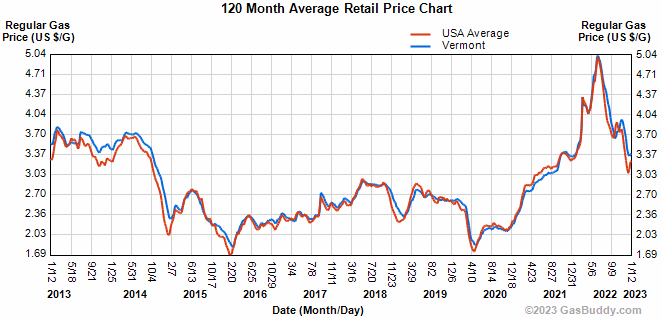

National Average Gas Price Under $3 Amidst Economic Slowdown

Table of Contents

Factors Contributing to the Drop in Gas Prices

Several interconnected factors have contributed to the remarkable fall in gas prices to below the $3 mark. These include reduced demand, increased oil supply, and a weakening global economy.

Reduced Demand

Economic uncertainty and persistent inflation have significantly impacted consumer spending, leading to a decrease in demand for gasoline. People are driving less due to concerns about their financial situations.

- Reduced discretionary driving: Fewer leisure trips and vacations are contributing to lower fuel consumption.

- Work-from-home trends: The continued prevalence of remote work reduces the daily commute for many, further impacting gasoline demand.

- Increased public transportation usage: As costs rise across the board, some consumers are opting for more affordable transportation options.

Recent data from the Consumer Confidence Index reflects a decline in consumer sentiment, directly correlating with reduced spending on non-essential items, including gasoline. For example, a recent survey indicated a 15% decrease in weekend driving among middle-income households.

Increased Oil Supply

The increased global supply of oil has played a crucial role in pushing gas prices down. This is a result of several factors:

- OPEC+ decisions: The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have influenced production levels, impacting global oil availability.

- US shale oil production: Increased domestic oil production in the United States has added to the global supply.

- Geopolitical factors: Changes in geopolitical stability and international relations can influence oil production and distribution, affecting prices.

Charts showcasing oil production levels from major producing countries and a comparison with previous years clearly demonstrate the recent surge in supply. This increased supply, even in the face of ongoing global conflict, has put downward pressure on oil prices, leading to cheaper gas at the pump.

Weakening Global Economy

Global recessionary fears are impacting demand for oil, adding to the price decline. Slowing economic growth in major economies worldwide has reduced the overall demand for energy, including gasoline.

- Slowing economic growth in major economies: Reports from the International Monetary Fund (IMF) and other organizations indicate a slowdown in global economic activity.

- Impact of international conflicts: Ongoing geopolitical tensions and conflicts continue to create uncertainty in the global energy market.

Economic forecasts consistently predict subdued growth in the coming quarters, suggesting that the current low gas prices are, at least partly, a reflection of this weakening global economic situation.

Impact of Low Gas Prices on the Economy

The decreased national average gas price, while seemingly beneficial, has a complex and multifaceted impact on the economy.

Consumer Spending Power

Lower gas prices translate to increased disposable income for many consumers. This could potentially stimulate spending in other sectors:

- Increased disposable income: Consumers can allocate more funds towards other goods and services, potentially boosting retail sales.

- Potential boost to retail sales: Increased consumer confidence and spending power could lead to a surge in sales across various retail sectors.

- Impact on tourism: Lower travel costs could encourage more people to engage in tourism and leisure activities.

Data analyzing consumer spending patterns following previous periods of low gas prices shows a clear correlation between decreased fuel costs and increased spending in other areas. However, this effect could be limited by the ongoing high inflation in other areas.

Inflationary Pressures

While lower gas prices can alleviate inflationary pressures, it’s important to remember that it's only one component of the overall inflation picture. Other costs may still be rising:

- Other costs may still be rising: The decrease in gas prices might be offset by increases in food prices, housing costs, or other essential goods.

- Impact on the Consumer Price Index (CPI): The impact of lower gas prices on the overall Consumer Price Index (CPI) is likely to be moderated by increases in other price categories.

Analyzing the CPI components reveals that while energy prices have decreased, other key components, such as food and housing, continue to exhibit significant inflationary pressure.

Impact on Businesses

Reduced fuel costs directly benefit businesses, particularly those in transportation and logistics:

- Impact on supply chains: Lower fuel costs can reduce transportation expenses, potentially improving supply chain efficiency.

- Potential for price reductions in goods and services: Businesses may be able to pass on some of the savings to consumers through lower prices.

- Impact on profitability: Lower fuel costs can improve the profitability of businesses reliant on transportation.

Predicting Future Gas Prices and Economic Outlook

Predicting future gas prices and the overall economic outlook is fraught with uncertainty.

Uncertainty in Global Markets

Several factors could influence future gas prices:

- Geopolitical events: Unforeseen geopolitical events could significantly impact oil production and global supply.

- OPEC decisions: Future decisions by OPEC+ regarding oil production will play a crucial role in shaping prices.

- Unexpected disruptions: Natural disasters or other unforeseen circumstances could disrupt oil production and distribution.

Economic Forecasts and Projections

Economic forecasts provide some insight into the future, although they're not without limitations:

- Predictions for economic growth: Various economic institutions offer forecasts for future economic growth, providing a context for gas price predictions.

- Outlook for inflation: Predictions regarding inflation are crucial in determining the overall economic climate and its influence on energy demand.

