Mississippi Governor's Tax Cut: Hernando Prepares For Impact

Table of Contents

Understanding the Mississippi Governor's Tax Cut

The Mississippi Governor's Tax Cut represents a substantial reduction in state income tax. The specifics include a [insert percentage]% reduction across various income brackets, effective [insert date]. This tax reform aims to stimulate the state's economy and provide tax relief to individuals and businesses.

- Who Benefits Most? While all taxpayers will see some benefit, those in lower-to-middle income brackets are expected to see the most significant percentage decrease in their tax liability. Families with children and small businesses may also find substantial relief.

- Limitations and Exclusions: [Specify any limitations or exclusions within the tax cut legislation. For example, mention if certain types of income are not eligible for the reduction]. It's crucial to understand these details to accurately assess your personal tax benefits.

- This Mississippi tax reform offers tax incentives and benefits by reducing the overall income tax burden on Mississippi residents. The reduction in tax brackets leads to increased disposable income.

The Potential Economic Impact on Hernando, Mississippi

The Mississippi Governor's Tax Cut's impact on Hernando's economy is multifaceted. The potential positive effects are considerable.

- Increased Consumer Spending: With more disposable income, Hernando residents may increase spending on local goods and services, boosting businesses within the community.

- Business Investment: Businesses may see this as an opportunity to invest in expansion or new ventures, potentially leading to job creation.

- Job Market Growth: The combined effect of increased consumer spending and business investment could lead to a healthier and more robust job market.

However, potential negative consequences need careful consideration:

- Inflation: Increased demand for goods and services could drive up prices, potentially negating some of the benefits of the tax cut.

- Strain on Local Services: While the state's budget might see an initial surplus, reduced tax revenue could potentially strain funding for local services depending on how the Hernando local government manages its budget.

- Differential Impacts: Businesses heavily reliant on consumer spending may see a more immediate positive impact, whereas others may experience less dramatic changes.

Economic Outlook Comparison:

| Factor | Before Tax Cut | After Tax Cut (Projected) |

|---|---|---|

| Consumer Spending | [Describe current spending levels] | Increased |

| Business Investment | [Describe current investment levels] | Increased |

| Job Market | [Describe current job market status] | Potential growth |

| Inflation | [Describe current inflation rates] | Potential increase |

| Strain on Local Services | [Describe current service capacity] | Potential increased strain |

How Hernando Residents Can Prepare for the Changes

The Mississippi Governor's Tax Cut presents both opportunities and challenges. Proactive financial planning is key.

- Budgeting: Review your current budget and identify areas where you can maximize the benefits of increased disposable income. This might include paying down debt, increasing savings, or investing.

- Savings: Consider increasing your savings rate to take advantage of the increased disposable income. This could be for emergency funds, a down payment on a house, or retirement.

- Investment Strategies: Consult with a financial advisor to explore potential investment opportunities and align your investment strategy with your financial goals.

- Seek Advice: Don't hesitate to reach out to local accountants or financial advisors in Hernando for personalized guidance.

Actionable Steps:

- Review your personal tax situation to determine your exact tax savings.

- Develop a revised budget incorporating the anticipated tax reduction.

- Explore investment opportunities suitable for your risk tolerance and financial goals.

- Consult with a financial professional for personalized guidance.

- Visit the Mississippi Department of Revenue website for official information on the tax cut.

Local Government Response and Budgetary Adjustments

The Hernando local government is currently evaluating the potential impact of the Mississippi Governor's Tax Cut on its budget. [Include details about the local government's response, including any anticipated changes to local services or spending. If available, include quotes from relevant local officials.]

- Potential Changes to Local Tax Rates: [Specify any potential changes to local tax rates or spending priorities. For example, will property taxes be adjusted to compensate for reduced state revenue?]

- Changes in Local Services: [Discuss potential alterations to the services provided by the local government as a result of the change.]

