Lower Than Expected Earnings For RBC: A Look At The Souring Loan Portfolio

Table of Contents

Analysis of RBC's Q2 2024 Earnings Report

Key Financial Metrics Showing Underperformance:

RBC's Q2 2024 earnings report revealed significant underperformance across key financial metrics. Net income fell short of analyst expectations by [insert percentage or specific figure], while diluted earnings per share (EPS) also missed projections by [insert percentage or specific figure]. Return on equity (ROE), a crucial indicator of profitability, registered at [insert figure], significantly lower than the previous quarter's [insert figure] and below industry benchmarks.

- Net Income: [Insert specific figures and comparison to previous quarters and expectations]

- Diluted EPS: [Insert specific figures and comparison to previous quarters and expectations]

- Return on Equity (ROE): [Insert specific figures and comparison to previous quarters and expectations]

[Insert a chart or graph visually representing the underperformance in these key metrics. Clearly label axes and data points.] The underperformance across these key metrics underscores the severity of the challenges facing RBC's profitability.

Impact of Rising Interest Rates on Loan Portfolio:

The recent surge in interest rates has had a significant negative impact on RBC's loan portfolio. Higher borrowing costs have led to increased loan defaults, particularly within sectors highly sensitive to interest rate fluctuations. The real estate and consumer loan segments appear to be disproportionately affected.

- Increased Loan Defaults: Rising interest rates make it harder for borrowers to repay their loans, resulting in a higher percentage of defaults.

- Real Estate Sector Impact: The housing market slowdown, exacerbated by higher mortgage rates, contributes to increased mortgage delinquencies.

- Consumer Loan Challenges: Increased borrowing costs strain consumer budgets, leading to higher credit card and personal loan defaults.

The rising delinquency rates directly impact RBC's loan performance, reducing profitability and necessitating higher loan loss provisions.

The Souring Loan Portfolio: A Closer Look at Problem Areas

Increased Non-Performing Loans (NPLs):

Non-performing loans (NPLs), defined as loans where borrowers have ceased making payments for a specified period, are a critical indicator of a bank's loan portfolio health. RBC has experienced a notable increase in NPLs across various loan categories in Q2 2024. This rise directly impacts profitability, as the bank needs to set aside larger loan loss provisions to cover potential losses.

- NPL Growth: [Insert data on the growth of NPLs in percentage terms or specific figures across different loan categories.]

- Impact on Profitability: The increase in NPLs has significantly reduced RBC's profitability by increasing loan loss provisions.

- Credit Quality Deterioration: The rise in NPLs signifies a deterioration in the overall credit quality of RBC's loan portfolio.

