Leveraged Semiconductor ETFs: A Look At Recent Investor Activity And Market Performance

Table of Contents

Understanding Leveraged Semiconductor ETFs

Leveraged exchange-traded funds (ETFs) aim to deliver a multiple (e.g., 2x, 3x) of the daily performance of an underlying index. In the context of semiconductors, these ETFs provide magnified exposure to the performance of a specific semiconductor index. However, it's crucial to understand the inherent risks before investing.

-

Definition and Amplification: Leveraged semiconductor ETFs aim to track the daily performance of a semiconductor index, typically with a multiplier of 2x or 3x. This means a 1% increase in the underlying index could result in a 2% or 3% increase in the ETF's value, and vice-versa.

-

Daily Rebalancing: A key aspect of leveraged ETFs is daily rebalancing. This means the ETF's holdings are adjusted daily to maintain the targeted leverage. While this ensures daily alignment with the multiplier, it can lead to significant deviations from the underlying index over longer periods, especially in volatile markets. Long-term performance may not mirror the amplified daily returns.

-

Risks and Suitability: Leveraged semiconductor ETFs are inherently risky. Their volatility is significantly higher than that of traditional ETFs, making them unsuitable for risk-averse investors or long-term buy-and-hold strategies. These instruments are generally more appropriate for sophisticated investors with a short-term trading horizon and a high-risk tolerance.

-

Examples: While specific ETF tickers can change, examples of leveraged semiconductor ETFs might include those tracking the PHLX Semiconductor Sector Index or similar benchmarks. Always check the ETF's prospectus for details on the underlying index and investment strategy.

Recent Investor Activity in Leveraged Semiconductor ETFs

Analyzing recent investor activity provides valuable insights into market sentiment and potential future trends. Tracking trading volume and capital flows helps gauge the level of interest and risk appetite in the leveraged semiconductor ETF market.

-

Trading Volume and Holdings: [Insert data on trading volume over the last quarter and year. Include sources for this data. For example: "Data from [Source] shows a 20% increase in average daily trading volume for SOXL in Q3 2024 compared to Q2 2024."] This data should illustrate trends in investor interest.

-

Capital Inflows and Outflows: [Analyze inflows and outflows of capital. For example: "Analysis of ETF holdings reveals significant capital outflows from leveraged semiconductor ETFs during periods of market uncertainty, suggesting risk-aversion among investors."]

-

Correlation with Market Events: [Discuss how investor behavior correlates with specific market events, such as earnings reports, geopolitical tensions, or supply chain disruptions. For example: "The recent chip shortage led to a surge in demand for leveraged semiconductor ETFs, followed by a decline as the shortage eased."]

-

Investor Sentiment Shifts: [Analyze shifts in bullish or bearish sentiment. For example: "Positive earnings reports from major semiconductor companies generally lead to increased investor confidence and higher inflows into leveraged semiconductor ETFs."]

The Role of Macroeconomic Factors

Macroeconomic conditions significantly impact the semiconductor industry and, consequently, the performance of leveraged semiconductor ETFs tracking it.

-

Interest Rates: Higher interest rates can dampen demand for capital-intensive semiconductor manufacturing equipment, potentially impacting industry growth and ETF performance.

-

Inflation: Inflation affects semiconductor prices and profitability. Rising input costs can squeeze margins, while pricing power may vary depending on market dynamics.

-

Global Economic Growth: Global economic expansion typically boosts demand for semiconductors across various sectors, positively impacting ETF returns. Conversely, a global recession can severely impact demand and ETF performance.

Market Performance Analysis of Leveraged Semiconductor ETFs

Analyzing the recent performance of key leveraged semiconductor ETFs requires comparing their returns against their underlying benchmark indexes and broader market indicators.

-

Performance Charts and Graphs: [Include charts and graphs showcasing the performance of selected leveraged semiconductor ETFs over specific periods. Clearly label the axes and the ETFs being compared.]

-

Comparison with Broad Market Indexes: [Compare the ETF returns against broader market indexes like the S&P 500 and Nasdaq. Discuss the relative performance and any deviations.]

-

Alpha and Beta Analysis: [Include an analysis of alpha (excess return) and beta (volatility relative to the market) to assess the ETF's risk-adjusted performance.]

-

Impact of Specific Events: [Analyze the impact of specific events, such as chip shortages or geopolitical tensions, on ETF performance.]

Strategies for Investing in Leveraged Semiconductor ETFs

Investing in leveraged semiconductor ETFs demands careful consideration of investment strategies, risk management, and diversification.

-

Short-Term Trading Strategies: [Discuss short-term trading strategies, such as day trading or swing trading, emphasizing the need for close monitoring and timely exits.]

-

Risk Management Techniques: [Highlight the importance of risk management techniques like stop-loss orders and position sizing to limit potential losses.]

-

Diversification Strategies: [Emphasize the importance of diversifying investments to mitigate risk and reduce reliance on a single sector.]

-

Risk Tolerance: [Reiterate the importance of understanding your own risk tolerance and investment goals before investing in leveraged products.]

