Landmark Saudi Rule Change: Unlocking A Massive ABS Market

Table of Contents

The New Regulations: What Has Changed?

The recent amendments to Saudi Arabia's regulatory framework have significantly altered the landscape for Asset-Backed Securities (ABS). These changes have streamlined the process of ABS issuance, making it more attractive to both domestic and international investors. The new regulations aim to foster a more transparent and efficient market, ultimately leading to increased liquidity and capital inflow.

-

Specific legal amendments impacting ABS issuance: The updated legislation clarifies the legal framework for creating, issuing, and trading ABS, reducing ambiguity and streamlining the approval process. This includes simplifying documentation requirements and providing clear guidelines on eligible assets.

-

Clarification on regulatory oversight and approval processes: The new regulations provide a clearer structure for regulatory oversight, specifying the roles and responsibilities of various regulatory bodies involved in the ABS market. This improved clarity reduces uncertainty and speeds up the approval process for new ABS issuances.

-

Changes in capital requirements for ABS issuers: The amendments have introduced more flexible capital requirements for ABS issuers, making it easier for companies to participate in the market. This fosters competition and promotes the development of a more diverse range of ABS products.

-

New frameworks for risk management and transparency within ABS transactions: The regulations introduce enhanced risk management frameworks and transparency measures, boosting investor confidence. These include stricter requirements for disclosure and reporting, strengthening the overall integrity of the ABS market. This focus on Saudi Arabia ABS regulations is crucial for long-term market stability.

Increased Investment Opportunities in Saudi Arabia's ABS Market

The revised regulations have broadened the range of assets eligible for securitization, opening up a wealth of new investment opportunities in Saudi Arabia's ABS market. This increased diversity attracts both domestic and international investors, further stimulating market growth.

-

Potential for securitization of real estate assets: The burgeoning real estate sector in Saudi Arabia now presents significant opportunities for ABS issuance, allowing developers and investors to unlock capital tied up in real estate projects.

-

Opportunities in the consumer finance sector (e.g., auto loans, credit cards): The expanding consumer finance sector provides a substantial pool of assets suitable for securitization, creating attractive investment prospects for investors seeking diversified portfolios.

-

Growth potential in infrastructure projects and government-backed initiatives: The Saudi government's substantial investments in infrastructure projects create a significant pipeline of assets eligible for securitization, attracting both domestic and international investment in Saudi Arabia ABS investment opportunities.

-

Attractiveness for both domestic and international investors: The improved regulatory clarity and increased transparency have made the Saudi ABS market increasingly attractive to both domestic and international investors seeking higher yields and diversification benefits. This influx of capital will further fuel market growth and economic development.

Economic Impact and Growth Potential of the Expanded ABS Market

The expanded ABS market in Saudi Arabia is poised to have a profound and positive impact on the national economy. Increased liquidity and capital inflow will drive economic growth and create new opportunities across various sectors.

-

Boost to the Saudi Arabian economy through increased investment: The inflow of capital from both domestic and international investors will stimulate economic activity and contribute to overall GDP growth. This injection of capital is expected to be significant and far-reaching.

-

Improved access to financing for businesses and individuals: The development of a robust ABS market provides businesses and individuals with improved access to credit, facilitating investment, expansion, and economic growth across the Kingdom.

-

Potential for job creation in related financial sectors: The growth of the ABS market will lead to the creation of new jobs in various related financial sectors, including legal, accounting, and risk management. This will contribute to reducing unemployment and boosting overall economic welfare.

-

Contribution to overall economic diversification strategies: The thriving ABS market aligns with Saudi Arabia's broader economic diversification strategy, reducing reliance on oil and fostering a more resilient and dynamic economy. This is a key factor in Saudi Arabia economic diversification strategies.

Challenges and Considerations for the Growing ABS Market

While the potential benefits are substantial, it's crucial to address potential challenges to ensure the sustainable growth of Saudi Arabia's ABS market.

-

Risk management strategies for investors: Investors need to implement robust risk management strategies to mitigate potential losses associated with ABS investments. This includes thorough due diligence and diversification of their portfolios.

-

Maintaining transparency and investor confidence: Maintaining transparency and building investor confidence is paramount for the long-term success of the ABS market. This requires adherence to high standards of disclosure and reporting.

-

Addressing potential systemic risks within the ABS market: Regulatory bodies must actively monitor and address potential systemic risks within the ABS market to prevent financial instability. This includes overseeing risk management practices and maintaining market integrity.

-

The importance of robust regulatory oversight: Continued robust regulatory oversight is crucial to ensuring the market's stability and preventing potential abuses. This includes regular reviews of the regulatory framework and adaptation to emerging challenges.

Conclusion

The landmark changes to Saudi Arabia's regulations have created a significant opportunity for growth in the Asset-Backed Securities (ABS) market. This opens doors for substantial investment, economic expansion, and diversification. By addressing the challenges and promoting transparency, Saudi Arabia can cultivate a robust and thriving ABS market, attracting both domestic and international investment. Understand the implications of this Asset-Backed Securities (ABS) in Saudi Arabia shift and capitalize on the exciting possibilities this burgeoning market offers. Learn more about the evolving landscape of Saudi Arabia ABS regulations and discover how you can participate in this exciting growth opportunity.

