Market Volatility And D-Wave Quantum (QBTS): Understanding Monday's Drop

Table of Contents

Market-Wide Volatility: A Contributing Factor to QBTS Stock Drop

Monday's market performance was far from rosy. Major indices like the S&P 500 and Nasdaq experienced noticeable declines, reflecting a broader sense of risk aversion among investors. This overall market correction played a significant role in QBTS's drop. Smaller-cap stocks, such as QBTS, are often disproportionately affected during periods of market uncertainty because they are considered higher risk.

- Increased Risk Aversion: Investors tend to move towards safer assets during periods of volatility, leading to a sell-off in riskier, growth-oriented stocks like those in the quantum computing sector.

- Impact of Macroeconomic Factors: Rising inflation, increasing interest rates, and persistent recessionary fears contributed to the negative market sentiment. This "risk-off" sentiment pushed investors away from speculative investments.

- Specific Market Events: For example, negative economic data releases or geopolitical instability could have amplified the overall market downturn, triggering widespread selling pressure, including on QBTS.

This broader market weakness created a headwind for QBTS, making it more susceptible to even minor negative news.

D-Wave Quantum (QBTS)-Specific News and Events

While the general market downturn played a role, it's crucial to investigate if any D-Wave-specific news or events contributed to Monday's drop in QBTS stock. Analyzing company-specific announcements is vital for a complete understanding.

- Absence of Positive News: The lack of significant positive news or announcements around the drop could have exacerbated investor concerns. Without positive catalysts, any market downturn could amplify negative sentiment.

- Analyst Ratings and Reports: Any downgrades from financial analysts or negative reports released around this time might have further pressured the stock price. Analyst opinions significantly impact investor confidence and trading decisions.

- Earnings Reports and Contract Announcements: The timing of any earnings reports or major contract announcements relative to the market drop needs careful scrutiny. Disappointing earnings or lack of significant contract wins could fuel negative sentiment.

