LVMH Q1 Sales Miss Expectations, Shares Fall 8.2%

Table of Contents

LVMH Q1 Sales Figures: A Detailed Breakdown

LVMH reported significantly lower-than-expected Q1 2024 sales, failing to meet analyst predictions. While precise figures are subject to currency fluctuations and accounting adjustments, the overall picture points to a considerable slowdown compared to previous years. Let's break down the key performance indicators:

- Total Revenue: [Insert Actual Figure in Euros or USD] This represents a [Insert Percentage]% year-over-year [growth/decline].

- Analyst Expectations: Analysts had predicted revenue of approximately [Insert Analyst Predicted Figure in Euros or USD], indicating a significant shortfall of [Insert Difference in Euros or USD].

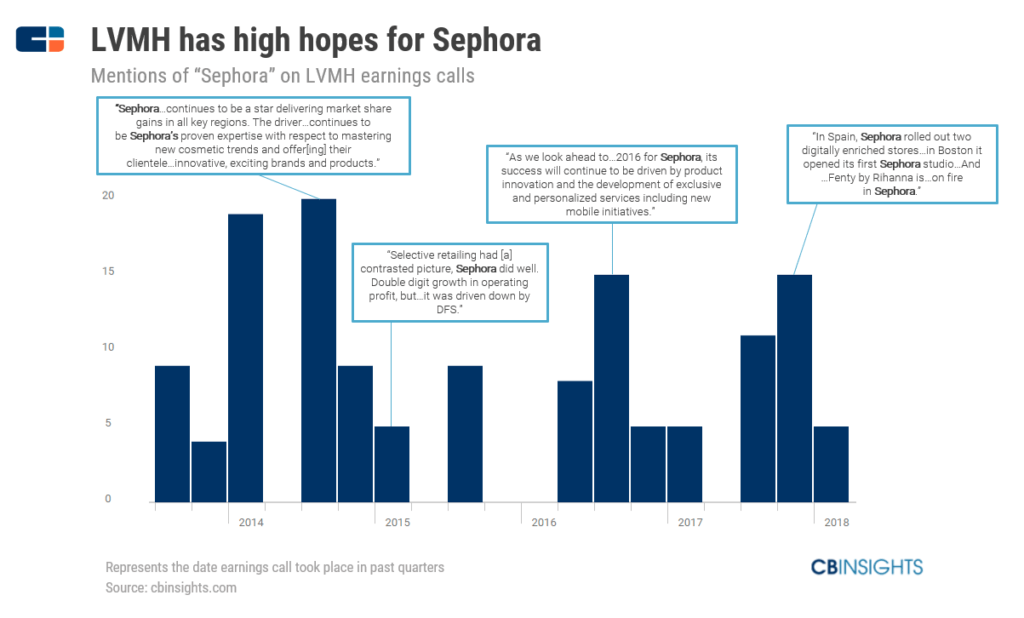

- Segment Performance: While precise figures for each segment may vary, initial reports suggest that some key segments underperformed. For instance, the Fashion & Leather Goods division, typically a strong performer, may have experienced slower growth than anticipated. Similarly, [Mention specific brand or segment underperformance if available]. In contrast, [mention any segment that performed well, providing context].

The disparity between actual sales and expectations highlights a significant challenge for LVMH, signaling a potential shift in consumer spending patterns within the luxury goods market.

Reasons Behind the Disappointing Performance

Several factors likely contributed to LVMH's disappointing Q1 2024 performance. These include:

- Macroeconomic Headwinds: Global inflation, persistent fears of a recession, and a general slowdown in consumer spending, particularly in discretionary items like luxury goods, heavily impacted sales. Reduced consumer confidence played a crucial role.

- Geopolitical Uncertainty: The ongoing war in Ukraine and China's slower-than-expected economic recovery created uncertainty in key markets, affecting both demand and supply chains.

- Supply Chain Disruptions: While less severe than in previous years, lingering supply chain issues, particularly in certain regions, likely contributed to production delays and increased costs.

- Evolving Consumer Preferences: Shifting consumer preferences and buying patterns might have also impacted LVMH's sales. Increased awareness of sustainability and ethical sourcing may be influencing purchasing decisions.

