Market Surge: Sensex Up, BSE Stocks With 10%+ Gains

Table of Contents

Top-Performing BSE Stocks with 10%+ Gains

Identifying High-Growth Stocks

Several BSE stocks have demonstrated exceptional performance, achieving gains exceeding 10%. Identifying these high-growth stocks is key to maximizing returns during this market rally. Analyzing the sectors and companies that have seen the most significant gains provides valuable insights into the current market trends.

-

Top 10 Performing Stocks (Illustrative - Data needs to be replaced with current market data):

- Company A: +15% (IT Sector)

- Company B: +12% (Pharma Sector)

- Company C: +18% (Financials Sector)

- Company D: +11% (Energy Sector)

- Company E: +14% (Consumer Goods Sector)

- Company F: +10% (Technology Sector)

- Company G: +13% (Infrastructure Sector)

- Company H: +17% (Metals Sector)

- Company I: +16% (FMCG Sector)

- Company J: +12% (Healthcare Sector)

(Note: The above list is for illustrative purposes only and should be replaced with actual top-performing stocks and their percentage gains at the time of publication.)

Each company's success is linked to its specific sector and recent performance. For example, Company A's surge in the IT sector could be attributed to strong quarterly earnings and positive industry outlook. Similarly, Company B’s success in Pharma might stem from new drug approvals or increased demand. Thorough research into individual companies and their respective sectors is vital.

Sector-Specific Analysis

Analyzing sectoral performance reveals broader market trends. This market surge is not limited to individual stocks; entire sectors are exhibiting remarkable growth.

- Top-Performing Sectors:

- Information Technology (IT): Driven by strong global demand for IT services and software.

- Pharmaceuticals: Fueled by new drug launches and increasing healthcare spending.

- Financials: Benefiting from improved economic conditions and rising interest rates.

- Energy: Driven by increased global energy demand and higher commodity prices.

Understanding the factors driving growth within each sector is crucial for making informed investment decisions. For instance, government policies supporting renewable energy are significantly impacting the Energy sector. Similarly, technological advancements are driving the growth in the IT sector.

Understanding the Drivers Behind the Surge

Several factors contribute to this impressive market surge. Identifying these drivers is critical for anticipating future market movements and managing investment risk.

- Potential Factors:

- Positive Global Economic News: Improved global economic indicators are boosting investor confidence.

- Reduced Inflation Concerns: Easing inflation pressures are creating a more favorable investment environment.

- Increased Investor Confidence: Positive sentiment and increased risk appetite are driving investment flows.

- Government Policies: Supportive government policies are contributing to positive market sentiment.

Geopolitical events also play a role. Any significant international developments should be carefully considered, as they can impact market volatility.

Strategies for Navigating the Market Surge

Risk Management in a Bull Market

Even during a bull market, risk management is paramount. While the current market trend is positive, it's crucial to protect your investments.

- Risk Mitigation Strategies:

- Diversification: Spreading investments across different sectors and asset classes reduces overall portfolio risk.

- Stop-Loss Orders: Setting stop-loss orders helps limit potential losses if the market takes an unexpected downturn.

- Portfolio Rebalancing: Regularly rebalancing your portfolio ensures your asset allocation aligns with your risk tolerance.

It's essential to remember that market corrections are a natural part of the investment cycle. Maintaining a cautious approach and anticipating potential downturns is crucial.

Identifying Potential Investment Opportunities

This market surge presents several opportunities for investors. However, it's essential to approach investment decisions strategically.

- Strategies for Identifying Opportunities:

- Fundamental Analysis: Assessing a company's financial health and future prospects.

- Technical Analysis: Analyzing price charts and market trends to identify potential entry and exit points.

- Following Market Trends: Keeping abreast of current market trends and sector performance.

While the temptation to chase short-term gains is high, focusing on long-term investment strategies is crucial for sustainable growth.

Conclusion: Capitalizing on the Sensex Surge and BSE Stock Market Gains

The Sensex surge is undeniable, with numerous BSE stocks showing significant gains. This market rally is driven by a combination of positive economic indicators, increased investor confidence, and supportive government policies. However, successful investment requires a balanced approach, combining the identification of promising opportunities with effective risk management strategies. Remember to diversify your portfolio, use stop-loss orders, and regularly rebalance your holdings. Conduct thorough research, consult with financial advisors, and develop a well-informed investment strategy to capitalize on the ongoing market surge and BSE stock market gains. Stay updated on Sensex movements and BSE stock performance for informed decision-making. Don't miss out on this opportunity to grow your investment portfolio – start planning your strategy today!

