Low Personal Loan Interest Rates Today: Secure Financing From 6%

Table of Contents

Factors Influencing Low Personal Loan Interest Rates

Several key factors determine the interest rate you'll receive on a personal loan. Understanding these factors can significantly improve your chances of securing low personal loan interest rates.

Credit Score's Crucial Role

Your credit score is the most significant factor influencing your interest rate. Lenders use your credit score to assess your creditworthiness and risk. A higher credit score indicates a lower risk to the lender, resulting in more favorable interest rates.

- 650 Credit Score: May receive interest rates in the 10-15% range.

- 750 Credit Score: Could qualify for rates as low as 8-12%.

- 800 Credit Score: Might secure rates as low as 6-8%, or even lower, depending on other factors.

Regularly checking your credit report from agencies like Experian, Equifax, and TransUnion and addressing any errors is crucial. Improving your credit score through responsible financial habits is key to getting the best personal loan rates.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) measures your monthly debt payments relative to your gross monthly income. A lower DTI demonstrates your ability to manage debt effectively. Lenders prefer borrowers with lower DTI ratios as it indicates a reduced risk of default.

- Acceptable DTI: Generally, a DTI below 43% is considered favorable for loan approval.

- Lowering your DTI: Strategies include paying down existing debts, increasing your income, or a combination of both.

You can calculate your DTI using online calculators readily available with a simple search for "DTI calculator."

Loan Amount and Term

The amount you borrow and the loan's repayment term also influence the interest rate. Larger loan amounts often come with slightly higher interest rates, reflecting increased risk for the lender. Similarly, longer loan terms may result in lower monthly payments, but you'll end up paying more interest overall.

- Loan Amount: A $5,000 loan might have a lower interest rate than a $25,000 loan.

- Loan Term: A 36-month loan will usually have a higher interest rate than a 60-month loan, but the total interest paid will be higher.

Choosing a repayment plan that aligns with your financial capabilities is essential to avoid default and maintain a good credit score.

The Lender's Role

Different lenders have varying policies and risk assessments, resulting in different interest rate offerings. Banks, credit unions, and online lenders all offer personal loans, but their rates and terms can differ significantly.

- Banks: Often offer a wider range of loan amounts and terms but may have stricter eligibility criteria.

- Credit Unions: May provide more competitive interest rates for members, but their loan offerings might be more limited.

- Online Lenders: Typically offer a streamlined application process and faster approvals, but may have higher fees or less personalized service. Always carefully compare the Annual Percentage Rate (APR), which includes fees, to get the full picture of the loan's cost.

How to Qualify for Low Personal Loan Interest Rates

Securing low interest personal loans requires proactive steps to improve your financial standing and shop strategically.

Improve Your Credit Score

A higher credit score is paramount for securing low interest rates. Focus on these key areas:

- Pay bills on time: Consistent on-time payments significantly improve your credit score.

- Keep credit utilization low: Aim to keep your credit card balances below 30% of your credit limit.

- Avoid applying for multiple loans simultaneously: Too many credit inquiries can negatively impact your score.

Numerous online resources offer guidance on improving your credit score.

Shop Around for the Best Rates

Don't settle for the first offer you receive. Comparing offers from multiple lenders is crucial to finding the best personal loan rates.

- Use online comparison tools: Several websites allow you to compare rates from various lenders.

- Read the fine print: Carefully review all terms and conditions before committing to a loan.

- Understand fees: Pay attention to origination fees, prepayment penalties, and other charges that can impact the overall cost.

Secure a Co-Signer (If Necessary)

If you have a lower credit score, a co-signer with good credit can significantly improve your chances of securing a loan with a lower interest rate.

- Co-signer responsibility: The co-signer shares responsibility for repaying the loan if you default.

- Alternatives: Explore options like secured loans (using collateral) if a co-signer is unavailable.

Where to Find Low Personal Loan Interest Rates Today

Finding the best low interest personal loans requires researching various lenders.

Online Lenders

Online lenders offer convenience and speed. However, it’s crucial to carefully vet their legitimacy and reputation.

- Reputable Online Lenders: Research and compare several reputable online lenders before applying.

- Convenience: Online applications often allow for quick approvals and funding.

Banks and Credit Unions

Traditional banks and credit unions also offer personal loans, often with personalized service but potentially longer processing times.

- Banks: Consider applying with banks for potential access to a broader range of loan options.

- Credit Unions: Credit unions may offer lower rates, particularly to their members, but their eligibility criteria might be more stringent. Check their eligibility requirements before applying.

