Live Stock Market Updates: Dow Jones, S&P 500, And Nasdaq For May 27

Table of Contents

Dow Jones Performance on May 27th

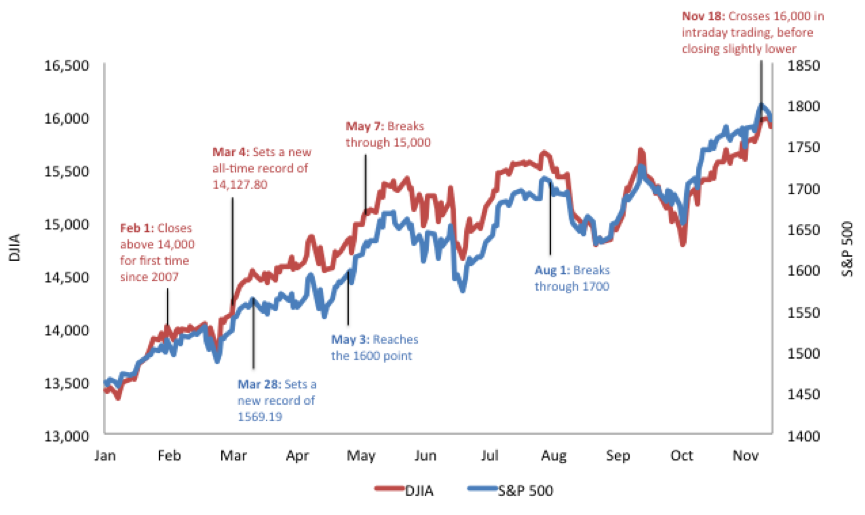

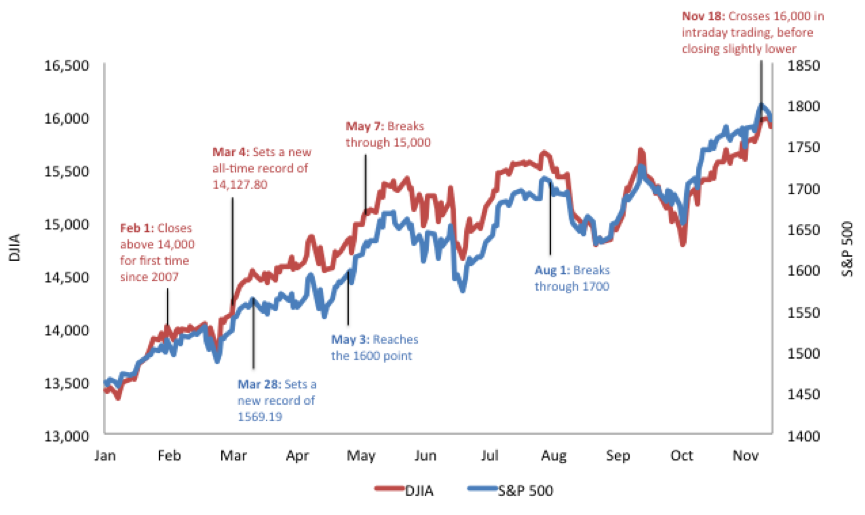

The Dow Jones Industrial Average (DJIA) suffered a considerable drop on May 27th. The index opened lower than the previous day's close and experienced increased volatility throughout the trading session.

- Percentage change: The Dow Jones closed down by X%, representing a significant decline compared to the previous day's closing value of Y points.

- Key factors: This downturn can be attributed to several factors, including disappointing economic data releases showing a slower-than-expected GDP growth, concerns about rising inflation, and negative news surrounding several major Dow Jones components. Geopolitical tensions also played a role in investor sentiment.

- Significant gainers/losers: While the overall trend was negative, certain sectors showed resilience. For example, [mention specific company or sector that performed relatively well]. Conversely, companies in the [mention specific sector] experienced particularly steep declines, significantly impacting the overall index.

- Visual representation: [Insert a chart or graph illustrating the Dow Jones's intraday performance on May 27th, clearly showing the opening, closing, high, and low points.]

S&P 500 Market Analysis for May 27th

The S&P 500, mirroring the Dow Jones's trajectory, also experienced a substantial drop on May 27th. This broader market index reflects the overall health of the US economy and showed a clear indication of negative investor sentiment.

- Percentage change and closing values: The S&P 500 closed at Z points, representing a Y% decrease from the previous day's close.

- Sector performance: The technology sector, a significant component of the S&P 500, was particularly hard hit. The energy and healthcare sectors also experienced declines, though less pronounced than technology.

