Moody's US Downgrade: White House Condemnation And Economic Fallout

Table of Contents

Moody's Rationale Behind the Downgrade

Moody's decision to downgrade the US credit rating wasn't arbitrary. It stemmed from a confluence of factors highlighting significant fiscal challenges facing the nation.

Increased US Debt Burden

The escalating US national debt is a primary concern.

- Rising national debt levels: The national debt continues to climb, exceeding projected GDP growth, creating a long-term fiscal imbalance.

- Fiscal challenges due to political gridlock: Persistent political gridlock and a lack of bipartisan agreement on long-term spending plans have hampered efforts to address the debt.

- Erosion of governance strength: Repeated near-debt ceiling crises demonstrate a weakening of the US government's ability to manage its finances effectively. This erodes investor confidence and impacts the nation's creditworthiness.

- Increased likelihood of debt ceiling crises: The recurring threat of debt ceiling breaches underscores the fragility of the US fiscal system and increases the risk of financial instability.

Fiscal Weakness and Political Polarization

The current political climate significantly contributes to the nation's fiscal woes.

- Repeated near-misses on debt ceiling deadlines: The repeated brinkmanship surrounding debt ceiling negotiations highlights the lack of long-term fiscal planning and the potential for future disruptions.

- Deepening political divisions hindering effective fiscal policy: Intense partisan polarization makes it increasingly difficult to enact responsible fiscal policies that address the nation's long-term debt challenges.

- Concerns over future fiscal policy predictability: The unpredictable nature of US fiscal policy due to political infighting raises concerns among investors and credit rating agencies.

- Impact of short-term debt solutions on long-term stability: Relying on short-term solutions to address the debt problem only postpones the need for substantive reforms and weakens long-term stability.

Comparison to other AAA-rated nations

Moody's explicitly compared the US fiscal situation to other AAA-rated nations.

- Moody's assessment of US fiscal strength relative to other countries: The agency assessed the US's fiscal strength relative to its peers, finding significant weaknesses compared to other countries with AAA ratings.

- Analysis of government debt and fiscal policy trajectories: The analysis considered the trajectory of US government debt and the projected efficacy of fiscal policy changes.

- Explanation of the downgrade methodology and factors considered: Moody's provided a detailed explanation of its methodology, outlining the specific factors that led to the downgrade decision.

The White House Response and Criticism

The White House responded swiftly and strongly to the Moody's US Downgrade, issuing a scathing rebuke.

Official Statements and Condemnations

The administration's response focused on downplaying the significance of the downgrade.

- Direct criticisms of Moody's methodology and conclusions: The White House criticized Moody's methodology and questioned the validity of their conclusions.

- Emphasis on the strength of the US economy: Administration officials highlighted positive economic indicators, such as job growth and low unemployment, to counter the negative assessment.

- Reiteration of commitment to responsible fiscal policy (though specifics lacking): The White House reiterated its commitment to responsible fiscal policy but provided few specifics on how it plans to address the underlying issues.

- Potential political maneuvering and blame-shifting: Some critics viewed the White House response as a political maneuver aimed at deflecting blame and shifting attention away from the administration's fiscal policies.

Economic Counterarguments

The White House employed several economic counterarguments to challenge Moody's assessment.

- Highlighting economic growth indicators: The administration emphasized positive economic growth figures to portray a more optimistic picture than Moody's assessment.

- Focusing on job creation and unemployment rates: The focus on job creation and low unemployment aimed to counter the negative impact of the downgrade on investor and public sentiment.

- Pointing to strong business investment and consumer spending: The administration cited strong business investment and consumer spending as evidence of economic resilience.

- Debating the accuracy of Moody's projections: The White House challenged the accuracy of Moody's projections regarding the long-term fiscal outlook.

Potential Economic Fallout of the Moody's US Downgrade

The Moody's US Downgrade carries significant potential economic ramifications both domestically and internationally.

Impact on Interest Rates

The downgrade is likely to impact interest rates across the board.

- Increased borrowing costs for the US government: The downgrade will likely increase borrowing costs for the US government, making it more expensive to finance the national debt.

- Potential ripple effect on mortgage rates and corporate lending: Higher government borrowing costs could lead to higher interest rates on mortgages and corporate loans, potentially slowing economic activity.

- Influence on inflation and economic growth: Changes in interest rates can impact inflation and economic growth, potentially leading to slower growth or even recession.

- Uncertainty and volatility in the bond market: The downgrade has introduced greater uncertainty and volatility into the bond market, potentially affecting investor confidence and capital flows.

Global Market Reactions and Implications

The implications extend beyond US borders, impacting global markets.

- Impact on the US dollar: The downgrade could weaken the US dollar, affecting international trade and investment flows.

- Effects on global stock markets and investor confidence: The downgrade could negatively affect global stock markets and investor confidence, potentially leading to decreased investment.

- Increased risk aversion and potential capital flight: Increased risk aversion might lead investors to move their capital away from the US, further impacting the economy.

- Influence on international trade and investment: The downgrade could affect international trade and investment patterns, potentially harming the US's competitiveness in the global marketplace.

