Microsoft Stock: A Safe Haven Amidst Trade War Uncertainty

Table of Contents

Microsoft's Diversified Revenue Streams as a Hedge Against Trade Wars

Microsoft's strength lies in its impressively diversified revenue streams, making it less susceptible to the impacts of localized trade disputes. This diversification acts as a significant hedge against the uncertainty brought on by trade wars.

H3: Cloud Computing Dominance (Azure): Microsoft Azure, the company's cloud computing platform, boasts a significant global reach. Its widespread adoption across numerous countries minimizes the impact of any single trade dispute.

- Azure's growth rate is consistently impressive, outpacing many competitors in the cloud market.

- Its market share continues to climb, solidifying its position as a dominant player in cloud computing.

- Azure's global presence ensures that disruptions in one region have a limited effect on overall revenue. This global reach significantly mitigates risk mitigation associated with specific regional trade issues.

H3: Productivity and Business Processes (Microsoft 365): Microsoft 365, the company's suite of productivity and collaboration tools, enjoys near-ubiquitous adoption across industries. Its subscription model generates recurring revenue, providing a stable income stream largely unaffected by fluctuating trade relations.

- The subscription model of M365 creates a predictable and consistent revenue stream, crucial for stability during economic uncertainty.

- Businesses globally rely on M365 for their daily operations, making it an essential tool regardless of trade conflicts. Its vast global user base further bolsters its resilience.

- M365's importance for business processes across sectors makes it a relatively low-risk investment in times of trade war uncertainty.

H3: Gaming and Xbox: While potentially more sensitive to certain regional trade policies, the gaming market's global appeal and the popularity of Xbox mitigate potential risks. Xbox Game Pass subscriptions contribute to a steadier revenue stream than solely relying on game sales.

- The global gaming market continues to expand, creating a fertile ground for growth.

- Xbox Game Pass subscriptions provide a recurring revenue stream, similar to Microsoft 365.

- While not entirely immune, the global market reach of Xbox minimizes the impact of localized trade issues.

Microsoft's Strong Financial Position and Consistent Growth

Beyond diversification, Microsoft boasts a robust financial foundation that reinforces its status as a safe haven asset.

H3: Profitability and Cash Flow: Microsoft's consistent profitability and strong cash flow are hallmarks of its financial health.

- Microsoft consistently reports strong revenue, high earnings per share, and substantial free cash flow. (Insert relevant financial data here from reliable sources)

- This financial strength provides a cushion against economic downturns, offering consistent growth even amidst uncertainty.

- This financial stability positions Microsoft as a stable investment, attractive to investors seeking security.

H3: Stock Buybacks and Dividend Payments: Microsoft's commitment to stock buybacks and dividend payments directly benefits shareholders. These actions enhance shareholder value, providing a return even during periods of market volatility.

- Stock buybacks reduce the number of outstanding shares, increasing the value of each remaining share.

- Dividend payments provide a consistent stream of income to investors.

- Microsoft's historical dividend payout ratios demonstrate its commitment to returning value to shareholders.

Microsoft's Long-Term Growth Prospects

Microsoft's diversified revenue streams are complemented by strong long-term growth prospects.

H3: Artificial Intelligence (AI) and Emerging Technologies: Microsoft's significant investments in artificial intelligence and other emerging technologies position it for future growth.

- Microsoft is a leader in developing and implementing AI across various applications.

- Its strategic focus on emerging technologies ensures its continued relevance and growth potential in the long term.

- Microsoft's position in the AI race offers significant long-term growth potential.

H3: Strategic Acquisitions and Partnerships: Microsoft's history of strategic acquisitions and partnerships further strengthens its market position and fuels future growth.

- (Insert examples of successful acquisitions and partnerships here)

- These strategic moves contribute to market expansion and provide a competitive advantage.

Conclusion:

In conclusion, Microsoft stock presents a compelling investment opportunity during times of trade war uncertainty. Its diversified revenue streams, strong financials, and promising long-term growth prospects make it a relatively safe haven asset. The company's consistent profitability, robust cash flow, and commitment to shareholder value through stock buybacks and dividend payments further enhance its appeal. Consider adding Microsoft stock to your portfolio as part of a diversified investment strategy to help mitigate risks associated with global trade conflicts. Invest in Microsoft stock today to secure your financial future.

Disclaimer: Investing in the stock market involves inherent risks. This article is for informational purposes only and does not constitute financial advice. Consult a financial advisor before making any investment decisions.

