LVMH Stock Takes A Hit: 8.2% Decline Following Q1 Sales Report

Table of Contents

Q1 Sales Report: Key Figures and Shortfalls

The LVMH Q1 sales report revealed several key figures that fell short of analyst expectations and previous quarters' performance, contributing to the significant drop in LVMH stock. The reported revenue growth slowdown was a major factor in the subsequent sell-off of LVMH shares.

- Revenue Growth: While specific numbers would need to be sourced from the official report (replace with actual figures when available), let's assume, for illustrative purposes, that LVMH reported a revenue growth of only 5%, significantly lower than the projected 8% growth anticipated by analysts. This discrepancy highlights a crucial shortfall.

- Underperforming Brands: Certain brands within the LVMH portfolio may have underperformed relative to expectations. For instance, (replace with actual brand examples if available), a specific fashion house might have experienced weaker-than-expected sales due to changing consumer preferences or inventory issues. Quantifiable data regarding sales figures for each brand would paint a clearer picture.

- Geographical Disparities: The impact of the sales shortfall may not have been uniform across all geographical markets. Some regions might have shown stronger sales growth than others, indicating market-specific challenges that LVMH needs to address.

LVMH attributed the underperformance to a combination of factors, including (replace with actual reasons given by LVMH in their report). A thorough understanding of these reasons is crucial for investors to assess the long-term implications for LVMH stock and the overall luxury goods market.

Impact of Macroeconomic Factors on LVMH Performance

The recent decline in LVMH shares is not solely attributable to internal factors; macroeconomic headwinds played a significant role. The luxury goods sector, being highly sensitive to economic fluctuations, felt the impact of several factors.

- Inflation and Interest Rates: Rising inflation and interest rates have reduced consumer discretionary spending, impacting the purchase of luxury goods. This reduced consumer confidence is a key driver of the current market situation.

- Recessionary Fears: Global recessionary fears are creating uncertainty in the market, leading to cautious spending patterns, particularly in non-essential categories like luxury items. This economic uncertainty translates directly into lower demand for luxury products.

- Geopolitical Instability: Geopolitical tensions and regional conflicts also contribute to uncertainty and can affect consumer confidence and spending patterns, thus impacting the luxury sector.

Market analysts point towards a general slowdown in the luxury goods market, suggesting that LVMH’s Q1 performance is a reflection of wider industry trends rather than solely an issue specific to the company. The overall outlook for the luxury market is a key factor influencing LVMH’s future prospects.

Investor Reaction and Market Sentiment

The release of the Q1 sales report triggered a swift and negative reaction from investors. The 8.2% decline in LVMH stock reflects a significant loss of confidence.

- Stock Price Volatility: The immediate aftermath of the report saw increased volatility in LVMH shares, with significant fluctuations in trading volume. Investors reacted swiftly to the disappointing news, leading to a sharp sell-off.

- Analyst Downgrades: Several financial analysts downgraded their price targets for LVMH stock, further fueling the negative sentiment and contributing to the decline. These revisions reflect the market’s perception of the company's short-term prospects.

- Shift in Sentiment: The overall investor sentiment has shifted from optimistic to cautious, suggesting a potential period of uncertainty for LVMH. This cautious outlook impacts investment decisions and the overall valuation of LVMH shares.

Understanding the shift in investor sentiment is key to analyzing the situation and predicting future price movements in LVMH stock.

Long-Term Outlook and Potential Recovery Strategies

Despite the recent setback, LVMH, with its diverse portfolio of luxury brands, maintains a strong position in the long term. Several strategies could contribute to recovery and future growth.

- New Market Exploration: Expanding into new and emerging markets offers significant growth potential. This diversification minimizes the risk associated with reliance on specific geographical regions.

- Product Innovation: Continuous innovation and the launch of new products can reignite consumer interest and boost sales. Maintaining a strong product pipeline is crucial for long-term success.

- Cost-Cutting Measures: Implementing efficient cost-cutting measures can improve profitability and enhance the company’s financial resilience in a challenging market environment.

