Live Stock Market Updates: Bond Sell-Off, Dow Futures Reaction, Bitcoin Rally

Table of Contents

The Bond Market Sell-Off: Unpacking the Causes

Rising Interest Rates and Inflationary Pressures:

Rising interest rates, implemented by central banks to combat inflation, significantly impact bond yields. This is because bonds offer a fixed income stream, making them less attractive when interest rates rise. The inverse relationship between bond prices and interest rates means that as interest rates climb, bond prices fall.

- Key Economic Indicators:

- Consumer Price Index (CPI): A key measure of inflation. High CPI readings often precede interest rate hikes.

- Inflation Expectations: Market forecasts of future inflation influence central bank decisions and bond yields.

- Producer Price Index (PPI): Measures inflation at the wholesale level, providing an early warning for consumer inflation.

This sell-off affects various bond types, including:

- Treasury bonds: Considered low-risk, government-issued bonds.

- Corporate bonds: Bonds issued by companies, carrying higher risk but potentially higher yields.

Geopolitical Uncertainty and its Influence:

Geopolitical events significantly influence investor sentiment. Uncertainty often leads to risk aversion, pushing investors towards safer assets and away from riskier investments like bonds. For example, ongoing geopolitical tensions can trigger a flight to safety, driving bond yields down initially, but longer-term uncertainty can lead to a sell-off.

- Impact of Geopolitical Events:

- Increased tensions can lead to higher demand for safe-haven assets, initially increasing bond prices.

- Prolonged uncertainty can erode investor confidence, causing a sell-off.

- Unexpected geopolitical events can create volatility and trigger rapid price swings.

Technical Factors Contributing to the Sell-Off:

Algorithmic trading and other technical factors can amplify the impact of fundamental market forces. Program trading, for example, can trigger automated sell-offs based on pre-programmed parameters, exacerbating existing downward pressure.

- Potential Consequences:

- Short-term: Increased volatility and potential for further price declines.

- Long-term: Potential for higher borrowing costs for governments and corporations.

Dow Futures Reaction: A Contagion Effect?

Correlation Between Bond Yields and Equity Markets:

There's an inverse relationship between bond yields and stock prices. Rising bond yields often signal higher borrowing costs for companies, impacting profitability and thus stock valuations. This can lead to decreased investor confidence in the equity market, triggering a sell-off.

Dow Futures: A Leading Indicator:

Dow futures trading provides a preview of potential stock market movements. Monitoring Dow futures activity gives insights into investor sentiment and expected market direction before the official market opening. Negative movements in Dow futures often foreshadow declines in the broader equity market.

- Implications:

- Sharp declines in Dow futures suggest a potential negative opening for the broader market.

- Stabilization in Dow futures might indicate a potential market bottoming.

Sector-Specific Impacts:

The bond sell-off and interest rate hikes disproportionately impact certain sectors. Interest-rate-sensitive sectors like utilities and real estate are particularly vulnerable. Conversely, sectors perceived as safe havens, such as consumer staples, may experience increased investor interest.

Bitcoin Rally: A Safe Haven or Speculation?

Bitcoin as a Hedge Against Inflation:

Some argue that Bitcoin can serve as a hedge against inflation and economic uncertainty. Its limited supply and decentralized nature are seen as attractive features in times of economic instability. However, this argument is still debated, given Bitcoin's inherent volatility.

Technical Factors Driving the Bitcoin Rally:

Technical indicators and trading patterns can explain the Bitcoin price surge. For example, a breakout above a key resistance level might trigger a wave of buying, further fueling the rally. Institutional and retail investor participation plays a crucial role in price movements.

Risks and Uncertainties in the Bitcoin Market:

The cryptocurrency market is inherently volatile. While the recent rally is noteworthy, investors must acknowledge the potential for sharp corrections and price reversals. Regulatory uncertainty and technological vulnerabilities also pose significant risks.

Conclusion

Today's live stock market updates reveal a complex interplay between bond markets, equity markets, and even cryptocurrencies. The bond sell-off, driven by rising interest rates and geopolitical uncertainty, is creating ripples across financial markets, influencing Dow futures and triggering a surprising rally in Bitcoin. While the Bitcoin rally presents an interesting counterpoint, investors must remain vigilant and carefully consider the risks involved. Understanding these interconnected market dynamics is crucial for navigating this volatile environment. Stay informed on future live stock market updates for the latest insights and make well-informed investment decisions. Regularly check back for more comprehensive live stock market updates to maintain a strong grasp on current market conditions.

