Live Music Stock Market Rally: Pre-Market Jump After Tumultuous Week

Table of Contents

Factors Contributing to the Live Music Stock Market Rally

The recent Live Music Stock Market Rally is not a random occurrence. Several converging factors have fueled this positive momentum, creating a fertile ground for investment and growth.

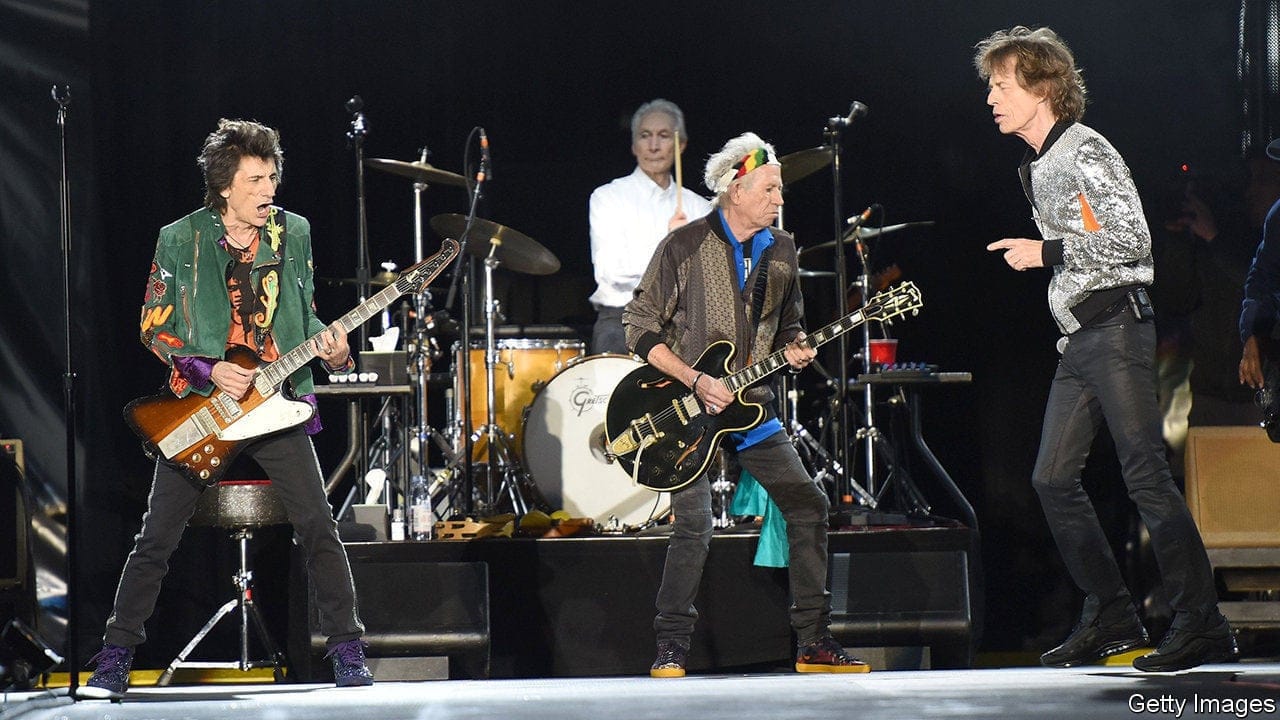

Resurgence of Concert Attendance

The post-pandemic recovery has been nothing short of phenomenal for the live music industry. Concert ticket sales have skyrocketed, exceeding even pre-pandemic levels in many cases. Reports indicate a percentage increase in ticket sales of over 30% in several key markets, with box office receipts reaching record-breaking figures. Successful tours by artists like Taylor Swift and Beyoncé, alongside the return of major festivals like Coachella and Glastonbury, have significantly contributed to this resurgence. This robust demand for live experiences directly translates into increased revenue and profitability for live music companies.

- Concert ticket sales: Significant upward trend across multiple genres.

- Live music revenue: Record-breaking box office receipts.

- Festival attendance: Strong numbers indicate a return to pre-pandemic levels and beyond.

- Post-pandemic recovery: The live music sector shows remarkable resilience.

- Box office receipts: A key indicator of the industry's health.

Strong Earnings Reports from Key Players

Leading players in the live music industry, such as Live Nation and AEG Presents, have released strong earnings reports, further bolstering investor confidence. These reports showcase impressive metrics, including:

- Increased profits: Significantly higher profit margins compared to the previous year.

- Positive revenue growth: Sustained growth demonstrating the industry's resilience.

- Expansion plans: Aggressive investments in new venues and technologies.