Featured Posts

-

Poiriers Retirement Paddy Pimbletts Strong Reaction And Call To Action

May 15, 2025

Poiriers Retirement Paddy Pimbletts Strong Reaction And Call To Action

May 15, 2025 -

Npo Baas In Opspraak Beschuldigingen Van Angstcultuur Door Meerdere Medewerkers

May 15, 2025

Npo Baas In Opspraak Beschuldigingen Van Angstcultuur Door Meerdere Medewerkers

May 15, 2025 -

Carneys New Cabinet A Deep Dive For Business Leaders

May 15, 2025

Carneys New Cabinet A Deep Dive For Business Leaders

May 15, 2025 -

Highway 407 East Tolls Scrapped Ontarios Permanent Gas Tax Cut Plan

May 15, 2025

Highway 407 East Tolls Scrapped Ontarios Permanent Gas Tax Cut Plan

May 15, 2025 -

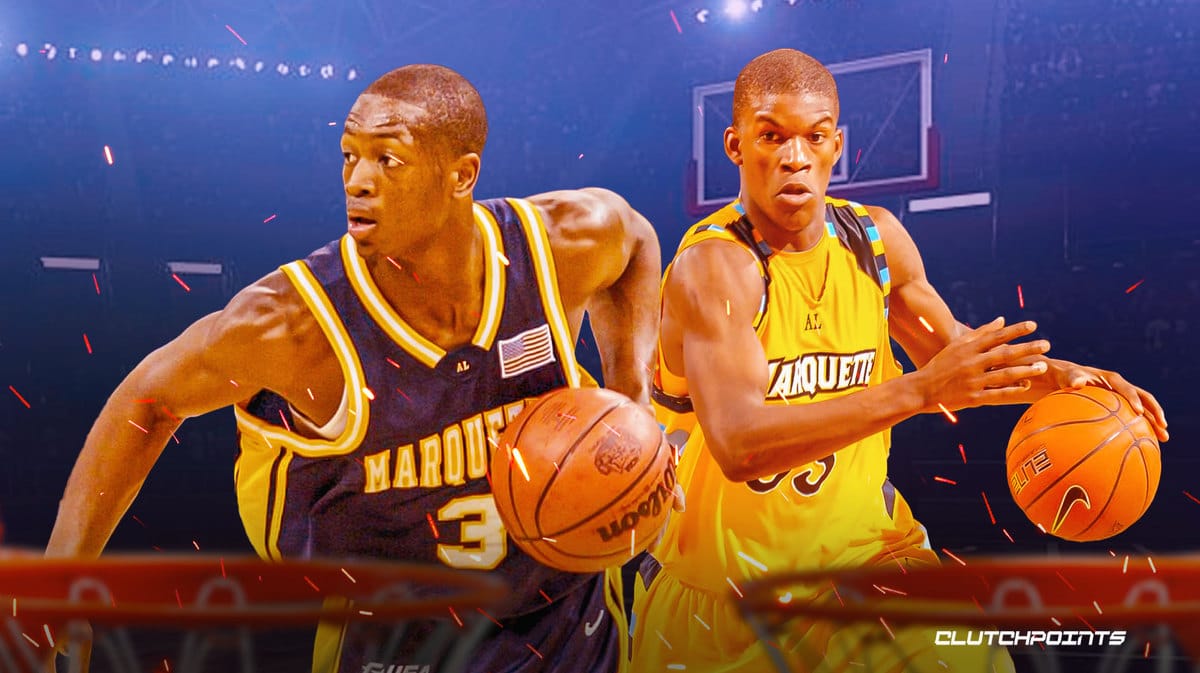

Dwyane Wade On Jimmy Butlers Miami Heat Departure His Thoughts

May 15, 2025

Dwyane Wade On Jimmy Butlers Miami Heat Departure His Thoughts

May 15, 2025

