Learn From Warren Buffett: Minimizing Errors And Cultivating Humility

Table of Contents

Warren Buffett's Risk Management Strategies: Avoiding Costly Mistakes

Successful investing is as much about avoiding losses as it is about generating gains. Buffett's risk management strategies are legendary, and understanding them is crucial for minimizing errors.

Understanding Your Circle of Competence:

Buffett famously emphasizes the importance of sticking to what you know. Your "circle of competence" encompasses the industries, businesses, and investment strategies you thoroughly understand. Venturing outside this circle increases the risk of significant errors.

- Buffett's Focus: Buffett has largely confined his investments to businesses he comprehends deeply, such as consumer goods (Coca-Cola) and insurance (Geico). This deep understanding allows for informed decision-making and a better assessment of long-term value.

- The Dangers of Overextension: Numerous examples exist of investors making costly mistakes by venturing into areas outside their expertise. A lack of understanding can lead to misjudging management, overlooking critical risks, and overpaying for assets.

- Defining Your Circle: To define your own circle of competence, identify industries you're passionate about and possess significant knowledge in. Thoroughly research companies within those industries, focusing on their financials, business models, and competitive landscapes.

Margin of Safety:

Buffett's adherence to the "margin of safety" principle is a cornerstone of his risk management approach. This involves buying assets significantly below their intrinsic value, creating a buffer against unforeseen circumstances.

- Intrinsic Value: Buffett's focus is always on identifying the true, underlying value of a company, independent of its current market price. He buys when the market price is substantially lower than his estimated intrinsic value.

- Examples: Buffett's investments often reflect this principle. He purchases companies with strong fundamentals and proven track records at prices that offer a considerable margin of safety.

- Mitigating Risk: The margin of safety acts as a cushion against errors in valuation or unexpected negative events. If the company performs worse than expected, the investor still has a considerable margin before losses are incurred.

Long-Term Perspective:

Buffett is a staunch advocate of long-term value investing. He ignores short-term market noise and focuses on the long-term growth potential of the underlying businesses.

- Avoiding Short-Term Volatility: A long-term perspective minimizes the emotional impact of short-term market fluctuations. Short-term traders often make impulsive decisions based on fear and greed, leading to significant errors.

- Compounding Returns: Buffett's wealth is a testament to the power of compounding returns over the long term. By holding onto well-chosen investments, he allows their value to grow exponentially over time.

The Importance of Humility in Investing: Learning from Mistakes

Humility is not just a personal virtue; it's a crucial ingredient for successful investing. Buffett's openness to admitting mistakes and learning from them is a hallmark of his approach.

Acknowledging Limitations and Admitting Errors:

Buffett openly acknowledges past investment mistakes, viewing them as learning opportunities. This contrasts with many investors who refuse to admit their errors, often leading to repeated mistakes.

- Public Acknowledgements: Buffett has publicly discussed past investment errors, highlighting the importance of self-reflection and continuous learning.

- Overcoming Ego: Ego can prevent investors from recognizing and correcting mistakes. Humility enables a more objective assessment of performance and fosters continuous improvement.

Seeking Diverse Perspectives and Mentorship:

Buffett's success stems partly from his willingness to learn from others and solicit diverse perspectives. He surrounds himself with trusted advisors and mentors.

- Collaboration: The collaborative nature of his investment process allows for a thorough examination of investment opportunities, reducing the likelihood of errors due to blind spots.

- Mentorship and Advice: Learning from experienced investors can significantly reduce the learning curve and prevent costly mistakes.

Continuous Learning and Adaptability:

Buffett's commitment to lifelong learning is unwavering. He constantly reads, researches, and adapts his strategies to changing market conditions.

- Staying Updated: The investment landscape is constantly evolving, requiring investors to remain informed and adapt their strategies accordingly.

- Resources for Learning: Buffett’s own writings, annual letters to Berkshire Hathaway shareholders, and biographies offer invaluable insights into his investment philosophy and strategies.

Conclusion

Minimizing investment errors and cultivating humility are crucial for long-term success in investing. By applying Warren Buffett’s wisdom, focusing on risk management, understanding your circle of competence, utilizing a margin of safety, adopting a long-term perspective, and embracing a humble approach to learning and self-reflection, you can significantly improve your investment outcomes. Embrace Warren Buffett's investment principles; apply his strategies, and cultivate investor humility to embark on a more successful and fulfilling investment journey. Continue exploring Warren Buffett's investment strategies and philosophies to further enhance your understanding and decision-making abilities.

