MNTN IPO: Ryan Reynolds' Company Could Go Public Next Week

Table of Contents

Understanding MNTN and its Business Model

Maximum Effort Marketing, the parent company behind the upcoming MNTN IPO, isn't your typical advertising agency. MNTN focuses on connected TV (CTV) advertising, a rapidly growing segment of the digital advertising market. This innovative approach sets them apart from traditional players.

-

Connected TV Advertising Focus: MNTN specializes in delivering highly targeted advertising campaigns on CTV platforms, reaching viewers who are increasingly cutting the cord. This strategic focus positions them perfectly for growth in a market moving away from traditional television.

-

Programmatic Advertising Capabilities: The company employs sophisticated programmatic advertising technology, using data-driven targeting to ensure ads reach the most relevant audiences. This allows for efficient ad spending and improved ROI for clients.

-

Leveraging Influencer Marketing and Celebrity Endorsements: The undeniable impact of Ryan Reynolds himself is a huge asset. MNTN leverages his influence and the power of celebrity endorsements, extending its reach and brand recognition significantly. This celebrity endorsement provides immediate brand awareness and trust, something many startups lack.

-

Competitive Advantages: MNTN boasts several competitive advantages, including its cutting-edge technology, data-driven approach, and strong celebrity backing. This combination makes them a formidable player in the increasingly competitive advertising technology landscape.

-

Successful Campaigns and Partnerships: While specific details may be limited before the IPO, the success of Aviation Gin (another Ryan Reynolds venture) demonstrates the power of their marketing strategies. This track record provides a strong foundation for investor confidence.

The Hype Surrounding the MNTN IPO

The MNTN IPO is generating significant buzz, fueled largely by Ryan Reynolds' involvement and MNTN's innovative approach to advertising. This anticipation translates into substantial potential investor interest.

-

Market Anticipation and Investor Interest: The "Ryan Reynolds effect" is a tangible factor. His known success in other ventures, combined with MNTN's unique business model, creates a high level of anticipation in the market, attracting investors seeking promising investment opportunities.

-

MNTN Valuation and Stock Price Speculation: While the precise valuation remains undisclosed, speculation is rife, with many analysts predicting strong performance based on the company’s potential and growth trajectory. The initial stock price is a key factor that will be closely watched.

-

Potential Risks and Challenges: Investing in an IPO always carries inherent risks. The success of the MNTN IPO depends on several factors, including market conditions, competition within the advertising tech sector, and the company's ability to execute its business plan.

-

Celebrity Endorsement Impact: While Ryan Reynolds' involvement enhances the brand and attracts attention, over-reliance on celebrity endorsement can be a risk. The long-term success of MNTN depends on more than just its celebrity connection. Maintaining innovation and a solid business model is critical for sustaining growth.

-

Market Conditions: The overall state of the stock market will significantly impact the IPO's success. Favorable market conditions will likely increase investor interest and lead to higher valuations.

