Land Your Dream Private Credit Role: 5 Do's And Don'ts To Follow

Table of Contents

5 Do's to Land Your Dream Private Credit Role

Do 1: Tailor Your Resume and Cover Letter to the Specific Private Credit Role

Your resume and cover letter are your first impression. Generic applications rarely succeed in the competitive private credit market. To stand out, you must demonstrate a clear understanding of the specific role and the firm's investment strategy.

- Highlight relevant experience: Focus on achievements demonstrating financial analysis, credit assessment, and portfolio management skills within private credit. Did you increase ROI on a specific portfolio? Reduced defaults? Quantify your successes.

- Quantify your accomplishments: Use metrics (e.g., "Increased ROI by 15%," "Reduced defaults by 10%"). Numbers speak louder than words in finance.

- Keywords are key: Incorporate relevant keywords directly from the job description. This might include terms like leveraged buyouts, distressed debt, mezzanine financing, senior secured loans, private equity, credit underwriting, credit risk management, and specific software.

- Showcase private credit-specific software proficiency: Mention experience with Bloomberg Terminal, Argus, DealCloud, or other relevant software used in private credit analysis. Demonstrate your technical capabilities.

Do 2: Network Strategically Within the Private Credit Industry

Networking is paramount in the private credit world. Building relationships can open doors to opportunities you might not find through online applications alone.

- Attend industry events: Conferences, seminars, and networking events provide excellent opportunities to meet professionals and learn about new private credit roles.

- Leverage LinkedIn: Connect with people working in private credit, join relevant groups (e.g., groups focused on private debt, leveraged finance, or specific credit strategies), and actively engage in discussions.

- Informational interviews: Request informational interviews to learn about different roles and gain insights into the industry. These conversations can be invaluable in understanding the nuances of specific private credit positions.

- Build relationships: Cultivate strong relationships; you never know where your next opportunity might come from. A strong network is a powerful asset in your job search.

Do 3: Prepare Thoroughly for Private Credit Interviews

Thorough preparation is the key to success in any private credit interview. Anticipate questions and practice your responses.

- Research the firm: Understand their investment strategy, portfolio, recent transactions, and cultural fit. Show your genuine interest by demonstrating your knowledge.

- Practice behavioral questions: Prepare answers that highlight your problem-solving abilities, teamwork skills, and resilience. Use the STAR method (Situation, Task, Action, Result) to structure your responses effectively.

- Prepare technical questions: Brush up on your knowledge of financial modeling, valuation, credit analysis techniques, and relevant accounting principles. Be ready to discuss complex financial concepts.

- Ask insightful questions: Show your genuine interest by asking thoughtful questions about the role, the team, the firm's culture, and their current investment focus.

Do 4: Showcase Your Understanding of Private Credit Investment Strategies

Demonstrate a deep understanding of various private credit strategies and market dynamics. This is crucial for demonstrating your expertise.

- Demonstrate knowledge of different private credit strategies: Distressed debt, mezzanine financing, senior secured loans, unitranche, and other strategies should be within your understanding. Be able to discuss the risks and rewards of each.

- Discuss market trends: Show your awareness of current market conditions (e.g., interest rate changes, economic forecasts) and their impact on private credit investments.

- Explain your investment philosophy: Articulate your approach to credit analysis and risk management. What are your key considerations when evaluating an investment?

- Highlight your understanding of due diligence processes: Explain your experience in conducting thorough due diligence on potential investments. This demonstrates your practical experience in private credit.

Do 5: Follow Up After the Interview

Following up demonstrates your professionalism and continued interest in the private credit role.

- Send a thank-you note: Express your gratitude and reiterate your interest in the specific private credit role. Personalize it to each interviewer.

- Maintain contact: Follow up with the interviewer(s) a week or two after the interview to inquire about the status of your application. Don't be overly persistent, but a polite follow-up is appropriate.

- Stay positive: Remain enthusiastic and persistent throughout the hiring process.

5 Don'ts to Avoid When Seeking a Private Credit Role

Don't 1: Submit a Generic Resume and Cover Letter

A generic application shows a lack of effort and interest. It will likely be overlooked.