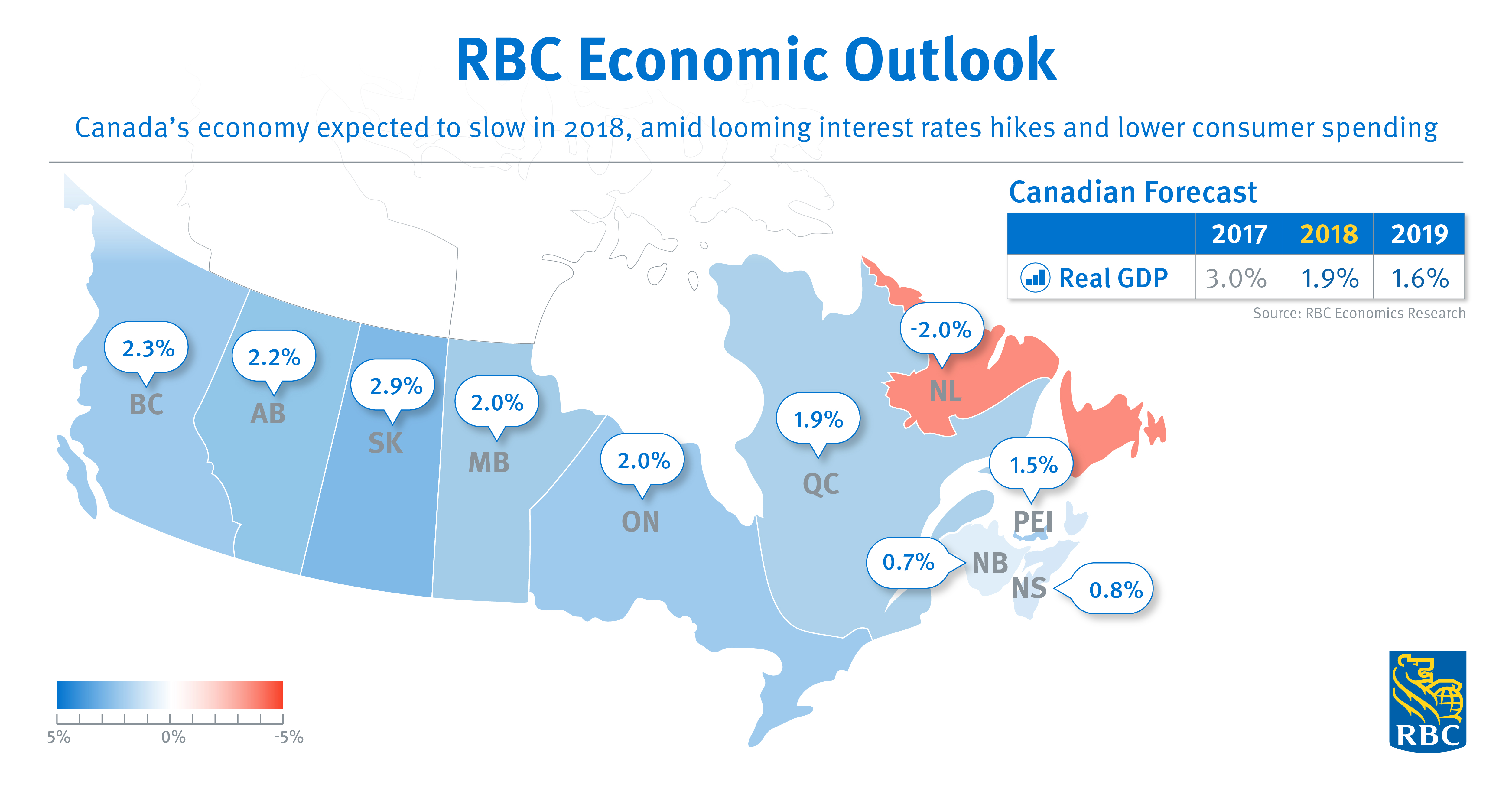

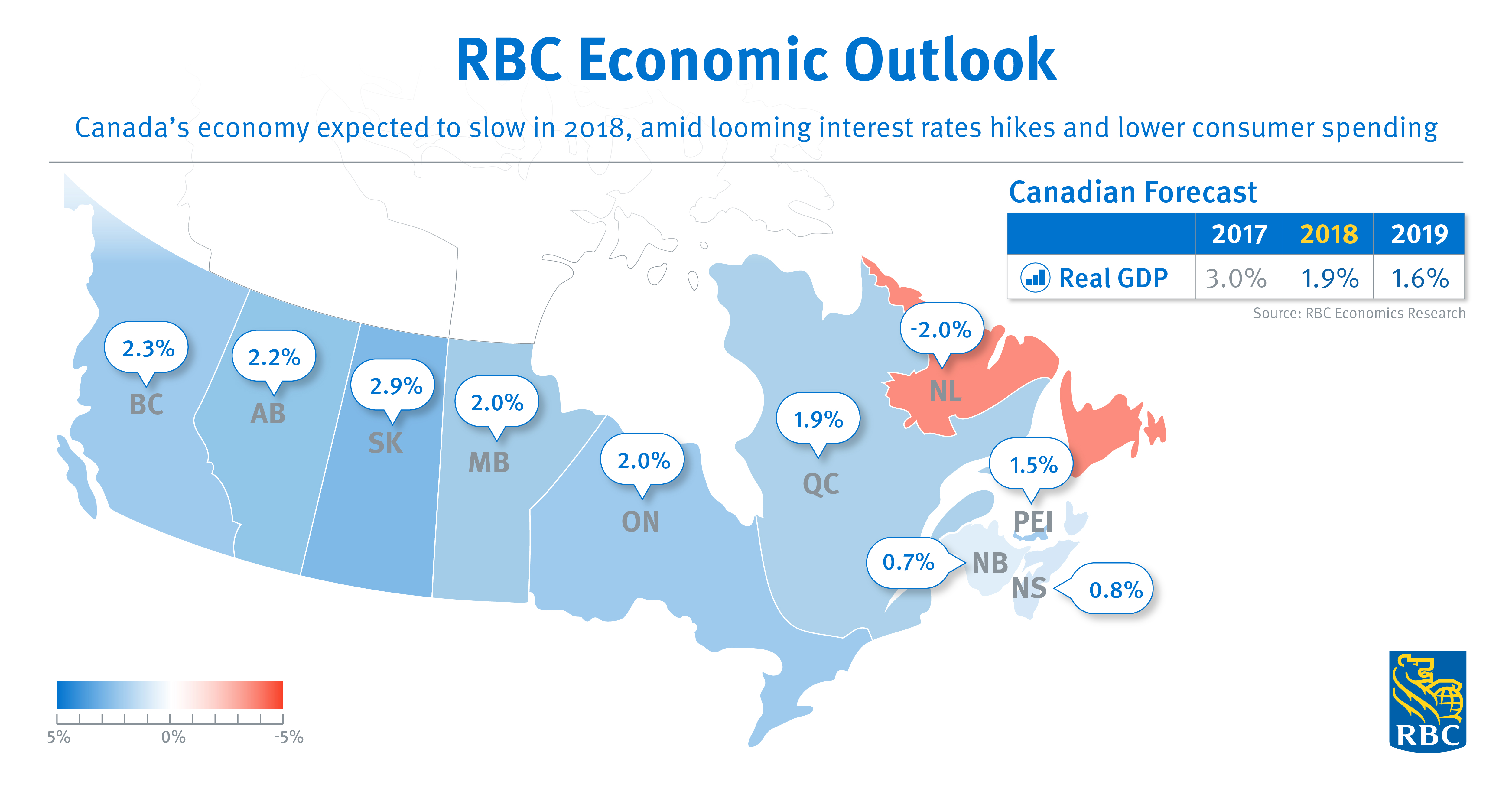

Geographic Concentration of Problem Loans:

The increase in problem loans isn't uniformly distributed across all regions. [Insert specific geographic regions or sectors where the concentration of problem loans is higher]. Factors contributing to this regional disparity might include differing economic conditions, real estate market dynamics, and industry-specific vulnerabilities. Understanding these geographic concentrations is crucial for effective risk management and strategic decision-making.

- Regional Economic Disparities: Economic downturns in specific regions can disproportionately impact loan performance.

- Real Estate Market Volatility: Fluctuations in housing prices can significantly influence the performance of mortgage loans.

- Industry-Specific Challenges: Specific industries facing economic headwinds might experience higher loan defaults.

RBC's Response to the Challenges

Strategies Implemented to Mitigate Risks:

In response to the deteriorating loan portfolio, RBC has implemented several strategies to mitigate risks and improve credit quality. These include stricter lending criteria, increased loan loss provisions, and a more rigorous credit underwriting process.

- Stricter Lending Criteria: RBC has likely tightened its lending standards, making it more difficult for high-risk borrowers to obtain loans.

- Increased Loan Loss Provisions: Setting aside larger reserves to cover potential losses from NPLs is a crucial risk management measure.

- Enhanced Credit Underwriting: Improving the process of assessing borrower creditworthiness aims to reduce the risk of future defaults.

The effectiveness of these strategies will be crucial in determining RBC's future financial performance.

Outlook and Future Expectations:

RBC's outlook regarding loan portfolio performance remains cautious. While the bank's implemented strategies aim to mitigate risks, challenges persist, primarily due to the uncertain economic climate and the potential for further interest rate hikes. Experts predict [insert expert opinion or forecast regarding future loan performance and potential impact on RBC's earnings].

