Live Stock Market Updates: Bond Sell-Off, Dow Futures, Bitcoin Rally

Table of Contents

The Bond Sell-Off: Understanding the Implications

The recent bond sell-off is a significant event impacting fixed-income investments. Rising interest rates, fueled by persistent inflation concerns, are the primary culprits. When interest rates rise, the yields on newly issued bonds become more attractive, causing the prices of existing bonds to fall – hence the sell-off. This impacts investors holding bonds, as their value decreases.

- Rising yields and their effect on bond prices: Higher interest rates directly translate to higher yields on new bonds, making older bonds with lower yields less appealing. This creates downward pressure on bond prices.

- Potential flight to safety or risk-off sentiment: While typically considered a safe haven, bonds are not immune to market shifts. During periods of uncertainty, investors may move away from bonds, seeking safer alternatives or assets perceived as less vulnerable to interest rate hikes.

- Strategies for navigating a bond sell-off: Diversification is key. Consider diversifying your fixed-income portfolio by including short-term bonds that are less sensitive to interest rate fluctuations. Careful analysis of the yield curve and understanding its implications for future interest rate movements are also crucial. Consult with a financial advisor to tailor a strategy to your specific risk tolerance and investment goals. This will help you manage your bond market investments effectively during periods of volatility.

Dow Futures: Predicting the Day's Trading

Dow futures are contracts to buy or sell the Dow Jones Industrial Average at a future date. They serve as a powerful indicator of the market's anticipated direction. By observing the movements in Dow futures, investors can gauge the market sentiment before the actual opening of the stock market. Recent Dow futures movements reflect anxieties regarding inflation, interest rate hikes and geopolitical instability.

- Interpretation of upward and downward trends in Dow futures: Upward trends generally suggest optimism and potential gains in the stock market, while downward trends indicate pessimism and potentially falling stock prices.

- Factors influencing Dow futures: Economic data releases (such as inflation reports and employment figures), geopolitical events (wars, political instability), and corporate earnings announcements all play a significant role in shaping Dow futures movements. Understanding technical analysis, such as chart patterns and indicators, can help refine predictions.

- Strategies for using Dow futures for trading and hedging: Dow futures can be used for both speculative trading (attempting to profit from price movements) and hedging (reducing risk in existing stock positions). Risk management is crucial when utilizing futures contracts. Understanding leverage and margin requirements is paramount.

Bitcoin Rally: Crypto's Response to Market Uncertainty

The recent Bitcoin price rally is a complex phenomenon with multiple potential causes. One factor is institutional adoption, with larger firms increasingly incorporating Bitcoin into their investment portfolios. Another is its potential role as an inflation hedge, as some investors see Bitcoin as a store of value that's less susceptible to inflationary pressures than traditional fiat currencies.

- Bitcoin's historical performance during market downturns: Bitcoin's price has historically shown a degree of decoupling from traditional markets. While it's not immune to overall market sentiment, its performance can sometimes diverge, offering potential diversification benefits.

- Potential risks and rewards associated with investing in Bitcoin: Bitcoin's volatility is well-documented. While it offers the potential for significant returns, it also carries substantial risk. Regulatory uncertainty also contributes to the overall risk profile.

- The role of cryptocurrencies in a diversified portfolio: Cryptocurrencies, including Bitcoin, can potentially play a role in a well-diversified investment portfolio, offering exposure to a distinct asset class. However, it's vital to allocate a portion that aligns with your overall risk tolerance.

Conclusion: Staying Informed on Live Stock Market Updates

This analysis of current live stock market updates highlights the complex interplay between the bond market, Dow futures, and the cryptocurrency market. The bond sell-off reflects anxieties around inflation and interest rates, while Dow futures provide valuable insights into market sentiment. The Bitcoin rally showcases the potential of cryptocurrencies in a volatile market. The interconnectedness of these markets underscores the importance of continuous monitoring and informed decision-making.

To make sound investment choices, regularly check for live stock market updates. Subscribe to reputable financial news sources, follow market analysts, and consider consulting a financial advisor before making any investment decisions. Understanding the dynamics of the bond market, Dow futures, and the Bitcoin rally is crucial for navigating the complexities of today's financial landscape. Remember to conduct thorough research and seek professional guidance before investing.

