Navan To Go Public: Investment Banks Hired For US IPO

Table of Contents

The Navan IPO: A Strategic Move for Growth

Navan's decision to pursue a US IPO is a calculated strategy driven by several key factors. The company has consistently demonstrated robust financial performance, experiencing impressive revenue growth and expanding its market share significantly. Its substantial customer base, comprised of both large enterprises and smaller businesses, underscores its strong market position. The IPO will provide Navan with several significant advantages:

-

Fueling Future Innovation: The influx of capital from the IPO will provide resources for research and development, enabling Navan to enhance its existing platform and develop new, innovative features. This could include advanced AI-powered tools for cost optimization, enhanced sustainability features, and further integration with existing corporate workflows.

-

Boosting Brand Visibility and Credibility: A successful IPO will significantly elevate Navan's brand visibility and solidify its position as a market leader. This increased credibility will attract more clients, partners, and top-tier talent.

-

Attracting Top Talent: The prestige associated with a publicly traded company often attracts and retains highly skilled professionals. This enhances the company's competitive edge.

-

Strategic Acquisition Opportunities: Access to capital opens doors to strategic acquisitions, allowing Navan to expand its capabilities and market reach through the integration of complementary businesses.

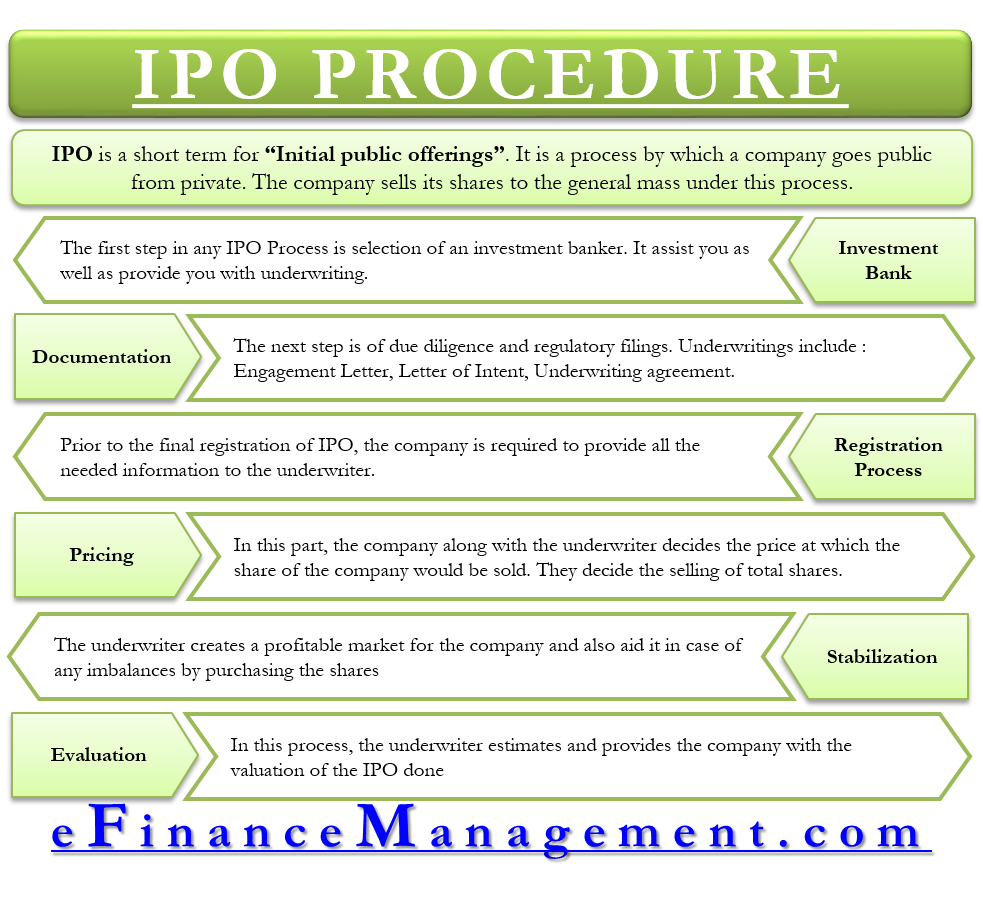

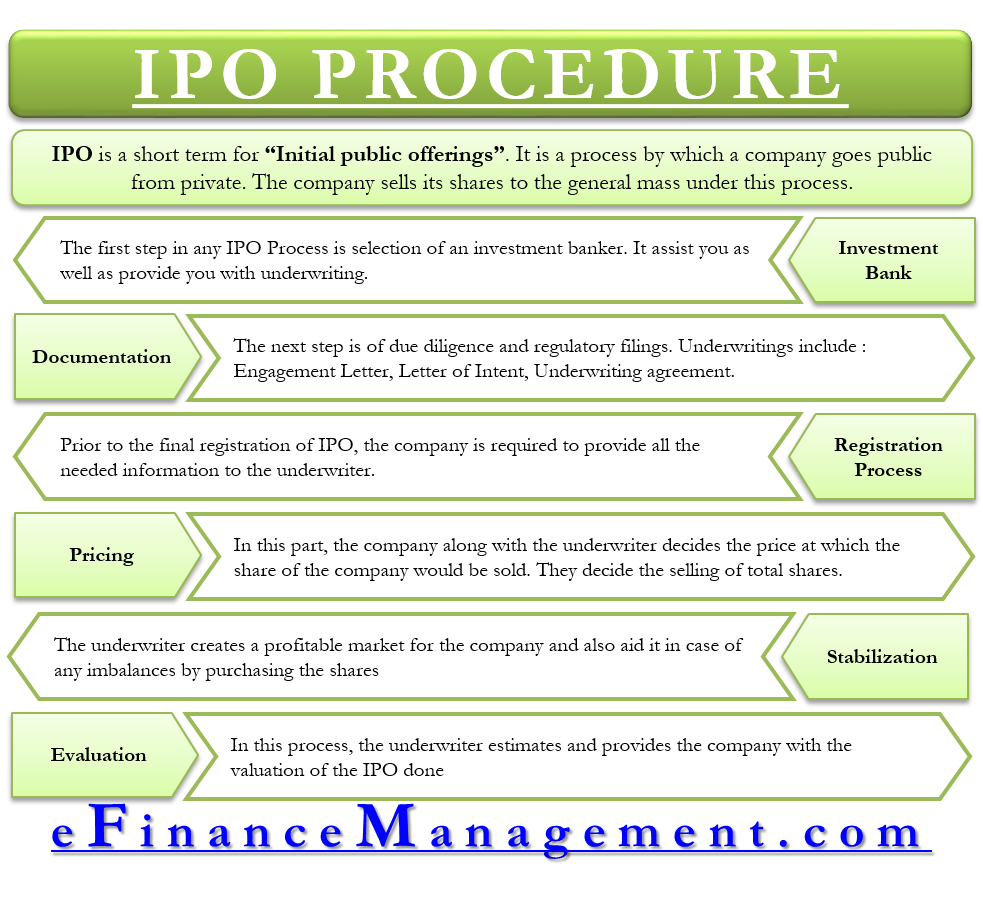

Investment Banks Leading the Navan IPO

Securing the right investment banks is crucial for a successful IPO. Navan's choice of underwriters (while not publicly confirmed at this time, we can expect major players) will reflect the company’s ambition and strategic vision. These firms, typically giants like Goldman Sachs, Morgan Stanley, JPMorgan Chase, or similar, will play key roles:

-

Underwriting: This involves the banks assessing the risk and pricing of the IPO, purchasing the shares from Navan, and then reselling them to investors.

-

Marketing and Distribution: The banks will be responsible for marketing the IPO to potential investors, highlighting Navan's strengths and growth potential. They will manage the distribution of the shares to institutional and retail investors.

The selection of these investment banks speaks volumes about Navan's confidence in the IPO's success and its strategic long-term goals. The banks' expertise in navigating the complexities of the public markets will be instrumental in achieving a favorable valuation and attracting a strong investor base.

