'Liberation Day' Tariffs: A Stock Market Perspective And Investment Strategies

Table of Contents

Understanding the Economic Impact of "Independence Day" Tariffs

The "Independence Day" tariffs, implemented on [Insert Date and Specific Details of Tariffs], have a far-reaching impact on the global economy. Understanding this impact is crucial for informed investment decisions.

-

Direct Impact on Specific Industries: The tariffs directly affect industries heavily involved in import/export, particularly [mention specific sectors like manufacturing, agriculture, or technology] which face increased costs or reduced market access. For example, the increased tariffs on imported steel could significantly impact the automotive manufacturing sector, increasing production costs and potentially reducing profitability.

-

Ripple Effects and Supply Chain Disruptions: The consequences extend beyond directly targeted sectors. Supply chain disruptions are likely, leading to increased prices for consumers and impacting businesses relying on international trade. For instance, delays in receiving imported components could impact production timelines in various industries.

-

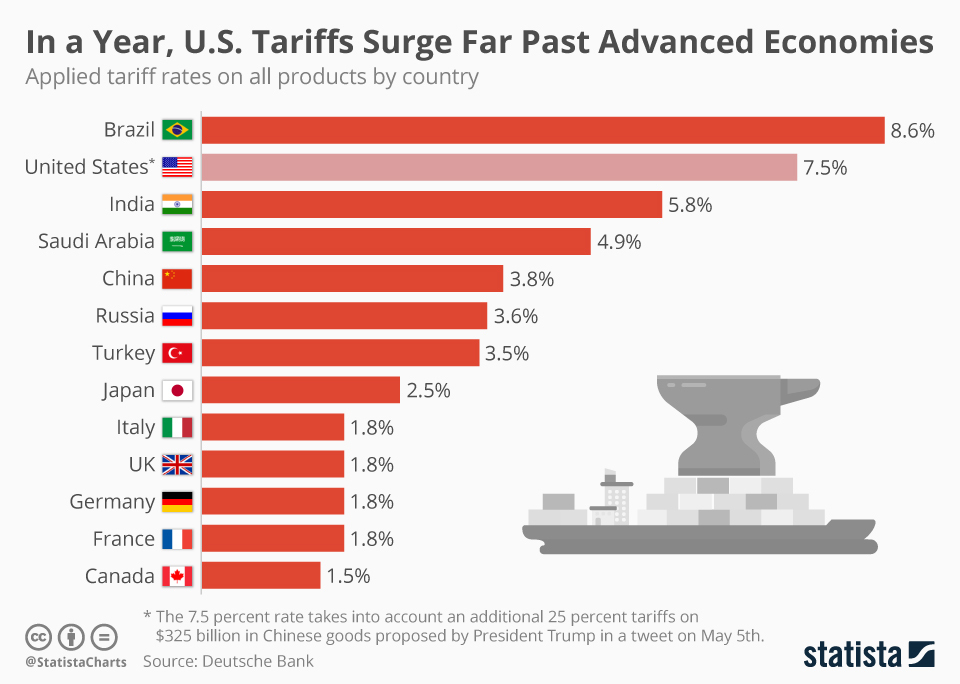

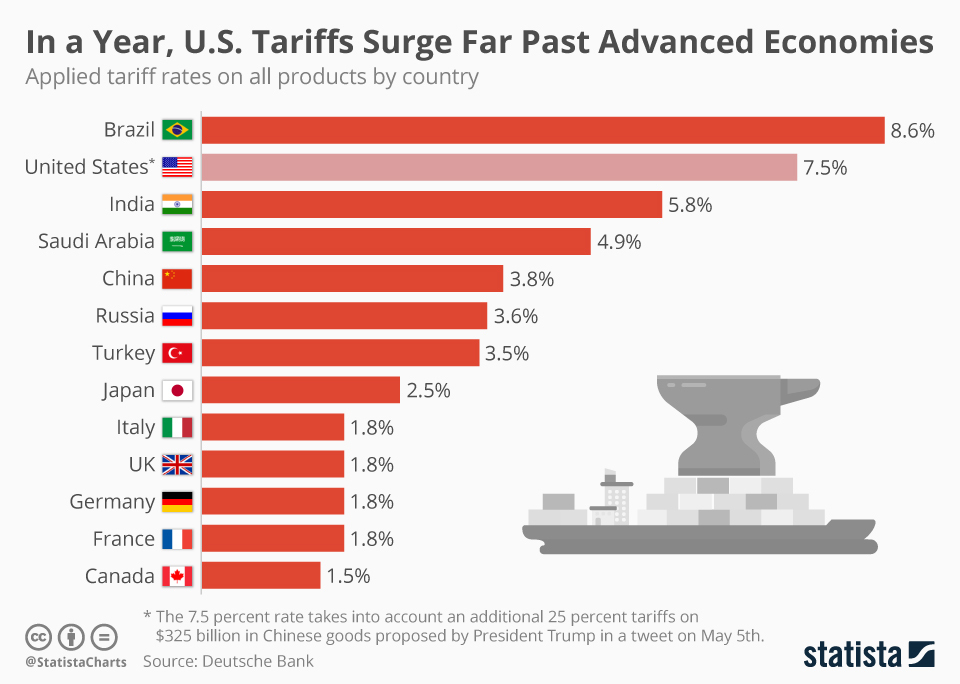

Macroeconomic Implications: These tariffs could significantly influence macroeconomic indicators. Increased import costs might fuel inflation, potentially slowing economic growth and leading to higher unemployment in certain sectors. The overall impact depends heavily on the scale of the tariffs and the resilience of the affected economies.

