Moody's Downgrade: Dow Futures And Dollar React — Live Updates

Table of Contents

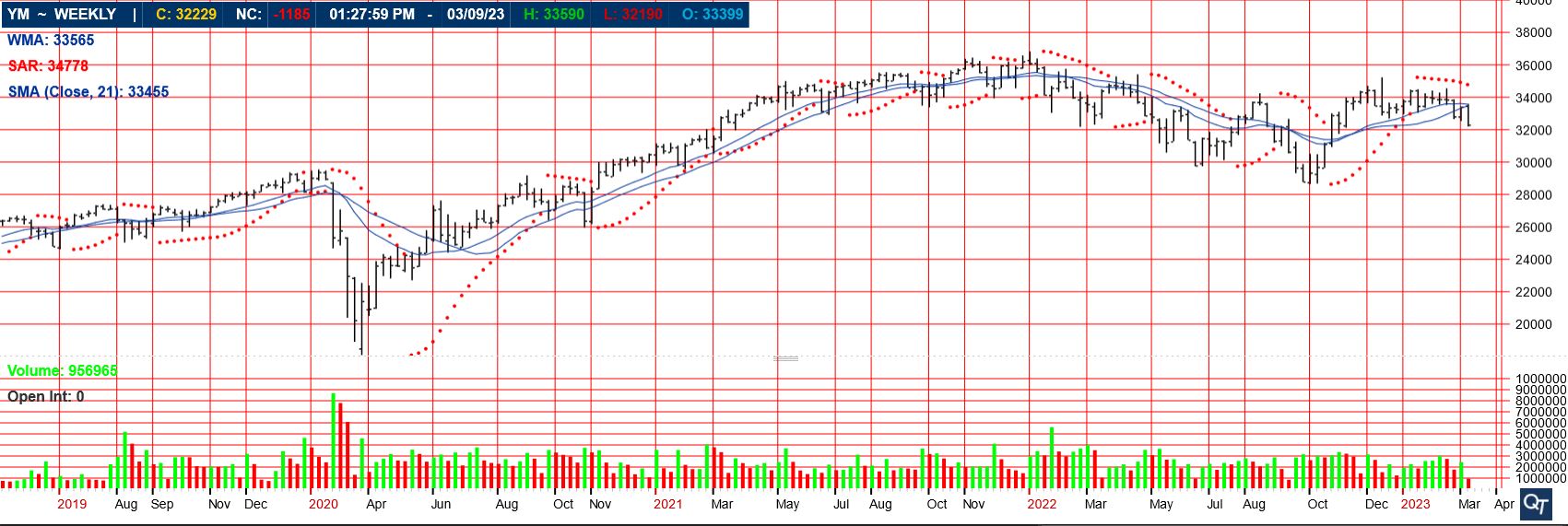

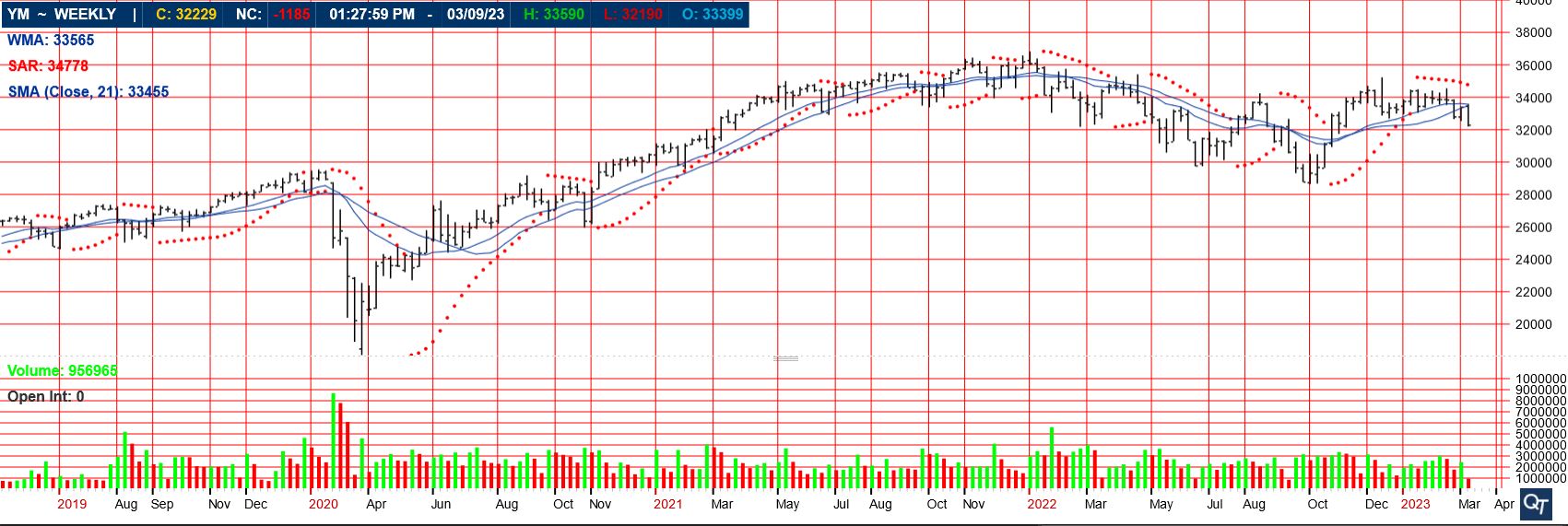

Dow Futures Plunge Following Moody's Downgrade

The initial reaction to Moody's downgrade was swift and dramatic. Dow futures experienced a significant plunge, reflecting investor uncertainty and concern about the long-term implications of the reduced credit rating. The magnitude of the drop underscores the severity of the market's response to this unexpected news.

