Live Stock Market Coverage: China Tariffs And UK Trade Agreement News

Table of Contents

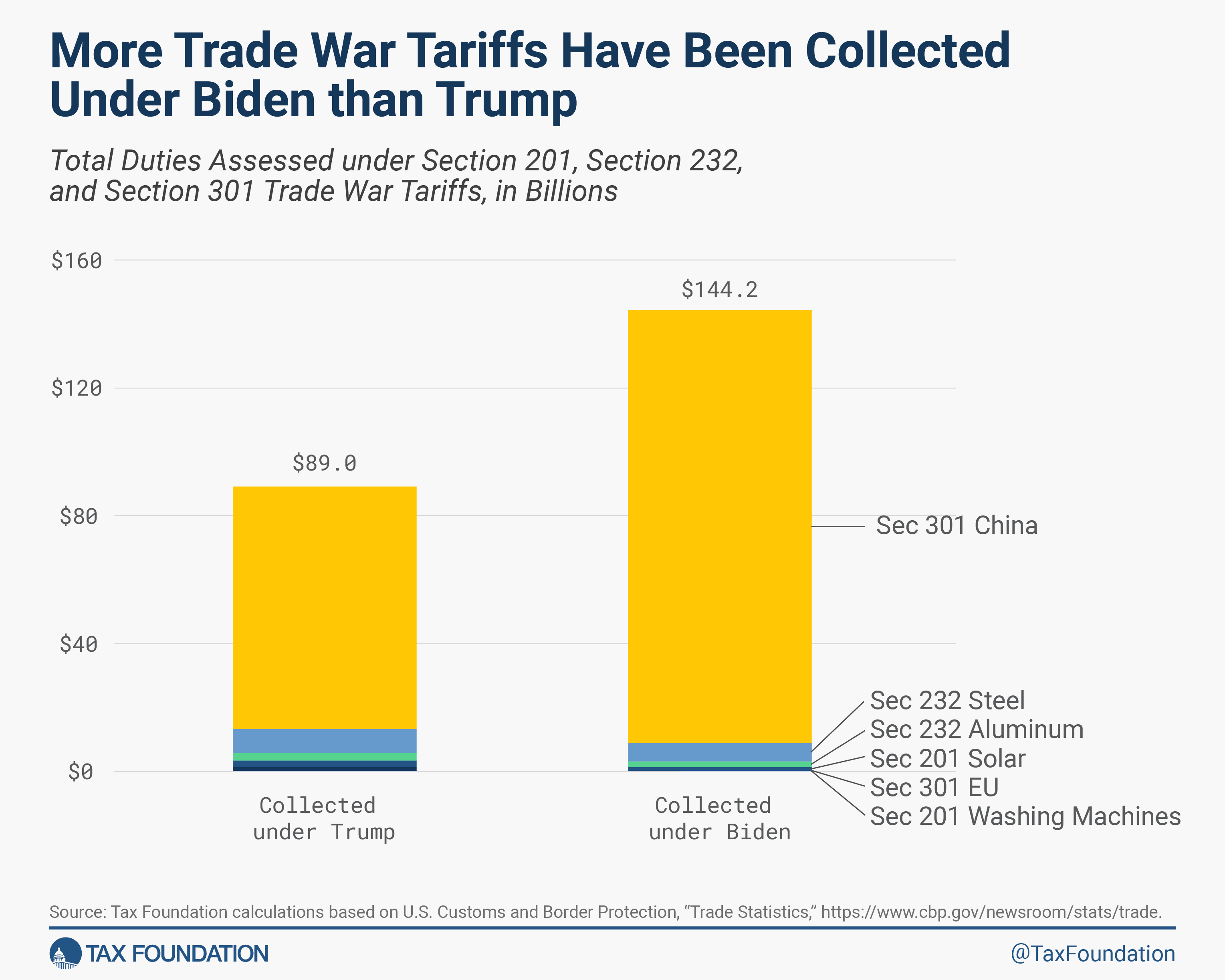

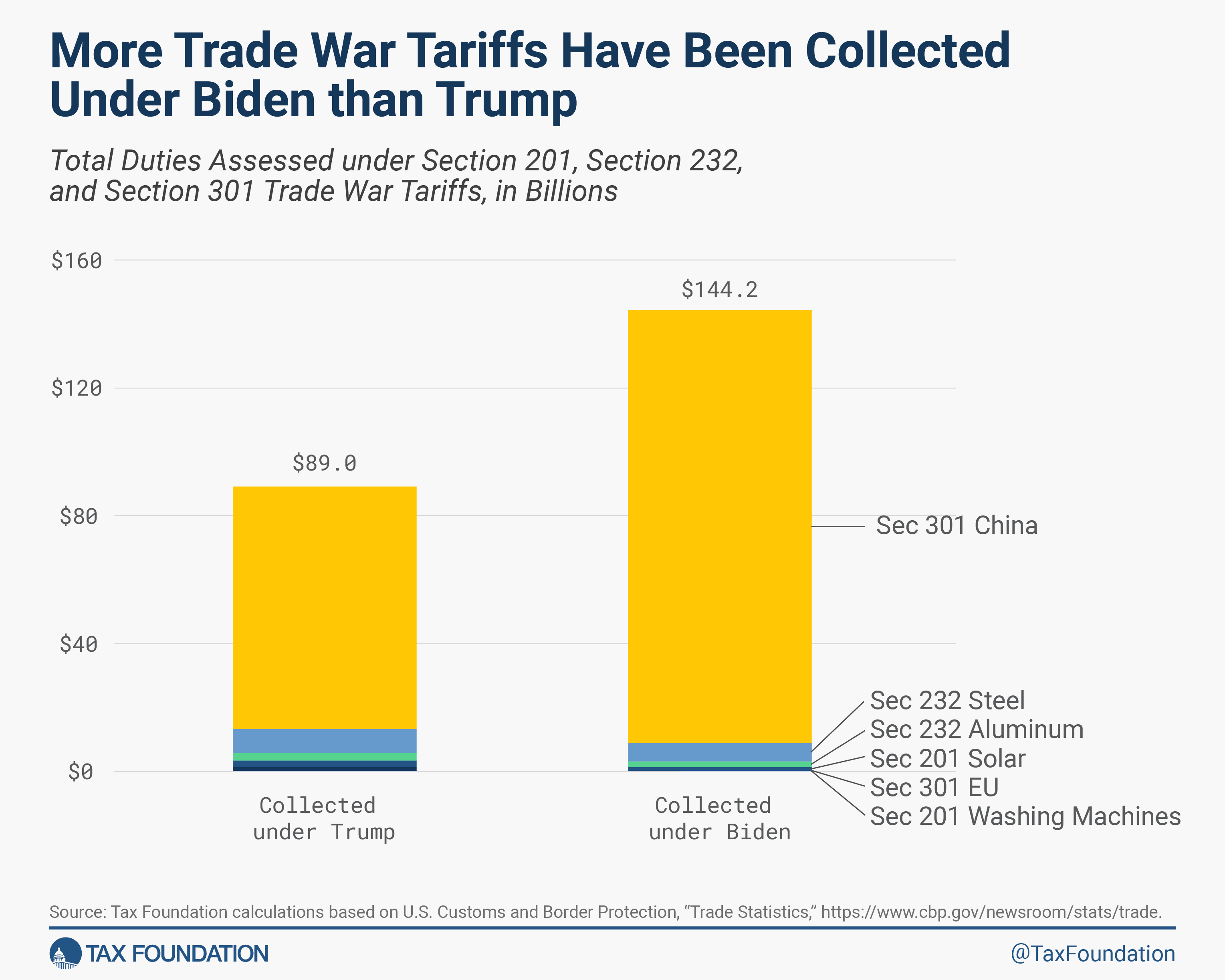

The Impact of China Tariffs on Global Stock Markets

China tariffs, implemented over the past few years, have significantly reshaped the global economic landscape. Their impact on the live stock market is multifaceted and far-reaching.

Specific Sectors Affected

Several sectors have been particularly vulnerable to the ripple effects of these tariffs.

-

Agriculture: The agricultural sector, including companies involved in soybean, pork, and other agricultural exports, has experienced substantial losses due to reduced demand and increased costs. For example, the price of soybeans dropped significantly after the imposition of tariffs.

-

Technology: The tech sector, heavily reliant on global supply chains, has also felt the pinch. Companies relying on components manufactured in China have faced increased production costs and disruptions.

