MicroStrategy Vs. Bitcoin: Investment Strategies For 2025 And Beyond

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Business Model and Bitcoin Adoption

MicroStrategy, a business intelligence company, made a bold move by adopting Bitcoin as a primary treasury reserve asset. This decision, largely spearheaded by CEO Michael Saylor, reflects a belief in Bitcoin's long-term potential as a store of value and a hedge against inflation. Their rationale centers on Bitcoin's scarcity, increasing adoption, and its potential for significant future price appreciation. As of [Insert latest date and data on MicroStrategy's Bitcoin holdings], MicroStrategy holds approximately [Insert number] BTC, representing a substantial portion of its total assets.

- Store of Value: MicroStrategy views Bitcoin as a superior alternative to traditional fiat currencies, believing its deflationary nature protects against inflation.

- Long-Term Growth Potential: The company anticipates significant long-term growth in Bitcoin's value, positioning it as a key component of their overall investment strategy.

- Hedge Against Inflation: In a time of economic uncertainty, Bitcoin's limited supply is seen as a hedge against inflationary pressures impacting traditional assets.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique proposition: indirect exposure to Bitcoin's price movements. While this offers potential upside, it also exposes investors to the volatility of the cryptocurrency market and the inherent risks associated with MicroStrategy's business performance.

- Market Volatility: MicroStrategy's stock price is heavily influenced by Bitcoin's price fluctuations. A downturn in Bitcoin's value directly impacts MicroStrategy's valuation.

- Company-Specific Risks: Like any publicly traded company, MicroStrategy faces business risks independent of its Bitcoin holdings, including competition, economic downturns, and operational challenges.

- Regulatory Uncertainty: Changes in cryptocurrency regulation could significantly impact MicroStrategy's Bitcoin holdings and its overall financial performance.

- Diversification Benefits: Investing in MicroStrategy can offer diversification benefits within a larger portfolio, providing exposure to both traditional and digital asset classes.

