Late 2025 Deadline: Analysts Predict Persistence Of Trump's 30% China Tariffs

Table of Contents

Introduction:

The looming 2025 deadline for the expiration of Trump-era tariffs on Chinese goods has sparked intense debate. While some anticipate their removal, many analysts predict the persistence of these significant trade barriers, specifically Trump's 30% China tariffs. This article delves into the factors contributing to this prediction and analyzes the potential long-term economic consequences. Understanding the implications of these tariffs is crucial for businesses navigating the complex landscape of US-China trade relations. The continued impact of these tariffs on the US and global economy is a subject demanding careful consideration.

H2: Economic Factors Fueling the Prediction of Continued Tariffs

The prediction that Trump's 30% China tariffs will remain in place until at least late 2025, and potentially longer, stems from several intertwined economic factors:

- Inflationary Pressures: The current high inflation rate in the US makes the complete removal of these tariffs politically challenging. Easing these tariffs, even partially, could be perceived as fueling further inflation, a major concern for the Biden administration.

- The impact of tariff removal on consumer prices is a key consideration. Economists are modeling various scenarios to predict the price changes associated with tariff removal on specific goods.

- Experts are divided on the extent of price changes following tariff removal, with some predicting minimal impact and others forecasting significant increases depending on the elasticity of demand for affected goods.

- Protectionist Sentiment: Despite a desire for improved US-China relations, protectionist sentiment remains strong among certain sectors and within the political landscape. These groups actively lobby to maintain tariffs, emphasizing the need to protect American industries. The debate around these tariffs often centers on the balance between protecting domestic jobs and promoting free trade.

- Powerful lobbying groups representing various industries continue to advocate for maintaining these tariffs, citing concerns about unfair competition and the need to safeguard American jobs.

- The political cost of removing tariffs is a significant deterrent for the current administration, particularly given the upcoming elections.

- National Security Concerns: Tariffs are often framed within the context of national security, particularly concerning strategic industries like technology and manufacturing. This framing provides a strong rationale for their continued imposition, irrespective of pure economic considerations. This national security argument often overshadows purely economic discussions.

- Concerns about Chinese technological dominance and intellectual property theft are influencing policy decisions, leading to calls for continued protectionist measures.

- Diversifying supply chains away from reliance on China remains a primary focus for national security, making tariff removal less likely in the short term.

H2: The Impact of Continued Trump's 30% China Tariffs on Businesses

The continued presence of Trump's 30% China tariffs will have profound and lasting impacts on businesses:

- Increased Costs: Businesses reliant on Chinese imports will face sustained elevated costs, potentially reducing profitability and competitiveness. This necessitates strategic adjustments, including exploring alternative sourcing options. The impact is particularly severe for businesses with low profit margins.

- Businesses are exploring reshoring (returning production to the US) and nearshoring (moving production to nearby countries) strategies to mitigate the impact of tariffs.

- Cost-cutting measures, including automation and process optimization, are essential for maintaining profitability in the face of higher import costs.

- Supply Chain Disruptions: Continued tariffs may further complicate global supply chains, impacting businesses' ability to efficiently procure goods and services. This highlights the need for greater supply chain resilience and diversification. The complexity of global supply chains makes adjusting to tariff changes difficult.

- Supply chain diversification is crucial for mitigating risk, with companies seeking alternative suppliers in other countries.

- Businesses are investing in technology, such as blockchain and AI, to improve supply chain visibility and responsiveness.

- Trade Wars and Retaliation: The persistence of these tariffs invites the possibility of further retaliatory measures from China, escalating the trade tensions between the two economic superpowers. This could result in more unpredictable market conditions and further complicate business operations. The potential for tit-for-tat tariffs adds another layer of uncertainty.

- The risk of further trade wars significantly impacts investment decisions, making businesses hesitant to commit to long-term projects.

- Businesses need to monitor trade policies closely and adapt accordingly, including developing contingency plans for various scenarios.

H2: Potential Long-Term Economic Consequences

The prolonged impact of Trump's 30% China tariffs could lead to several long-term economic consequences:

- Reduced Global Trade: Continued tariffs discourage free trade and create barriers to economic growth, potentially affecting global trade volumes. This could lead to a slowdown in overall global economic growth.

- Economic Slowdown: The increased cost of goods can contribute to inflationary pressures and potentially slow down economic growth, both in the US and globally. This is particularly concerning in the context of existing economic uncertainties.

