Late-Night Deal: House Approves Altered Trump Tax Plan

Table of Contents

Key Changes in the Altered Trump Tax Plan

The altered Trump tax plan deviates considerably from its original form. Several key modifications impact individual taxpayers and corporations alike. These changes are not simply minor adjustments; they represent a recalibration of tax burdens and incentives.

-

Changes to Individual Tax Rates: The revised plan includes a reduction in the top individual income tax bracket from 39.6% to 37%, a significant concession made during negotiations. Simultaneously, the standard deduction has been increased, offering a larger tax break for many taxpayers.

-

Modifications to Corporate Tax Rates: The corporate tax rate, a central element of the original Trump tax plan, has remained largely unchanged at 21%. However, certain deductions and loopholes previously available to corporations have been either eliminated or significantly restricted.

-

Amendments to Deductions: Perhaps the most contentious changes involve deductions. The state and local tax (SALT) deduction, previously unlimited, now faces a $10,000 cap. This change is expected to disproportionately affect taxpayers in high-tax states. Similarly, modifications to the mortgage interest deduction have been made, limiting the amount of interest deductible for some homeowners. These changes to key deductions significantly alter the tax burden for many families.

-

Impact on Specific Income Brackets: The impact varies across income brackets. While higher-income earners benefit from the lower top tax rate, the impact on middle-income families is more nuanced. The increased standard deduction offers some relief, but the SALT cap could offset this benefit for many middle-class households in high-tax states. Low-income taxpayers are largely unaffected by the changes in the top bracket rate but may benefit from the increased standard deduction.

Political Fallout and Congressional Debate

The late-night approval of the altered Trump tax plan was preceded by weeks of intense political wrangling and behind-the-scenes negotiations. Key House members from both parties played a significant role in shaping the final legislation. President [President's Name] actively lobbied for the bill's passage, emphasizing its potential to stimulate economic growth.

-

Key Players and Stances: [Mention specific House members and their roles in the negotiations, highlighting their stances on key issues].

-

Significant Disagreements and Compromises: The final version of the bill represents a series of compromises. [Detail specific areas of disagreement and how they were resolved].

-

Future Challenges in the Senate: The Senate's approval is far from guaranteed. [Discuss potential hurdles for the bill's passage in the Senate, including potential filibusters and dissenting viewpoints].

Economic Implications of the Altered Tax Plan

The altered Trump tax plan carries significant economic implications, both short-term and long-term. Economists offer differing perspectives on the plan's overall effect, leading to diverse predictions about its impact on various economic indicators.

-

Projected Impact on the National Debt: The tax cuts are projected to add significantly to the national debt over the next decade. [Include specific figures or estimates from reputable economic sources].

-

Potential Effects on Job Creation and Economic Growth: Supporters of the tax plan argue that the cuts will stimulate economic growth and lead to job creation. [Present evidence supporting this claim, referencing economic models or analyses]. Critics, on the other hand, suggest that the benefits will disproportionately flow to the wealthy, leading to limited job growth.

-

Predicted Effects on Inflation and Interest Rates: The tax cuts could lead to increased inflation and higher interest rates. [Explain the potential mechanisms leading to these effects].

-

Expert Opinions and Economic Forecasts: [Summarize various economic forecasts and expert opinions on the potential economic impact of the tax plan].

Long-Term Effects of the Tax Reform

The long-term consequences of this tax reform are uncertain but could be profound. The changes may necessitate further adjustments in tax policy in future years.

-

Possible Changes in Tax Policy in Future Years: The current plan may necessitate future tax increases to address the growing national debt or to fund other government programs.

-

Long-Term Effects on Income Inequality: The plan's impact on income inequality remains a subject of debate, with some economists predicting a widening gap between the rich and the poor.

-

Potential for Unintended Consequences: Economic models may not fully capture the complexity of human behavior and its impact on the overall economy. Therefore, the potential for unintended and unforeseen consequences exists.

Understanding Your Tax Liability Under the New Law

The altered Trump tax plan significantly impacts how you will file your taxes. Understanding these changes is crucial for accurate tax preparation.

-

Resources for Taxpayers: The IRS website ([link to IRS website]) provides information and resources on the new tax law.

-

Seeking Professional Tax Advice: Consulting with a tax professional is highly recommended to understand how the new tax law affects your specific circumstances.

-

Tips for Planning for Tax Season: Start planning your taxes early, taking into account the changes in deductions and tax brackets.

Conclusion

The House's late-night approval of the revised Trump tax plan represents a landmark shift in US tax policy. The altered legislation features key changes to individual and corporate tax rates, deductions, and overall tax burdens. The economic and political consequences remain a subject of debate, with varying predictions about its impact on the national debt, job creation, inflation, and income inequality. Understanding your tax liability under this new law is crucial; seek professional advice to navigate these changes effectively. Stay informed about the evolving situation surrounding this altered Trump tax plan and its effects. Learn more about the implications of this crucial tax reform and how it may affect your financial future.