Long-Term Economic Consequences

The long-term consequences of the Moody's US Downgrade remain uncertain but could be significant.

- Potential for slower economic growth: Increased borrowing costs and decreased investor confidence could lead to slower economic growth.

- Increased risk of recession: The combination of factors could increase the risk of a recession in the US and potentially globally.

- Impact on social programs and government spending: Higher borrowing costs could force cutbacks in government spending on social programs and other initiatives.

- Long-term implications for national debt management: The downgrade highlights the urgent need for long-term solutions to manage the national debt and restore fiscal stability.

Conclusion

The Moody's US Downgrade is a serious development with potentially far-reaching consequences. While the White House has attempted to downplay its significance, the underlying fiscal challenges and political polarization remain significant hurdles. The potential for higher interest rates, market volatility, and slower economic growth necessitates careful monitoring and proactive measures. Understanding the intricacies of the Moody's US Downgrade and its ramifications is crucial for businesses, investors, and policymakers alike. Stay informed and continue to monitor developments related to the Moody's US Downgrade to make informed decisions and navigate the economic uncertainty ahead.

Featured Posts

-

Sydney Crown Property Acquired By Air Trunk Billionaire Second Luxurious Investment

May 18, 2025

Sydney Crown Property Acquired By Air Trunk Billionaire Second Luxurious Investment

May 18, 2025 -

Angels Vs Dodgers Trout And Moniak Homer But Angels Fall Short

May 18, 2025

Angels Vs Dodgers Trout And Moniak Homer But Angels Fall Short

May 18, 2025 -

Kanye West Accuses Kim Kardashian Of Sex Trafficking A Detailed Analysis

May 18, 2025

Kanye West Accuses Kim Kardashian Of Sex Trafficking A Detailed Analysis

May 18, 2025 -

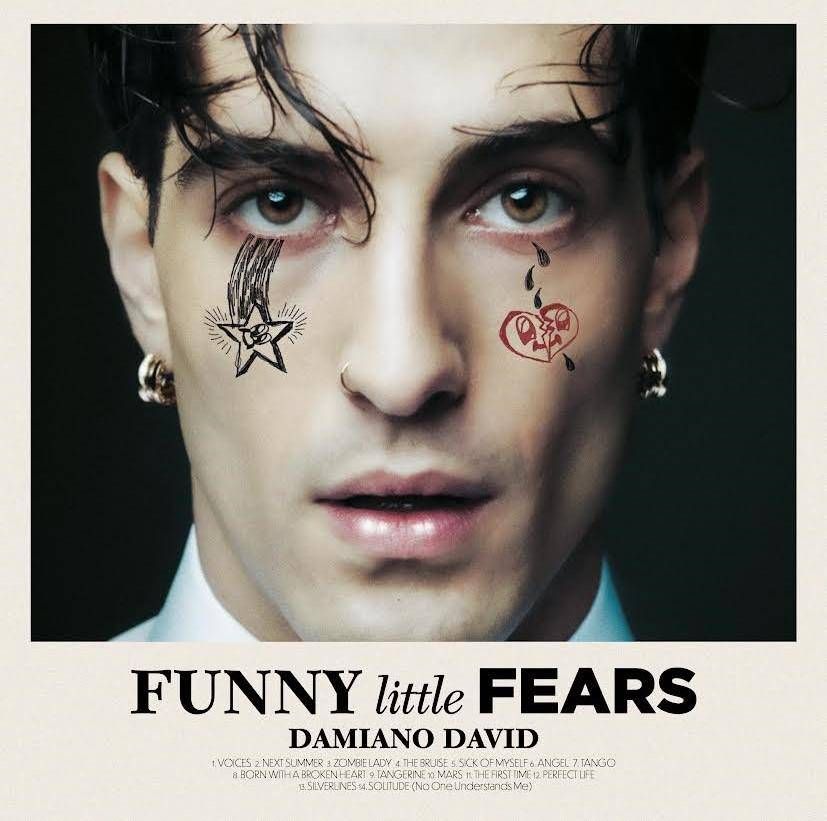

Maneskins Damiano David Annuncia Il Suo Album Da Solista Funny Little Fears

May 18, 2025

Maneskins Damiano David Annuncia Il Suo Album Da Solista Funny Little Fears

May 18, 2025 -

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025

Latest Posts

-

Bbc Three Hd Programming Easy A Air Dates And Times

May 18, 2025

Bbc Three Hd Programming Easy A Air Dates And Times

May 18, 2025 -

Your Guide To Easy A On Bbc Three Hd

May 18, 2025

Your Guide To Easy A On Bbc Three Hd

May 18, 2025 -

Easy As Bbc Three Hd Broadcast Schedule Dont Miss It

May 18, 2025

Easy As Bbc Three Hd Broadcast Schedule Dont Miss It

May 18, 2025 -

Bbc Three Hd Tv Guide When To Watch Easy A

May 18, 2025

Bbc Three Hd Tv Guide When To Watch Easy A

May 18, 2025 -

Easy A On Bbc Three Hd Tv Guide And Schedule

May 18, 2025

Easy A On Bbc Three Hd Tv Guide And Schedule

May 18, 2025