- Contributing factors: Similar to the Dow Jones, disappointing economic indicators, inflation concerns, and geopolitical uncertainty contributed significantly to the S&P 500's decline. Negative earnings reports from several key companies also weighed on investor confidence.

- Visual representation: [Insert a chart or graph displaying the S&P 500's daily performance on May 27th, highlighting key trends.]

Nasdaq Composite Index: A Deep Dive into May 27th Trading

The Nasdaq Composite, heavily weighted towards technology stocks, experienced the most significant decline among the three major indices on May 27th. This underscores the vulnerability of the tech sector to broader economic anxieties.

- Technology sector influence: The technology sector's underperformance was a major driver of the Nasdaq's drop. Concerns about rising interest rates and potential regulatory changes in the tech industry contributed to this decline.

- Significant technology companies: Several large technology companies experienced substantial losses, amplifying the negative trend within the Nasdaq. [Mention specific companies and their performance].

- Regulatory changes/news: [Discuss any specific regulatory news or announcements that negatively impacted the Nasdaq on May 27th.]

- Visual representation: [Insert a chart or graph demonstrating the Nasdaq's performance throughout the day, highlighting the impact of technology stocks.]

Overall Market Sentiment and Predictions

The overall market sentiment on May 27th was overwhelmingly negative, as indicated by the significant drops across the Dow Jones, S&P 500, and Nasdaq. Investor anxiety was palpable, reflecting concerns about economic growth and future market direction.

- Investor reactions and volatility: Investors reacted to the negative news with widespread selling, leading to increased market volatility.

- Reasons behind market trends: A confluence of factors—disappointing economic data, inflation fears, and geopolitical instability—created a perfect storm for a market downturn.

- Future market outlook: Predicting future market movements is inherently challenging. However, based on current trends, we may see continued volatility in the short term. A cautious approach is advisable until economic uncertainty subsides. [Include appropriate disclaimers about investment advice.]

- Expert opinions/analyst predictions: [Mention any relevant expert opinions or analyst predictions regarding future market trends, citing sources.]

Conclusion

The live stock market updates for May 27th reveal a significant market downturn across the Dow Jones, S&P 500, and Nasdaq indices. Disappointing economic data, inflation concerns, and geopolitical uncertainties contributed to widespread negative investor sentiment and increased market volatility. To stay informed about these crucial market shifts and gain valuable insights into daily market analysis, we encourage you to regularly check our website for live stock market updates. Follow us on social media [link to social media] for continuous updates on the Dow Jones, S&P 500, and Nasdaq, and refine your investing strategies accordingly. Stay updated with our daily market analysis to make informed decisions.

Featured Posts

-

The Us And The Growing Threat From Russia Fortifying Europes Northern Border

May 28, 2025

The Us And The Growing Threat From Russia Fortifying Europes Northern Border

May 28, 2025 -

Samsung Galaxy S25 Ultra 256 Go A 953 75 E L Offre La Plus Interessante

May 28, 2025

Samsung Galaxy S25 Ultra 256 Go A 953 75 E L Offre La Plus Interessante

May 28, 2025 -

Prakiraan Cuaca Kaltim Terbaru Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025

Prakiraan Cuaca Kaltim Terbaru Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025 -

Resmi Aciklama Yakin Cristiano Ronaldo Al Nassr Da 2 Yil Oynayacak

May 28, 2025

Resmi Aciklama Yakin Cristiano Ronaldo Al Nassr Da 2 Yil Oynayacak

May 28, 2025 -

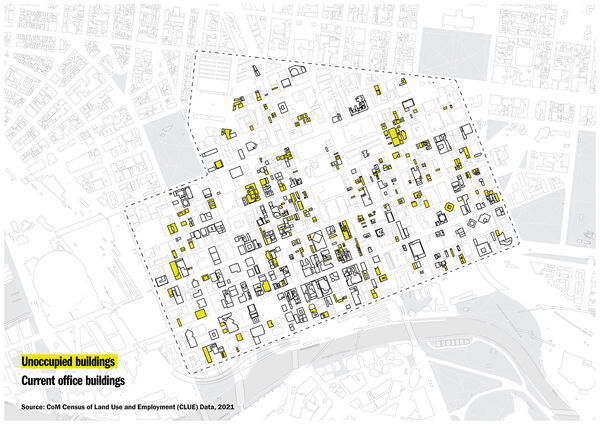

The Netherlands Analyzing The Delays In Converting Vacant Commercial Properties To Homes

May 28, 2025

The Netherlands Analyzing The Delays In Converting Vacant Commercial Properties To Homes

May 28, 2025