Market Analysis: Bitcoin Rally Predicted (May 6 Chart Review)

Table of Contents

Technical Analysis: Identifying Bullish Signals

Technical analysis provides crucial insights into potential price movements. Examining the Bitcoin charts from May 6th reveals several bullish signals supporting a predicted Bitcoin rally. We used several key indicators to reach this conclusion.

-

Moving Averages: The 50-day and 200-day moving averages showed a clear bullish crossover on May 6th. This classic bullish signal indicates a shift in momentum from bearish to bullish, strengthening the prediction of a Bitcoin rally. The 50-day MA crossed above the 200-day MA, a powerful indicator of a long-term upward trend.

-

Relative Strength Index (RSI): The RSI, a momentum indicator, registered above 50 on May 6th, indicating bullish momentum. Furthermore, we observed positive RSI divergence, where the price made lower lows while the RSI formed higher lows. This divergence suggests a potential price reversal and a subsequent Bitcoin price surge.

-

Moving Average Convergence Divergence (MACD): The MACD histogram showed a clear bullish crossover on May 6th. This crossover, coupled with increased volume, strongly suggested growing buying pressure and further supports the Bitcoin rally prediction.

<img src="may6chart.png" alt="Bitcoin chart showing bullish indicators on May 6th, including moving average crossover, RSI divergence, and MACD bullish crossover">

- Trading Volume: Increased trading volume accompanied the price increase on May 6th, confirming the strength of the bullish momentum. High volume during price increases is a positive sign, suggesting strong conviction amongst buyers.

These signals, when considered collectively, significantly contribute to the prediction of an imminent Bitcoin rally. The confluence of bullish indicators points toward a sustained upward trend for Bitcoin.

Market Sentiment and News Impacting Bitcoin

Prevailing market sentiment plays a crucial role in influencing Bitcoin's price. On May 6th, social media sentiment was largely bullish, with many analysts and influencers expressing optimism about Bitcoin's future. News articles also reflected this positive sentiment, highlighting factors contributing to a potential Bitcoin rally.

-

Recent Regulatory Developments: While regulatory uncertainty always exists, there were no major negative regulatory announcements on May 6th that could derail a potential Bitcoin price surge. Positive developments, such as increased clarity from certain jurisdictions regarding cryptocurrency regulation, could contribute to a more bullish market.

-

Adoption by Major Institutions: Increased institutional investment in Bitcoin continues to be a significant driver of price appreciation. While specific announcements may not have occurred on May 6th, the ongoing trend of institutional adoption remains a positive factor supporting a potential Bitcoin rally.

-

Impact of Macroeconomic Factors: While macroeconomic factors like inflation and interest rates can influence Bitcoin's price, their impact on May 6th appeared to be overshadowed by the positive technical signals and market sentiment. However, these macroeconomic conditions should be continuously monitored as they can impact the cryptocurrency market significantly.

The overall positive market sentiment and the absence of major negative news on May 6th aligned perfectly with the technical indicators, reinforcing the prediction of a Bitcoin rally.

Potential Catalysts for a Bitcoin Price Surge

Several factors could act as catalysts for a substantial Bitcoin price increase in the coming weeks and months.

-

Halving Event (if applicable): While the next Bitcoin halving is not immediately imminent, its anticipated impact on scarcity and ultimately price is a long-term bullish catalyst. The anticipation of future halving events often fuels speculation and price increases leading up to the event itself.

-

Launch of new Bitcoin-related projects or applications: Innovation within the Bitcoin ecosystem, such as the development of new layer-2 solutions or decentralized finance (DeFi) applications built on Bitcoin, can generate renewed interest and drive price appreciation.

-

Increased Institutional Investment: The continued entry of institutional investors into the Bitcoin market adds significant buying pressure and is a key driver of long-term price growth.

-

Growing adoption in developing countries: As Bitcoin adoption increases in developing countries with high inflation or limited access to traditional financial systems, it fuels demand and further contributes to a potential Bitcoin rally.

The combination of these catalysts could lead to a significant Bitcoin price surge within a timeframe of several months, potentially resulting in a substantial price increase from the May 6th levels.

Risk Assessment and Potential Downsides

While the outlook for a Bitcoin rally appears positive based on our May 6th analysis, it’s crucial to acknowledge potential downsides.