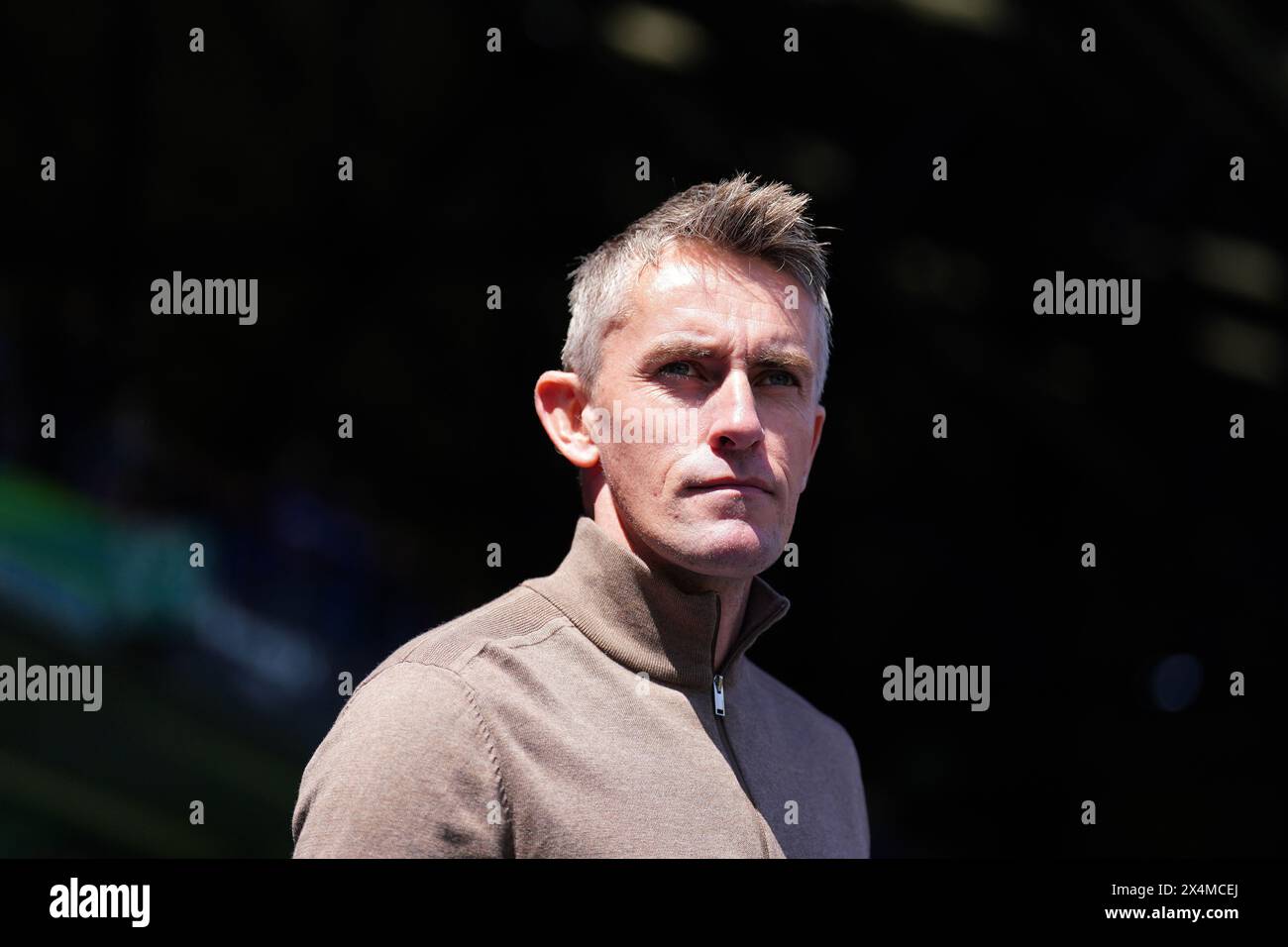

The Role of Ryan Reynolds and Celebrity Influence

Ryan Reynolds’ involvement is a defining characteristic of the MNTN IPO. His personal brand significantly influences the company's success.

-

Brand Recognition and Market Appeal: Reynolds' widespread recognition and appeal instantly boost MNTN's brand visibility and credibility, opening doors to partnerships and investors that a lesser-known brand might not attract.

-

Strengthening Marketing Strategies: His involvement is not merely a celebrity endorsement; he’s actively involved in shaping MNTN's marketing strategies, leveraging his experience and understanding of successful campaigns.

-

Risks and Rewards of Celebrity Endorsement: While celebrity endorsement can provide a significant initial boost, long-term success requires a strong underlying business model. Over-reliance on the celebrity alone can create vulnerability if the celebrity's image is tarnished or their involvement diminishes.

-

Comparison to Other Successful Ventures: The success of Aviation Gin demonstrates the power of Ryan Reynolds' involvement in building a brand. However, it's important to acknowledge that this is a separate venture, and the success of MNTN needs to be evaluated independently.

Potential Investment Opportunities and Risks

The MNTN IPO offers a compelling investment opportunity, but prospective investors must carefully assess both the potential rewards and risks.

-

Investment Opportunities and Risks: The opportunity lies in the potential for high returns given MNTN's innovative business model and market position. However, investing in an IPO is inherently risky, and losses are possible.

-

Due Diligence: Before investing, conducting thorough due diligence is crucial. This includes understanding the company's financials, its competitive landscape, and its long-term growth prospects.

-

High Returns vs. Potential Losses: The potential for significant returns exists, but investors should be prepared for the possibility of losses. A balanced perspective is necessary.

-

Factors to Consider: Evaluate MNTN's financials, management team, competitive landscape, market conditions, and your own risk tolerance. Don't solely rely on celebrity influence.

-

Resources for Further Research: Utilize reputable financial news sources, analyst reports, and consult with a financial advisor before making any investment decision.

Conclusion

The upcoming MNTN IPO presents a potentially exciting investment opportunity, leveraging Ryan Reynolds' brand power and a unique approach to connected TV advertising. While potential returns are enticing, thorough research and risk assessment are crucial before investing. The success of this IPO will depend on various factors including market conditions, execution of MNTN's business strategy, and the continued relevance of its innovative advertising platform.

Call to Action: Stay informed about the MNTN IPO and explore the potential investment opportunity further. Research the MNTN stock thoroughly and consult with a financial advisor before making any investment decisions. Don't miss out on the potential of this significant MNTN stock offering!

Featured Posts

-

Indy 500 Announcement Sparks Driver Safety Debate For 2025 Season

May 12, 2025

Indy 500 Announcement Sparks Driver Safety Debate For 2025 Season

May 12, 2025 -

Adorable Rory Mc Ilroys Daughter Shows Off Golf Skills At Augusta

May 12, 2025

Adorable Rory Mc Ilroys Daughter Shows Off Golf Skills At Augusta

May 12, 2025 -

Live Stream Grand Slam Track Kingston Everything You Need To Know

May 12, 2025

Live Stream Grand Slam Track Kingston Everything You Need To Know

May 12, 2025 -

Marvels Nova Could Henry Cavill Be The Star A Look At The Rumor Mill

May 12, 2025

Marvels Nova Could Henry Cavill Be The Star A Look At The Rumor Mill

May 12, 2025 -

The Conor Mc Gregor Fox News Interviews What To Expect

May 12, 2025

The Conor Mc Gregor Fox News Interviews What To Expect

May 12, 2025

Latest Posts

-

27 Puntos De Anunoby Impulsan Victoria De Knicks Ante Sixers

May 12, 2025

27 Puntos De Anunoby Impulsan Victoria De Knicks Ante Sixers

May 12, 2025 -

Sheehan Ipswich Towns Undeterred Manager After Setback

May 12, 2025

Sheehan Ipswich Towns Undeterred Manager After Setback

May 12, 2025 -

Anunoby Con 27 Puntos Victoria De Knicks Sobre Sixers Novena Derrota Para Philadelphia

May 12, 2025

Anunoby Con 27 Puntos Victoria De Knicks Sobre Sixers Novena Derrota Para Philadelphia

May 12, 2025 -

Knicks Derrotan A Sixers Anunoby Brilla Con 27 Puntos

May 12, 2025

Knicks Derrotan A Sixers Anunoby Brilla Con 27 Puntos

May 12, 2025 -

Nba Playoffs Odigos Gia Ta Zeygaria Kai Tis Imerominies Ton Agonon

May 12, 2025

Nba Playoffs Odigos Gia Ta Zeygaria Kai Tis Imerominies Ton Agonon

May 12, 2025