Featured Posts

-

Tu Horoscopo Semana Del 11 Al 17 De Marzo De 2025

May 23, 2025

Tu Horoscopo Semana Del 11 Al 17 De Marzo De 2025

May 23, 2025 -

Valerie Rodriguez Confirmada Como Secretaria Del Daco Por El Senado

May 23, 2025

Valerie Rodriguez Confirmada Como Secretaria Del Daco Por El Senado

May 23, 2025 -

Tva Group Cuts 30 Jobs Ceo Cites Streaming Services And Regulators

May 23, 2025

Tva Group Cuts 30 Jobs Ceo Cites Streaming Services And Regulators

May 23, 2025 -

New Netflix Series White Lotus Star And Oscar Winner In A Sexy Darkly Funny Drama

May 23, 2025

New Netflix Series White Lotus Star And Oscar Winner In A Sexy Darkly Funny Drama

May 23, 2025 -

Triumf Aleksandrovoy Pobeda Nad Samsonovoy Na Starte Shtutgartskogo Turnira

May 23, 2025

Triumf Aleksandrovoy Pobeda Nad Samsonovoy Na Starte Shtutgartskogo Turnira

May 23, 2025

Latest Posts

-

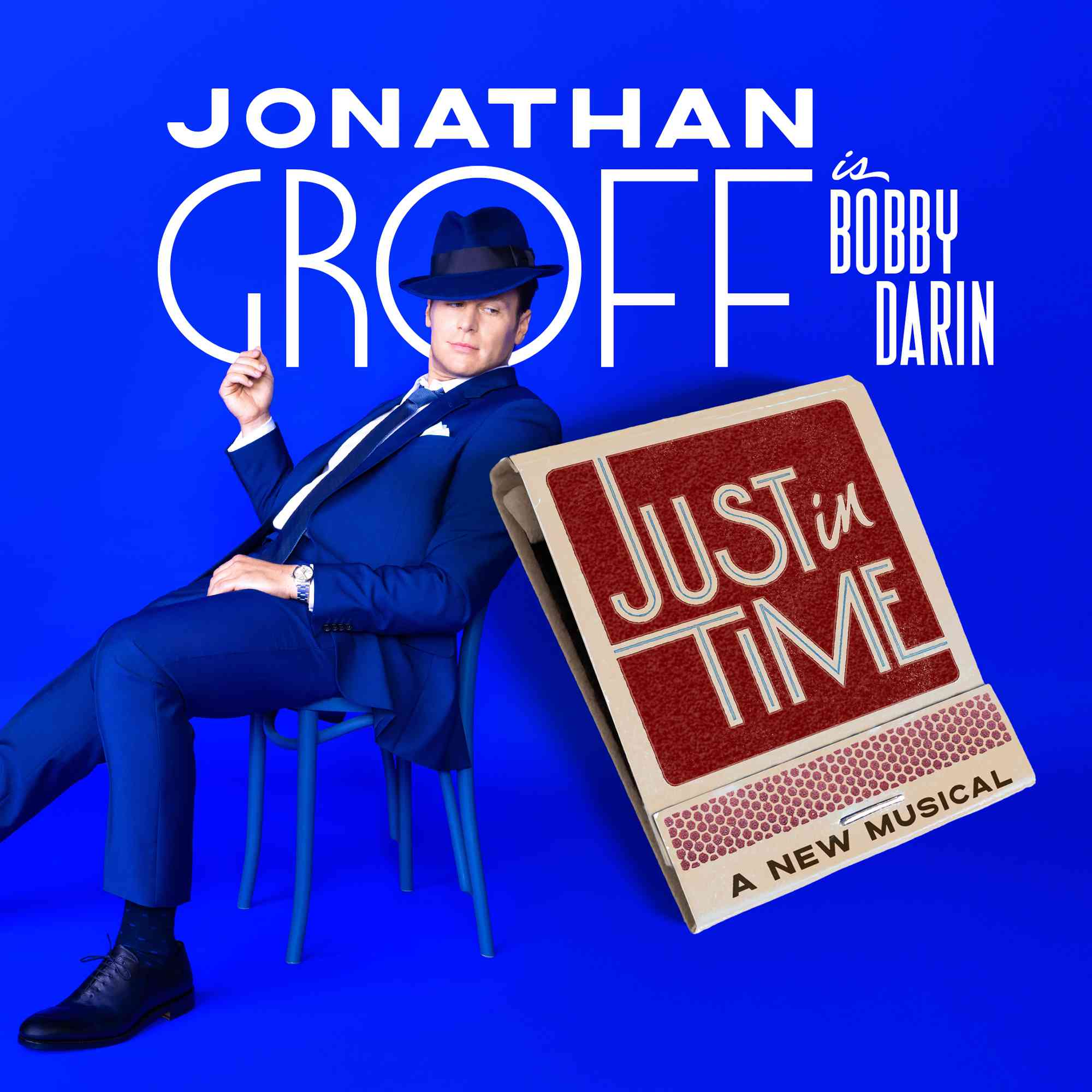

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groff Discusses His Experiences With Asexuality

May 23, 2025

Jonathan Groff Discusses His Experiences With Asexuality

May 23, 2025 -

Jonathan Groffs Bobby Darin Transformation Just In Time And The Power Of Performance

May 23, 2025

Jonathan Groffs Bobby Darin Transformation Just In Time And The Power Of Performance

May 23, 2025 -

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 23, 2025

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 23, 2025