Conclusion: Navigating the National Average Gas Price Under $3

The current national average gas price under $3 is a result of a complex interplay of factors, including reduced demand, increased oil supply, and a weakening global economy. While lower gas prices offer some relief to consumers, their impact on the overall economy is complex and nuanced. The potential benefits in terms of increased consumer spending power must be weighed against the persistent inflationary pressures in other sectors. The uncertainty in global markets and the varying economic forecasts make predicting future gas prices challenging. Stay informed about fluctuations in the national average gas price and the broader economic landscape to make informed decisions. Resources such as the Energy Information Administration (EIA) and the Bureau of Economic Analysis (BEA) offer valuable data and insights to help you track these key indicators.

Featured Posts

-

Gas Buddy Update Average Virginia Gasoline Prices Fall

May 22, 2025

Gas Buddy Update Average Virginia Gasoline Prices Fall

May 22, 2025 -

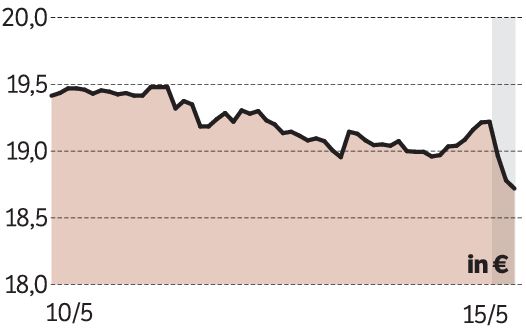

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 22, 2025

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 22, 2025 -

Problemen Met Online Betalingen Bij Abn Amro Storing

May 22, 2025

Problemen Met Online Betalingen Bij Abn Amro Storing

May 22, 2025 -

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 22, 2025

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 22, 2025 -

I Hope You Rot In Hell A Pub Landlords Explosive Reaction To A Resignation

May 22, 2025

I Hope You Rot In Hell A Pub Landlords Explosive Reaction To A Resignation

May 22, 2025

Latest Posts

-

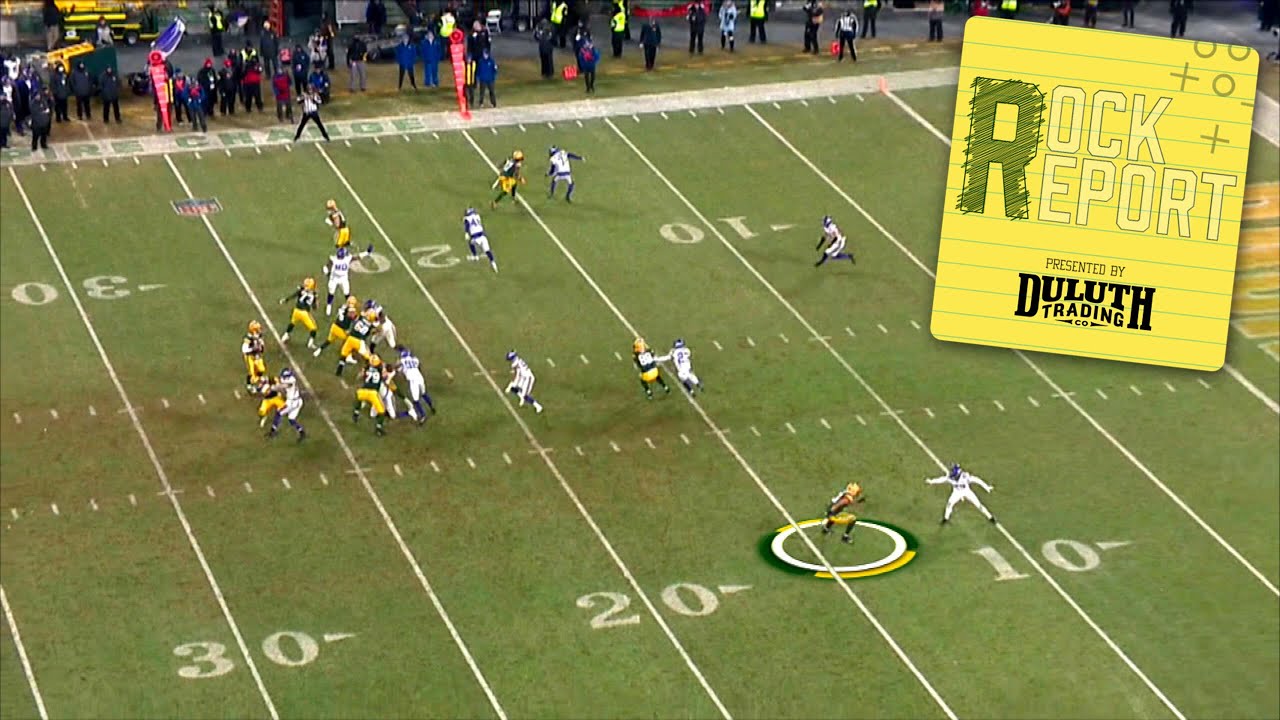

Listen Again Big Rig Rock Report 3 12 99 5 The Fox

May 23, 2025

Listen Again Big Rig Rock Report 3 12 99 5 The Fox

May 23, 2025 -

Is A My Cousin Vinny Reboot Happening Ralph Macchio Weighs In On Joe Pescis Potential Return

May 23, 2025

Is A My Cousin Vinny Reboot Happening Ralph Macchio Weighs In On Joe Pescis Potential Return

May 23, 2025 -

Big Rig Rock Report 3 12 Full Report From 99 5 The Fox

May 23, 2025

Big Rig Rock Report 3 12 Full Report From 99 5 The Fox

May 23, 2025 -

Ralph Macchio On My Cousin Vinny Reboot Latest News And Joe Pesci Update

May 23, 2025

Ralph Macchio On My Cousin Vinny Reboot Latest News And Joe Pesci Update

May 23, 2025 -

5 The Fox Big Rig Rock Report 3 12 Recap

May 23, 2025

5 The Fox Big Rig Rock Report 3 12 Recap

May 23, 2025