Live Music Stocks Surge Pre-Market Monday Following A Week Of Volatility

Table of Contents

Factors Contributing to the Pre-Market Surge in Live Music Stocks

Several key factors converged to propel live music stocks higher in Monday's pre-market trading. Understanding these factors is crucial for investors seeking to navigate this exciting, yet sometimes turbulent, market segment.

Stronger-than-Expected Q3 Earnings Reports

Positive financial reports from major players in the live music industry played a significant role in boosting investor confidence. Live Nation, for example, exceeded expectations, reporting strong revenue growth and increased concert attendance figures. This positive performance, coupled with similarly impressive results from other key players like Ticketmaster, signaled a healthy recovery for the sector.

- Live Nation's Q3 earnings: Exceeded analyst predictions, showing significant revenue growth driven by increased ticket sales and robust concert attendance.

- Ticketmaster's performance: Also reported positive results, demonstrating the resilience of the ticketing market and its close correlation with live music event success.

- Key Metrics: Strong revenue growth, high concert attendance figures, and improved profitability across the board contributed to the positive sentiment.

Positive Industry Trends and Outlook

Beyond the strong Q3 earnings, several positive industry trends contributed to the pre-market surge. The live music sector is showing clear signs of a robust post-pandemic recovery.

- Pent-up demand: After two years of restrictions and cancellations, there’s a significant pent-up demand for live music experiences.

- Easing of COVID restrictions: The lifting of pandemic-related restrictions has allowed for larger concerts and festivals to resume, driving increased revenue.

- Renewed interest in live events: People are increasingly prioritizing in-person experiences, leading to a surge in concert ticket sales and higher attendance rates at live events.

Investor Sentiment and Market Speculation

The pre-market surge in live music stocks also reflects a significant shift in investor sentiment. Positive analyst reports and speculation about future growth potential have likely contributed to the increase in stock prices.

- Positive analyst ratings: Several financial analysts have upgraded their ratings on live music stocks, citing positive industry trends and strong financial performance.

- Strategic partnerships: New strategic partnerships and technological advancements within the sector may also be boosting investor confidence.

- Stock price prediction: Positive market forecasts for live music companies have fueled speculation, attracting more investment and pushing stock prices higher.

Analyzing the Volatility of the Previous Week

While Monday's pre-market surge was encouraging, it's important to acknowledge the volatility experienced in the previous week. Understanding the factors that contributed to this fluctuation is key to making informed investment decisions.

Impact of Macroeconomic Factors

Broader macroeconomic factors, such as inflation and rising interest rates, significantly impacted the market last week. This general economic uncertainty created ripple effects across various sectors, including the live music industry.

- Inflation's impact: Rising inflation affects consumer spending, potentially impacting ticket sales and overall revenue for live music companies.

- Interest rate hikes: Increased interest rates can make borrowing more expensive for companies, potentially impacting investment and expansion plans.

- Market correction: The previous week's volatility could have been part of a broader market correction, affecting numerous sectors, including live music.

Specific Events Affecting Live Music Companies

In addition to macroeconomic factors, specific events within the live music industry contributed to the previous week's volatility.

- Supply chain disruptions: Ongoing supply chain issues can impact the costs of staging live events, putting pressure on profit margins.

- Concert cancellations: Unforeseen circumstances, such as artist illnesses or venue issues, can lead to concert cancellations, affecting revenue streams.

- Legal challenges: Lawsuits or regulatory changes can create uncertainty and impact investor confidence.

Potential Future Outlook for Live Music Stocks

The recent pre-market surge offers a glimpse into the potential future of live music stocks, but careful consideration of both short-term and long-term prospects is necessary.

Short-Term Predictions

Based on current trends and market analysis, the short-term outlook for live music stocks appears positive. Continued strong earnings reports and sustained high demand for live events could fuel further growth. However, macroeconomic conditions will continue to play a role in short-term performance.

