Musk's X Debt Sale: New Financials Reveal A Transforming Company

Table of Contents

The Details of the Debt Sale

The specifics of X's debt sale are still emerging, but initial reports suggest a substantial amount raised to bolster the company's financial position. Understanding the intricacies of this financing is crucial to grasping its impact on X's future.

- Total debt raised: While the exact figure remains unconfirmed, reports suggest billions of dollars were raised through a combination of high-yield bonds and potentially other financing instruments. The scale of this debt issuance is unprecedented for a platform of X's size and reflects the significant financial commitment required to execute Musk’s ambitious vision.

- Interest rates and repayment terms: The interest rates associated with this debt are likely to be substantial, given the inherent risk involved in lending to a company undergoing such significant restructuring. Repayment terms will play a critical role in X's long-term financial health; the details surrounding these terms are highly anticipated by financial analysts.

- Key lenders and their investment strategies: A diverse range of lenders, including both traditional financial institutions and potentially private equity firms, are expected to be involved. Their investment strategies will significantly influence the terms of the loan and the overall risk profile for X. Identifying the key players and understanding their motives is key to deciphering the implications of this debt sale.

- Impact on X's overall debt load: The debt sale dramatically increases X's overall debt load. This necessitates a meticulous strategy for debt servicing and efficient management of financial resources to prevent potential future financial distress. The balance between leveraging debt for growth and managing risk will define X’s success in this new financial environment. This is crucial to evaluating X’s financial restructuring. Keywords: X debt financing, Elon Musk financing, X financial restructuring

Impact on X's Financial Health

The debt sale will undoubtedly have both short-term and long-term implications for X's financial stability. While it provides immediate financial relief, it also introduces significant challenges.

- Improved cash flow and liquidity: The influx of capital will undoubtedly improve X's short-term cash flow and liquidity, providing the much-needed resources to fund immediate operational expenses and planned investments. This is a crucial step in stabilizing the company’s finances and laying the groundwork for future growth.

- Increased debt servicing costs: The higher debt levels will necessitate significant interest payments, potentially impacting X's profitability and free cash flow in the long run. Efficient management of these costs is essential to ensure financial sustainability.

- Potential impact on credit rating: The increased debt load could negatively affect X's credit rating, making it more expensive to secure future financing. Maintaining a healthy credit rating is critical for X’s long-term financial well-being and access to capital.

- Opportunities for future investments and acquisitions: The funds raised could also be utilized for strategic investments and acquisitions, aligning with Musk's ambitious vision for X's future. This could range from enhancing existing features to acquiring complementary technologies or companies. Keywords: X financial performance, Twitter debt, X financial stability, Musk's X financial strategy

Musk's Vision and X's Transformation

The debt sale is intrinsically linked to Musk's overarching vision for X, moving beyond its microblogging roots to become a comprehensive "everything app."

- Musk's plans for X's future: Musk's vision for X encompasses various features, including enhanced payment systems, expanded e-commerce capabilities, and potentially even integration with other services under his umbrella of companies. This makes X’s transformation even more complex and impactful.

- How the funding will support those plans: The capital raised through the debt sale is crucial for executing these ambitious plans. Funds will likely be directed towards technological improvements, infrastructure upgrades, new feature development, and marketing initiatives to grow X's user base and engagement.

- The role of debt in fueling X's growth and innovation: Musk's strategy suggests a high-risk, high-reward approach, using debt to accelerate X's transformation and growth. This approach requires careful execution and effective management of the associated financial risks.

- Potential risks and challenges associated with Musk's ambitious vision: The ambitious scope of Musk's vision presents significant risks, including potential delays in development, integration challenges, and the possibility of exceeding budget allocations. Effectively managing these risks is critical to X’s success. Keywords: X everything app, Musk's X vision, X future plans, Twitter transformation

Market Reaction and Investor Sentiment

The market's reaction to the debt sale has been mixed, reflecting the inherent uncertainty surrounding X's future trajectory.

- Stock price fluctuations (if applicable): Depending on the structure of X's ownership, its stock price may have fluctuated in response to the news. This reflects the market's assessment of the risks and potential rewards associated with the debt sale.