Featured Posts

-

Proces Panstwowa Spolka Vs Dziennikarze Onetu 100 Tys Zl W Gre

May 07, 2025

Proces Panstwowa Spolka Vs Dziennikarze Onetu 100 Tys Zl W Gre

May 07, 2025 -

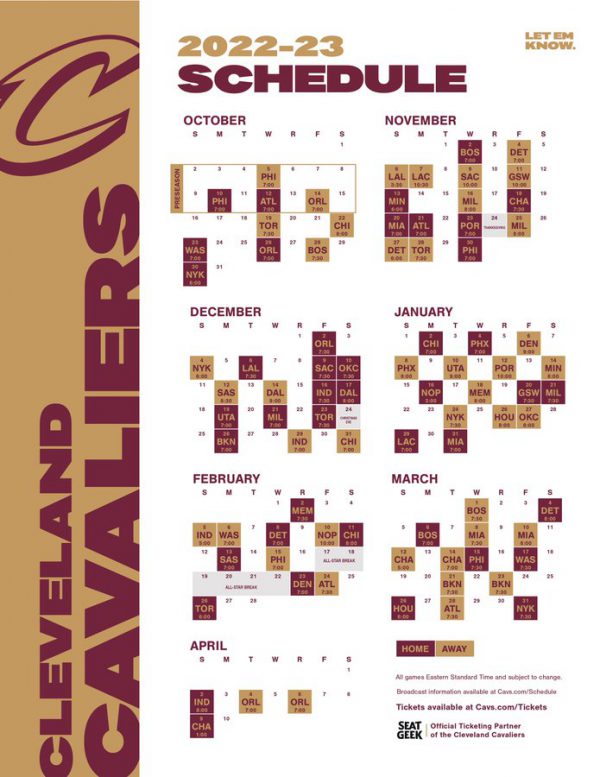

Round 2 Cavs Tickets Sale Starts Tuesday

May 07, 2025

Round 2 Cavs Tickets Sale Starts Tuesday

May 07, 2025 -

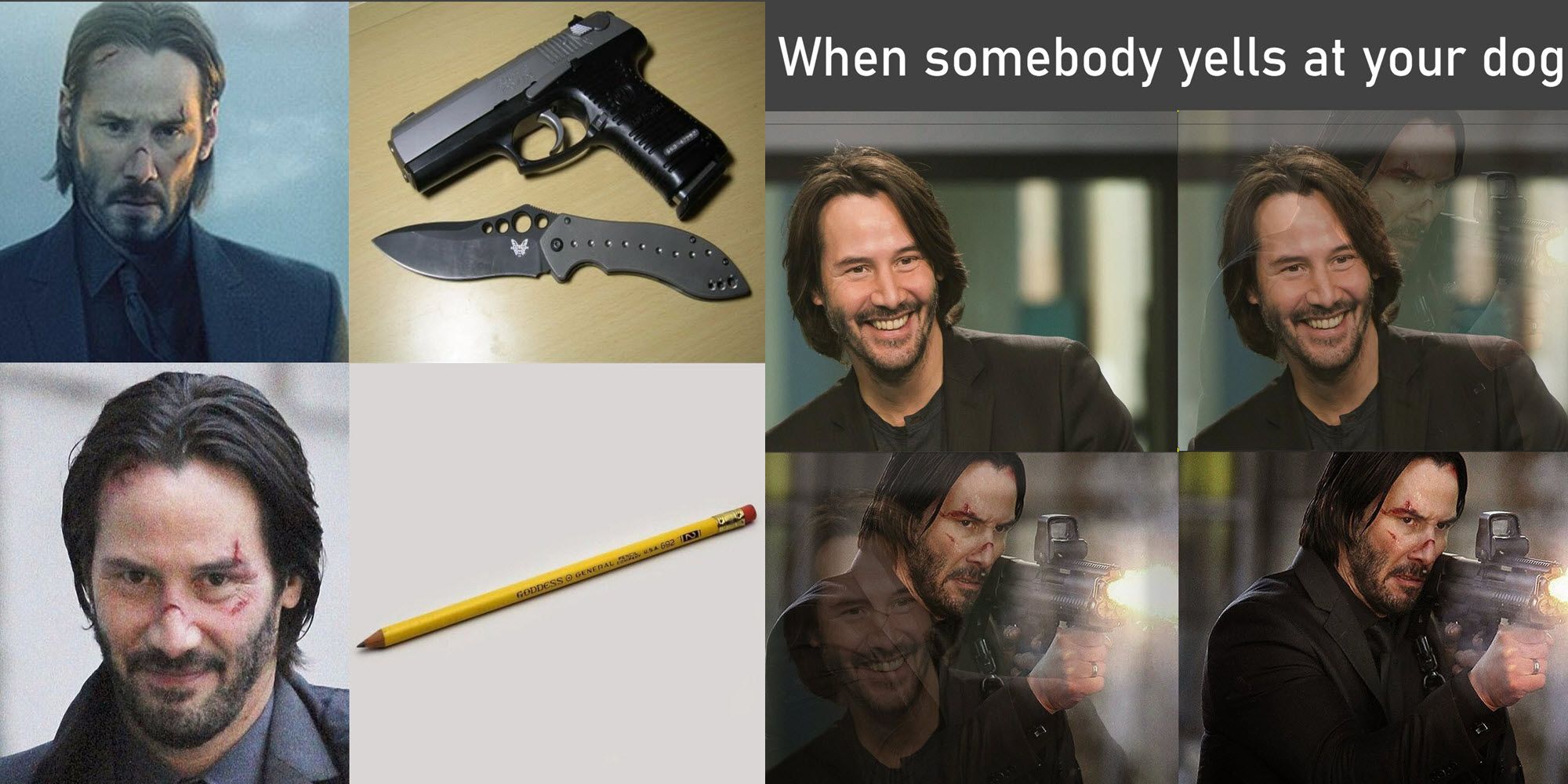

The Case Against John Wick 5 A Critical Analysis

May 07, 2025

The Case Against John Wick 5 A Critical Analysis

May 07, 2025 -

Ovechkin On The 4 Nations Tournament Russias Absence And His Viewing Plans

May 07, 2025

Ovechkin On The 4 Nations Tournament Russias Absence And His Viewing Plans

May 07, 2025 -