-

Examples:

- Shares of agricultural companies like [insert example stock ticker] saw a [percentage]% decline following the imposition of tariffs.

- The tech index [insert example index] experienced a [percentage]% decrease as supply chain disruptions impacted profitability.

The mechanisms through which tariffs influence stock prices are complex:

- Supply chain disruptions: Tariffs increase the cost of imported goods, disrupting supply chains and reducing the availability of products.

- Reduced demand: Higher prices caused by tariffs lead to lower consumer demand, affecting company revenues and profitability.

- Investor sentiment: The uncertainty surrounding trade policies negatively impacts investor confidence, often leading to market sell-offs.

Strategies for Investors During Tariff Uncertainty

Navigating the uncertainty created by China tariffs requires a proactive and diversified investment strategy.

- Diversification: Spreading investments across different sectors and geographies minimizes the impact of any single event.

- Hedging: Using financial instruments like options or futures contracts can help protect against potential losses.

- Fundamental analysis: Thoroughly researching companies' financial health and their exposure to trade policies is crucial for informed decision-making.

Analyzing the UK Trade Agreement's Influence on the Live Stock Market

The UK trade agreement, while aiming to boost the UK economy, also presents both opportunities and challenges for the live stock market.

Positive Impacts of the Agreement

The agreement offers several potential benefits:

-

Increased trade volume: Reduced trade barriers are expected to lead to increased trade between the UK and its trading partners.

-

Reduced barriers: Easier access to new markets will potentially create new opportunities for UK businesses.

-

Examples:

- Companies in the [specific sector] are projected to see a [percentage]% increase in exports to [trading partner].

- Improved market access could boost the revenue of [specific company] by [estimated amount].

The improved market access resulting from the agreement could significantly benefit various sectors.

Potential Challenges and Risks

Despite the potential positives, several challenges and risks exist:

-

Increased competition: UK businesses might face increased competition from companies in other countries.

-

Unforeseen regulations: New regulations arising from the agreement could impact certain sectors negatively.

-

Examples:

- The [specific sector] could face heightened competition from [country].

- New regulatory requirements might increase compliance costs for companies in the [specific sector].

These factors need careful consideration when assessing the overall impact.

Long-Term Outlook and Predictions

Predicting the long-term effects of the UK trade agreement requires considering several key factors:

- Global economic growth: The overall health of the global economy will influence the success of the agreement.

- Geopolitical stability: Trade relations between the UK and other countries will play a vital role.

- Regulatory adaptation: The speed and effectiveness of adapting to new regulations will influence the outcomes.

Based on current trends and projections from reputable sources like [cite reputable source], the long-term impact on specific sectors such as [mention sector] is likely to be [positive/negative/mixed], with potential implications for related stocks and indices.

Conclusion: Staying Ahead in the Dynamic Live Stock Market

The impacts of China tariffs and the UK trade agreement on the live stock market are complex and interconnected. Continuous monitoring of global events and informed decision-making are essential for navigating this dynamic environment. Staying updated on market news, analyzing data, and employing diversified investment strategies are crucial for success. For continuous live stock market coverage and expert analysis on the impacts of China tariffs and UK trade agreements, subscribe to our newsletter!

Featured Posts

-

Bundesliga 2 Matchday 27 Overview Cologne Now Leads

May 10, 2025

Bundesliga 2 Matchday 27 Overview Cologne Now Leads

May 10, 2025 -

Tomas Hertls Two Hat Tricks Fuel Golden Knights Victory

May 10, 2025

Tomas Hertls Two Hat Tricks Fuel Golden Knights Victory

May 10, 2025 -

Vegas Golden Nayts Pobezhdaet Minnesotu V Overtayme Pley Off

May 10, 2025

Vegas Golden Nayts Pobezhdaet Minnesotu V Overtayme Pley Off

May 10, 2025 -

Trumps Executive Orders Experiences Of Transgender Americans

May 10, 2025

Trumps Executive Orders Experiences Of Transgender Americans

May 10, 2025 -

Investing In Palantir Stock Before May 5th What You Need To Know

May 10, 2025

Investing In Palantir Stock Before May 5th What You Need To Know

May 10, 2025