- Avoid generic templates: Tailor your application materials to each specific private credit opportunity. Highlight the skills and experience most relevant to the particular role.

- Don't overlook detail: Ensure your resume and cover letter are free of errors and inconsistencies. Proofread carefully!

Don't 2: Neglect Networking Opportunities

Networking is not optional; it's essential. Don't miss opportunities to connect with people in the industry.

Don't 3: Underprepare for Private Credit Interviews

Going unprepared shows a lack of seriousness and significantly reduces your chances of success.

Don't 4: Lack Understanding of Private Credit Fundamentals

A strong foundation in private credit concepts and terminology is crucial. Brush up on key concepts before your interviews.

Don't 5: Fail to Follow Up

Following up shows your interest and professionalism. Don't leave the process to chance.

Conclusion

Securing your dream private credit role requires a combination of skill, preparation, and strategic action. By following these five "Do's" and avoiding the five "Don'ts," you'll significantly increase your chances of success. Remember to tailor your applications, network effectively, prepare thoroughly for interviews, demonstrate your understanding of private credit, and consistently follow up. Don't delay – start implementing these strategies today and land your dream private credit role!

Featured Posts

-

Double Strike Cripples Hollywood Writers And Actors Demand Fair Treatment

Apr 26, 2025

Double Strike Cripples Hollywood Writers And Actors Demand Fair Treatment

Apr 26, 2025 -

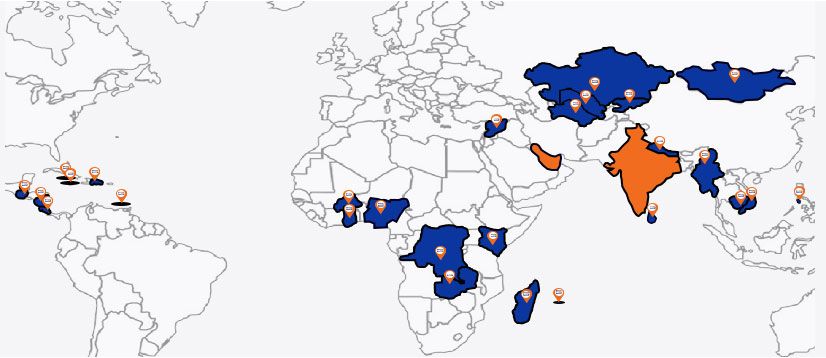

Identifying And Mapping Promising New Business Areas In The Country

Apr 26, 2025

Identifying And Mapping Promising New Business Areas In The Country

Apr 26, 2025 -

Trump On Ukraine And Nato Assessing The Political Landscape

Apr 26, 2025

Trump On Ukraine And Nato Assessing The Political Landscape

Apr 26, 2025 -

Exploring The Global Impact Of Chinese Vehicle Manufacturing

Apr 26, 2025

Exploring The Global Impact Of Chinese Vehicle Manufacturing

Apr 26, 2025 -

Nintendo Switch 2 Preordering At Game Stop My Experience

Apr 26, 2025

Nintendo Switch 2 Preordering At Game Stop My Experience

Apr 26, 2025

Latest Posts

-

Jannik Sinners Doping Case A Timeline And Analysis

Apr 27, 2025

Jannik Sinners Doping Case A Timeline And Analysis

Apr 27, 2025 -

Resolution Reached In World No 1 Tennis Players Doping Inquiry

Apr 27, 2025

Resolution Reached In World No 1 Tennis Players Doping Inquiry

Apr 27, 2025 -

Jannik Sinner And The Wada A Doping Case Settlement

Apr 27, 2025

Jannik Sinner And The Wada A Doping Case Settlement

Apr 27, 2025 -

Upset In Charleston Pegulas Dramatic Win Against Collins

Apr 27, 2025

Upset In Charleston Pegulas Dramatic Win Against Collins

Apr 27, 2025 -

Charleston Open Pegulas Epic Comeback Defeats Collins

Apr 27, 2025

Charleston Open Pegulas Epic Comeback Defeats Collins

Apr 27, 2025