Landmark Saudi Rule Change: Unlocking A Booming ABS Market

Table of Contents

Easing Regulatory Hurdles for ABS Issuance

The new regulations significantly simplify the process of issuing ABS in Saudi Arabia, making it far more attractive for companies of all sizes. This simplification directly addresses previous bottlenecks, encouraging greater participation and market expansion.

Simplified Issuance Procedures

The new rules streamline the issuance process, reducing bureaucratic hurdles and promoting efficiency. This translates to significant cost and time savings for issuers.

- Reduced paperwork: The new regulations minimize the required documentation, reducing the administrative burden on issuers.

- Faster approvals: Streamlined application processes and shorter review times lead to quicker approvals, accelerating project timelines.

- Clearer guidelines: Improved clarity in regulatory guidelines minimizes ambiguity and uncertainty, reducing the risk of delays.

- Improved transparency: Increased transparency throughout the process fosters trust and confidence among all stakeholders.

For example, the introduction of online application portals has significantly reduced processing times, shortening the approval period from months to weeks in some cases. This enhanced efficiency is a key driver of increased ABS issuance.

Broadened Eligibility Criteria

The broadened eligibility criteria are a game-changer, allowing a wider range of assets to be securitized. This unlocks new opportunities for issuers across various sectors, fostering greater market depth and liquidity.

- Inclusion of previously ineligible assets: The new regulations include assets previously excluded, such as receivables from specific sectors (e.g., healthcare, education) and certain types of real estate projects. This significantly expands the potential pool of securitizable assets.

- Increased participation from SMEs: The simplified process and broadened criteria create easier access to funding for small and medium-sized enterprises (SMEs), a critical segment often underserved by traditional financing channels.

This inclusivity ensures that a broader range of businesses can benefit from ABS financing, contributing to overall economic growth and diversification. The inclusion of previously ineligible asset classes, such as certain types of real estate and infrastructure projects, further deepens the market and attracts a wider range of investors.

Attracting Foreign Investment in the Saudi ABS Market

The regulatory overhaul has dramatically enhanced the attractiveness of the Saudi ABS market to foreign investors. The increased transparency, alignment with international standards, and improved investor protections are key factors driving this influx of capital.

Enhanced Investor Confidence

The clarity and transparency of the new regulations have significantly boosted investor confidence, both regionally and internationally. This translates to increased liquidity and a more robust market.

- Improved credit ratings: The strengthened regulatory framework and improved transparency contribute to better credit ratings for Saudi ABS, attracting more risk-averse investors.

- Increased market liquidity: The influx of both domestic and foreign investment enhances market liquidity, making it easier to buy and sell ABS.

- Stronger regulatory framework: The robust regulatory environment provides greater certainty and protection for investors, reducing perceived risks.

Specific measures, such as the establishment of independent credit rating agencies and the implementation of robust disclosure requirements, have significantly enhanced transparency and investor confidence. This is attracting substantial Foreign Direct Investment (FDI) into the Saudi ABS market.

Alignment with International Best Practices

The revised framework aligns Saudi Arabia's ABS market with global standards, making it more appealing to international investors familiar with these practices.

- Compliance with international accounting standards: Adoption of internationally recognized accounting standards (e.g., IFRS) ensures consistency and comparability, attracting global investors.

- Adoption of global risk management practices: The implementation of globally recognized risk management practices enhances the credibility and stability of the market.

The adoption of Basel III principles, for example, demonstrates Saudi Arabia's commitment to aligning with international best practices, further solidifying its position as a globally competitive ABS market. This alignment reduces uncertainty and risk for international investors, encouraging greater participation.

Stimulating Economic Growth through the Saudi ABS Market

The growth of the Saudi ABS market is a significant catalyst for economic development, providing businesses with enhanced access to finance and contributing to economic diversification.

Increased Access to Finance for Businesses

The improved ABS market provides companies, especially SMEs, with easier and cheaper access to capital. This fuels business expansion, innovation, and job creation.

- Lower borrowing costs: Increased competition among investors leads to lower borrowing costs for businesses, making expansion and innovation more feasible.

- Increased availability of credit: A more robust ABS market increases the overall availability of credit for businesses, addressing a critical financing gap.

- Greater investment in infrastructure and technology: Easier access to capital enables businesses to invest in infrastructure upgrades and technological advancements, boosting productivity.

The availability of affordable credit fosters economic development and job creation, particularly within sectors like infrastructure, technology, and renewable energy.

Diversification of the Saudi Economy

The growth of the ABS market contributes to a more diversified and resilient Saudi economy, reducing reliance on traditional sectors and promoting sustainable growth.

- Development of new financial instruments: The evolving market fosters the development of innovative financial instruments, providing more sophisticated financing options for businesses.

- Increased participation from non-traditional sectors: The broadened eligibility criteria encourage participation from previously underserved sectors, leading to a more diversified and dynamic economy.

By promoting innovation and reducing dependence on traditional industries like oil, the ABS market actively contributes to the Kingdom's Vision 2030 goals of economic diversification and sustainable growth.

Conclusion

The landmark regulatory changes in Saudi Arabia's ABS market represent a significant step towards a more robust and dynamic financial sector. By streamlining issuance procedures, attracting foreign investment, and stimulating economic growth, these changes pave the way for a booming Saudi ABS market. Companies looking to access capital and investors seeking attractive opportunities should actively explore the potential of this rapidly evolving market. Understanding the implications of this Saudi ABS market transformation is crucial for anyone involved in or interested in the Saudi Arabian financial landscape. Don't miss out on the opportunities presented by this burgeoning market – learn more about the Saudi ABS market and its potential for growth today!