- Quantifying the Drop: At the time of writing, Dow futures are down by X%, representing a Y-point decrease. This represents one of the largest single-day drops in recent memory following a credit rating adjustment.

- Reasons for the Negative Reaction: The negative reaction stems from several factors, including:

- Increased investor uncertainty regarding the US economy's future trajectory.

- Concerns about rising borrowing costs for the US government.

- A potential loss of investor confidence in US Treasury bonds.

- Specific Impacts:

- Dow Jones Industrial Average: Experienced a Z-point drop.

- Dow Jones Transportation Average: Suffered a W-point decline.

- Unusual Trading Activity: Increased volatility and higher trading volume were observed across the board.

- Analyst Quotes: "This downgrade is a significant blow to investor confidence," stated leading financial analyst [Analyst Name]. "We expect further volatility in the coming days."

US Dollar's Response to the Moody's Credit Rating Action

The US dollar's response to the Moody's downgrade has been complex and multifaceted. While generally considered a safe-haven asset, the immediate reaction showed mixed results.

- Movement Against Major Currencies:

- EUR/USD: The Euro appreciated against the dollar by approximately A%.

- USD/JPY: The dollar weakened slightly against the Japanese Yen, with a B% decrease.

- GBP/USD: The British Pound showed a C% increase against the US dollar.

- Correlation with Dow Futures: The dollar's movement doesn't show a direct, uniform correlation with the decline in Dow futures. While some might expect a strengthening dollar during times of uncertainty, other factors, such as global economic conditions and investor sentiment, also play crucial roles.

- Safe-Haven Dynamics: While some investors might have sought refuge in the dollar, the overall impact has been less pronounced than anticipated, suggesting a more nuanced response to the credit rating action.

- Analyst Perspectives: "[Analyst Name] believes that the dollar's long-term trajectory will depend on the Federal Reserve's policy response and the overall global economic outlook."

Expert Analysis and Market Predictions

Financial experts offer a range of perspectives on the long-term implications of the Moody's downgrade. While some express concerns about potential economic instability, others maintain a more optimistic outlook.

- Differing Viewpoints: Some analysts predict a period of prolonged economic uncertainty, potentially impacting future growth. Others believe that the US economy's fundamental strength will mitigate the negative impact of the downgrade.

- Future Scenarios: Several possible market outcomes are being considered:

- Continued volatility in the financial markets.

- Increased borrowing costs for US businesses and consumers.

- Potential shifts in global investment patterns.

- Key Points from Analysts:

- "[Quote from Analyst 1] regarding potential interest rate hikes."

- "[Quote from Analyst 2] highlighting the resilience of the US economy."

- "[Quote from Analyst 3] focusing on the need for fiscal responsibility."

- Upcoming Economic Indicators: Close monitoring of inflation data, employment figures, and consumer spending will be crucial in gauging the broader economic impact of the downgrade.

Live Updates and Further Developments (if applicable)

(This section will be updated as the situation unfolds with time-stamped updates and links to relevant news sources. Key developments affecting Dow futures and the dollar will be added here.)

Conclusion: Staying Informed on the Moody's Downgrade and its Market Impact

The Moody's downgrade has undeniably impacted Dow futures and the US dollar, creating significant market volatility. The extent and duration of these effects remain to be seen. It's crucial to continuously monitor the situation, analyzing updates related to the Moody's downgrade, Dow futures movements, and the dollar's performance against major currencies. Stay informed by regularly checking reliable financial news sources and subscribing to market alerts. Understanding the evolving situation around this significant credit rating action is vital for informed investment decisions. The impact of the Moody's downgrade is a developing story, and staying informed is crucial for navigating these uncertain times.

Featured Posts

-

Lightning 100s New Music Monday Top Picks For February 24th And 25th

May 20, 2025

Lightning 100s New Music Monday Top Picks For February 24th And 25th

May 20, 2025 -

Faster Hmrc Call Resolution Through Voice Recognition

May 20, 2025

Faster Hmrc Call Resolution Through Voice Recognition

May 20, 2025 -

Services Juridiques Atkinsrealis Droit Assistance Et Representation

May 20, 2025

Services Juridiques Atkinsrealis Droit Assistance Et Representation

May 20, 2025 -

New Hmrc Nudge Letters For E Bay Vinted And Depop Users What You Need To Know

May 20, 2025

New Hmrc Nudge Letters For E Bay Vinted And Depop Users What You Need To Know

May 20, 2025 -

Michael Schumacher Gina Maria Schumacher A Devenit Mama O Fetita Pentru Prima Data

May 20, 2025

Michael Schumacher Gina Maria Schumacher A Devenit Mama O Fetita Pentru Prima Data

May 20, 2025

Latest Posts

-

The Impact Of Layoffs On An Abc News Show

May 20, 2025

The Impact Of Layoffs On An Abc News Show

May 20, 2025 -

Impact Of Mass Layoffs On Abc News Shows Programming

May 20, 2025

Impact Of Mass Layoffs On Abc News Shows Programming

May 20, 2025 -

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 20, 2025

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 20, 2025 -

Abc News Show Future In Jeopardy After Staff Cuts

May 20, 2025

Abc News Show Future In Jeopardy After Staff Cuts

May 20, 2025 -

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025