Latest Posts

-

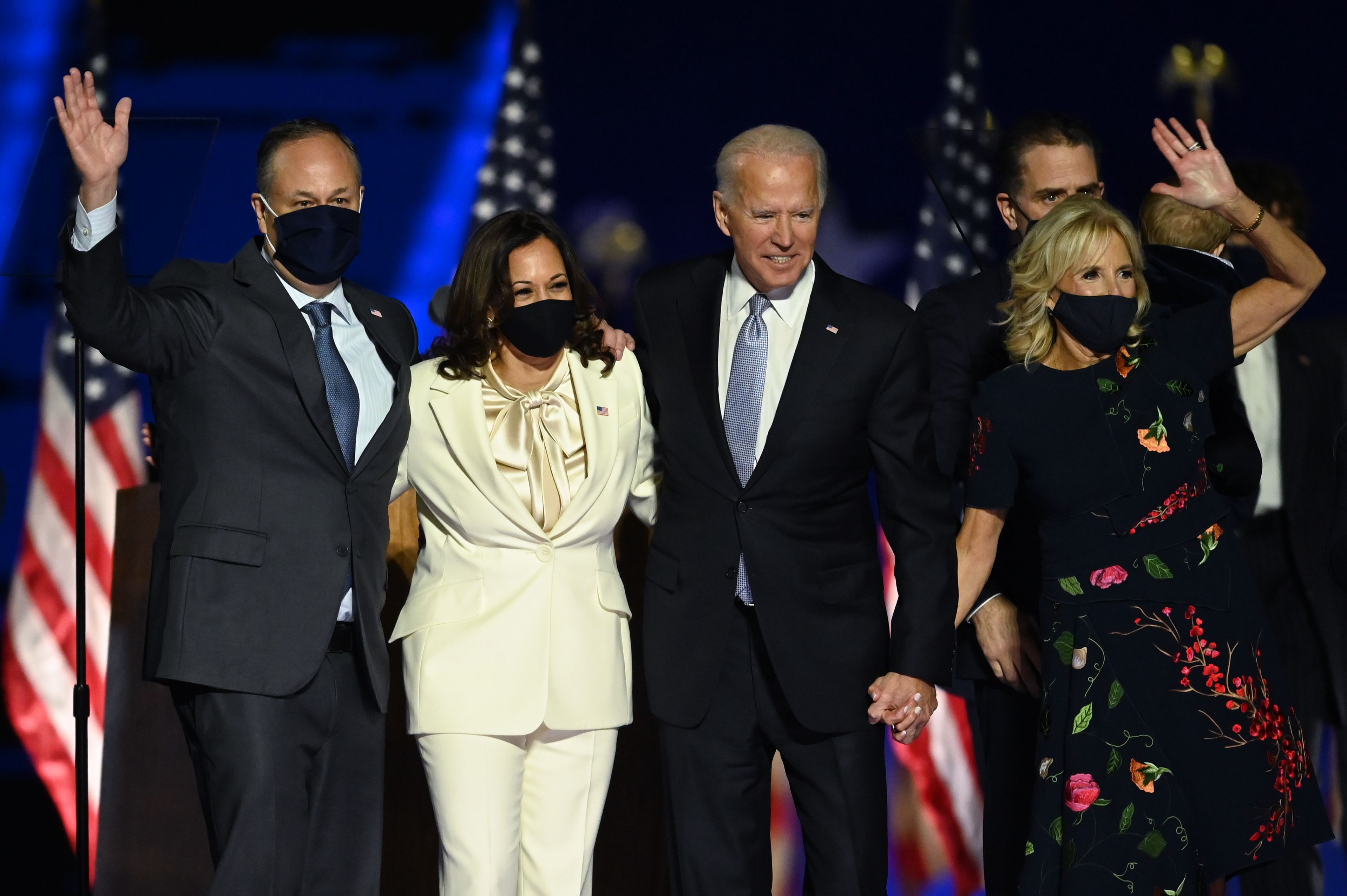

Kamala Harris And Jill Biden Separating Fact From Fiction Regarding Their Relationship

May 15, 2025

Kamala Harris And Jill Biden Separating Fact From Fiction Regarding Their Relationship

May 15, 2025 -

Warrens Failed Attempt To Defend Bidens Mental State

May 15, 2025

Warrens Failed Attempt To Defend Bidens Mental State

May 15, 2025 -

Jeffrey Goldbergs Trump Interview An Account Of Unconventional Encounters

May 15, 2025

Jeffrey Goldbergs Trump Interview An Account Of Unconventional Encounters

May 15, 2025 -

Dispelling The Myths The Truth About The Biden Harris Dynamic

May 15, 2025

Dispelling The Myths The Truth About The Biden Harris Dynamic

May 15, 2025 -

Elizabeth Warrens Defense Of Bidens Mental Fitness Backfires

May 15, 2025

Elizabeth Warrens Defense Of Bidens Mental Fitness Backfires

May 15, 2025