Mississippi's Potential Income Tax Elimination: A Hernando Perspective

Table of Contents

Economic Impacts on Hernando

The potential elimination of Mississippi's income tax could significantly reshape Hernando's economic landscape, creating both opportunities and challenges.

Potential Economic Growth

A major anticipated benefit is increased disposable income for Hernando residents. This influx of cash could lead to:

- Higher consumer spending: More money in pockets means more spending at local businesses, boosting sales and creating a ripple effect throughout the Hernando economy. This could translate to increased employment opportunities in retail, hospitality, and other service sectors.

- Attraction of new businesses and residents: Hernando could become a more attractive location for businesses seeking a lower tax burden, leading to job creation and economic diversification. This influx of people could further fuel economic growth.

- Stimulation of the local real estate market: Increased demand for housing, driven by new residents and businesses, could lead to rising property values, benefiting homeowners and boosting local tax revenue (though potentially offsetting income tax losses).

- Increased investment in local infrastructure and businesses: With more disposable income and a more attractive business environment, there’s potential for increased private investment in Hernando's infrastructure and businesses, leading to improvements in quality of life and overall economic vitality. This includes things like new roads, updated utilities, and expansion of existing businesses.

Keywords: Hernando economy, economic growth, tax benefits, Mississippi tax reform

Potential Challenges and Concerns

While the prospect of a tax-free Mississippi is exciting, it's crucial to acknowledge potential downsides:

- Reduced state revenue impacting funding for vital public services: Eliminating the income tax would significantly reduce state revenue, potentially impacting funding for crucial public services such as education, healthcare, and infrastructure in Hernando and across the state. This could lead to cuts in essential programs and services.

- Potential for increased property taxes or sales taxes: To compensate for the loss of income tax revenue, the state might increase other taxes, such as property taxes or sales taxes, negating some of the benefits for Hernando residents and businesses. This would be a critical point to consider during the transition.

- The need for careful planning and budgeting: A successful transition requires careful planning and budgeting to ensure a smooth shift and avoid unforeseen economic consequences. This would involve detailed analysis of potential revenue shortfalls and strategies for mitigating their impact.

- Uncertainty regarding the long-term economic effects: The long-term effects of eliminating the income tax are uncertain and depend on numerous economic factors, including the reaction of businesses and individuals both within and outside Mississippi. Thorough economic modeling and forecasting are crucial.

Keywords: Hernando budget, public services, tax revenue, fiscal responsibility, economic uncertainty

Impact on Hernando Residents

The Mississippi income tax elimination would directly affect the financial well-being of Hernando residents, both positively and negatively.

Benefits for Individuals

For individual Hernando residents, the primary benefit would be increased disposable income:

- More money in individual pockets, enabling higher savings and investments: This would give Hernando residents more financial flexibility, allowing them to save more, invest more, and potentially reduce their reliance on debt.

- Increased purchasing power, potentially stimulating the local economy: Increased purchasing power would translate into more spending at local businesses, thus fueling local economic growth.

- Enhanced financial freedom and reduced tax burdens for Hernando families: A simpler tax system with lower overall taxes would translate into greater financial freedom for families in Hernando.

- Simplification of tax filing and preparation: Eliminating state income tax would simplify the tax filing process for individuals, saving time and reducing the need for professional tax preparation services.

Keywords: Hernando residents, individual tax benefits, disposable income, tax simplification

Potential Drawbacks for Individuals

However, some potential downsides need careful consideration:

- Potential increase in other taxes (property, sales) to offset the lost revenue: As mentioned earlier, the state might need to increase other taxes to compensate for the loss of income tax revenue, potentially negating some of the individual benefits.

- Reduced access to public services if state funding is significantly cut: Reduced state funding could lead to reduced access to quality public services such as education, healthcare, and infrastructure, potentially impacting the quality of life in Hernando.

- Uncertainty surrounding the future economic landscape of Mississippi: The long-term economic consequences of income tax elimination are uncertain, which creates risk for residents and their families.

Keywords: Hernando taxes, public services funding, tax reform impact, economic uncertainty

Hernando Businesses and the Income Tax Elimination

The proposed income tax elimination holds both opportunities and challenges for businesses in Hernando.

Opportunities for Businesses

Hernando businesses could benefit from a more competitive business climate:

- Increased competitiveness with other states with lower income taxes: Eliminating the income tax would make Mississippi, and Hernando specifically, more competitive with other states that have lower or no income tax, potentially attracting new businesses and investment.