Conclusion

Securing low personal loan interest rates depends on several factors, primarily your credit score and debt-to-income ratio. By improving your creditworthiness, shopping around for the best rates, and understanding the lender's role, you can significantly increase your chances of obtaining affordable financing. Don't miss out on securing low personal loan interest rates starting from 6%! Start your application today and find the best low interest personal loans available to you – begin your comparison now!

Featured Posts

-

Arsenal Transfer Target Striker Prefers Gunners Despite Tottenhams 58m Bid

May 28, 2025

Arsenal Transfer Target Striker Prefers Gunners Despite Tottenhams 58m Bid

May 28, 2025 -

Late Game Heroics Stowers Grand Slam Secures Marlins Win

May 28, 2025

Late Game Heroics Stowers Grand Slam Secures Marlins Win

May 28, 2025 -

Missing Teen Bryan County Sheriffs Office Investigation Underway

May 28, 2025

Missing Teen Bryan County Sheriffs Office Investigation Underway

May 28, 2025 -

Cristiano Ronaldo Nun Adanali Ronaldolu Nun Elestirilerine Cevabi

May 28, 2025

Cristiano Ronaldo Nun Adanali Ronaldolu Nun Elestirilerine Cevabi

May 28, 2025 -

Kapolda Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali

May 28, 2025

Kapolda Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali

May 28, 2025

Latest Posts

-

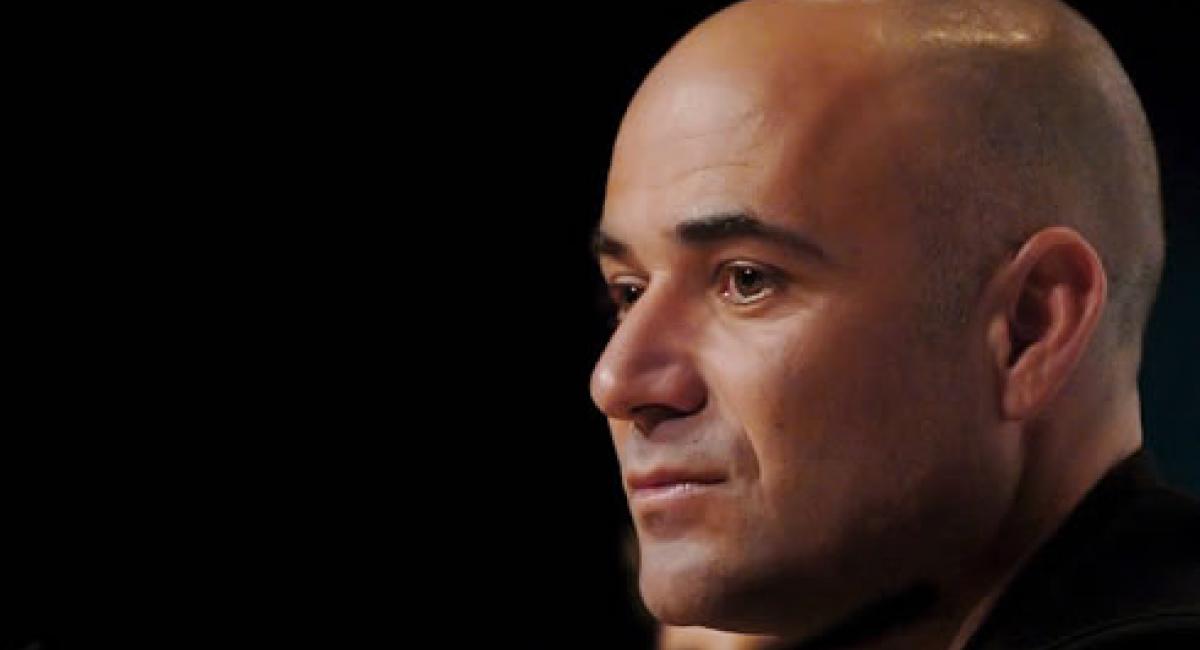

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025 -

Erfolg Im Pickleball Die Methoden Von Steffi Graf Und Andre Agassi

May 30, 2025

Erfolg Im Pickleball Die Methoden Von Steffi Graf Und Andre Agassi

May 30, 2025 -

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025 -

Andre Agassi Vuelve Al Deporte Nueva Etapa Nuevos Retos

May 30, 2025

Andre Agassi Vuelve Al Deporte Nueva Etapa Nuevos Retos

May 30, 2025 -

Pickleball Profis Steffi Graf Und Andre Agassi Verraten Ihre Strategien

May 30, 2025

Pickleball Profis Steffi Graf Und Andre Agassi Verraten Ihre Strategien

May 30, 2025