Land Your Dream Job: 5 Do's And Don'ts In The Private Credit Industry

Table of Contents

Do: Network Strategically in the Private Credit Sector

Building a strong network is paramount in securing a private credit job. The industry thrives on relationships, and proactive networking significantly increases your chances of landing your dream role.

Attend Industry Events

Conferences and workshops are invaluable networking hubs. They offer opportunities to meet key players, learn about industry trends, and showcase your expertise.

- SuperReturn: A leading global private equity and infrastructure investment event series.

- SDA events: The Structured Debt Association hosts numerous events focusing on private credit and alternative lending.

- Industry-specific conferences: Research smaller, niche conferences relevant to your specific area of interest within private credit (e.g., direct lending, distressed debt, etc.).

To maximize your impact at these events, prepare talking points highlighting your skills and interests in private credit, and always follow up with new contacts within 24 hours.

Leverage LinkedIn Effectively

Your LinkedIn profile is your digital resume. Optimize it with relevant keywords like "private debt," "alternative lending," "direct lending," "credit analysis," and "structured finance."

- Keywords: Integrate these keywords naturally throughout your headline, summary, and experience sections.

- Experience Description: Quantify your achievements whenever possible (e.g., "Increased efficiency by 15% through process improvement").

- Profile Picture: Use a professional headshot.

Actively engage with industry professionals by commenting on relevant posts, joining private credit groups, and connecting with recruiters specializing in private debt and alternative lending.

Informational Interviews

Informational interviews provide invaluable insights and networking opportunities. Reach out to professionals working in private credit roles that interest you.

- Questions to Ask: "What are the biggest challenges in your role?", "What skills are most important for success?", "What advice would you give to someone entering the field?"

- Follow Up: Send a thank-you note and keep in touch. These connections can lead to future opportunities.

Do: Tailor Your Resume and Cover Letter for Private Credit Roles

Generic applications rarely succeed. Tailoring your materials for each private credit job application significantly increases your chances.

Keyword Optimization

Use keywords from the job description in your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a potential match.

- Keywords: "Direct lending," "fund management," "credit analysis," "structured finance," "asset-based lending," "mezzanine financing."

- Natural Incorporation: Avoid keyword stuffing. Weave keywords naturally into your descriptions of experience and skills.

Highlight Relevant Skills

Showcase skills crucial to private credit roles, such as financial modeling, credit underwriting, and deal structuring.

- Key Skills: Financial modeling (Excel, Bloomberg Terminal), credit analysis, debt structuring, due diligence, legal documentation review, communication, and teamwork.

- Quantifiable Achievements: Instead of "Managed portfolio," use "Managed a $50 million portfolio of private credit investments, resulting in a 12% return."

Showcase Your Understanding of the Industry

Demonstrate your knowledge of market trends and recent developments in private credit.

- Key Publications: Follow industry publications like PEI Media, Private Debt Investor, and Debtwire.

- Subtle Showcasing: Mention relevant industry news or trends in your cover letter to demonstrate your awareness and interest.

Don't: Neglect Your Financial Modeling Skills

Proficiency in financial modeling is non-negotiable in private credit. You'll need to build complex models to analyze potential investments.

- Excel Mastery: Develop strong Excel skills, including proficiency in functions like DCF, LBO, and sensitivity analysis.

- Software Proficiency: Consider learning other modeling software like Argus or similar platforms used in private credit analysis.

- Improve Skills: Take online courses or workshops to enhance your modeling capabilities.

Don't: Underestimate the Importance of Soft Skills

While technical skills are crucial, soft skills are equally vital. Private credit requires strong collaboration and communication.

- Communication: Clearly and concisely convey complex financial information.

- Teamwork: Effectively collaborate with colleagues across different departments.

- Problem-solving: Analyze complex situations and develop creative solutions.

Don't: Settle for a Job That Doesn't Excite You

The private credit industry is vast. Find a role that aligns with your interests and long-term career goals within private debt or alternative lending.

- Identify Interests: Do you prefer direct lending, distressed debt, or mezzanine financing?

- Research Firms: Research firms known for their culture and opportunities in your preferred area.