- Attraction of skilled workers and businesses to Hernando due to tax advantages: The lower tax burden could attract skilled workers and businesses to Hernando, stimulating economic growth and job creation.

- Expansion of businesses due to improved profitability: Businesses would likely see improved profitability due to the lower tax burden, allowing them to reinvest in their operations, expand, and create more jobs.

- Increased investments in local businesses: The improved business climate could attract more investment in local businesses, leading to growth and expansion.

Keywords: Hernando businesses, business growth, tax incentives, investment opportunities, Mississippi business climate

Challenges for Businesses

However, businesses should also be aware of potential difficulties:

- Uncertainty surrounding the long-term economic effects and potential changes in other taxes: The long-term economic consequences of the tax elimination are uncertain, creating uncertainty for businesses planning for the future.

- Adapting to potential changes in the business environment and regulatory landscape: The elimination of the income tax might lead to changes in other areas, such as regulations and business practices, requiring businesses to adapt and adjust.

- Potential challenges in attracting and retaining skilled labor: While the tax reduction might attract some workers, it's not the only factor determining location choices for skilled labor. Businesses may still face challenges in attracting and retaining skilled employees.

Keywords: Hernando business challenges, economic impact, workforce development, business adaptation, tax reform implications

Conclusion

The potential elimination of Mississippi's income tax presents both significant opportunities and challenges for Hernando. While it offers the promise of economic growth and increased disposable income for residents and businesses, careful consideration must be given to the potential drawbacks, including potential increases in other taxes and the need for effective fiscal planning to maintain essential public services. Understanding the potential impacts of a Mississippi income tax elimination is crucial for Hernando residents and businesses to prepare for the future. Stay informed about the ongoing legislative discussions and engage in the debate surrounding Mississippi income tax elimination to ensure the best possible outcome for your community. Learn more about the proposed changes and how they might affect you – stay informed on the future of Mississippi income tax elimination and how it relates to Hernando.

Featured Posts

-

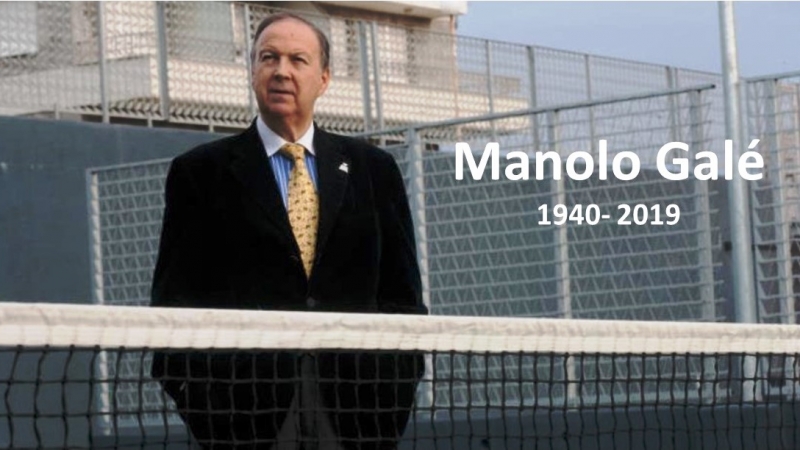

Luto En El Tenis Espanol Muere Juan Aguilera

May 19, 2025

Luto En El Tenis Espanol Muere Juan Aguilera

May 19, 2025 -

Diy Chateau Decor Simple Steps To A Luxurious Look

May 19, 2025

Diy Chateau Decor Simple Steps To A Luxurious Look

May 19, 2025 -

Kiprskiy Vopros Prodolzhaetsya Diskussiya O Vyvode Turetskikh Voysk Haqqin Az

May 19, 2025

Kiprskiy Vopros Prodolzhaetsya Diskussiya O Vyvode Turetskikh Voysk Haqqin Az

May 19, 2025 -

Ruling Over London Festivals A Dark New Era For Live Music

May 19, 2025

Ruling Over London Festivals A Dark New Era For Live Music

May 19, 2025 -

Rescate Y Transformacion En Cortes Quienes Son Sus Candidatos A Diputados

May 19, 2025

Rescate Y Transformacion En Cortes Quienes Son Sus Candidatos A Diputados

May 19, 2025