing factors, underscores the inherent risks in the stock market. The interplay of regulatory actions, macroeconomic conditions, and global market dynamics significantly impacts market performance. Understanding these interconnected factors is vital for effective investment decision-making. Staying informed about developments related to Operation Sindoor and the KSE 100 Index is crucial for making informed investment decisions. Continue monitoring the situation and consider seeking professional financial advice to optimize your investment strategy in the face of current KSE 100 Index volatility. Learn more about effective strategies for navigating the KSE 100 market and mitigating risks associated with Pakistan Stock Market fluctuations.

Featured Posts

-

Tougher Uk Immigration Rules Impact On English Language Requirements

May 09, 2025

Tougher Uk Immigration Rules Impact On English Language Requirements

May 09, 2025 -

Analysis Williams Public Statement Regarding Doohan And Colapinto

May 09, 2025

Analysis Williams Public Statement Regarding Doohan And Colapinto

May 09, 2025 -

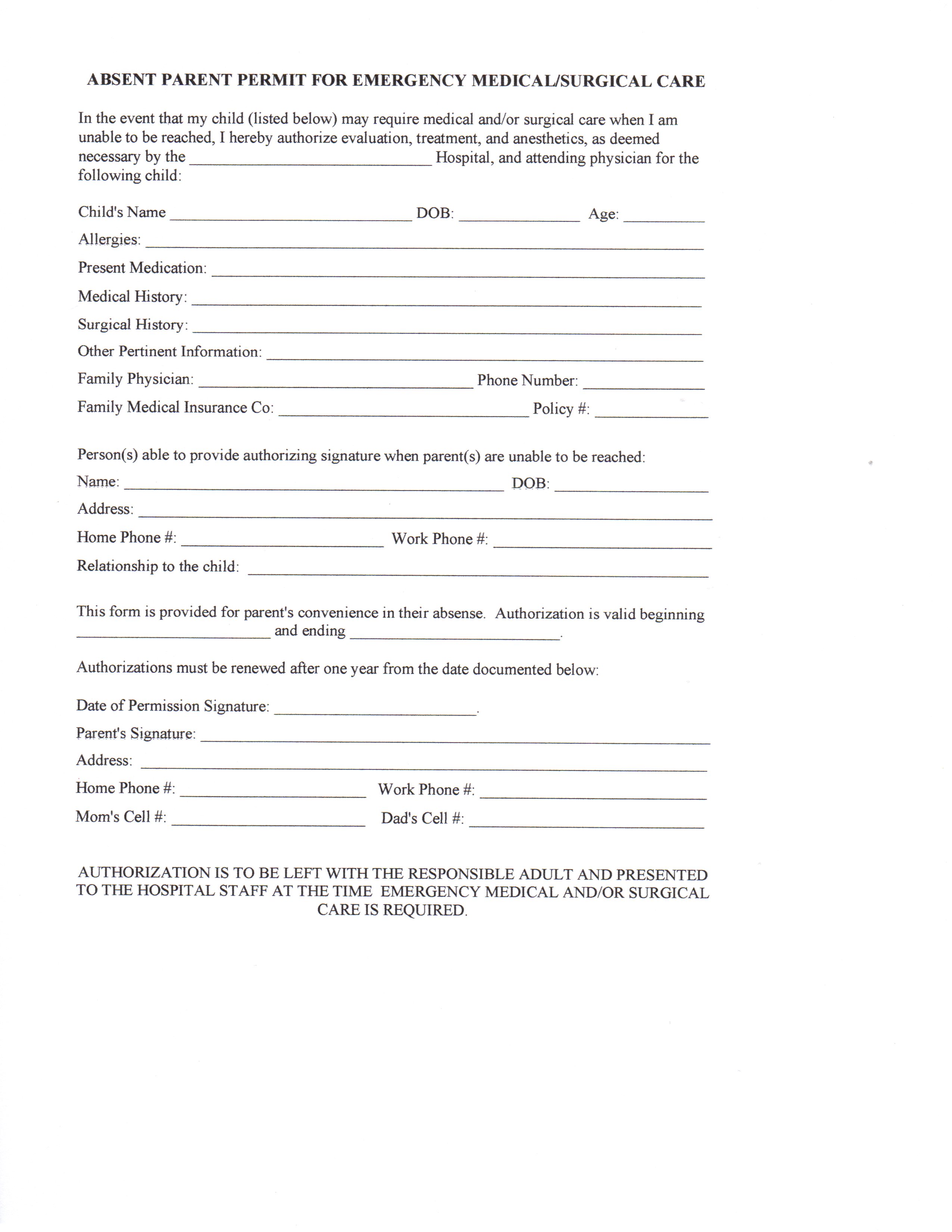

Nc Daycare License Suspension What Parents Need To Know

May 09, 2025

Nc Daycare License Suspension What Parents Need To Know

May 09, 2025 -

Msyrt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 09, 2025

Msyrt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 09, 2025 -

Sekretet E Suksesit Te Psg 11 Shenja Te Rendesishme

May 09, 2025

Sekretet E Suksesit Te Psg 11 Shenja Te Rendesishme

May 09, 2025