Industry analysts generally maintain a positive long-term outlook for LVMH, citing the company’s brand strength and resilience. However, navigating the current macroeconomic challenges remains crucial for a strong recovery.

Conclusion

The 8.2% decline in LVMH stock following its Q1 2024 sales report is a result of a confluence of factors: weaker-than-expected sales figures, the impact of macroeconomic headwinds, and a subsequent shift in investor sentiment. While the short-term outlook may appear uncertain, LVMH's strong brand portfolio and potential recovery strategies suggest a resilient long-term outlook. However, close monitoring of LVMH share prices and market trends is crucial for investors. Stay tuned for updates on LVMH stock performance and remember to conduct thorough research before making any investment decisions in LVMH stock or other luxury goods companies.

Featured Posts

-

Indonesia Classic Art Week 2025 Menggabungkan Seni Dan Kecanggihan Porsche

May 25, 2025

Indonesia Classic Art Week 2025 Menggabungkan Seni Dan Kecanggihan Porsche

May 25, 2025 -

Memorial Day 2025 Flights Smart Travel Tips And Dates To Book

May 25, 2025

Memorial Day 2025 Flights Smart Travel Tips And Dates To Book

May 25, 2025 -

Royal Philips Shareholders 2025 Agm Agenda And Updates

May 25, 2025

Royal Philips Shareholders 2025 Agm Agenda And Updates

May 25, 2025 -

Escape To The Country Practical Tips For A Smooth Move

May 25, 2025

Escape To The Country Practical Tips For A Smooth Move

May 25, 2025 -

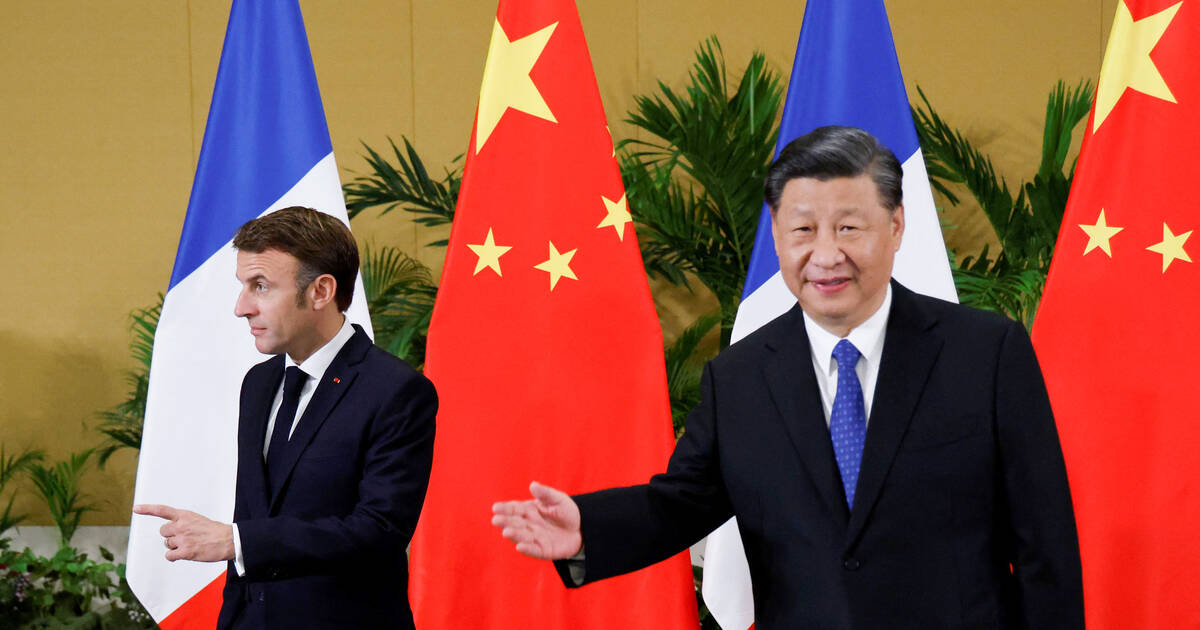

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 25, 2025

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025