Featured Posts

-

Invest In Excellence Riviera Blue Porsche 911 S T For Sale

May 24, 2025

Invest In Excellence Riviera Blue Porsche 911 S T For Sale

May 24, 2025 -

Yubileyniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Yubileyniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025 -

Hollywood Shut Down Writers And Actors On Strike What It Means For Film And Tv

May 24, 2025

Hollywood Shut Down Writers And Actors On Strike What It Means For Film And Tv

May 24, 2025 -

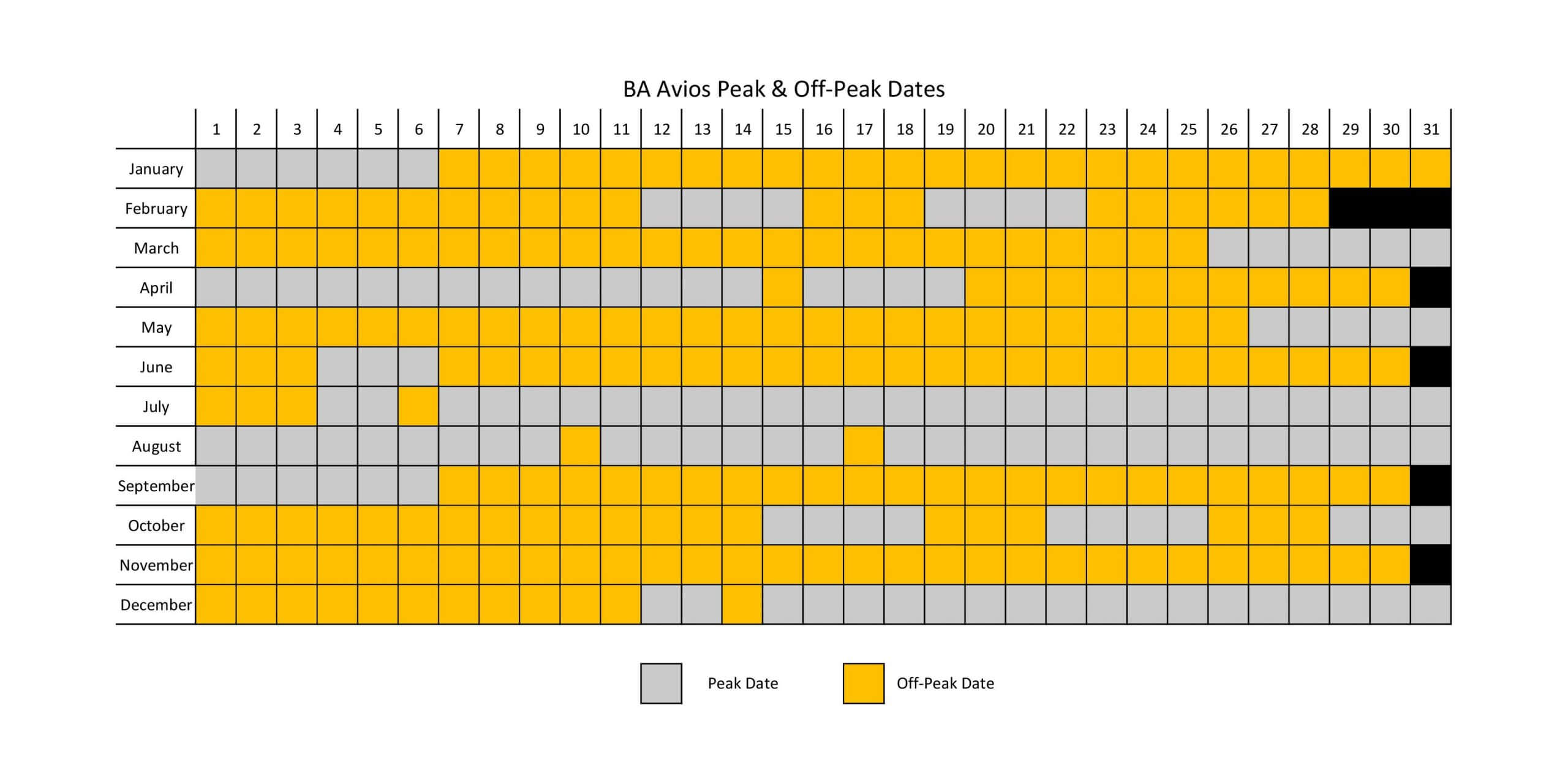

Memorial Day 2025 Air Travel Peak And Off Peak Flight Dates

May 24, 2025

Memorial Day 2025 Air Travel Peak And Off Peak Flight Dates

May 24, 2025 -

10 Let Posle Pobedy Na Evrovidenii Sudby Pobediteley

May 24, 2025

10 Let Posle Pobedy Na Evrovidenii Sudby Pobediteley

May 24, 2025

Latest Posts

-

Kermit The Frogs University Of Maryland Commencement Speech 2025

May 24, 2025

Kermit The Frogs University Of Maryland Commencement Speech 2025

May 24, 2025 -

2025 Commencement Kermit The Frog Addresses University Of Maryland Graduates

May 24, 2025

2025 Commencement Kermit The Frog Addresses University Of Maryland Graduates

May 24, 2025 -

Maryland University Chooses Kermit The Frog For 2025 Graduation Ceremony

May 24, 2025

Maryland University Chooses Kermit The Frog For 2025 Graduation Ceremony

May 24, 2025 -

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025 -

University Of Maryland Chooses Kermit The Frog For 2025 Commencement

May 24, 2025

University Of Maryland Chooses Kermit The Frog For 2025 Commencement

May 24, 2025