These positive financial results demonstrate the industry's robust recovery and its potential for continued growth. Live Nation stock, for instance, has seen significant gains reflecting this positive outlook. The strong financial performance of these key players directly impacts the overall market sentiment and attracts further investment.

Investor Confidence and Market Sentiment

The Live Music Stock Market Rally is also a reflection of broader investor sentiment. After a period of market uncertainty, investors are increasingly seeking out sectors demonstrating resilience and growth potential. Positive news surrounding macroeconomic indicators and a general improvement in market confidence have contributed to this shift. The live music sector, with its demonstrable recovery and strong growth trajectory, is attracting significant attention from investors with a higher risk appetite. Speculative investment in the sector is increasing, further driving up stock prices.

- Investor sentiment: A shift towards more optimistic projections.

- Market confidence: Improved overall market conditions influencing investment decisions.

- Stock market trends: Positive trends in related sectors contribute to overall confidence.

- Risk appetite: Increased willingness to invest in potentially high-reward sectors.

- Speculative investment: Increased interest from investors seeking high-growth opportunities.

Technological Advancements and Innovation

The integration of new technologies is revolutionizing the live music industry and attracting substantial investment. Digital ticketing platforms are streamlining the purchasing process, improving security, and providing valuable data for artists and promoters. Live streaming services are expanding the reach of concerts to a global audience, creating new revenue streams. These advancements, coupled with ongoing innovation in areas like immersive sound and augmented reality, are attracting tech-savvy investors and contributing to the industry's growth.

- Digital ticketing: Improved efficiency and security for ticket sales.

- Live streaming: Expanding the reach and revenue potential of live music events.

- Music technology: Innovation driving efficiency and improving the fan experience.

- Investment opportunities: Technological advancements are attracting significant investment.

Analyzing the Pre-Market Jump: Short-Term vs. Long-Term Implications

The pre-market jump in live music stocks is a significant event requiring careful analysis.

Interpreting the Pre-Market Activity

The pre-market surge suggests a strong anticipation of positive news and potentially short covering by investors who had bet against the sector. This rapid increase, while exciting, might not fully reflect the long-term picture. Short-term gains can be volatile and influenced by speculative trading.

- Pre-market trading: Significant price movements before regular market hours.

- Stock price fluctuations: Short-term volatility is a characteristic of the stock market.

- Short-term gains: Opportunities for quick profits, but also high risk.

- Market speculation: Influenced by expectations and rumours.

Long-Term Growth Potential

Despite the short-term fluctuations, the long-term growth potential of the live music industry remains strong. However, investors must acknowledge potential challenges:

- Long-term investment: A strategy for sustained growth, despite market volatility.

- Growth potential: The live music industry shows great promise for long-term growth.

- Market risks: Economic downturns, competition, and inflation present challenges.

- Industry challenges: Adapting to changing consumer behaviour and technological disruptions.

- Future outlook: Positive, but requires careful consideration of risks and opportunities.

Conclusion: Navigating the Live Music Stock Market Rally

The Live Music Stock Market Rally is a complex phenomenon driven by a confluence of factors, including the resurgence of concert attendance, strong earnings reports, positive investor sentiment, and technological innovation. The pre-market jump underscores the industry's potential but also highlights the need for a cautious approach. While the opportunities are significant, investors must carefully assess the associated risks before making investment decisions. Stay informed about the exciting developments in the live music stock market rally and conduct thorough due diligence to capitalize on its potential while mitigating its inherent risks. Remember to align your investment strategy with your risk tolerance and financial goals before investing in this dynamic sector.

Featured Posts

-

Savvato 15 3 Epiloges Tiletheasis

May 30, 2025

Savvato 15 3 Epiloges Tiletheasis

May 30, 2025 -

Cts Eventim Reports Strong Early Year Performance

May 30, 2025

Cts Eventim Reports Strong Early Year Performance

May 30, 2025 -

The Cut White Tiger Scene In Daredevil Born Again Episode 4 Analysis And Speculation

May 30, 2025

The Cut White Tiger Scene In Daredevil Born Again Episode 4 Analysis And Speculation

May 30, 2025 -

Talq Awstabynkw Mstmr Fy Mwsm Almlaeb Altrabyt

May 30, 2025

Talq Awstabynkw Mstmr Fy Mwsm Almlaeb Altrabyt

May 30, 2025 -

Lebanons Southern Front Hezbollah Weakened By Israeli Intel

May 30, 2025

Lebanons Southern Front Hezbollah Weakened By Israeli Intel

May 30, 2025