Minority Government Election: Could The Loonie Fall?

Table of Contents

Economic Uncertainty and Investor Sentiment

A minority government inherently creates economic uncertainty. The potential for instability and difficulties in passing crucial legislation significantly impacts investor sentiment. This uncertainty translates directly into risk for businesses and international investors, affecting investment decisions and capital flows.

- Increased political risk: The fragility of a minority government increases the perceived political risk in Canada. Sudden changes in leadership or policy are more likely.

- Potential for gridlock on key economic policies: Passing budgets and other crucial economic legislation becomes more challenging, leading to delays and potential gridlock. This can stifle economic growth.

- Reduced investor confidence leading to capital flight: Uncertainty discourages foreign and domestic investment, potentially leading to capital flight as investors seek safer havens.

- Negative impact on foreign direct investment (FDI): Companies are less likely to invest in a country with a politically unstable environment, hindering economic growth and job creation.

Investor sentiment plays a crucial role in determining the Loonie's value. Negative sentiment, driven by uncertainty surrounding a minority government, can lead to a decrease in demand for the Canadian dollar, consequently driving down its value against other major currencies. A weakening Loonie can further exacerbate economic uncertainty by increasing import costs and potentially fueling inflation.

Fiscal Policy and the Loonie

The potential impact of differing fiscal policies advocated by various political parties presents another significant risk to the Loonie. Differing approaches to government spending and taxation can dramatically affect the economic landscape and, in turn, the currency's value.

- Increased government spending vs. fiscal restraint: Parties with differing views on government spending could lead to significant shifts in fiscal policy. Increased spending can stimulate the economy in the short term, but potentially lead to higher inflation and increased national debt. Fiscal restraint can have the opposite effect.

- Impact of potential tax changes on business investment and consumer spending: Tax changes can significantly affect business investment and consumer confidence, impacting economic growth and the Loonie. Uncertainty about future tax policies further dampens investor enthusiasm.

- Potential for increased national debt and its effect on credit rating: Increased government borrowing to finance increased spending can lead to a higher national debt and potentially downgrade Canada's credit rating, making borrowing more expensive and further impacting the Loonie.

Different fiscal policies influence the Loonie's value through their effects on inflation, interest rates, and the overall economic outlook. Expansionary fiscal policies (increased spending) can lead to inflation, potentially causing the central bank to raise interest rates, which might attract foreign investment and strengthen the Loonie temporarily, although potentially harming growth in the long run. Conversely, contractionary fiscal policies (fiscal restraint) may lead to lower inflation and interest rates, potentially weakening the Loonie.

Potential for Political Instability and its Impact

Minority governments are inherently unstable, vulnerable to confidence votes and potential snap elections. This inherent instability creates a significant risk for the Loonie.

- Increased likelihood of snap elections: The possibility of a sudden election adds to the uncertainty, further discouraging investment and impacting the Loonie's value.

- Difficulty in implementing long-term economic strategies: The short-term nature of a minority government makes it challenging to implement long-term economic plans and reforms, creating further uncertainty for investors.

- Potential for policy shifts based on shifting alliances: A minority government's reliance on support from other parties can lead to unpredictable policy shifts, adding to the overall uncertainty.

This political instability directly impacts the Loonie by creating uncertainty and making it a less attractive currency for international investors. The increased risk associated with investing in a politically unstable environment leads to capital flight and a weakening of the Canadian dollar.