Featured Posts

-

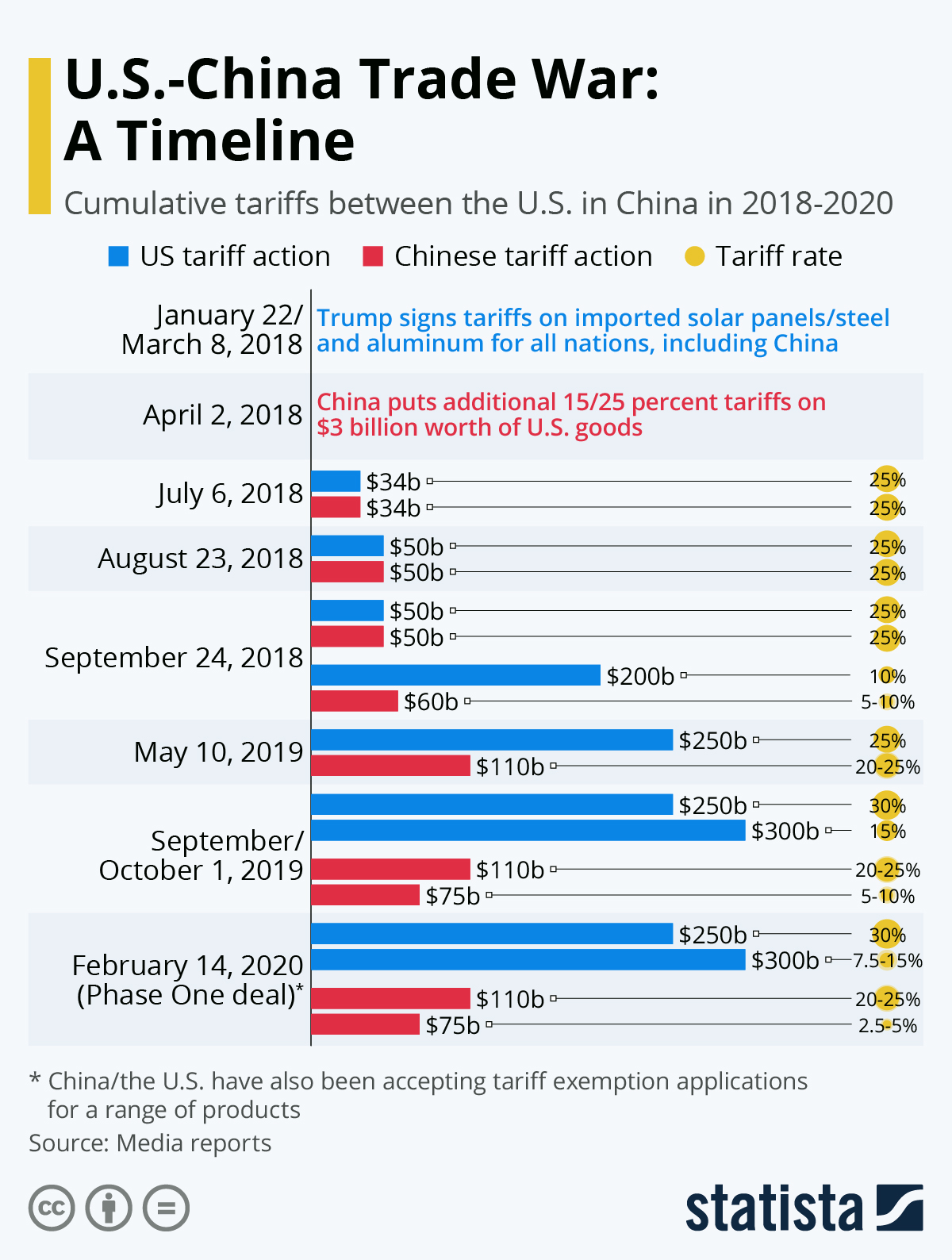

Beijings Trade War Pain Hiding The Economic Impact From America

May 02, 2025

Beijings Trade War Pain Hiding The Economic Impact From America

May 02, 2025 -

Milk And Honey Welcomes Andrew Goldstone To Lead Electronic Music

May 02, 2025

Milk And Honey Welcomes Andrew Goldstone To Lead Electronic Music

May 02, 2025 -

Celebrity Traitors Bbc Faces Star Departures

May 02, 2025

Celebrity Traitors Bbc Faces Star Departures

May 02, 2025 -

Justice Department Ends Louisiana School Desegregation Order A New Chapter

May 02, 2025

Justice Department Ends Louisiana School Desegregation Order A New Chapter

May 02, 2025 -

Understanding Rare Seabirds A Focus On Te Ipukarea Societys Research

May 02, 2025

Understanding Rare Seabirds A Focus On Te Ipukarea Societys Research

May 02, 2025

Latest Posts

-

Challenges For Reform Uk A Potential Party Split Looms

May 03, 2025

Challenges For Reform Uk A Potential Party Split Looms

May 03, 2025 -

Afghan Migrants Death Threat Against Nigel Farage During Uk Trip

May 03, 2025

Afghan Migrants Death Threat Against Nigel Farage During Uk Trip

May 03, 2025 -

Farages Reform Uk Internal Divisions And The Threat Of A Split

May 03, 2025

Farages Reform Uk Internal Divisions And The Threat Of A Split

May 03, 2025 -

Reform Uks Future Uncertain Breakaway Threat From Former Deputy

May 03, 2025

Reform Uks Future Uncertain Breakaway Threat From Former Deputy

May 03, 2025 -

Farage Faces Tory Accusations Over Reform Party Defection Claims

May 03, 2025

Farage Faces Tory Accusations Over Reform Party Defection Claims

May 03, 2025