Lecon De Basket Les Cavaliers Infligent Une Defaite Record De 55 Points Au Heat

May 07, 2025

Lecon De Basket Les Cavaliers Infligent Une Defaite Record De 55 Points Au Heat

May 07, 2025

Latest Posts

-

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025 -

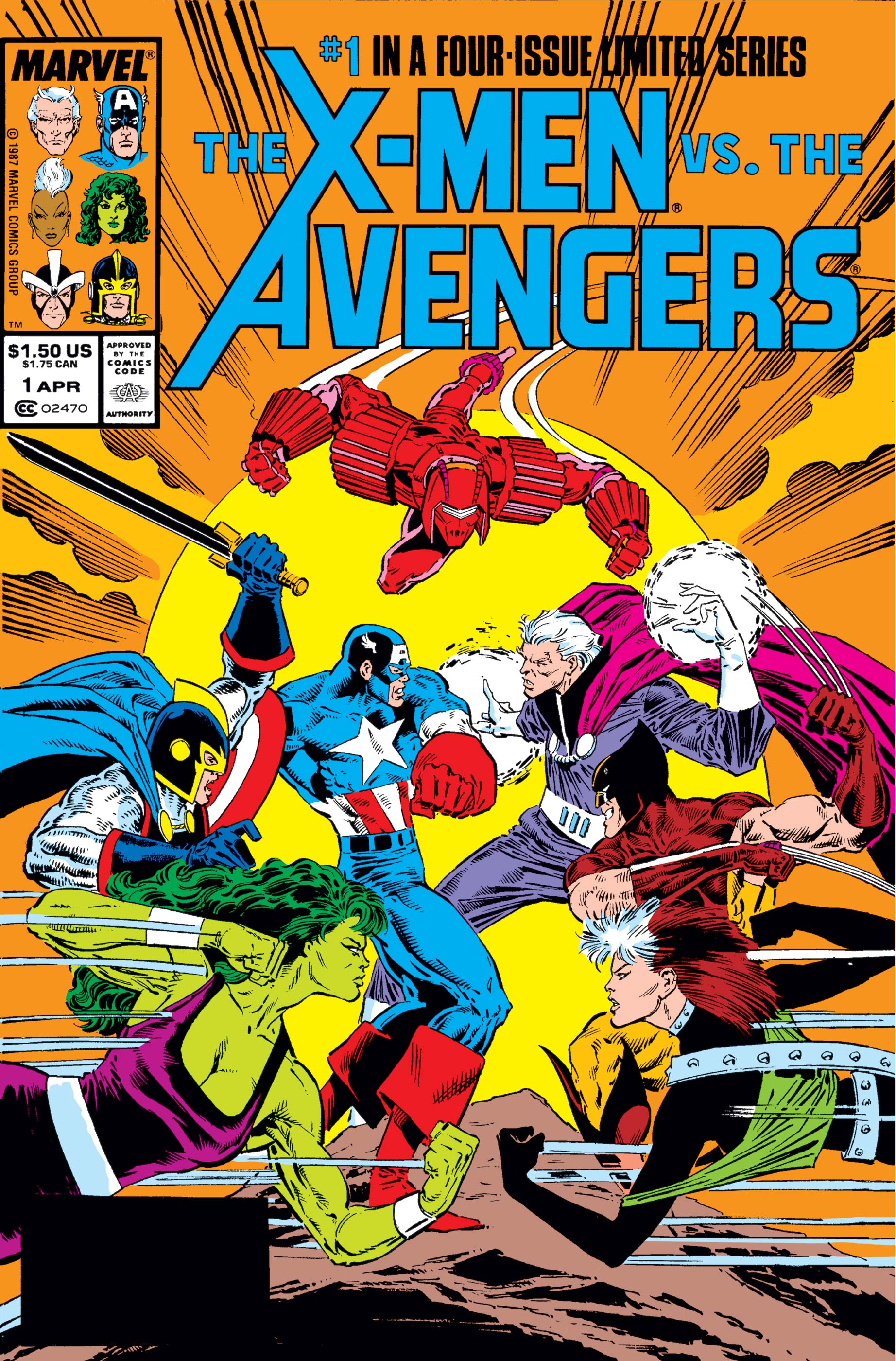

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025 -

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025 -

Rethinking Rogues Place Avengers Vs X Men

May 08, 2025

Rethinking Rogues Place Avengers Vs X Men

May 08, 2025 -

Rogues Evolution Cyclops Powers Emerge In New X Men Storyline

May 08, 2025

Rogues Evolution Cyclops Powers Emerge In New X Men Storyline

May 08, 2025