-

Key Affected Sectors and Potential Responses:

- Manufacturing: Increased production costs, potential relocation of manufacturing facilities.

- Agriculture: Reduced export opportunities, increased domestic prices.

- Technology: Higher costs for imported components and finished goods.

- Retail: Increased prices for consumers, potential shifts in consumer spending.

Keywords: Economic Impact, Supply Chain, Inflation, Economic Growth, Industry Analysis.

Stock Market Reactions to "Independence Day" Tariffs: Historical Context and Predictions

Analyzing historical precedent is essential to predicting the stock market's reaction to the "Independence Day" tariffs. Similar tariff implementations in the past have often resulted in short-term market volatility.

-

Historical Precedent: [Insert examples of past tariff implementations and their impact on stock markets, including specific data points and indices affected – e.g., the Smoot-Hawley Tariff Act and its consequences]. These historical examples highlight the potential for both short-term declines and subsequent recovery.

-

Potential Short-Term and Long-Term Market Reactions: The immediate reaction might involve a sell-off as investors react to the uncertainty. However, depending on the overall economic conditions and the government's response, the market could subsequently consolidate or even experience growth as certain sectors adapt and find new opportunities.

-

Investor Sentiment and Market Psychology: Investor sentiment will significantly influence the market's reaction. Fear and uncertainty could drive short-term selling, while optimism regarding long-term economic resilience might fuel a recovery.

-

Anticipated Performance of Market Indices: The impact will likely vary across different market indices. The Dow Jones, S&P 500, and Nasdaq could all react differently depending on their sector compositions and the specific industries affected by the tariffs. Sectors less sensitive to the tariffs, like technology or healthcare, might demonstrate greater resilience.

Keywords: Market Reaction, Investor Sentiment, Stock Market Volatility, Market Predictions, Historical Precedent.

Investment Strategies for Navigating "Independence Day" Tariffs

Navigating the uncertainty surrounding the "Independence Day" tariffs requires a well-defined investment strategy focusing on risk mitigation and opportunity identification.

-

Diversification Strategies: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate the risks associated with tariff-related volatility. Geographic diversification, spreading investments across different countries, can also help reduce exposure to any single market's fluctuations.

-

Specific Investment Approaches: Depending on your risk tolerance and market predictions, consider various investment approaches:

- Value Investing: Focus on undervalued companies that may show resilience during economic downturns.

- Growth Investing: Invest in companies with high growth potential, potentially less affected by the tariffs.

- Defensive Investing: Focus on companies in stable sectors (e.g., consumer staples) that offer consistent returns regardless of economic conditions.

-

Opportunities in Less Impacted Sectors: Explore investment opportunities in sectors less directly affected by the tariffs or those that might benefit from changes in consumer spending habits or supply chains.

-

Risk Management and Due Diligence: Thorough research and due diligence are paramount. Understand the companies you invest in and their exposure to the tariffs.

-

Seeking Professional Advice: Consider consulting a financial advisor to create a personalized investment strategy aligned with your financial goals and risk tolerance.

Keywords: Investment Strategies, Diversification, Risk Management, Asset Allocation, Portfolio Management.

Conclusion: Making Informed Investment Decisions Amidst "Independence Day" Tariffs

The "Independence Day" tariffs present a complex economic and market challenge. Understanding their potential impact on various sectors, coupled with a historical perspective and a well-defined investment strategy, is crucial for navigating this dynamic landscape. Remember that diversification, risk management, and thorough research are paramount. While the short-term market reaction might be volatile, a long-term perspective and a robust investment plan can help you weather the storm and potentially capitalize on emerging opportunities. Stay informed about the evolving impact of "Independence Day" tariffs on the stock market and develop a robust investment strategy to navigate this dynamic landscape. Consider seeking professional financial advice before making any significant investment decisions.

Keywords: Investment Strategy, Independence Day Tariffs, Stock Market Outlook, Financial Planning.

Featured Posts

-

Kripto Para Yatirimlarinda Dikkat Rusya Merkez Bankasi Nin Uyarilari

May 08, 2025

Kripto Para Yatirimlarinda Dikkat Rusya Merkez Bankasi Nin Uyarilari

May 08, 2025 -

Why Colin Cowherd Keeps Questioning Jayson Tatums Abilities

May 08, 2025

Why Colin Cowherd Keeps Questioning Jayson Tatums Abilities

May 08, 2025 -

Kripto Para Yatirimcilari Icin Kripto Lider Analizi Riskler Ve Firsatlar

May 08, 2025

Kripto Para Yatirimcilari Icin Kripto Lider Analizi Riskler Ve Firsatlar

May 08, 2025 -

The Hunger Games Directors New Stephen King Horror Film 2025 Release Date Announced

May 08, 2025

The Hunger Games Directors New Stephen King Horror Film 2025 Release Date Announced

May 08, 2025 -

Dwp Warning 12 Benefits Requiring Urgent Bank Account Action

May 08, 2025

Dwp Warning 12 Benefits Requiring Urgent Bank Account Action

May 08, 2025