Lowest Personal Loan Interest Rates Today: Compare & Save

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several factors influence the interest rate you'll receive on a personal loan. Understanding these factors is crucial to securing the lowest possible rate.

Credit Score: The Foundation of Your Loan Rate

Your credit score is arguably the most significant factor determining your eligibility for lower interest rates. Lenders view a strong credit history as less risky, leading to more favorable terms. A higher FICO score translates directly to better loan offers.

- Check your credit report: Regularly review your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) to identify and dispute any errors.

- Pay bills on time: Consistent on-time payments demonstrate responsible financial behavior and significantly boost your credit score.

- Maintain low credit utilization: Keep your credit card balances well below your credit limits (ideally under 30%). High utilization suggests a higher risk to lenders.

Keywords: Credit score, credit report, credit history, credit utilization, FICO score, Experian, Equifax, TransUnion

Debt-to-Income Ratio (DTI): Managing Your Debt Load

Your debt-to-income ratio (DTI) shows lenders the proportion of your income dedicated to debt repayment. A lower DTI indicates a greater ability to manage your financial obligations, making you a less risky borrower.

- Reduce existing debt: Prioritize paying down high-interest debt like credit card balances before applying for a personal loan.

- Increase income: Explore opportunities to increase your income, such as a side hustle or a raise at your current job.

- Carefully budget expenses: Create a detailed budget to identify areas where you can reduce spending and improve your DTI.

Keywords: Debt-to-income ratio, debt consolidation, debt management, budgeting, financial planning

Loan Amount and Term: The Size and Length of Your Loan

The amount you borrow and the length of your repayment term also influence your interest rate. Generally, larger loan amounts and longer terms come with higher rates.

- Borrow only what you need: Avoid borrowing more than necessary to keep your loan payments manageable.

- Consider a shorter loan term: A shorter repayment period means higher monthly payments but significantly less interest paid over the life of the loan.

Keywords: Loan amount, loan term, repayment period, interest calculation, monthly payment

Lender Type: Comparing Apples to Apples

Different lenders – banks, credit unions, and online lenders – offer varying rates and terms. It's essential to compare offers from multiple sources to find the best fit.

- Compare offers from multiple lenders: Don't limit yourself to just one lender. Shop around and compare APRs (Annual Percentage Rates) and fees from various institutions.

- Consider fees and additional charges: Pay close attention to origination fees, prepayment penalties, and late fees, as these can significantly impact the overall cost of your loan.

Keywords: Banks, credit unions, online lenders, loan comparison, interest rates comparison, APR, annual percentage rate, origination fees

How to Find the Lowest Personal Loan Interest Rates

Finding the lowest interest rates requires proactive effort and smart comparison strategies.

Use Online Comparison Tools: Streamlining Your Search

Several websites specialize in comparing loan offers from multiple lenders. These tools can save you significant time and effort.

- Input your financial details: Provide accurate information to receive personalized loan offers tailored to your financial profile.

- Compare APRs and fees: Pay close attention to the annual percentage rate (APR), which represents the total cost of borrowing, including interest and fees.

Keywords: Loan comparison websites, online loan calculators, APR, annual percentage rate, loan fees, online loan application

Check with Your Bank or Credit Union: Loyalty Can Pay Off

Your existing financial institution may offer competitive rates, especially if you're a loyal customer.

- Inquire about special offers or promotions: Banks and credit unions often have promotional periods with reduced interest rates.

- Negotiate for a better rate: Don't be afraid to negotiate with your lender to see if they can match or beat offers from competitors.

Keywords: Bank loans, credit union loans, personalized loan offers, loan negotiation

Shop Around and Negotiate: Don't Settle for the First Offer

Never accept the first loan offer you receive. Shop around and use competing offers to negotiate for better terms.

- Use competing offers to leverage better terms: Show your current lender the offers you've received from other institutions to encourage them to lower their rate.

- Be prepared to walk away: If you're not satisfied with the offered terms, be prepared to walk away and explore other options.

Keywords: Loan negotiation, interest rate negotiation, best loan offers, competitive loan rates

Understanding APR and Other Loan Costs

Understanding the Annual Percentage Rate (APR) and other associated loan costs is critical. The APR reflects the total cost of borrowing, including interest and fees.

- APR Calculation: The APR is calculated by considering the interest rate, loan fees (origination fees, prepayment penalties, late payment fees), and the loan term. A higher APR means a more expensive loan.

- Origination Fees: These are upfront fees charged by lenders for processing your loan application.

- Prepayment Penalties: Some lenders charge a fee if you pay off your loan early.

- Late Payment Fees: Missing loan payments can result in significant late fees. Always pay on time to avoid these charges.

