Market Downturn: Why Professionals Sell And Individuals Often Buy

Table of Contents

Why Professionals Sell During a Market Downturn

Professionals, armed with sophisticated strategies and a long-term perspective, often utilize market downturns strategically. Their actions are driven by calculated risk management, not panic. Let's examine some key reasons:

Tax Loss Harvesting

Tax loss harvesting is a powerful strategy employed during market downturns. It involves selling assets that have lost value to offset capital gains taxes from previous profitable investments. This reduces your overall tax liability, effectively turning a loss into a tax benefit.

- Examples of tax-loss harvesting strategies: Selling losing stocks to offset gains from other stocks or bonds, using wash-sale rules strategically to minimize tax implications.

- Benefits for high-income earners: High-income individuals often benefit most from tax loss harvesting due to higher tax brackets.

- Limitations: You cannot harvest losses against ordinary income. There are also wash-sale rules that prevent you from immediately repurchasing substantially identical securities after selling at a loss.

These professional investor tactics, centered around tax loss harvesting, demonstrate proactive management during a market downturn.

Portfolio Rebalancing

Professionals regularly rebalance their portfolios to maintain their desired asset allocation. A market downturn might throw your portfolio out of balance, shifting the weight to assets that have performed poorly. Rebalancing involves selling some assets that have outperformed and buying others that have underperformed to restore your target allocation.

- Examples of rebalancing strategies: Regularly scheduled rebalancing (e.g., annually or quarterly), rebalancing based on percentage deviations from target allocation.

- Importance of risk tolerance: Rebalancing strategies should be tailored to an investor's risk tolerance and investment timeline.

- Adjusting investment timelines: Market downturns can be an opportune time to reassess your investment timeline and adjust your strategy accordingly.

Portfolio rebalancing is a core component of market correction strategies employed by professionals.

Taking Profits

A market downturn doesn’t always mean everything is falling. Some assets may have significantly appreciated before the downturn. Professionals may sell these assets to lock in gains before potential further declines. This is a form of profit-taking, a key element of their investment strategies.

- Identifying overvalued assets: Thorough fundamental analysis is crucial for identifying assets that may be overvalued despite the market correction.

- Considerations for capital gains taxes: The timing of profit-taking is carefully considered to minimize capital gains taxes.

- Long-term investment horizon vs. short-term gains: Professionals consider their long-term investment horizon when deciding whether to take profits during a downturn.

Why Individuals Often Buy During a Market Downturn

In contrast to professionals, individual investors often make emotional decisions during market downturns, frequently leading to poor outcomes. Let's explore the common reasons:

Fear of Missing Out (FOMO)

The fear of missing out (FOMO) is a powerful psychological force that can drive emotional buying decisions. Seeing the market dip, individual investors may fear further losses and jump in, believing they're missing a chance to recover quickly.

- Psychological factors influencing buying decisions: Anxiety, regret aversion, herd mentality.

- Common mistakes driven by fear: Buying high and selling low, chasing short-term gains, neglecting diversification.

- Importance of rational investment strategies: Developing a well-defined investment plan based on your risk tolerance and financial goals is crucial to mitigating the impact of FOMO.

"Bargain Hunting" Mentality

Many individuals fall into the trap of believing that a falling market automatically translates into bargains. While opportunities exist, identifying genuine bargains requires careful analysis. The "bargain hunting" mentality often leads to purchasing value traps – companies that appear cheap but have fundamental flaws.

- Identifying genuine bargains vs. value traps: Thorough fundamental analysis, including reviewing financial statements and industry trends, is essential.

- The importance of fundamental analysis: Don't just focus on the price; assess the underlying value of the asset.

- Long-term value vs. short-term price fluctuations: Focus on long-term value creation rather than being swayed by short-term market volatility.

Lack of Long-Term Perspective

A short-term focus is a significant contributor to impulsive decisions during market fluctuations. Many individual investors lack a well-defined long-term investment plan, making them susceptible to panic selling or emotional buying.

