Lower Tariffs, Deeper Recession? A Canadian Economic Analysis

Table of Contents

The Current State of the Canadian Economy

Understanding the current economic climate is crucial to evaluating the potential impact of tariff reductions. Canada is currently facing a confluence of challenges. Inflation, though showing signs of easing, remains above the Bank of Canada's target range, squeezing consumer spending power. Recent GDP growth figures have been mixed, reflecting uneven performance across sectors. Unemployment rates, while relatively low, mask significant sectoral variations, with some industries facing labour shortages while others experience job losses. Consumer confidence remains fragile, further complicating the economic outlook.

- Current Inflation Rate and its Impact: Persistent inflation erodes purchasing power, dampening consumer spending and investment.

- Recent GDP Growth Figures: While positive growth is reported, the rate is slowing, indicating a potential weakening of the economy.

- Unemployment Trends and Sectoral Variations: Job losses in certain sectors, particularly those sensitive to global competition, could be exacerbated by tariff reductions.

- Analysis of Consumer Spending Patterns: Consumer spending is a major driver of economic growth. Reduced confidence and inflation are impacting spending habits.

The Impact of Tariffs on Canadian Industries

Different sectors of the Canadian economy are differentially affected by tariffs, both import and export. Reducing tariffs could have significant consequences.

The automotive industry, for example, is heavily reliant on both imported parts and exports to the US. Lower tariffs could lead to cheaper imported vehicles, benefiting consumers but potentially harming domestic auto manufacturers. The agricultural sector, meanwhile, is vulnerable to increased competition from cheaper imports, potentially impacting farmers' incomes. The manufacturing sector, already facing challenges from automation and global competition, could experience further job displacement if lower tariffs lead to a flood of cheaper imports.

- Case Study: Impact of Tariffs on the Canadian Auto Industry: Reduced tariffs could lead to increased competition, potentially impacting domestic production and employment.

- Analysis of the Agricultural Sector's Vulnerability to Import Competition: Canadian farmers may face challenges competing with lower-priced imports from countries with lower production costs.

- Discussion of Potential Job Displacement in Manufacturing Due to Cheaper Imports: Lower tariffs could lead to job losses in the manufacturing sector as companies shift production to countries with lower labour costs.

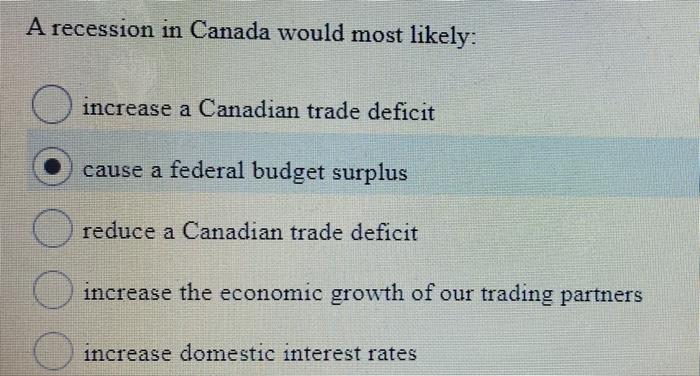

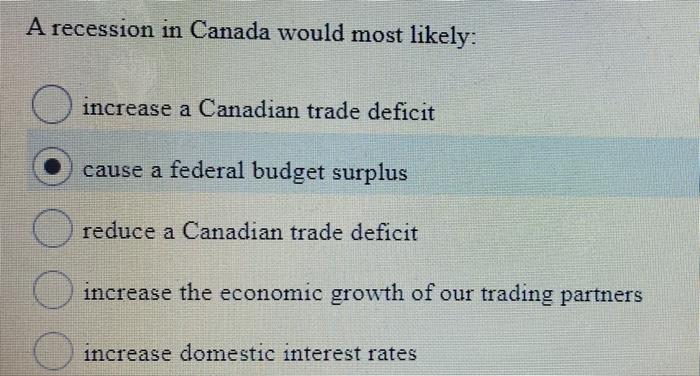

Lower Tariffs and the Risk of a Deeper Recession

The potential negative consequences of lower tariffs on the Canadian economy are significant. Increased competition from cheaper imports could lead to reduced domestic production, job losses, and a decline in business investment. This could trigger a downward spiral, leading to decreased consumer spending and a deeper recession. While lower prices might stimulate demand in some sectors, the negative impact on employment and consumer confidence could outweigh the benefits of cheaper goods. This necessitates a careful examination of the potential macroeconomic effects.

- Modeling the Impact of Tariff Reductions on GDP Growth: Economic modeling is necessary to predict the overall impact of tariff reductions on GDP growth.

- Assessing the Potential for Increased Unemployment: Job displacement in industries facing increased competition is a major concern.

- Analysis of the Impact on Consumer and Business Confidence: Decreased consumer confidence and business investment could further exacerbate the economic downturn.

- Discussion of Potential Government Intervention Strategies: Government intervention might be necessary to mitigate the negative effects of tariff reductions.

Alternative Economic Policies and Mitigation Strategies

To mitigate the potential negative impacts of lower tariffs, the Canadian government could implement various strategies. Targeted support for affected industries, such as subsidies or tax breaks, could help them remain competitive. Retraining programs and job placement initiatives could assist workers displaced by increased competition. Investing in infrastructure projects could stimulate economic growth and create jobs. A balanced approach is necessary, weighing the benefits of free trade with the need to protect domestic industries and workers.

- Discussion of Potential Government Support Programs for Impacted Industries: Targeted support could help industries adapt to increased competition and prevent job losses.

- Analysis of the Effectiveness of Retraining and Job Placement Initiatives: Investing in retraining programs is crucial to help workers transition to new jobs.

- Evaluation of Infrastructure Investments to Stimulate Economic Growth: Infrastructure investments can create jobs and boost economic activity.

Lower Tariffs, Deeper Recession? A Canadian Economic Analysis: Conclusion

This analysis reveals the complex interplay of factors surrounding tariff reductions in Canada. While lower tariffs can offer potential benefits such as increased consumer choice and lower prices, the risk of a deeper recession due to increased competition and job displacement is substantial. The potential negative impact on domestic industries, employment, and consumer confidence necessitates a cautious and strategic approach. The Canadian government must carefully consider alternative economic policies and mitigation strategies to balance the advantages of free trade with the need to protect its domestic economy. Further research and public dialogue are essential to fully understand the implications of "lower tariffs" on the Canadian economy, and active participation in this crucial debate is urged. Engage with policymakers and advocate for policies that support a robust and resilient Canadian economy.

Featured Posts

-

Bof As Argument Against Stock Market Valuation Concerns

Apr 23, 2025

Bof As Argument Against Stock Market Valuation Concerns

Apr 23, 2025 -

Diamondbacks Secure Walk Off Victory Over Brewers In Ninth Inning

Apr 23, 2025

Diamondbacks Secure Walk Off Victory Over Brewers In Ninth Inning

Apr 23, 2025 -

Go Ahead Entry At Target Field New Facial Recognition System Speeds Entry

Apr 23, 2025

Go Ahead Entry At Target Field New Facial Recognition System Speeds Entry

Apr 23, 2025 -

2024 Milwaukee Brewers Roster Players To Miss And Players To Forget

Apr 23, 2025

2024 Milwaukee Brewers Roster Players To Miss And Players To Forget

Apr 23, 2025 -

Seance Boursiere Parisienne Du 17 02 Analyse Fdj Et Schneider Electric

Apr 23, 2025

Seance Boursiere Parisienne Du 17 02 Analyse Fdj Et Schneider Electric

Apr 23, 2025