Historical Precedents

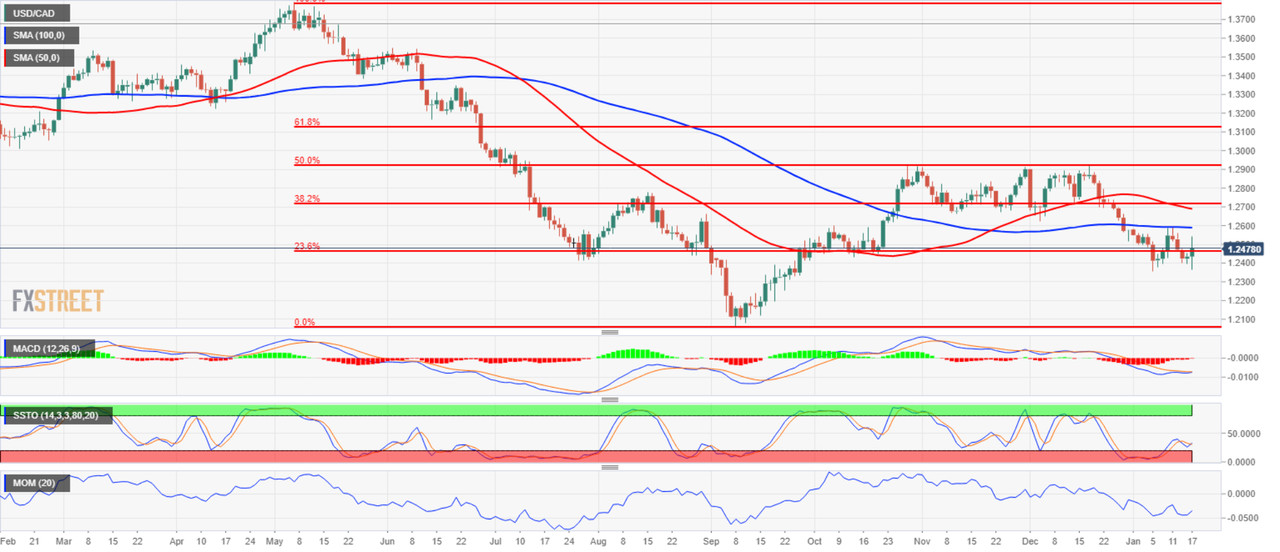

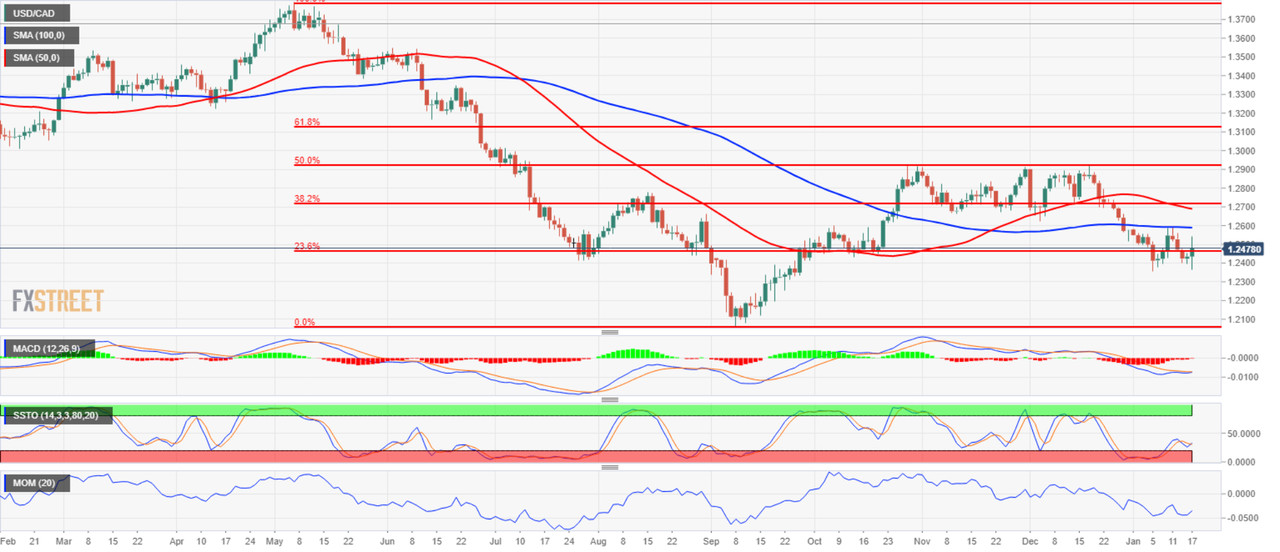

While each minority government presents unique challenges, historical data reveals a general trend of increased economic uncertainty and Loonie volatility during periods of minority government. Analyzing past instances, including examining the impact on key economic indicators like inflation, interest rates, and FDI, provides valuable insights and context for understanding potential future trends. (Note: This section would ideally include specific data and charts illustrating historical correlations).

Conclusion

A minority government election presents considerable risk to the Canadian economy, potentially leading to Loonie volatility due to economic uncertainty, differing fiscal policies, and inherent political instability. The interconnectedness between political stability, investor confidence, and the Canadian dollar is undeniable. A weakening Loonie can negatively impact various sectors of the Canadian economy.

Stay informed about the upcoming minority government election and its potential effects on the Loonie. Monitor economic indicators and consider diversifying your investments to mitigate potential risks associated with a minority government election. Understanding the potential impact of a minority government on the Loonie is crucial for both individual investors and businesses navigating the Canadian economic landscape.

Featured Posts

-

Ovechkin I Ego Rekord Reaktsiya Zakharovoy

Apr 30, 2025

Ovechkin I Ego Rekord Reaktsiya Zakharovoy

Apr 30, 2025 -

Rozkrittya Tayemnitsi Chomu Tramp I Zelenskiy Sidili Okremo Pid Chas Zustrichi

Apr 30, 2025

Rozkrittya Tayemnitsi Chomu Tramp I Zelenskiy Sidili Okremo Pid Chas Zustrichi

Apr 30, 2025 -

200 Disney Employees Laid Off Impact On Tv And Abc News

Apr 30, 2025

200 Disney Employees Laid Off Impact On Tv And Abc News

Apr 30, 2025 -

La Afa De Duelo Fallecimiento De Un Joven Referente Del Futbol Argentino

Apr 30, 2025

La Afa De Duelo Fallecimiento De Un Joven Referente Del Futbol Argentino

Apr 30, 2025 -

5 Key Dos And Don Ts To Succeed In The Private Credit Market

Apr 30, 2025

5 Key Dos And Don Ts To Succeed In The Private Credit Market

Apr 30, 2025