Long-Term Growth Potential

The long-term growth potential for the live music industry remains substantial. The continued popularity of live music, coupled with technological advancements improving the concert experience, suggests a bright future for the sector. This makes live music stocks an attractive option for long-term investors.

Risks and Challenges

Despite the positive outlook, potential risks and challenges remain. Economic downturns, increased competition, and unforeseen events could impact future performance. Investors need to be aware of these potential headwinds.

Conclusion: Navigating the Future of Live Music Stocks

The pre-market surge in live music stocks on Monday provides a compelling counterpoint to the volatility experienced the previous week. Stronger-than-expected Q3 earnings, positive industry trends, and a shift in investor sentiment all contributed to this positive development. However, macroeconomic factors and specific industry events can create significant fluctuations. Understanding these dynamics is key to navigating the complexities of this growing sector. Stay informed about the latest developments in live music stocks and make informed investment decisions. The future of live music stocks remains promising, but careful monitoring and analysis are essential for success.

Featured Posts

-

Experiencia Mejorada Para Comprar Boletos Setlist Fm Se Integra Con Ticketmaster

May 30, 2025

Experiencia Mejorada Para Comprar Boletos Setlist Fm Se Integra Con Ticketmaster

May 30, 2025 -

M72 World Tour 2026 Metallicas Uk And European Dates

May 30, 2025

M72 World Tour 2026 Metallicas Uk And European Dates

May 30, 2025 -

Des Moines School Track Meet Cancelled After Shots Fired

May 30, 2025

Des Moines School Track Meet Cancelled After Shots Fired

May 30, 2025 -

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Sud Ouest

May 30, 2025

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Sud Ouest

May 30, 2025 -

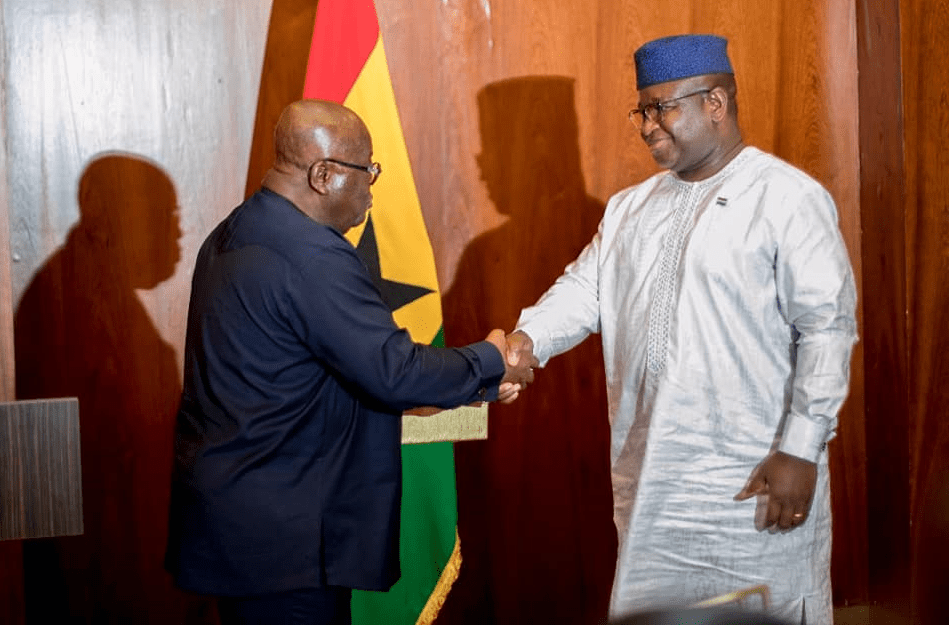

Leijdekkers Ties To Sierra Leone Presidents Daughter Extradition Obstacles

May 30, 2025

Leijdekkers Ties To Sierra Leone Presidents Daughter Extradition Obstacles

May 30, 2025