Featured Posts

-

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai Via Alterya Acquisition

May 15, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Via Alterya Acquisition

May 15, 2025 -

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025 -

Cassidy Hutchinsons Upcoming Memoir On The January 6th Hearings

May 15, 2025

Cassidy Hutchinsons Upcoming Memoir On The January 6th Hearings

May 15, 2025 -

Ind Ra Robust Monsoon Forecast To Fuel Growth In Indias Farm Sector

May 15, 2025

Ind Ra Robust Monsoon Forecast To Fuel Growth In Indias Farm Sector

May 15, 2025

Latest Posts

-

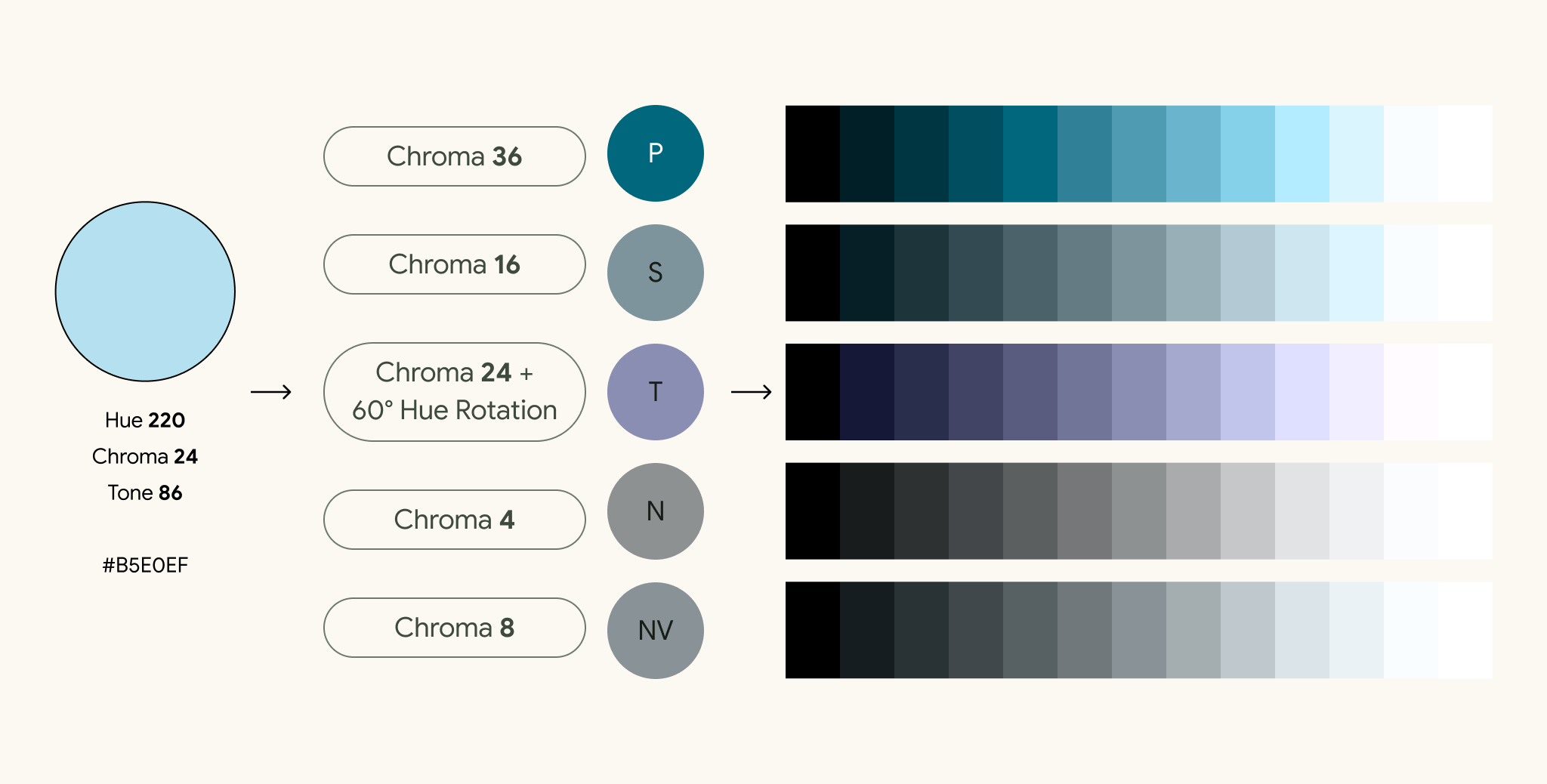

Introducing Androids Evolved Design Language

May 15, 2025

Introducing Androids Evolved Design Language

May 15, 2025 -

The New Android Design A Deep Dive

May 15, 2025

The New Android Design A Deep Dive

May 15, 2025 -

Android Design Overhaul Key Features And Updates

May 15, 2025

Android Design Overhaul Key Features And Updates

May 15, 2025 -

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025 -

Exploring Androids Updated Design Language

May 15, 2025

Exploring Androids Updated Design Language

May 15, 2025