- Geopolitical Instability: The ongoing trade conflict fuels geopolitical uncertainty, creating an unstable environment for businesses and investors. This uncertainty can deter investment and hinder economic growth.

Conclusion:

The evidence suggests that the 2025 deadline for Trump's 30% China tariffs might not lead to their immediate removal. Several economic and political factors point towards their continued existence, at least for the foreseeable future. Businesses need to understand these implications and adapt their strategies to navigate the complexities of this evolving trade landscape. Staying informed about updates on Trump's 30% China tariffs and related trade policies is crucial for strategic planning and risk mitigation. Proactive planning and adaptation are key to mitigating the impact of Trump's 30% China tariffs. Understanding the potential long-term implications of these tariffs is vital for businesses to make informed decisions and ensure future success. Continue to monitor updates on Trump's 30% China tariffs and their potential impact on your business.

Featured Posts

-

Betting On Natural Disasters The La Wildfires And The Changing Landscape Of Gambling

May 18, 2025

Betting On Natural Disasters The La Wildfires And The Changing Landscape Of Gambling

May 18, 2025 -

Blue Origins New Glenn Launch Cancelled Subsystem Failure Reported

May 18, 2025

Blue Origins New Glenn Launch Cancelled Subsystem Failure Reported

May 18, 2025 -

Anchor Brewing Company Shuts Down After 127 Years Of Brewing History

May 18, 2025

Anchor Brewing Company Shuts Down After 127 Years Of Brewing History

May 18, 2025 -

Fortnite I Os Unvailability Reasons And Potential Return

May 18, 2025

Fortnite I Os Unvailability Reasons And Potential Return

May 18, 2025 -

Alka Yagnk Ke Mdahwn Ky Fhrst Myn Asamh Bn Ladn Ky Ahmyt

May 18, 2025

Alka Yagnk Ke Mdahwn Ky Fhrst Myn Asamh Bn Ladn Ky Ahmyt

May 18, 2025

Latest Posts

-

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025 -

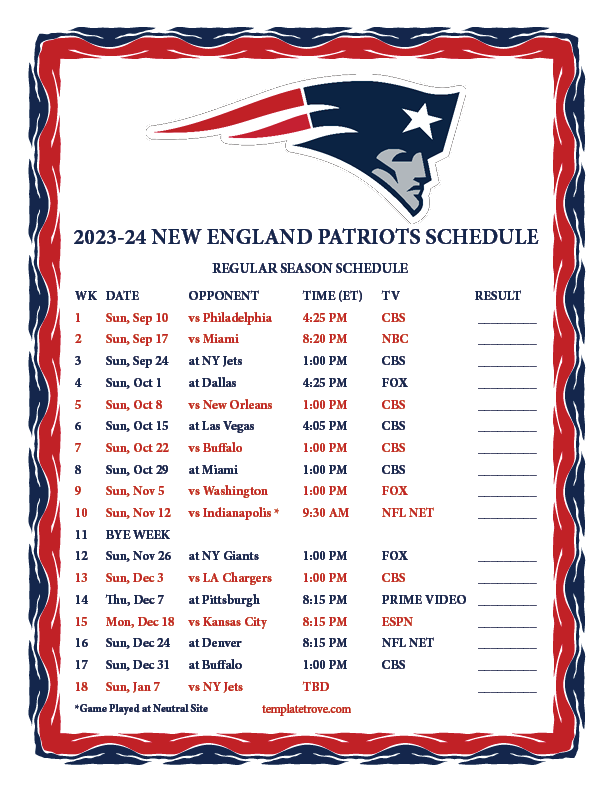

2025 Nfl Draft Expert Assessment Of The New England Patriots

May 18, 2025

2025 Nfl Draft Expert Assessment Of The New England Patriots

May 18, 2025 -

Nfl Analyst Evaluates Patriots Trajectory Following 2025 Draft

May 18, 2025

Nfl Analyst Evaluates Patriots Trajectory Following 2025 Draft

May 18, 2025 -

Jersey Mikes Subs Galesburg Location Menu And More

May 18, 2025

Jersey Mikes Subs Galesburg Location Menu And More

May 18, 2025 -

Will Stephen Miller Become The Next National Security Advisor Analyzing The Possibility

May 18, 2025

Will Stephen Miller Become The Next National Security Advisor Analyzing The Possibility

May 18, 2025