Lumina Gold Sold To CMOC For $581 Million: Analyzing The Impact On The Mining Sector

Table of Contents

Deal Details and Significance

The acquisition of Lumina Gold by CMOC, finalized at $581 million, represents a significant strategic move for the Chinese mining giant. The deal involved a cash purchase of all outstanding Lumina Gold shares, effectively taking the Canadian gold and copper mining company private. This acquisition was driven by several key factors, making Lumina Gold's assets highly attractive to CMOC.

- Acquisition price and payment structure: The $581 million price tag represents a premium over Lumina Gold's market capitalization at the time of the announcement, reflecting the strategic value of its assets. The transaction was structured as an all-cash deal, ensuring a swift and decisive acquisition.

- Lumina Gold's key assets (mines, projects): Lumina Gold possessed a portfolio of attractive gold and copper projects, notably its flagship projects in Ecuador and other promising exploration properties. These assets offer CMOC access to high-quality reserves and potential for future production expansion.

- CMOC's strategic rationale behind the acquisition: CMOC's acquisition strategy points towards a desire to diversify its portfolio, enhance its gold and copper reserves, and gain a foothold in strategically important regions. Lumina Gold's assets perfectly align with this strategic goal.

- Expected synergies and operational improvements: The integration of Lumina Gold into CMOC's existing operations is expected to unlock synergies through optimized resource allocation, improved operational efficiency, and enhanced technological expertise.

Impact on the Gold Mining Market

The Lumina Gold acquisition has significant implications for the gold mining market. While the short-term impact on gold prices may be minimal, the long-term effects are more complex.

- Short-term and long-term effects on gold prices: The immediate market response might not reflect a substantial price change for gold. However, increased consolidation in the sector through such large-scale acquisitions could influence future price movements.

- Shift in market dynamics among major gold producers: CMOC’s acquisition strengthens its position within the gold mining landscape, potentially altering the competitive dynamics among major players and encouraging further mergers and acquisitions in the sector.

- Potential for increased investment in gold exploration and mining: The deal signals confidence in the gold mining sector, potentially leading to more investments in gold exploration and development activities.

- Analysis of competitor reactions to the acquisition: Competitors may view this acquisition as a benchmark, potentially prompting them to evaluate their own strategies and explore potential partnerships or acquisitions to maintain competitiveness.

Implications for the Copper Mining Sector

Lumina Gold's copper assets represent a valuable addition to CMOC's existing portfolio, particularly given the growing global demand for copper and its crucial role in the green energy transition.

- CMOC's existing copper operations and future expansion plans: This acquisition provides CMOC with a boost to its existing copper operations, allowing for potential expansion and increased production capacity to meet global demand.

- Global copper market outlook and the role of this acquisition: With increasing demand driven by the global shift towards renewable energy, the acquisition positions CMOC favorably within the copper market and enhances its ability to capitalize on future growth.

- Potential impact on copper prices and market competition: The increased copper production potential from Lumina Gold’s assets could impact copper prices, although the extent of this effect will depend on broader market factors. The acquisition also intensifies competition in the copper mining sector.

- Opportunities for further copper exploration and development: Lumina Gold's exploration projects present opportunities for CMOC to further expand its copper reserves and strengthen its position in the global market.

Investor Perspective and Future Outlook

The acquisition sent positive signals to investors, although immediate stock market reactions varied. However, the deal has significant implications for future investment decisions and overall market sentiment.

- Stock market reaction to the news of the acquisition: While stock prices of both companies initially fluctuated, the overall market sentiment reflects a positive view of the acquisition’s strategic potential.

- Investor sentiment and outlook for both companies: Investors are generally optimistic about the synergies and growth opportunities presented by the combined entity, leading to a largely positive outlook.

- Potential for increased M&A activity in the mining industry: The Lumina Gold acquisition may act as a catalyst for further consolidation within the mining sector, potentially leading to an increase in merger and acquisition activity.

- Long-term implications for shareholders and investors: The long-term implications for shareholders depend on CMOC's success in integrating Lumina Gold's assets and realizing the anticipated synergies. Further strategic investments will play a key role in future returns.

Conclusion

The $581 million acquisition of Lumina Gold by CMOC is a significant event in the global mining industry, underscoring the growing strategic importance of gold and copper assets. This deal reshapes the competitive landscape, influencing both the gold and copper markets. The integration of Lumina Gold’s assets promises significant operational synergies and opportunities for future growth for CMOC.

The Lumina Gold acquisition by CMOC provides a compelling case study for understanding the dynamics of the global mining market. Stay informed on further developments in this evolving sector by following our updates on major mining acquisitions and industry trends. Learn more about the impact of this significant acquisition and how it shapes the future of Lumina Gold and the broader mining industry.