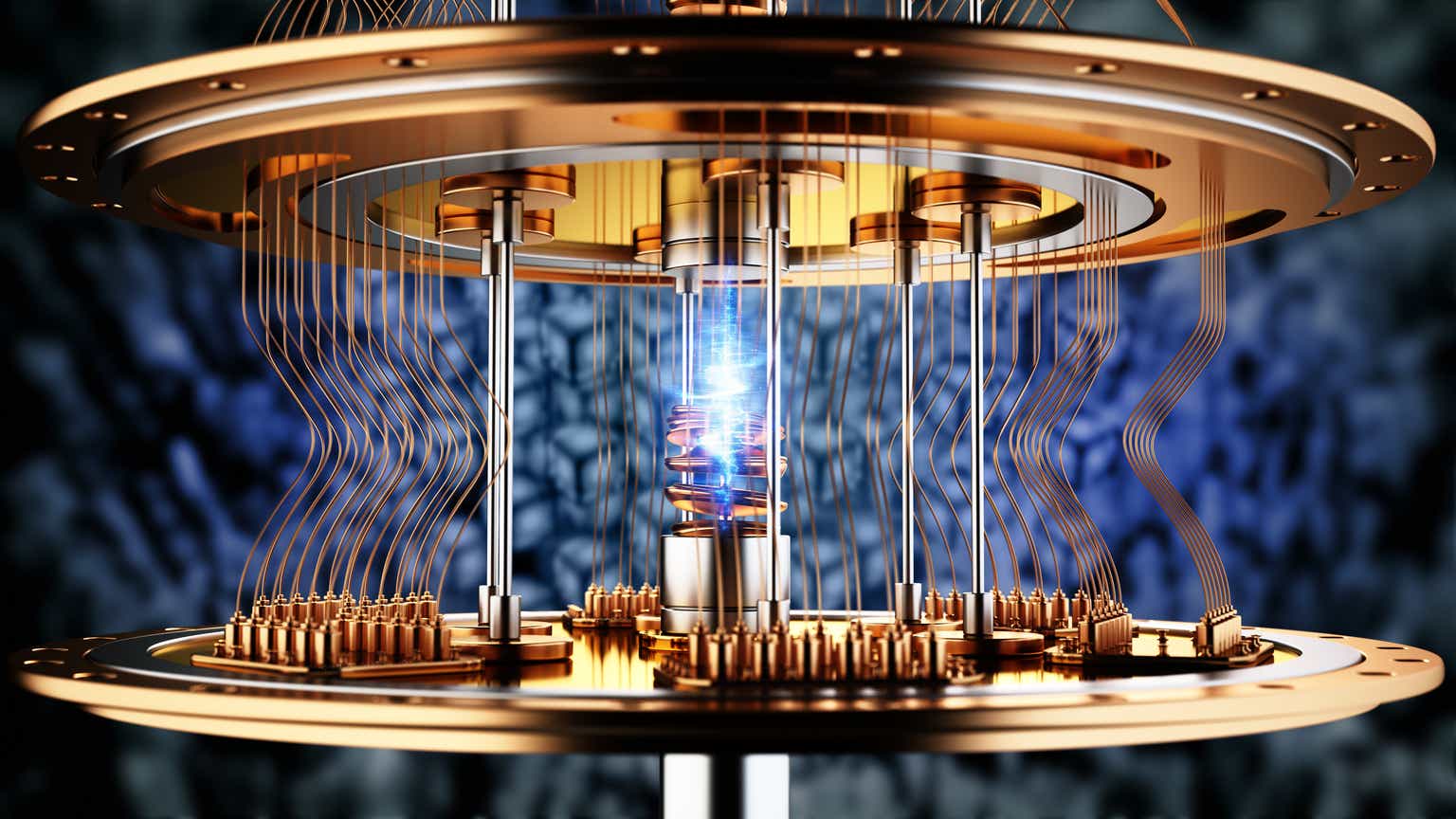

Technical Analysis of QBTS Stock Chart

A review of the QBTS stock chart from Monday provides valuable technical insights. (Insert Chart Here) The chart reveals specific technical indicators which further explain the movement.

- Trading Volume: High trading volume on Monday, alongside the price drop, suggests significant selling pressure. This indicates a strong conviction among sellers.

- Support and Resistance Levels: Did the stock price break through key support levels, indicating a potential continuation of the downward trend? Analyzing these levels provides context for the price movement.

- Candlestick Patterns: Examining candlestick formations can offer clues about the market sentiment and potential future price direction. However, it's essential to avoid over-interpreting these patterns and making overly speculative claims.

Sentiment Analysis and Social Media Buzz

Social media sentiment plays an increasingly crucial role in shaping market dynamics.

- Negative Sentiment on Social Media: Analyzing social media discussions on platforms like Twitter and StockTwits can reveal the prevailing sentiment around QBTS. A surge in negative comments or bearish predictions could have contributed to the sell-off.

- Influence of Social Media Trading: The interconnectedness of social media and trading means that negative sentiment can quickly translate into real market activity. This effect is particularly noticeable with smaller-cap stocks.

Conclusion: Navigating Volatility with D-Wave Quantum (QBTS)

Monday's drop in QBTS stock price was a result of a combination of factors. Broad market volatility, fueled by macroeconomic anxieties and a general risk-off sentiment, created a challenging environment for QBTS. Furthermore, the absence of positive company-specific news and possibly negative sentiment on social media likely exacerbated the decline.

Understanding both the macro (market conditions) and micro (company-specific events) influences is crucial for navigating the complexities of investing in volatile growth stocks like QBTS. Investing in quantum computing companies carries inherent risk. Before making any investment decisions in D-Wave Quantum (QBTS) or any other quantum computing stock, conduct thorough research, assess your risk tolerance, and seek professional financial advice. Making informed investment decisions in the quantum computing sector requires careful consideration of both the exciting potential and the significant risks involved. Understanding QBTS stock requires a nuanced understanding of market dynamics.

Featured Posts

-

Nouveaux Chefs A Biarritz Adresses Et Tendances 2024

May 20, 2025

Nouveaux Chefs A Biarritz Adresses Et Tendances 2024

May 20, 2025 -

Over The Counter Birth Control A New Era Of Reproductive Healthcare

May 20, 2025

Over The Counter Birth Control A New Era Of Reproductive Healthcare

May 20, 2025 -

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025 -

Michael Schumacher Gina Maria Schumacher A Devenit Mama O Fetita Pentru Prima Data

May 20, 2025

Michael Schumacher Gina Maria Schumacher A Devenit Mama O Fetita Pentru Prima Data

May 20, 2025 -

Can Mainzs Henriksen Emulate Klopp And Tuchels Success

May 20, 2025

Can Mainzs Henriksen Emulate Klopp And Tuchels Success

May 20, 2025

Latest Posts

-

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025 -

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025 -

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025 -

Protomagia Oropedio Evdomos Idaniki Eksormisi Gia Tin Anoiksi

May 20, 2025

Protomagia Oropedio Evdomos Idaniki Eksormisi Gia Tin Anoiksi

May 20, 2025 -

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025