MicroStrategy Vs. Bitcoin: Predicting Investment Returns In 2025

Table of Contents

MicroStrategy's Bitcoin Holdings: A Corporate Bet

Understanding MicroStrategy's Investment Strategy

MicroStrategy, a business intelligence company, has made a significant bet on Bitcoin, accumulating a substantial hoard of the cryptocurrency. Their rationale centers on several key factors:

-

Inflation Hedge: MicroStrategy views Bitcoin as a hedge against inflation, believing its limited supply will protect its value during periods of economic uncertainty. This strategy is particularly attractive given concerns about fiat currency devaluation.

-

Long-Term Growth Potential: The company sees Bitcoin as a long-term growth asset, anticipating significant price appreciation over the coming years. This is based on their belief in the growing adoption of Bitcoin as a store of value and a medium of exchange.

-

Technological Innovation: MicroStrategy also recognizes Bitcoin's underlying blockchain technology as a disruptive force with the potential to transform various industries. This adds another layer to their investment thesis.

-

Historical Context: MicroStrategy began accumulating Bitcoin in August 2020, making a significant commitment early in the institutional adoption phase.

-

Current Holdings: As of [Insert Current Date], MicroStrategy holds approximately [Insert Current Number] Bitcoin, representing a substantial investment. The average acquisition cost is approximately [Insert Average Acquisition Cost].

-

Regulatory Impact: Regulatory changes, including potential taxation policies or outright bans on Bitcoin, could significantly impact MicroStrategy's Bitcoin holdings and their overall valuation. The regulatory landscape remains a critical factor influencing this investment.

Analyzing MicroStrategy's Stock Performance Linked to Bitcoin

MicroStrategy's stock price shows a strong correlation with the price of Bitcoin. When Bitcoin's price rises, MicroStrategy's stock tends to follow suit, and vice-versa.

- Historical Data: Historical data clearly demonstrates this relationship, showing that significant Bitcoin price movements directly impact MicroStrategy's market capitalization.

- Decoupling Factors: However, factors could decouple the two in the future. Strong company performance unrelated to Bitcoin, or negative news concerning MicroStrategy's operations, could lead to a divergence. Similarly, broader market trends could also play a crucial role.

- Investment Risks: Investing in MicroStrategy stock as a Bitcoin proxy carries inherent risks. You are not only exposed to Bitcoin's price volatility but also to MicroStrategy's business risks and financial performance.

Predicting MicroStrategy Stock Returns in 2025

Predicting MicroStrategy's stock price in 2025 requires considering various scenarios for Bitcoin's price:

- Bullish Scenario: If Bitcoin reaches [Insert Bullish Price Target], MicroStrategy's stock price could potentially reach [Insert Bullish Stock Price Target]. This scenario assumes continued institutional adoption and positive regulatory developments.

- Neutral Scenario: If Bitcoin's price remains relatively stable around [Insert Neutral Price Target], MicroStrategy's stock price might see moderate growth to [Insert Neutral Stock Price Target]. This accounts for a more conservative outlook.

- Bearish Scenario: A significant drop in Bitcoin's price to [Insert Bearish Price Target] could severely impact MicroStrategy's stock, potentially leading to a price of [Insert Bearish Stock Price Target]. This highlights the inherent risk associated with the strategy.

These projections consider broader market conditions and MicroStrategy's operational performance beyond its Bitcoin holdings.