- Importance of long-term investment plans: Developing a long-term plan helps to weather market downturns and stick to your investment strategy.

- Benefits of dollar-cost averaging: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can help mitigate the risk of market timing.

- Avoiding panic selling: Sticking to your investment plan and avoiding panic selling is crucial during market downturns.

Conclusion

The contrasting behaviors of professionals and individuals during a market downturn highlight the importance of informed decision-making and long-term planning. Professionals often utilize downturns for strategic selling, employing tactics like tax loss harvesting and portfolio rebalancing. Individuals, however, often react emotionally, driven by FOMO or a misguided "bargain hunting" mentality, leading to potentially poor investment outcomes. Understanding the nuances of a market downturn, and the difference between professional and individual investor behavior, is crucial. Don't let fear dictate your investment decisions; instead, develop a robust long-term strategy to navigate market downturns effectively. Seek professional financial advice before making significant investment decisions during a market downturn to make informed decisions and protect your portfolio.

Featured Posts

-

2025 Nascar Jack Link 500 At Talladega Expert Prop Bets And Betting Analysis

Apr 28, 2025

2025 Nascar Jack Link 500 At Talladega Expert Prop Bets And Betting Analysis

Apr 28, 2025 -

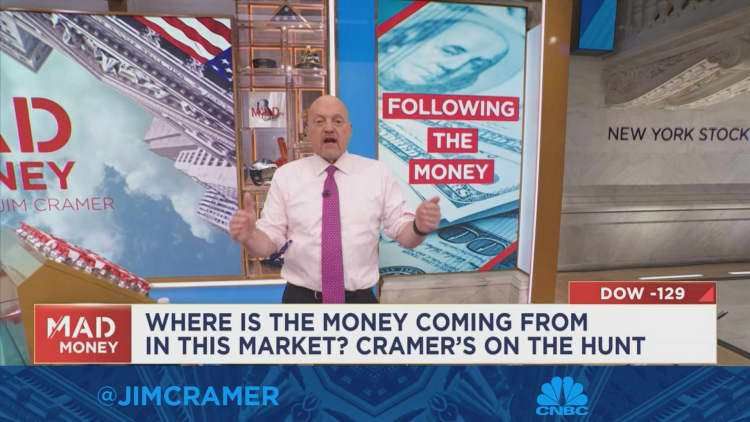

Abu Dhabi Pass 10 Gb Sim Card And 15 Discount On Attractions

Apr 28, 2025

Abu Dhabi Pass 10 Gb Sim Card And 15 Discount On Attractions

Apr 28, 2025 -

Cassidy Hutchinsons Fall Memoir A Deeper Look At The January 6th Hearings

Apr 28, 2025

Cassidy Hutchinsons Fall Memoir A Deeper Look At The January 6th Hearings

Apr 28, 2025 -

Analysis Bubba Wallaces Martinsville Restart And The Road To Victory

Apr 28, 2025

Analysis Bubba Wallaces Martinsville Restart And The Road To Victory

Apr 28, 2025 -

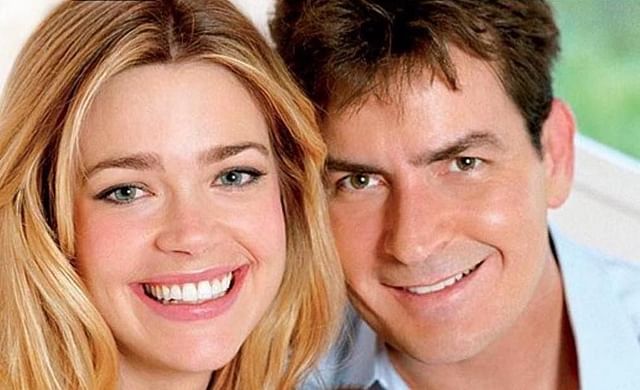

Creditor Seeks Denise Richards Husbands Bank Records

Apr 28, 2025

Creditor Seeks Denise Richards Husbands Bank Records

Apr 28, 2025