Conclusion

Leveraged semiconductor ETFs offer the potential for amplified returns but come with significant risks due to daily rebalancing and amplified volatility. Recent investor activity reveals a correlation between market sentiment, macroeconomic conditions, and ETF performance. While these ETFs can be part of a sophisticated investment strategy, careful consideration of risk tolerance and the adoption of appropriate risk management techniques are paramount. While leveraged semiconductor ETFs offer the potential for significant gains, they also carry substantial risk. Carefully consider your investment goals and risk tolerance before investing in leveraged semiconductor ETFs. Conduct thorough research and consult a financial advisor if needed. Remember, understanding the nuances of leveraged semiconductor ETFs is crucial for making informed investment decisions.

Featured Posts

-

Dodgers Vs Cubs Game Prediction Analyzing Las Unbeaten Home Streak

May 13, 2025

Dodgers Vs Cubs Game Prediction Analyzing Las Unbeaten Home Streak

May 13, 2025 -

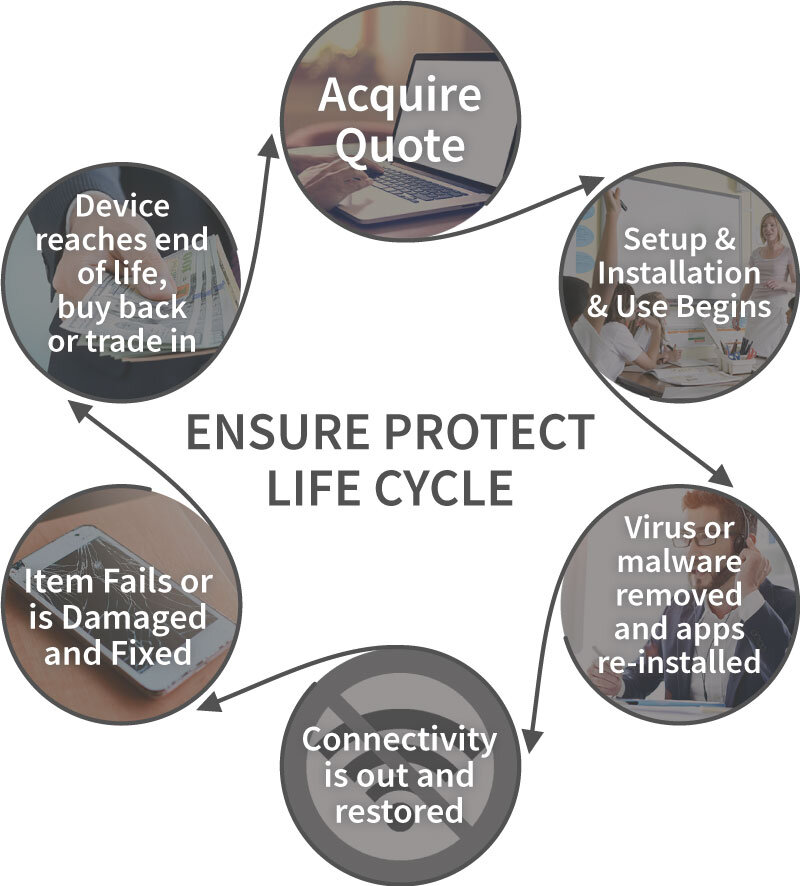

Campus Farm Animals A Hands On Approach To Life Cycle Education

May 13, 2025

Campus Farm Animals A Hands On Approach To Life Cycle Education

May 13, 2025 -

Landman Season 2 Casting Update Addresses Demi Moore Concerns

May 13, 2025

Landman Season 2 Casting Update Addresses Demi Moore Concerns

May 13, 2025 -

Dzherard Btlr Neochakvanata Vrzka S Blgariya

May 13, 2025

Dzherard Btlr Neochakvanata Vrzka S Blgariya

May 13, 2025 -

Securing A Professorship In Fine Arts A Focus On Spatial Design

May 13, 2025

Securing A Professorship In Fine Arts A Focus On Spatial Design

May 13, 2025

Latest Posts

-

Tommy Tiernans Wife A Rare Glimpse Into Her Life And Surprising Vatican Invitation

May 14, 2025

Tommy Tiernans Wife A Rare Glimpse Into Her Life And Surprising Vatican Invitation

May 14, 2025 -

Tommy Fury Receives Speeding Ticket Days After Molly Mae Relationship News

May 14, 2025

Tommy Fury Receives Speeding Ticket Days After Molly Mae Relationship News

May 14, 2025 -

Tommy Fury Hit With Driving Fine Following Molly Mae Split

May 14, 2025

Tommy Fury Hit With Driving Fine Following Molly Mae Split

May 14, 2025 -

9 Massive Hollyoaks Spoilers You Wont Want To Miss

May 14, 2025

9 Massive Hollyoaks Spoilers You Wont Want To Miss

May 14, 2025 -

9 Huge Hollyoaks Spoilers Whats Coming Next Week

May 14, 2025

9 Huge Hollyoaks Spoilers Whats Coming Next Week

May 14, 2025