-

Regulatory Uncertainty: Changes in regulatory frameworks worldwide remain a significant risk factor. Negative regulatory actions could impact investor confidence and trigger a market correction.

-

Market Volatility: The cryptocurrency market is inherently volatile, and sharp price corrections can occur unexpectedly.

-

Competition from other cryptocurrencies: The emergence of new cryptocurrencies with innovative features could divert investment away from Bitcoin, potentially limiting its price growth.

-

Potential for a Market Correction: Even with bullish signals, the possibility of a market correction remains. A period of consolidation or even a temporary price drop is a normal occurrence in any market.

These risks should be carefully considered when assessing the potential for a Bitcoin rally. However, the strength of the bullish signals on May 6th suggests that even with these risks, the potential for a positive outcome remains significant.

Conclusion

This May 6th chart review indicates a strong potential for a Bitcoin rally, driven by bullish technical indicators, positive market sentiment, and promising catalysts. While risks remain, the overall picture suggests a bullish outlook for Bitcoin in the near future. The confluence of positive technical analysis, bullish sentiment, and potential catalysts strongly supports the prediction of a Bitcoin price surge.

Call to Action: Stay informed about the evolving cryptocurrency market and continue to monitor the Bitcoin price movements. This analysis provides valuable insights into the potential for a Bitcoin rally, but remember to conduct your own thorough research before making any investment decisions. Learn more about identifying future Bitcoin rally opportunities through continuous market analysis and stay updated on market trends for better informed investment decisions.

Featured Posts

-

Mraksh Myn Kshty Hadthh Ansany Asmglng Ke 4 Mlzman Grftar

May 08, 2025

Mraksh Myn Kshty Hadthh Ansany Asmglng Ke 4 Mlzman Grftar

May 08, 2025 -

First Look The Long Walk Trailer A Chilling Dystopian Thriller

May 08, 2025

First Look The Long Walk Trailer A Chilling Dystopian Thriller

May 08, 2025 -

Taiwan Dollars Surge A Necessary Economic Overhaul

May 08, 2025

Taiwan Dollars Surge A Necessary Economic Overhaul

May 08, 2025 -

Ethereum Price Forecast 2 700 On The Horizon Wyckoff Accumulation Explained

May 08, 2025

Ethereum Price Forecast 2 700 On The Horizon Wyckoff Accumulation Explained

May 08, 2025 -

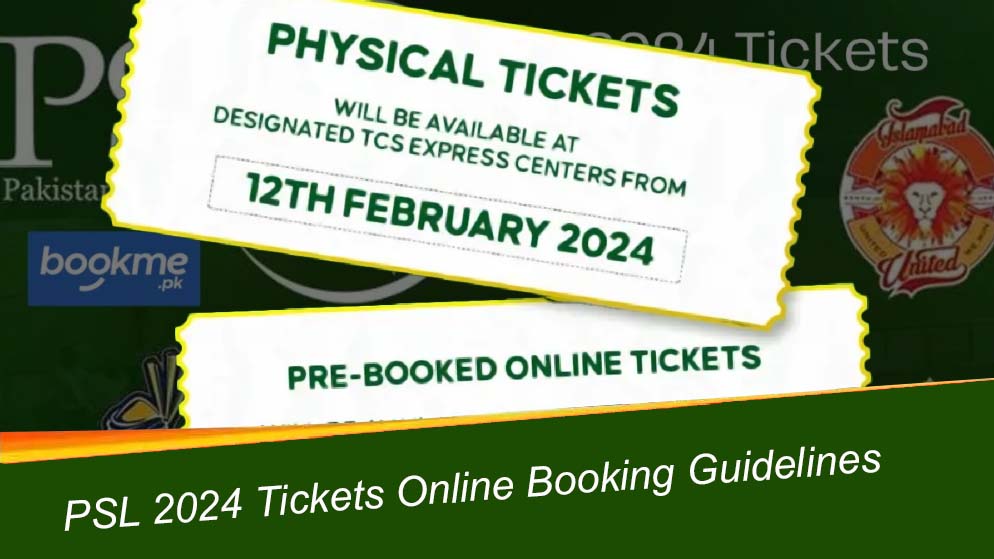

Psl 10 Tickets Available Buy Your Seats Today

May 08, 2025

Psl 10 Tickets Available Buy Your Seats Today

May 08, 2025