Conclusion

Landing your dream job in private credit requires a strategic combination of hard and soft skills, networking prowess, and targeted job applications. By following these do's and don'ts, you significantly increase your chances of success. Remember to network strategically, tailor your applications, hone your financial modeling skills, highlight your soft skills, and choose a role that excites you. Start networking today and land your dream job in private credit! [Link to relevant job board]

Featured Posts

-

Des Moines School Track Meet Cancelled After Shots Fired

May 30, 2025

Des Moines School Track Meet Cancelled After Shots Fired

May 30, 2025 -

Pasxalines Tileoptikes Metadoseis E Thessalia Gr Odigos Programmatos

May 30, 2025

Pasxalines Tileoptikes Metadoseis E Thessalia Gr Odigos Programmatos

May 30, 2025 -

Mobilite Durable Au Vietnam Le Role Cle De La Cooperation Avec La France

May 30, 2025

Mobilite Durable Au Vietnam Le Role Cle De La Cooperation Avec La France

May 30, 2025 -

Alcarazs Comeback Victory Monte Carlo Masters Triumph

May 30, 2025

Alcarazs Comeback Victory Monte Carlo Masters Triumph

May 30, 2025 -

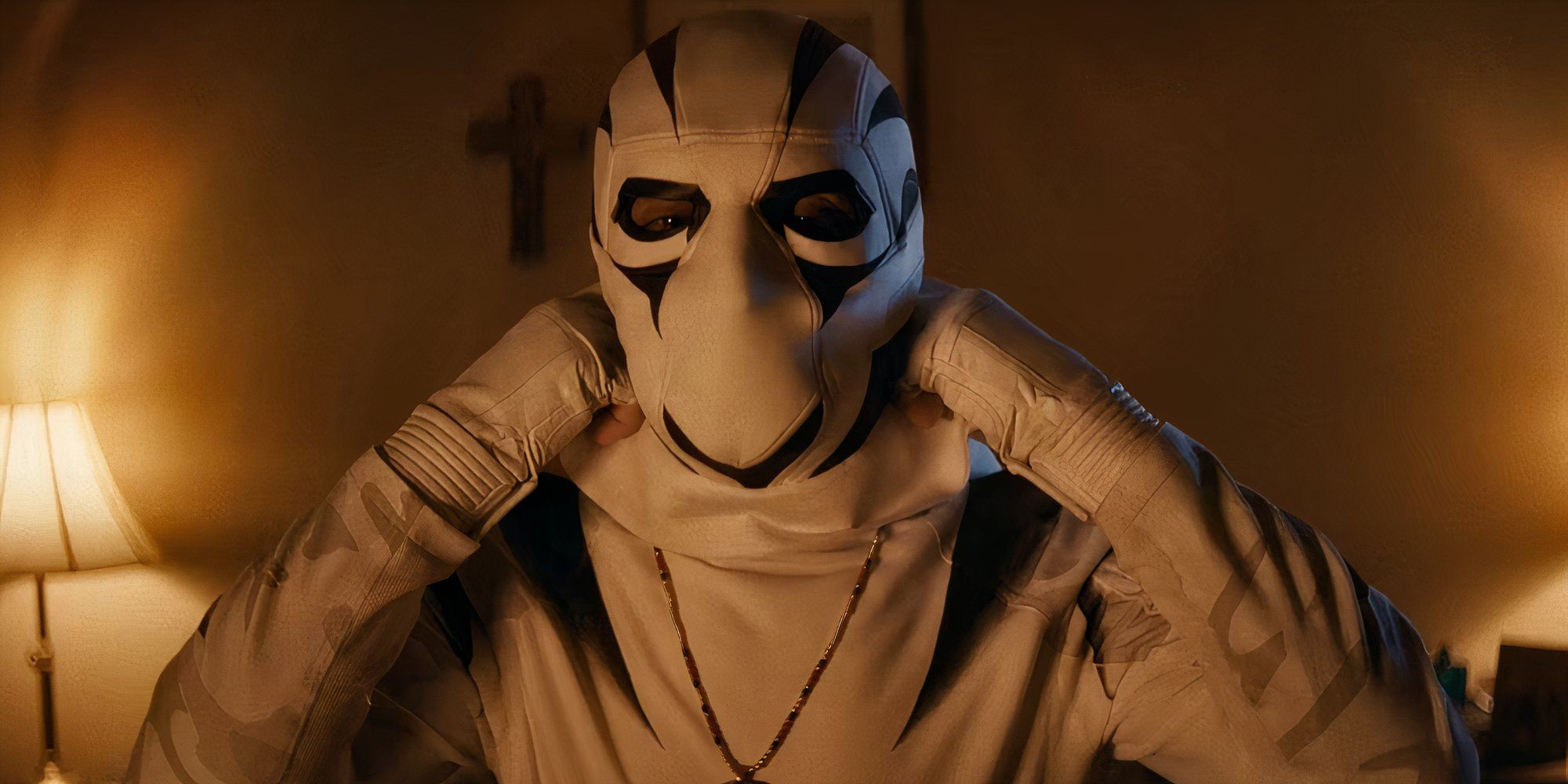

The Cut White Tiger Scene In Daredevil Born Again Episode 4 Analysis And Speculation

May 30, 2025

The Cut White Tiger Scene In Daredevil Born Again Episode 4 Analysis And Speculation

May 30, 2025