Direct Bitcoin Investment: Strategies and Considerations

Bitcoin as a Long-Term Investment

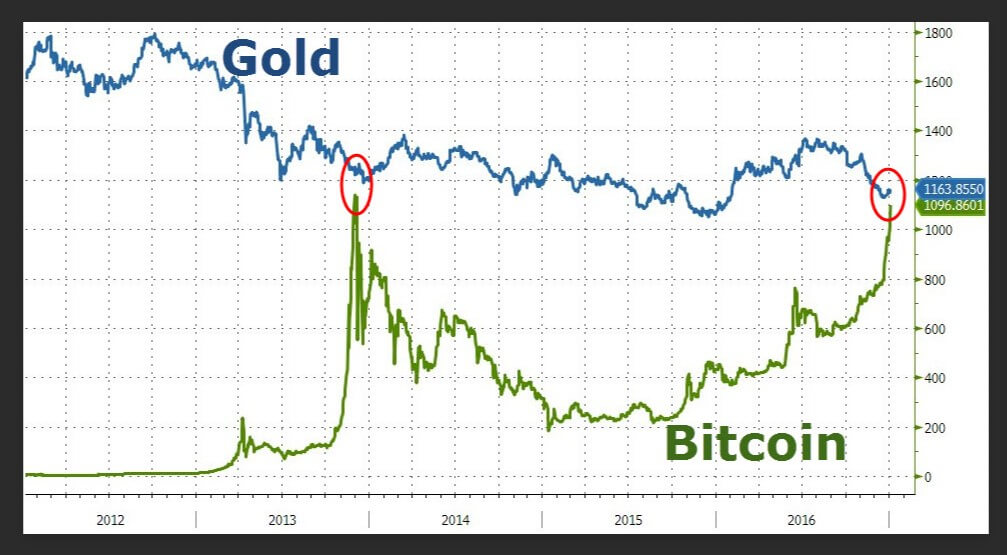

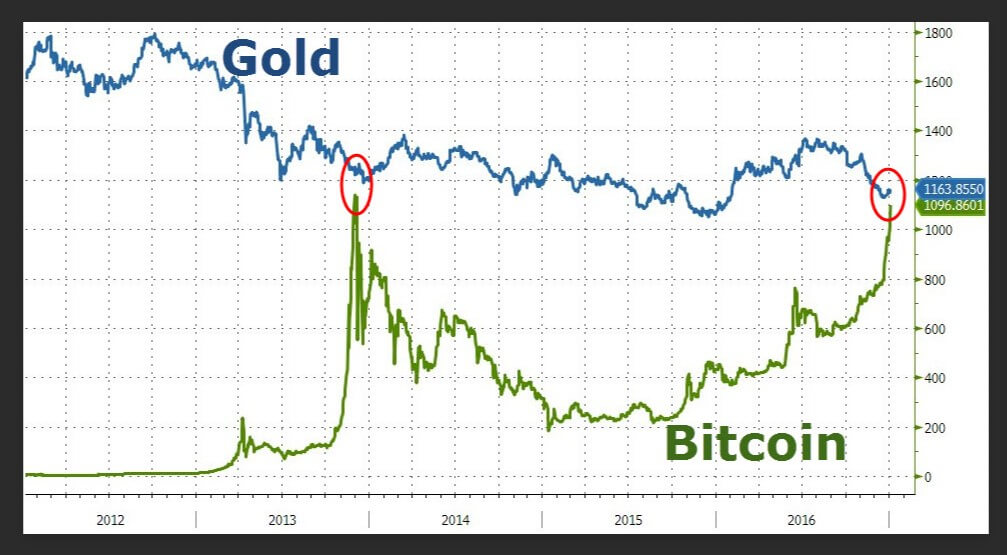

Many investors see Bitcoin as a long-term store of value, similar to gold. Its limited supply of 21 million coins contributes to its perceived scarcity. The increasing adoption by institutional investors and governments further fuels the narrative of long-term growth. Dollar-cost averaging (DCA), a strategy of regularly investing a fixed amount regardless of price fluctuations, is often recommended for mitigating risk in a volatile market like Bitcoin's.

- Limited Supply: The fixed supply ensures Bitcoin cannot be inflated, making it a potentially attractive hedge against inflation.

- Increasing Institutional Adoption: Large financial institutions are increasingly investing in Bitcoin, signaling growing legitimacy and potential for future price appreciation.

- Technological Advancement: Ongoing advancements in the Bitcoin ecosystem, such as the Lightning Network, enhance its functionality and usability.

- Volatility Risk: Bitcoin's price is highly volatile, subject to significant short-term fluctuations. This volatility can lead to substantial gains or losses.

Short-Term Bitcoin Trading Strategies (with cautionary notes)

While short-term trading strategies like day trading, swing trading, and arbitrage exist within the Bitcoin market, they are extremely risky and unsuitable for inexperienced investors. These strategies require advanced knowledge of technical analysis, risk management, and a high tolerance for volatility. The potential for significant losses significantly outweighs the potential for quick profits for most individuals.

- High Risk, High Reward (but mostly High Risk): Short-term trading can lead to substantial losses if not executed with expertise and careful risk management.

- Requires Extensive Knowledge: Success in short-term Bitcoin trading demands a deep understanding of market dynamics, technical indicators, and risk management techniques.

- Emotional Discipline Crucial: The volatility of the Bitcoin market can trigger emotional decision-making, leading to poor trading choices and substantial losses.

Comparing MicroStrategy and Direct Bitcoin Investment

Risk Tolerance and Investment Goals

The choice between investing in MicroStrategy stock and directly holding Bitcoin depends heavily on individual risk tolerance and investment goals. Direct Bitcoin investment carries significantly higher volatility but potentially higher returns. MicroStrategy offers indirect exposure to Bitcoin, tempering the volatility but adding the risk associated with the company's overall performance.

- Risk-Averse Investors: May prefer the slightly lower volatility of MicroStrategy stock, acknowledging the indirect Bitcoin exposure and company-specific risks.

- Risk-Tolerant Investors: Might opt for direct Bitcoin investment, accepting the high volatility in exchange for the potential for greater returns.

- Long-Term vs. Short-Term Goals: Long-term investors might find both options suitable, while short-term investors should strongly consider the risks involved in either approach.

Diversification and Portfolio Allocation

Both MicroStrategy and Bitcoin should be part of a well-diversified investment portfolio. Over-allocating to either asset increases overall portfolio risk. The appropriate allocation depends on your risk tolerance and financial goals.

- Diversification is Key: Spread investments across different asset classes to mitigate risk.

- Consider Portfolio Allocation: Allocate a percentage of your portfolio to Bitcoin and/or MicroStrategy based on your risk profile and investment objectives.

- Seek Professional Advice: Consult a financial advisor for personalized portfolio allocation guidance.

Conclusion

MicroStrategy and Bitcoin represent distinct investment avenues with varying risk profiles. Investing in MicroStrategy provides indirect Bitcoin exposure with added company-specific risk, while direct Bitcoin investment carries substantially higher volatility but potentially higher returns. The optimal strategy depends on your risk tolerance, investment timeline, and financial goals. Carefully research and consider your options before making any investment decisions involving MicroStrategy and Bitcoin. Remember, investing in cryptocurrency carries inherent risks. Diversify your portfolio wisely. Start your research today to develop a sound investment strategy for MicroStrategy and Bitcoin.

Featured Posts

-

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025 -

Bayern Munich Vs Inter Milan A Comprehensive Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Inter Milan A Comprehensive Match Preview And Prediction

May 09, 2025 -

Nhl Hart Trophy Draisaitl Hellebuyck And Kucherov In Final Race

May 09, 2025

Nhl Hart Trophy Draisaitl Hellebuyck And Kucherov In Final Race

May 09, 2025 -

Lac Kir Dijon Violente Agression De Trois Hommes

May 09, 2025

Lac Kir Dijon Violente Agression De Trois Hommes

May 09, 2025 -

Palantir Technology Stock Should You Invest Before May 5th Analyst Predictions

May 09, 2025

Palantir Technology Stock Should You Invest Before May 5th Analyst Predictions

May 09, 2025