'Liberation Day' Tariffs And Their Long-Term Effects On Stock Market Performance

Table of Contents

The Immediate Impact of 'Liberation Day' Tariffs on Stock Market Indices

The announcement and subsequent implementation of "Liberation Day" tariffs triggered immediate and significant reactions across major stock market indices.

Initial Market Reactions:

The initial response was largely negative, reflecting widespread uncertainty and apprehension amongst investors. The imposition of tariffs, particularly those affecting key sectors, created a climate of fear and uncertainty.

- Dow Jones Industrial Average: Experienced a sharp decline of X% within the first trading day following the tariff announcement.

- S&P 500: Suffered a Y% drop, indicating a broad-based negative impact across various market sectors.

- Nasdaq Composite: Showed a Z% decrease, with technology companies particularly vulnerable due to their reliance on global supply chains.

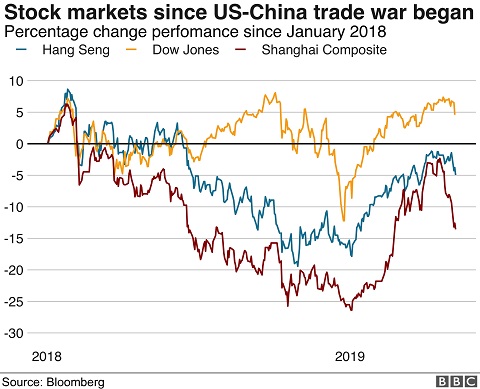

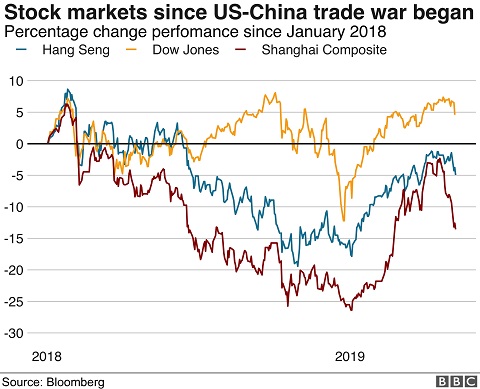

The impact was not uniform across all sectors. Technology companies, heavily reliant on imported components, experienced steeper declines than, for example, domestically focused energy companies. Charts illustrating these index movements would provide a compelling visual representation of the immediate market reaction to "Liberation Day" tariffs.

Long-Term Effects on Specific Sectors

The long-term consequences of "Liberation Day" tariffs varied widely depending on the sector. Some industries experienced growth opportunities, while others faced significant challenges.

Winners and Losers:

The tariffs created a complex landscape of winners and losers.

-

Import-dependent industries: Sectors heavily reliant on imported goods, such as consumer electronics and apparel, faced increased costs and reduced competitiveness. This led to decreased profitability and, in some cases, job losses. For instance, Company A, a major importer of electronics, saw its stock price decline by X% over the following year.

-

Export-oriented industries: Conversely, some export-oriented sectors benefited from increased domestic demand as consumers shifted away from foreign-made goods. However, this benefit was often offset by retaliatory tariffs imposed by other countries. Company B, a domestic manufacturer of steel, experienced increased demand and higher stock prices in the short term, but this was eventually tempered by reduced export opportunities.

The tariffs prompted a significant shift in investment strategies, as investors reassessed the risk profiles of different sectors. Many shifted towards companies less exposed to international trade, prioritizing those with robust domestic operations and strong supply chains.

The Influence of 'Liberation Day' Tariffs on Investor Sentiment and Confidence

"Liberation Day" tariffs significantly impacted investor sentiment and market confidence.

Shifting Investor Behavior:

The uncertainty created by the tariffs led to increased market volatility and decreased investor confidence.

- Uncertainty: The unpredictable nature of trade policies fueled uncertainty, prompting investors to adopt more cautious approaches.

- Market Volatility: Trading volumes increased significantly in the period following the tariff announcements, reflecting heightened investor activity and uncertainty.

- Risk Aversion: Investors displayed increased risk aversion, leading to a shift away from riskier assets and towards safer investments like government bonds. This resulted in a flight to safety, further impacting the performance of certain market sectors.

Macroeconomic Consequences and Their Reflection in the Stock Market

The "Liberation Day" tariffs had far-reaching macroeconomic consequences that reverberated through the stock market.

Broader Economic Impacts:

The imposition of tariffs contributed to increased inflation, slower GDP growth, and a rise in unemployment in certain sectors.

- Inflation: Increased import costs led to higher consumer prices, impacting consumer spending and overall economic growth.

- GDP Growth: The uncertainty and reduced trade flows negatively impacted GDP growth rates.

- Unemployment: Industries heavily affected by the tariffs experienced job losses, contributing to higher unemployment rates.

Government policy responses played a critical role in mitigating these effects, with some interventions proving more successful than others. Analyzing the interplay between government policy and market reaction is crucial for understanding the long-term impact of "Liberation Day" tariffs.

Conclusion: Assessing the Long-Term Implications of 'Liberation Day' Tariffs on Stock Market Investment Strategies

The "Liberation Day" tariffs had a multifaceted impact on stock market performance, both in the short and long term. While some sectors experienced short-term gains, the overall effect was largely negative, marked by increased market volatility, decreased investor confidence, and dampened economic growth. The long-term effects continue to unfold, highlighting the complex interplay between trade policy and market dynamics. Understanding the complexities of "Liberation Day" tariffs and their lasting impact on the stock market is crucial for informed investment decisions. Continue your research to optimize your portfolio in light of future trade policy changes. Further research into the specific impact of these tariffs on individual companies and broader economic trends can provide a deeper understanding of their long-term implications.

Featured Posts

-

The Impact Of Trumps Economic Policies On Bitcoins Future Price

May 08, 2025

The Impact Of Trumps Economic Policies On Bitcoins Future Price

May 08, 2025 -

First Look The Long Walk Trailer A Chilling Dystopian Thriller

May 08, 2025

First Look The Long Walk Trailer A Chilling Dystopian Thriller

May 08, 2025 -

Postane Alimlari 2025 Tarihler Basvuru Kosullari Ve Kpss

May 08, 2025

Postane Alimlari 2025 Tarihler Basvuru Kosullari Ve Kpss

May 08, 2025 -

Angels Defeat Dodgers Despite Missing Shortstops

May 08, 2025

Angels Defeat Dodgers Despite Missing Shortstops

May 08, 2025 -

Singer Smokey Robinson Hit With Multiple Sexual Assault Allegations

May 08, 2025

Singer Smokey Robinson Hit With Multiple Sexual Assault Allegations

May 08, 2025