Lion Electric's Future Uncertain: Court-Appointed Monitor Suggests Liquidation

Table of Contents

The Court-Appointed Monitor's Report and its Recommendations

The court-appointed monitor's report, a crucial document in the Lion Electric liquidation proceedings, details the company's dire financial situation. The report paints a grim picture, citing several key factors that led to the recommendation for liquidation.

-

Unsustainable Debt Load: The report likely highlights Lion Electric's crippling debt burden, unsustainable in the face of ongoing losses and dwindling cash reserves. Specific figures regarding debt levels and outstanding liabilities would be crucial details within the report.

-

Production and Market Challenges: The company's struggles to scale production efficiently and meet growing market demands are likely cited as significant contributors to its financial woes. This includes difficulties in supply chain management and the competitiveness of the EV market.

-

Failed Funding Attempts: The report will probably detail the company's unsuccessful attempts to secure additional funding to remain operational. This could include failed negotiations with investors and lenders, highlighting the lack of confidence in the company's future prospects.

-

Restructuring Feasibility Analysis: The monitor's analysis likely explored various restructuring options before concluding that Lion Electric liquidation represented the most viable path, given the severity of the financial issues and the lack of feasible alternatives. The report likely compared the costs and benefits of liquidation versus potential restructuring plans, concluding that liquidation minimizes losses for creditors.

Impact on Lion Electric's Investors and Stakeholders

The potential Lion Electric liquidation carries severe consequences for a wide range of stakeholders.

-

Shareholder Losses: Shareholders face the potential for a complete loss of their investments, as the value of Lion Electric stock is likely to plummet further. The extent of these losses will depend on the specifics of the liquidation process and the recovery of assets.

-

Employee Job Losses: The most immediate impact is likely to be job losses for Lion Electric employees. Thousands of jobs are at risk, leading to significant economic hardship for workers and their families. The liquidation process will involve the termination of employment contracts and the need for employees to seek new opportunities.

-

Supply Chain Disruptions: Suppliers who rely on Lion Electric for business will experience significant disruptions to their supply chains, potentially leading to financial difficulties and delays in their own operations. This ripple effect could impact the broader EV ecosystem.

-

Customer Uncertainty: Customers who have placed orders or are relying on Lion Electric's products face uncertainty regarding the fulfillment of their orders. The liquidation process may result in cancelled orders and the need for customers to find alternative suppliers. This could cause reputational damage to the EV industry as a whole.

Potential legal ramifications, including class-action lawsuits from disgruntled shareholders and employees, are highly probable.

The Broader Implications for the Electric Vehicle Industry

The potential Lion Electric bankruptcy has significant implications for the wider EV landscape.

-

Investor Sentiment: The event could negatively impact investor confidence in the EV sector as a whole, making it more difficult for other companies in the industry to secure funding. This could slow down innovation and growth within the EV market.

-

Slowdown in EV Adoption: The failure of a prominent EV manufacturer could temporarily dampen enthusiasm for electric vehicles among consumers, potentially slowing down the overall rate of adoption. Negative news stories can deter potential buyers and impact the public's perception of EV reliability.

-

Increased Competition: Established competitors are likely to benefit from Lion Electric's demise, gaining market share and consolidating their positions in the increasingly competitive EV market. This could lead to further consolidation in the industry.

-

Government Policy Review: Governments supporting the EV transition through subsidies and incentives may need to re-evaluate their policies in light of Lion Electric's challenges, considering measures to strengthen the financial stability of the EV industry.

Potential Alternatives and Future Scenarios

Although the court-appointed monitor has recommended liquidation, there's still a small possibility of alternative scenarios, however unlikely they may seem.

-

Buyout or Investment: A last-minute buyout by another company or a significant investment from a new investor could potentially save Lion Electric from liquidation. This would require a substantial infusion of capital and a credible restructuring plan.

-

Restructuring Plan: A revised restructuring plan, addressing the issues identified in the monitor's report, might be proposed and approved, offering a path to financial recovery. This would require the agreement of creditors and investors.

However, given the severity of Lion Electric's financial problems and the lack of apparent viable alternatives, the likelihood of these scenarios materializing remains low.