Conclusion: Mississippi Governor's Tax Cut: Navigating the Changes in Hernando

The Mississippi Governor's Tax Cut presents a complex scenario for Hernando residents. While it offers potential economic benefits such as increased consumer spending and business investment, it also necessitates careful financial planning and consideration of potential challenges like inflation and the strain on local services. By taking proactive steps such as reviewing your budget, seeking financial advice, and staying informed about the tax cut’s implementation, Hernando residents can best navigate these changes and leverage the opportunities for financial growth within their community. Learn more about how the Mississippi Governor's Tax Cut will affect you and your financial planning in Hernando. Visit [link to relevant resource] to access detailed information and resources.

Featured Posts

-

Ecu Baseball Parker Byrds Inspiring Run As First Amputee To Drive In A Run

May 19, 2025

Ecu Baseball Parker Byrds Inspiring Run As First Amputee To Drive In A Run

May 19, 2025 -

Park Music Festivals Cancelled Following Court Ruling

May 19, 2025

Park Music Festivals Cancelled Following Court Ruling

May 19, 2025 -

Office365 Security Flaw Exposed Millions Stolen Through Executive Email Hacks

May 19, 2025

Office365 Security Flaw Exposed Millions Stolen Through Executive Email Hacks

May 19, 2025 -

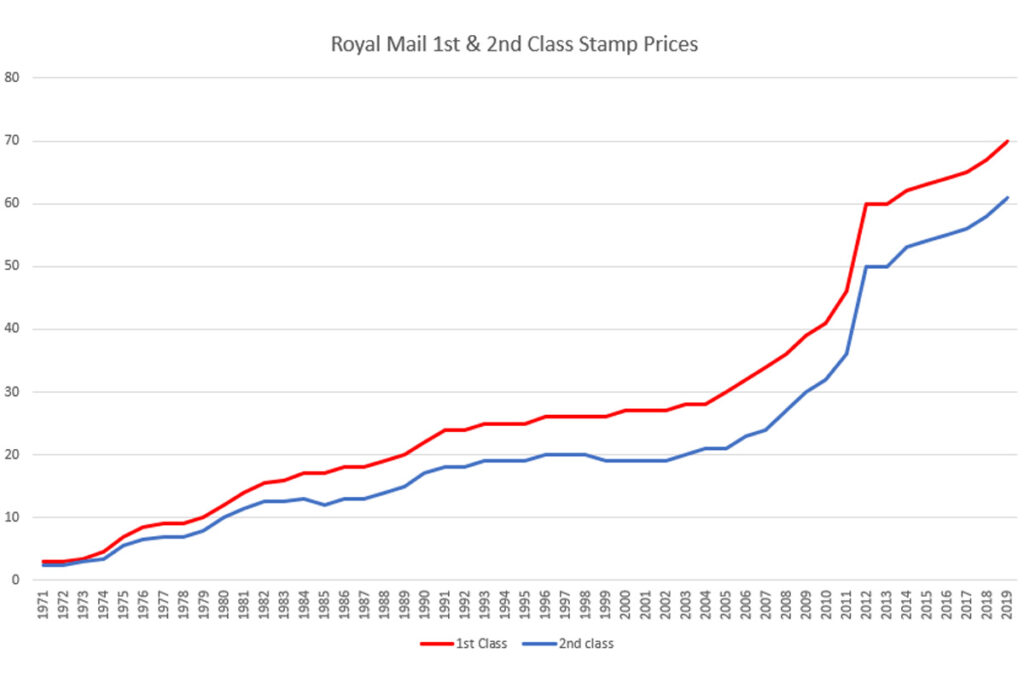

Royal Mail Stamp Price Increases Are Brits Being Unfairly Treated

May 19, 2025

Royal Mail Stamp Price Increases Are Brits Being Unfairly Treated

May 19, 2025 -

Istoriki Synantisi Nea Epoxi Synergasias Ierosolymon Kai Antioxeias

May 19, 2025

Istoriki Synantisi Nea Epoxi Synergasias Ierosolymon Kai Antioxeias

May 19, 2025