Featured Posts

-

11 1 Royals Complete Domination In Brewers Home Opener

Apr 23, 2025

11 1 Royals Complete Domination In Brewers Home Opener

Apr 23, 2025 -

Who Will Be The Next Pope 10 Cardinal Contenders

Apr 23, 2025

Who Will Be The Next Pope 10 Cardinal Contenders

Apr 23, 2025 -

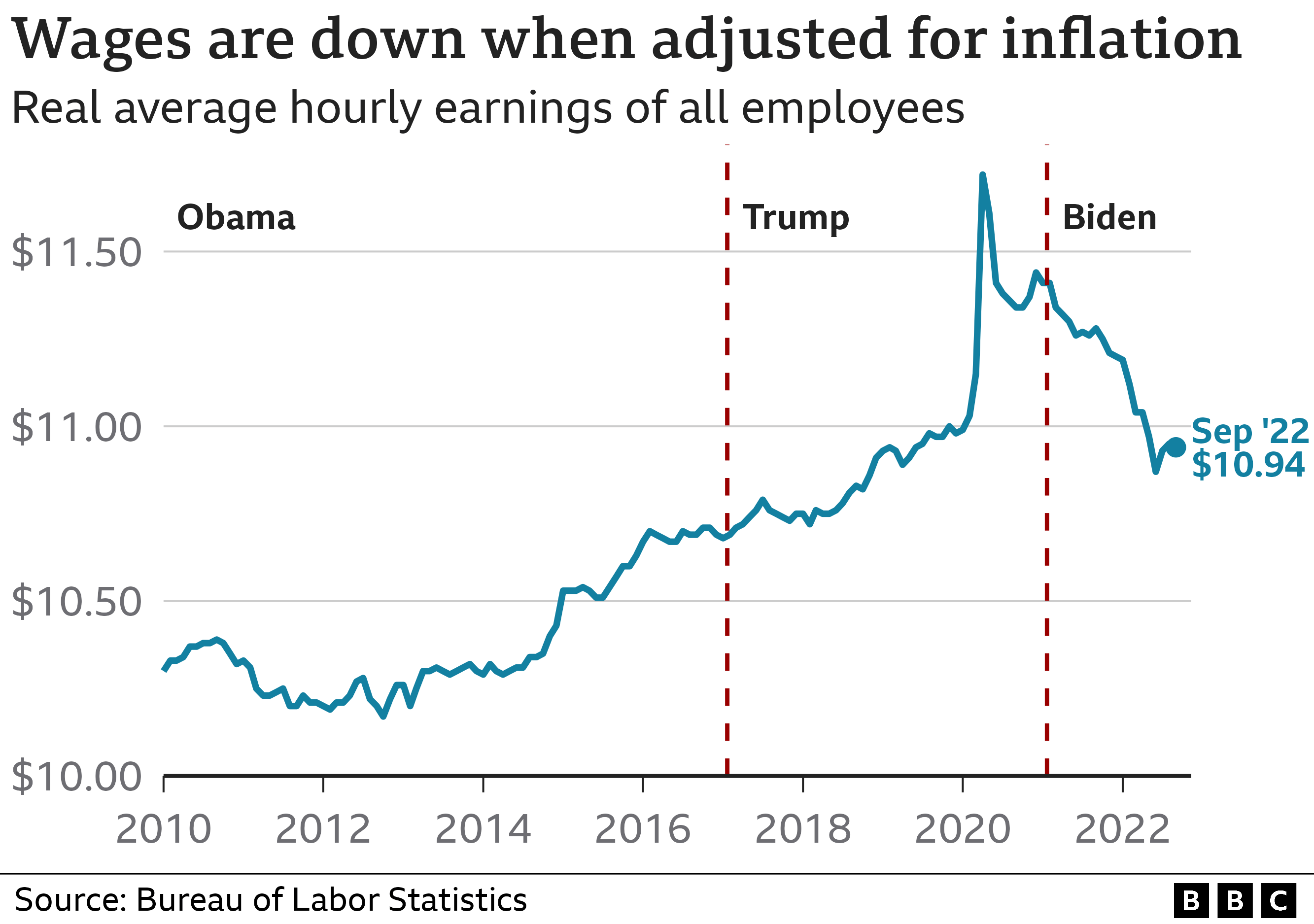

The Trump Presidency And Economic Performance A Data Driven Assessment

Apr 23, 2025

The Trump Presidency And Economic Performance A Data Driven Assessment

Apr 23, 2025 -

Decryptage Des Seuils Techniques Ameliorez Votre Alerte Trader

Apr 23, 2025

Decryptage Des Seuils Techniques Ameliorez Votre Alerte Trader

Apr 23, 2025 -

Colorado Rockies Win Brenton Doyles 5 Rbis Fuel 7 2 Victory

Apr 23, 2025

Colorado Rockies Win Brenton Doyles 5 Rbis Fuel 7 2 Victory

Apr 23, 2025