Keywords: APR calculation, origination fees, prepayment penalties, late payment fees, total loan cost, loan repayment

Conclusion: Secure the Best Personal Loan Interest Rates Today

Securing the lowest personal loan interest rates today requires careful planning and comparison. By understanding the factors influencing interest rates and actively shopping around, you can significantly reduce the overall cost of your loan. Remember to check your credit score, manage your debt-to-income ratio, and compare offers from multiple lenders before making a decision. Don't hesitate to negotiate for better terms! Start your search for the lowest personal loan interest rates today and save money on your next loan. Begin comparing loan offers now and take control of your finances!

Featured Posts

-

Chicago Med Season 10 Unexpected Outcomes From The One Chicago Crossover

May 28, 2025

Chicago Med Season 10 Unexpected Outcomes From The One Chicago Crossover

May 28, 2025 -

Angels Complete Freeway Series Sweep Of Dodgers

May 28, 2025

Angels Complete Freeway Series Sweep Of Dodgers

May 28, 2025 -

Lotto Reveals Locations Of Two Winning Irish Euro Millions Tickets

May 28, 2025

Lotto Reveals Locations Of Two Winning Irish Euro Millions Tickets

May 28, 2025 -

Three Withdrawals Rock Barcelona Open Before First Serve

May 28, 2025

Three Withdrawals Rock Barcelona Open Before First Serve

May 28, 2025 -

How Journaling Helped Kyle Stowers Breakout Season With The Marlins

May 28, 2025

How Journaling Helped Kyle Stowers Breakout Season With The Marlins

May 28, 2025

Latest Posts

-

Le Mandat De Laurent Jacobelli Depute De La Moselle Et Vice President Du Groupe Rn

May 30, 2025

Le Mandat De Laurent Jacobelli Depute De La Moselle Et Vice President Du Groupe Rn

May 30, 2025 -

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025 -

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025 -

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025 -

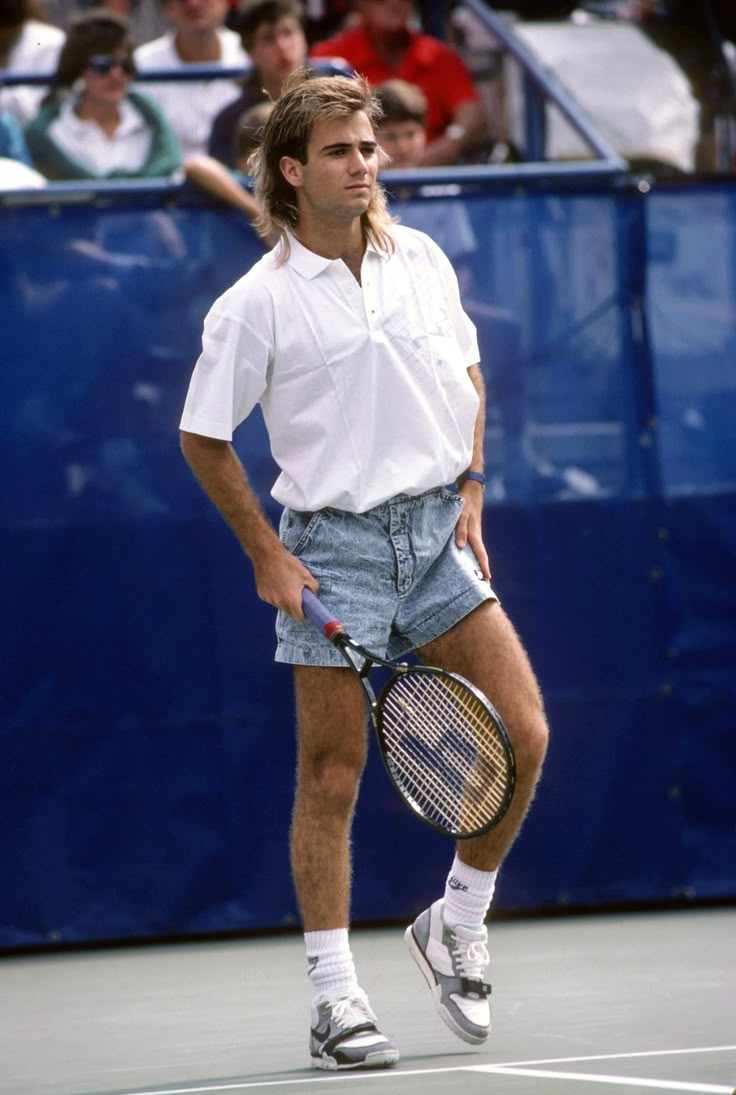

Andre Agassi Cambio De Cancha Misma Pasion

May 30, 2025

Andre Agassi Cambio De Cancha Misma Pasion

May 30, 2025