Featured Posts

-

Ohio Train Derailment Investigation Into Lingering Toxic Chemical Contamination

May 03, 2025

Ohio Train Derailment Investigation Into Lingering Toxic Chemical Contamination

May 03, 2025 -

Is Joe Biden Responsible For The Economic Slowdown A Critical Analysis

May 03, 2025

Is Joe Biden Responsible For The Economic Slowdown A Critical Analysis

May 03, 2025 -

Concerts Danse Et Cinema A La Seine Musicale 2025 2026

May 03, 2025

Concerts Danse Et Cinema A La Seine Musicale 2025 2026

May 03, 2025 -

Arkansas Real Estate Keller Williams Announces New Affiliate

May 03, 2025

Arkansas Real Estate Keller Williams Announces New Affiliate

May 03, 2025 -

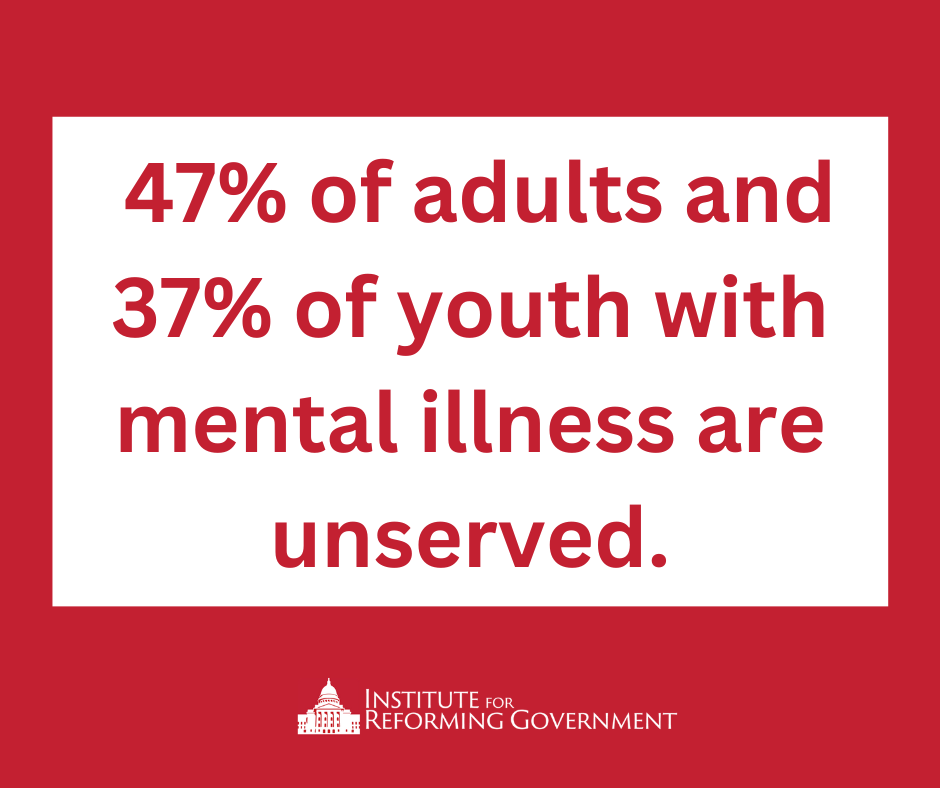

Reforming Mental Health Care A Path Forward

May 03, 2025

Reforming Mental Health Care A Path Forward

May 03, 2025

Latest Posts

-

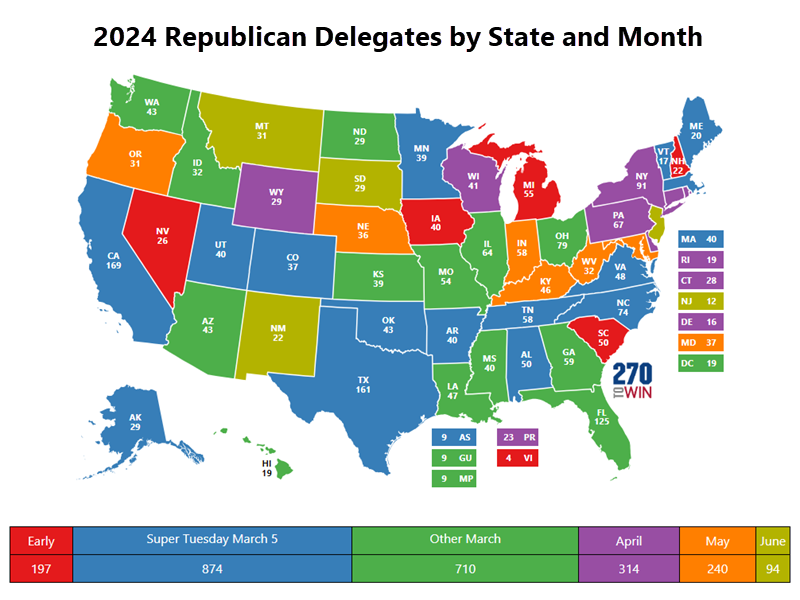

Nc Supreme Court Election Appeal Implications Of The Gop Candidates Action

May 03, 2025

Nc Supreme Court Election Appeal Implications Of The Gop Candidates Action

May 03, 2025 -

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 03, 2025

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 03, 2025 -

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025 -

Maines Post Election Audit Pilot Transparency And Accountability

May 03, 2025

Maines Post Election Audit Pilot Transparency And Accountability

May 03, 2025 -

Recent Survey 93 Of Respondents Trust South Carolina Elections

May 03, 2025

Recent Survey 93 Of Respondents Trust South Carolina Elections

May 03, 2025