Low Inflation Podcast: Planning For The Future

Table of Contents

Understanding Low Inflation and its Implications

Defining Low Inflation:

Low inflation is generally defined as a sustained increase in the general price level of goods and services of less than 3% annually. This contrasts sharply with deflation (a decrease in the general price level) and high inflation (a rapid increase in prices, often exceeding 10%). Low inflation can be caused by various factors, including decreased consumer demand, increased productivity, technological advancements, and strong competition.

- Deflation: A general decline in prices, often indicating a weak economy.

- Low Inflation: A slow, steady increase in prices, typically considered healthy for economic stability.

- High Inflation: A rapid increase in prices, eroding purchasing power.

- Causes of Low Inflation: Increased productivity, technological advancements, globalization, and strong competition.

Impacts of Low Inflation on Savings and Investments:

Low inflation significantly impacts interest rates, affecting returns on savings accounts and influencing investment strategies. Lower inflation typically leads to lower interest rates, which can make it challenging for savers to earn a substantial return on their deposits. However, it can present opportunities for investors.

- Challenges: Lower returns on savings accounts, bonds becoming less attractive.

- Opportunities: Potential for increased stock market growth (as borrowing costs are lower), real estate investment can benefit from lower mortgage rates.

- Investment Strategies: Consider a diversified portfolio including stocks, real estate, and alternative investments like commodities. Value investing strategies can also be effective in low-inflation environments.

Low Inflation's Effect on Retirement Planning:

Low inflation can subtly yet significantly influence retirement planning. While seemingly beneficial, low returns on savings and investments can mean slower growth of retirement funds.

- Impact on Pensions: Lower interest rates can affect the growth of pension funds, potentially leading to smaller payouts.

- Social Security Benefits: While adjusted annually for inflation, low inflation may lead to smaller adjustments.

- Retirement Fund Growth: Lower returns mean needing to save more aggressively to reach retirement goals. Consider adjusting your contribution rates to compensate for lower returns.

Strategies for Financial Planning in a Low-Inflation Environment

Diversifying Your Investment Portfolio:

Diversification is crucial in any economic climate but particularly vital during low inflation. Spreading investments across different asset classes helps mitigate risks and potentially improve returns.

- Stocks: Offer potential for growth, but higher risk.

- Bonds: Provide stability, but lower returns in a low-inflation environment.

- Real Estate: Can provide a hedge against inflation and generate rental income.

- Commodities: Offer diversification, but can be volatile.

- Example Portfolio: A mix of index funds (for stock market exposure), high-yield bonds, and a small allocation to real estate investment trusts (REITs).

Utilizing Debt Strategically:

While responsible debt management is always important, a low-inflation environment can present some opportunities. Low interest rates may make borrowing more attractive.

- Benefits: Lower interest rates on mortgages and loans.

- Risks: Over-leveraging can be detrimental if economic conditions change.

- Strategies: Prioritize paying down high-interest debt first. Consider refinancing existing loans to lower interest rates.

The Role of Real Estate in Low Inflation:

Real estate investments can serve as a hedge against low inflation, providing potential for capital appreciation and rental income.

- Rental Properties: Generate passive income, benefiting from rent increases that outpace inflation.

- REITs: Provide exposure to the real estate market without direct property ownership.

- Importance of Research: Careful market research is vital before investing in real estate; location is paramount.

Finding and Utilizing Low Inflation Podcasts

Identifying Reputable Sources:

Choosing reliable financial podcasts is critical. Look for podcasts hosted by qualified financial professionals with a track record of sound advice.

- Credentials: Check the host’s qualifications and experience.

- Transparency: Look for podcasts that clearly state their affiliations and potential conflicts of interest.

- Diverse Perspectives: Consider podcasts that offer a range of views on financial planning rather than promoting a single strategy.

Leveraging Podcast Content for Planning:

Once you find reliable Low Inflation Podcasts, actively engage with the content to apply it to your situation.

- Note-Taking: Jot down key takeaways and strategies.

- Personalization: Adapt general advice to your specific financial goals and circumstances.

- Actionable Steps: Identify concrete steps you can take based on the podcast information.

Secure Your Future with Low Inflation Podcast Insights

This article has highlighted key strategies for navigating a low-inflation environment, including diversifying investments, managing debt strategically, and leveraging the insights from reliable Low Inflation Podcasts. Remember, low inflation presents unique challenges and opportunities, requiring a proactive approach to financial planning.

Start listening to Low Inflation Podcasts today, and take control of your financial future. Don't let low inflation limit your potential; use it to your advantage! Proactive financial planning, regardless of the inflationary environment, is the key to securing your long-term financial well-being.

Featured Posts

-

The End Of Revenge Travel In America Fear And Uncertainty Take Hold

May 27, 2025

The End Of Revenge Travel In America Fear And Uncertainty Take Hold

May 27, 2025 -

Is Kai Cenat Addressing His Friends Racist Jokes Awaiting His Response

May 27, 2025

Is Kai Cenat Addressing His Friends Racist Jokes Awaiting His Response

May 27, 2025 -

How To Watch Yellowstone 1923 Season 2 Episode 5 For Free Tonight

May 27, 2025

How To Watch Yellowstone 1923 Season 2 Episode 5 For Free Tonight

May 27, 2025 -

Ajc Launches Global Initiative To Map Antisemitic Incidents

May 27, 2025

Ajc Launches Global Initiative To Map Antisemitic Incidents

May 27, 2025 -

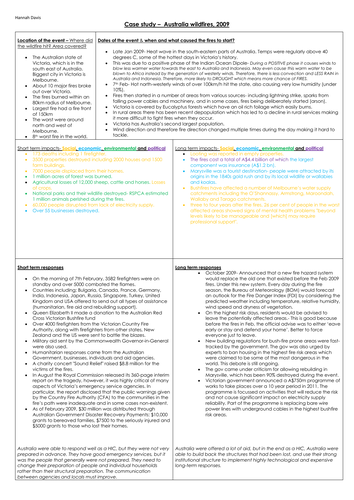

The Rise Of Disaster Betting Examining The Los Angeles Wildfire Case Study

May 27, 2025

The Rise Of Disaster Betting Examining The Los Angeles Wildfire Case Study

May 27, 2025

Latest Posts

-

Sanofi Et Ses Concurrents Europeens Une Etude De La Sous Performance Boursiere

May 31, 2025

Sanofi Et Ses Concurrents Europeens Une Etude De La Sous Performance Boursiere

May 31, 2025 -

Sanofi Fda Erteilt Orphan Drug Status Fuer Rilzabrutinib Chancen Fuer Die Aktie

May 31, 2025

Sanofi Fda Erteilt Orphan Drug Status Fuer Rilzabrutinib Chancen Fuer Die Aktie

May 31, 2025 -

Rilzabrutinib Sanofi Orphan Drug Designation Auswirkungen Auf Die Sanofi Aktie

May 31, 2025

Rilzabrutinib Sanofi Orphan Drug Designation Auswirkungen Auf Die Sanofi Aktie

May 31, 2025 -

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025 -

Sanofi Depakine Et L Enquete Sur Les Rejets Toxiques A Mourenx

May 31, 2025

Sanofi Depakine Et L Enquete Sur Les Rejets Toxiques A Mourenx

May 31, 2025