Featured Posts

-

The Close Call Dylan Dreyer And Her Near Absence From The Today Show

May 23, 2025

The Close Call Dylan Dreyer And Her Near Absence From The Today Show

May 23, 2025 -

Vybz Kartel Breaks Silence Prison Family And Future Music Plans

May 23, 2025

Vybz Kartel Breaks Silence Prison Family And Future Music Plans

May 23, 2025 -

The Impact Of A Recent Mishap On Dylan Dreyers Today Show Dynamics

May 23, 2025

The Impact Of A Recent Mishap On Dylan Dreyers Today Show Dynamics

May 23, 2025 -

A Real Pain Disney Release Date Confirmed For April

May 23, 2025

A Real Pain Disney Release Date Confirmed For April

May 23, 2025 -

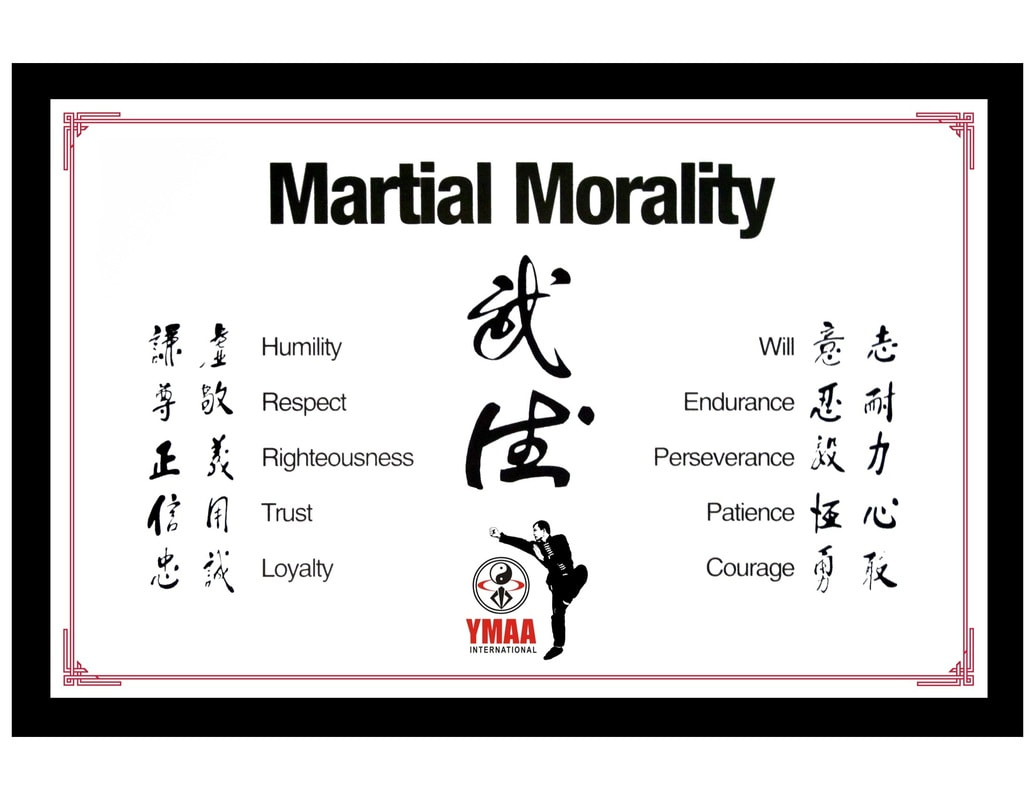

Analyzing The Karate Kid Martial Arts Morality And Coming Of Age

May 23, 2025

Analyzing The Karate Kid Martial Arts Morality And Coming Of Age

May 23, 2025

Latest Posts

-

Waldbrand In Essen Heisingen 07 04 2025 Feuerwehr Im Einsatz

May 23, 2025

Waldbrand In Essen Heisingen 07 04 2025 Feuerwehr Im Einsatz

May 23, 2025 -

Aetqalat Fy Almanya Ela Khlfyt Aemal Shghb Mn Mshjeyn

May 23, 2025

Aetqalat Fy Almanya Ela Khlfyt Aemal Shghb Mn Mshjeyn

May 23, 2025 -

Essen Ereignisse Rund Um Das Uniklinikum Beruehrend Und Bewegend

May 23, 2025

Essen Ereignisse Rund Um Das Uniklinikum Beruehrend Und Bewegend

May 23, 2025 -

Polizeimeldungen Essen Heisingen 07 04 2025 Grossbrand Im Wald

May 23, 2025

Polizeimeldungen Essen Heisingen 07 04 2025 Grossbrand Im Wald

May 23, 2025 -

Skandal An Nrw Unis Haftstrafen Fuer Manipulierte Noten

May 23, 2025

Skandal An Nrw Unis Haftstrafen Fuer Manipulierte Noten

May 23, 2025