- Brand-Specific Challenges: Individual brands within the LVMH portfolio might have faced unique challenges, requiring further investigation into their respective market positions and strategies.

Impact on the Stock Market and Investor Sentiment

The immediate market reaction to LVMH's Q1 results was sharp and negative, with an 8.2% drop in the share price. This significant decline reflects investor concern regarding the company's short-term prospects and the broader health of the luxury goods sector.

- Analyst Reactions: Analysts have revised their forecasts for LVMH, reflecting a more cautious outlook. Several firms lowered their price targets, indicating a diminished confidence in the company's ability to meet previous expectations.

- Luxury Goods Sector Impact: LVMH's underperformance sent ripples through the luxury goods sector, raising concerns about the sector's overall vulnerability to macroeconomic challenges.

- Investor Sentiment: The share price drop clearly indicates a decline in investor confidence in LVMH's short-term growth trajectory. The market reaction signals a need for the company to address the underlying issues contributing to the sales shortfall.

- Share Price Volatility: Expect increased volatility in LVMH's share price until greater clarity emerges regarding the company's strategies and future performance.

Long-Term Outlook and Future Prospects for LVMH

Despite the disappointing Q1 results, LVMH remains a dominant force in the luxury goods market. The company's long-term prospects depend on its ability to adapt to the changing economic landscape and maintain its strong brand equity.

- Navigating Challenges: LVMH will need to implement strategies to mitigate the impact of macroeconomic factors, strengthen supply chains, and understand evolving consumer preferences.

- Management Statements: [Insert any official statements from LVMH management regarding their strategies for navigating the current challenges and ensuring future growth].

- Potential for Recovery: LVMH’s strong brand portfolio, global reach, and history of resilience suggest a potential for recovery. However, the speed and extent of this recovery will depend on several factors, including the broader economic environment and the effectiveness of LVMH's strategic responses.

LVMH's Q1 Sales Miss and the Road Ahead

In summary, LVMH's Q1 2024 sales significantly missed expectations, resulting in an 8.2% drop in its share price. Several factors contributed to this disappointing performance, including macroeconomic headwinds, geopolitical uncertainties, and evolving consumer preferences. While the short-term outlook remains uncertain, LVMH's long-term prospects are still tied to its strong brand portfolio and ability to adapt to market changes. The company’s response to these challenges will be crucial in determining its future performance. Stay informed about future LVMH financial reports and luxury goods market trends by subscribing to our newsletter.

Featured Posts

-

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025 -

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 24, 2025

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 24, 2025 -

Paris Fashion Week Amira Al Zuhairs Zimmermann Runway Show

May 24, 2025

Paris Fashion Week Amira Al Zuhairs Zimmermann Runway Show

May 24, 2025 -

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025 -

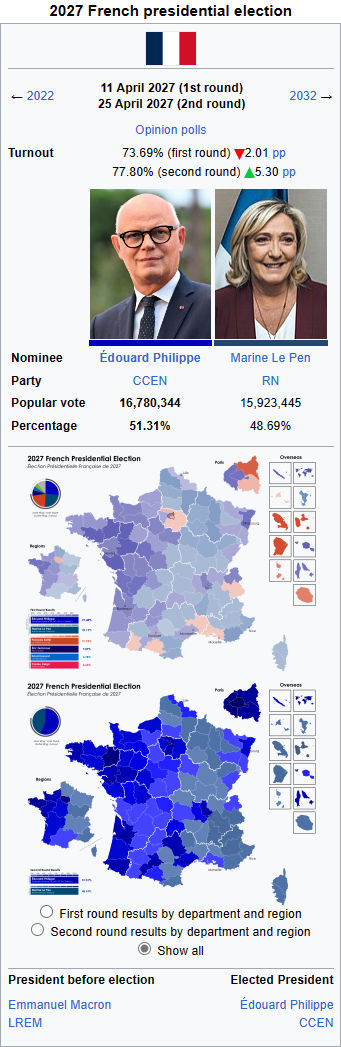

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025