Conclusion

The Lion Electric liquidation recommendation represents a significant setback for the company and the broader EV industry. The potential consequences are substantial, affecting investors, employees, and the overall trajectory of electric vehicle adoption. While a successful turnaround seems improbable, continued monitoring of the situation is crucial. Understanding the unfolding Lion Electric liquidation process is vital for anyone invested in the electric vehicle market or concerned about the future of this critical sector. Stay informed for the latest updates on this developing story and the implications of Lion Electric's potential demise.

Featured Posts

-

Lotto And Lotto Plus Saturday April 12 2025 Results

May 07, 2025

Lotto And Lotto Plus Saturday April 12 2025 Results

May 07, 2025 -

7 Sezon Chernogo Zerkala Data Vykhoda I Chto Ozhidat

May 07, 2025

7 Sezon Chernogo Zerkala Data Vykhoda I Chto Ozhidat

May 07, 2025 -

How Apple Watches Are Enhancing Nhl Game Officiating

May 07, 2025

How Apple Watches Are Enhancing Nhl Game Officiating

May 07, 2025 -

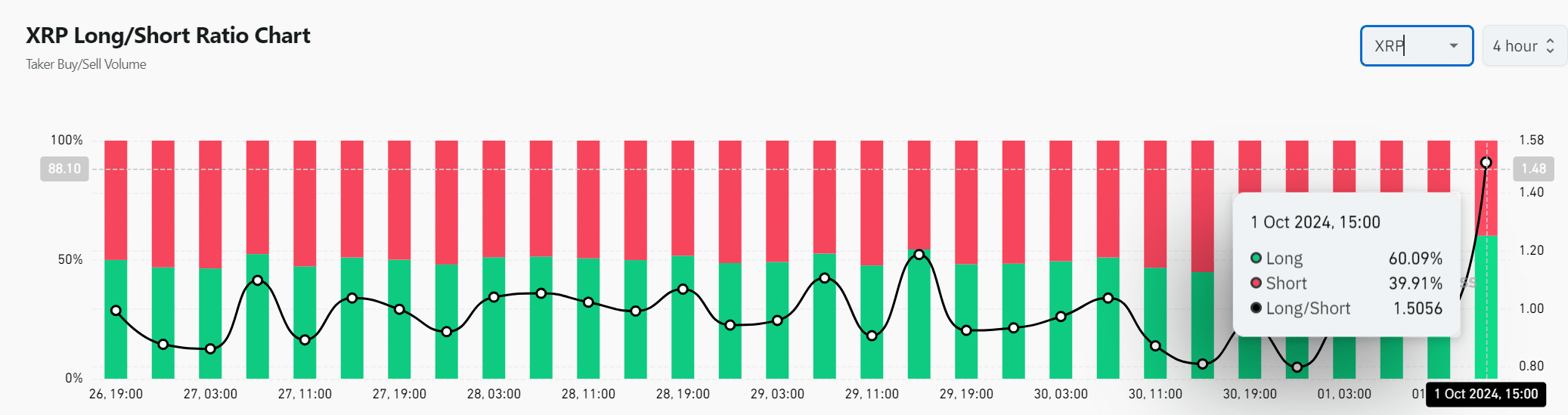

5880 Potential Is This Altcoin The Next Xrp Whale Activity Fuels Speculation

May 07, 2025

5880 Potential Is This Altcoin The Next Xrp Whale Activity Fuels Speculation

May 07, 2025 -

Clippers Rally Insufficient In Defeat To Cavaliers

May 07, 2025

Clippers Rally Insufficient In Defeat To Cavaliers

May 07, 2025

Latest Posts

-

Betts Absence Dodgers Face Freeway Series Without Star Outfielder

May 08, 2025

Betts Absence Dodgers Face Freeway Series Without Star Outfielder

May 08, 2025 -

Fifth Straight Loss For Angels Mike Trouts Knee Injury A Major Blow

May 08, 2025

Fifth Straight Loss For Angels Mike Trouts Knee Injury A Major Blow

May 08, 2025 -

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five

May 08, 2025

Knee Injury Forces Mike Trout Out Angels Extend Losing Streak To Five

May 08, 2025 -

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025 -

Mike Trout Out With Knee Injury Angels Drop Fifth Consecutive Game

May 08, 2025

Mike Trout Out With Knee Injury Angels Drop Fifth Consecutive Game

May 08, 2025