- Analyst ratings and predictions: Financial analysts will be closely monitoring X's performance and issuing updated ratings and predictions, reflecting their assessment of the company’s financial health and growth prospects.

- Investor confidence levels: Investor confidence in X will likely depend on the transparency of its financial reporting and the demonstrable progress made towards Musk's stated goals. Clear communication is essential to fostering investor confidence and attracting future investment.

- Comparison to other tech companies' financial strategies: X’s financial strategy can be compared to those of other tech giants, highlighting both similarities and differences. Understanding these dynamics adds another layer of analysis to X's strategy. Keywords: X stock price, investor confidence in X, market reaction to X debt sale

Conclusion

Musk's X debt sale marks a significant turning point for the platform, injecting substantial capital while simultaneously increasing its financial risk. The success of this strategy hinges on Musk's ability to execute his ambitious vision and navigate the complexities of substantial debt servicing. The long-term impact will depend on X's ability to generate revenue, control costs, and deliver on its promises. This Musk's X debt sale represents a bold gamble with potentially transformative consequences for the platform.

Stay informed about the ongoing developments surrounding Musk's X debt sale and its implications for the future of the platform. Follow [Your Website/Source] for further updates and in-depth analysis on Musk's X financials, X debt, and the evolving financial landscape of X.

Featured Posts

-

Monstrous Beauty A Feminist Reimagining Of Chinoiserie At The Met

Apr 28, 2025

Monstrous Beauty A Feminist Reimagining Of Chinoiserie At The Met

Apr 28, 2025 -

10 Gb Uae Tourist Sim Abu Dhabi Pass 15 Attraction Discount

Apr 28, 2025

10 Gb Uae Tourist Sim Abu Dhabi Pass 15 Attraction Discount

Apr 28, 2025 -

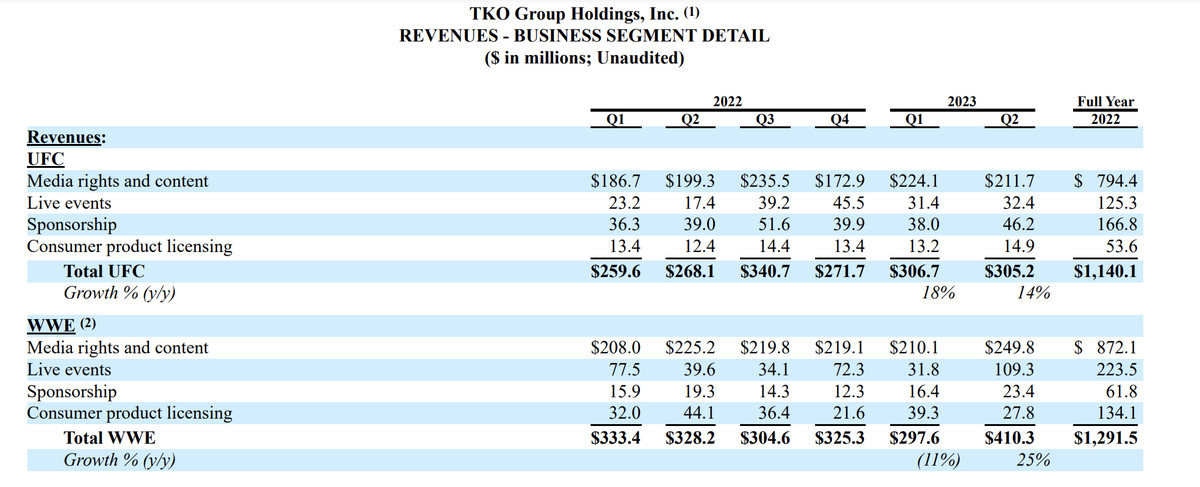

Canadian Trade Mission Fuels Southeast Asias Energy Growth

Apr 28, 2025

Canadian Trade Mission Fuels Southeast Asias Energy Growth

Apr 28, 2025 -

Slight Lineup Change For Red Sox Doubleheader Game 1

Apr 28, 2025

Slight Lineup Change For Red Sox Doubleheader Game 1

Apr 28, 2025 -

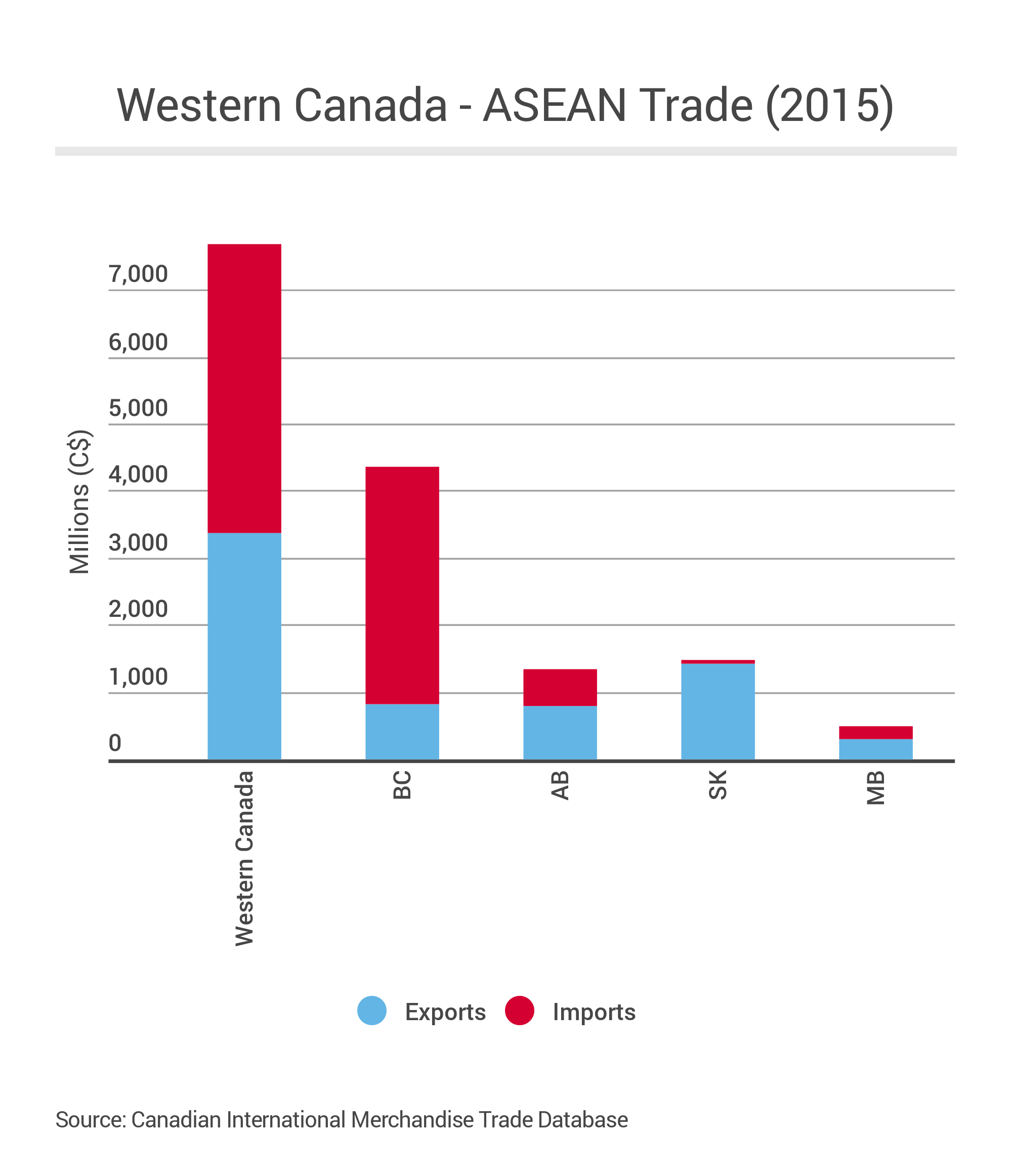

High Gpu Prices Factors Contributing To The Surge

Apr 28, 2025

High Gpu Prices Factors Contributing To The Surge

Apr 28, 2025