- Economic Uncertainty: The overall economic outlook remains a significant factor influencing loan performance.

- Further Interest Rate Hikes: Any further increases in interest rates could exacerbate the problem of loan defaults.

- Potential for Recovery: Specific sectors showing signs of recovery could positively influence loan performance.

Conclusion: Understanding RBC's Lower-Than-Expected Earnings and the Implications for Investors

RBC's lower-than-expected earnings in Q2 2024 are strongly linked to a deteriorating loan portfolio characterized by increased NPLs and the impact of rising interest rates. The bank's response, including stricter lending practices and increased provisions, is crucial to monitor. Investors should carefully analyze RBC's future performance, paying close attention to its ability to manage credit risk and navigate the evolving economic landscape. Staying informed about RBC's ongoing efforts to address its souring loan portfolio is vital for investors to make informed decisions. Regularly checking for updates on RBC's earnings and engaging with relevant financial news sources will provide valuable insights into the bank's performance and the broader economic situation. Further research into credit risk management and the overall banking sector performance will enhance your understanding of the challenges and opportunities facing RBC and other financial institutions.

Featured Posts

-

The 30 Day Minimalism Challenge Declutter Your Life

May 31, 2025

The 30 Day Minimalism Challenge Declutter Your Life

May 31, 2025 -

Rising Risk Alberta Wildfires And The Future Of Oil Extraction

May 31, 2025

Rising Risk Alberta Wildfires And The Future Of Oil Extraction

May 31, 2025 -

Perseteruan Usai Selena Gomez Dan Miley Cyrus Akan Jalani Kencan Ganda

May 31, 2025

Perseteruan Usai Selena Gomez Dan Miley Cyrus Akan Jalani Kencan Ganda

May 31, 2025 -

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025

Sous Valorisation De Sanofi Comparaison Avec Les Laboratoires Pharmaceutiques Europeens

May 31, 2025 -

India Covid 19 Cases Increase Slightly Amidst Global Xbb 1 16 Variant Spread

May 31, 2025

India Covid 19 Cases Increase Slightly Amidst Global Xbb 1 16 Variant Spread

May 31, 2025