Direct Bitcoin Investment: A Decentralized Approach

Bitcoin's Price Volatility and Future Predictions

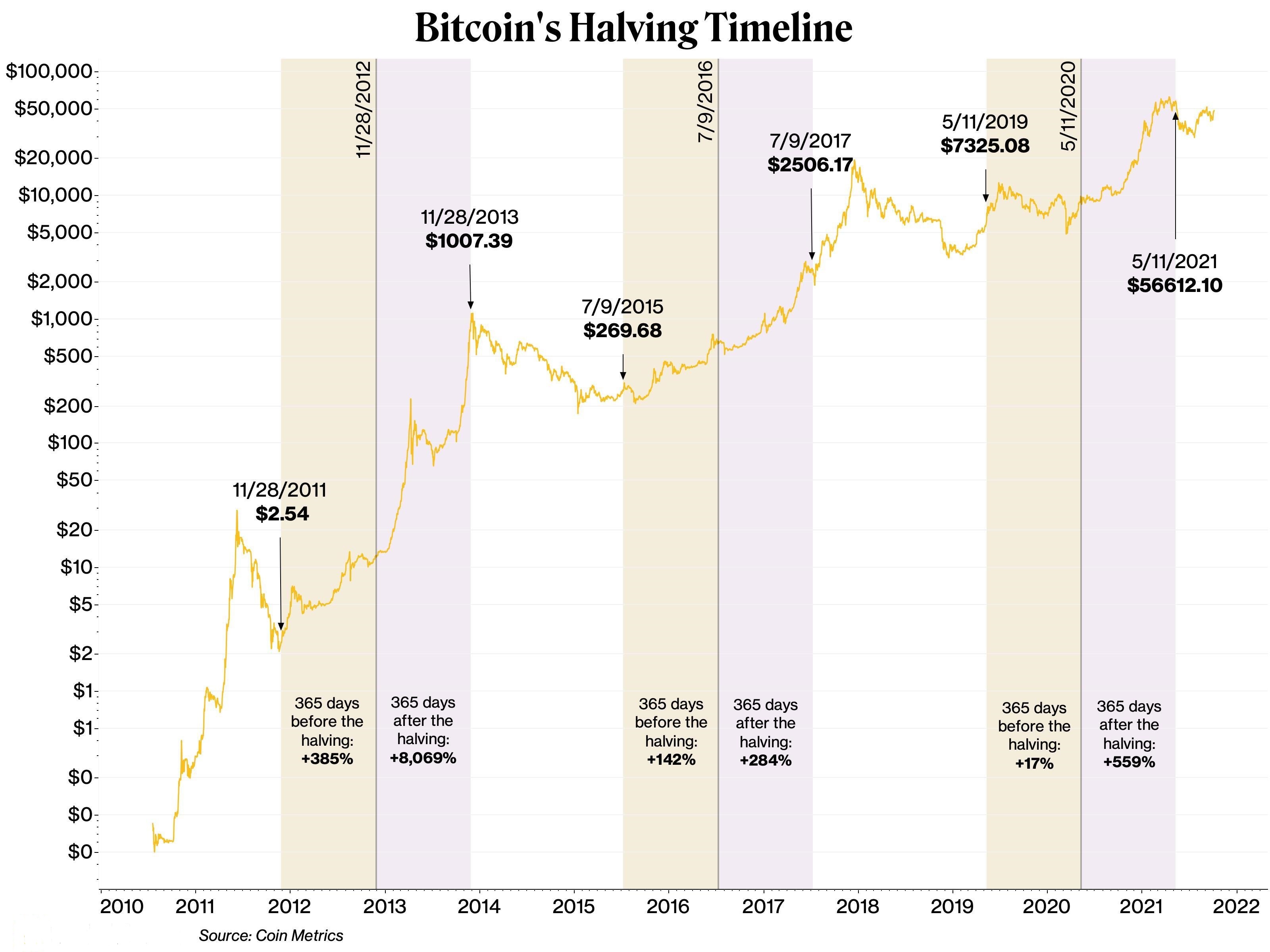

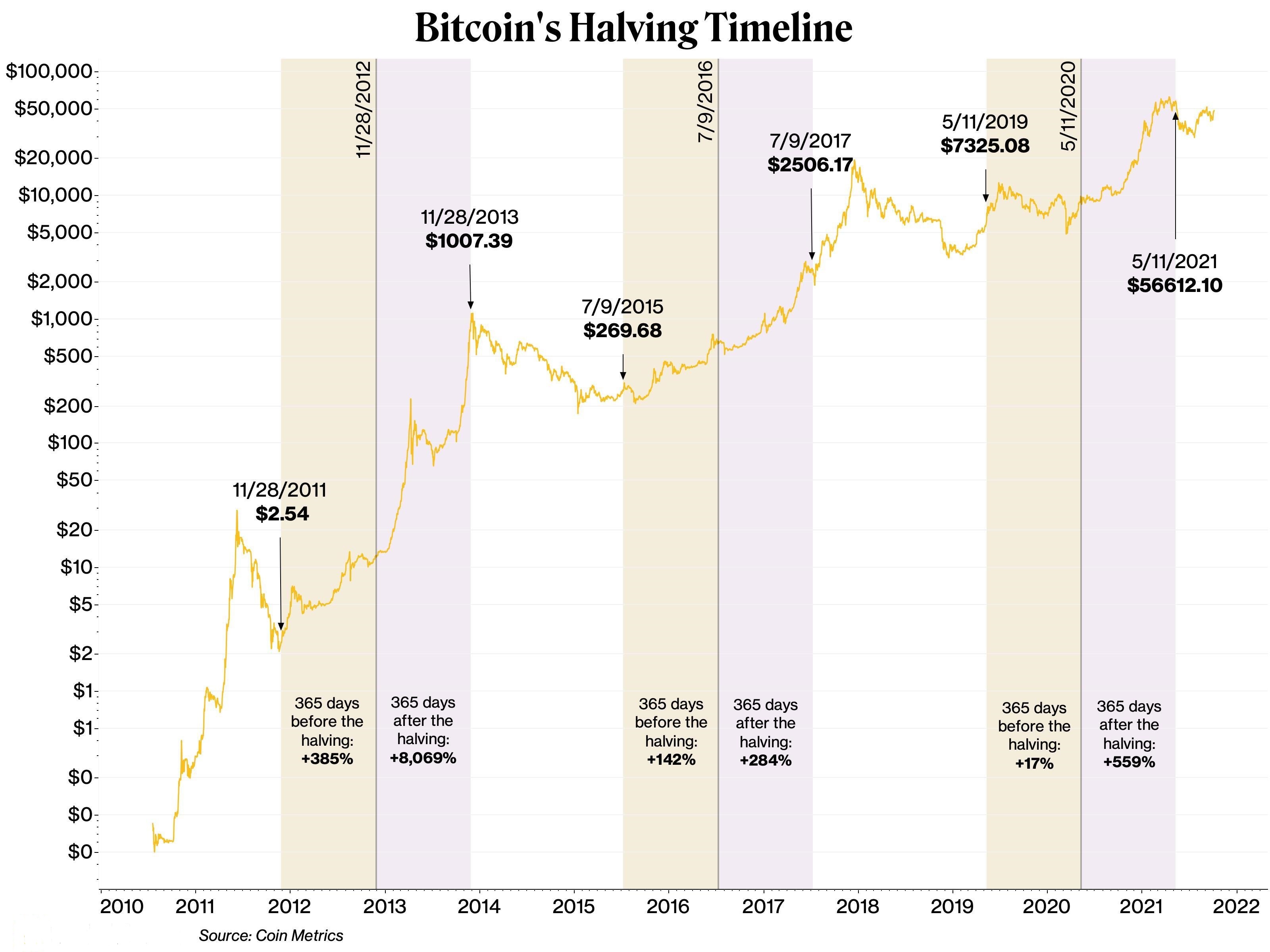

Bitcoin's price has historically been incredibly volatile. However, several factors influence its future price:

-

Adoption Rate: Increased adoption by institutions, governments, and individuals will likely drive price appreciation. Widespread adoption is a key bullish factor.

-

Regulatory Landscape: Positive regulatory frameworks and clear legal guidelines would instill confidence and potentially boost Bitcoin's price. Negative regulatory actions, conversely, present a significant risk.

-

Technological Advancements: Innovations in Bitcoin's underlying technology, such as the Lightning Network, could enhance its scalability and usability, potentially driving price growth.

-

Macroeconomic Factors: Global economic events, inflation rates, and geopolitical instability can all significantly affect Bitcoin's value. It's crucial to consider these factors.

-

Price Increase Catalysts: Wider institutional adoption, acceptance by major payment processors, and the development of Bitcoin-backed ETFs are potential catalysts for price increases.

-

Potential Risks: Regulatory crackdowns, successful attacks on the Bitcoin network, and the emergence of superior competing cryptocurrencies pose significant risks.

-

Competing Cryptocurrencies: The rise of altcoins with potentially superior technology or features could challenge Bitcoin's dominance, impacting its price.

Predicting Bitcoin's Price in 2025

Predicting Bitcoin's price in 2025 is inherently challenging but can be attempted using various models:

- Price-to-Value Ratio: Analyzing Bitcoin's market capitalization relative to its perceived value (e.g., based on scarcity and network effects) can offer some insight.

- Adoption Rate Projections: Estimating future adoption rates and extrapolating their impact on price provides another approach, though it is heavily reliant on assumptions.

- Price Range: Based on these models, a reasonable price range for Bitcoin in 2025 could be between [Insert Lower Bound] and [Insert Upper Bound]. The lower bound reflects a bearish scenario, while the upper bound represents a bullish one. The significant range highlights the uncertainty involved.

MicroStrategy vs. Direct Bitcoin Investment: A Comparative Analysis

Risk Tolerance and Investment Goals

Investing directly in Bitcoin versus investing in MicroStrategy stock involves distinct risk profiles:

- Volatility: Direct Bitcoin investment is significantly more volatile than investing in MicroStrategy. MicroStrategy's diversification beyond Bitcoin partially mitigates risk.

- Return Potential: Direct Bitcoin investment offers higher potential returns but also carries a higher risk of substantial losses. MicroStrategy offers a slightly more moderated risk/return profile.

- Diversification: Direct Bitcoin investment lacks diversification. MicroStrategy stock offers some diversification but remains heavily dependent on Bitcoin's price. Consider your overall portfolio diversification needs.

Comparing Potential Returns in 2025

The following table summarizes the predicted returns for both investment options:

| Investment | Bullish Scenario | Neutral Scenario | Bearish Scenario |

|---|---|---|---|

| Direct Bitcoin | [Insert Bitcoin Return] | [Insert Bitcoin Return] | [Insert Bitcoin Return] |

| MicroStrategy Stock | [Insert MicroStrategy Return] | [Insert MicroStrategy Return] | [Insert MicroStrategy Return] |

This comparison highlights that while direct Bitcoin investment offers higher potential returns under bullish scenarios, it also carries significantly greater risks under bearish scenarios. MicroStrategy offers a more cushioned approach. The best choice depends on your risk tolerance and investment horizon.

Conclusion

Predicting investment returns, especially in the volatile cryptocurrency market, is inherently challenging. While this analysis offers potential outcomes for MicroStrategy and direct Bitcoin investment by 2025, remember that these are estimations based on current trends and forecasts. Thorough research and understanding of the inherent risks associated with both MicroStrategy and Bitcoin are crucial before making any investment decisions. Conduct your own due diligence before investing in either MicroStrategy or Bitcoin, carefully considering your risk tolerance and investment goals. Remember that this is not financial advice. Further research into MicroStrategy vs. Bitcoin investment strategies is always recommended.

Featured Posts

-

Carusos Historic Performance Thunder Clinch Game 1 Playoff Victory

May 08, 2025

Carusos Historic Performance Thunder Clinch Game 1 Playoff Victory

May 08, 2025 -

Post Event Transportation 5 Uber Shuttles From United Center

May 08, 2025

Post Event Transportation 5 Uber Shuttles From United Center

May 08, 2025 -

Will Trumps Policies Push Bitcoin Above 100 000 A Price Prediction Analysis

May 08, 2025

Will Trumps Policies Push Bitcoin Above 100 000 A Price Prediction Analysis

May 08, 2025 -

Restaurante Cantina Canalla Resena Y Guia Completa En Malaga

May 08, 2025

Restaurante Cantina Canalla Resena Y Guia Completa En Malaga

May 08, 2025 -

De Andre Jordan I Nikola Jokic Objasnjenje Za Trostruki Poljubac

May 08, 2025

De Andre Jordan I Nikola Jokic Objasnjenje Za Trostruki Poljubac

May 08, 2025