Market Expectations and Potential Valuation for the Navan IPO

Market analysts are eagerly awaiting the Navan IPO, with various predictions circulating regarding its potential valuation. The final valuation will depend on various factors, including market conditions, competitor valuations, and Navan's financial performance leading up to the IPO. Analyzing comparable companies, such as other publicly traded travel management firms, will provide a benchmark for assessing Navan's potential valuation. However, considering Navan's innovative technology and strong growth trajectory, a substantial valuation is widely anticipated.

-

Expected IPO Valuation Range: While precise figures remain speculative, the market anticipates a significant valuation, reflecting Navan's strong market position and future growth potential.

-

Key Factors Influencing Valuation: Factors such as revenue growth, profitability, market share, and competitive landscape will be pivotal in determining Navan's final IPO valuation.

-

Comparison with Similar Companies: Benchmarking against similar companies' IPOs will offer valuable insight into a potential valuation range.

-

Potential Risks and Challenges: The success of the Navan IPO is not without potential challenges. Market volatility, economic conditions, and competitive pressures will all play a role.

The Future of Navan Post-IPO

Following the IPO, Navan is expected to continue its aggressive growth strategy. The influx of capital will enable further product development, expansion into new markets, and potentially strategic acquisitions. This phase promises significant innovation and expansion for the company.

-

Projected Revenue Growth Post-IPO: Analysts predict strong revenue growth in the coming years, fueled by increased market penetration and new product offerings.

-

Plans for Product Development and Innovation: Navan is likely to prioritize further investments in AI-driven features and integrations, enhancing its platform's capabilities.

-

Expansion into New Markets: Geographical expansion into new regions and potentially new market segments is a likely strategy for sustained growth.

-

Potential for Strategic Partnerships: Strategic partnerships and collaborations could accelerate market penetration and broaden Navan's reach.

The Navan IPO: A Milestone in Travel Management

The Navan IPO represents a landmark achievement for the company and a significant development for the travel and expense management industry. Navan’s strategic decision to go public, the involvement of leading investment banks, and the high market anticipation underscore the company's potential for sustained growth and innovation. The successful completion of the Navan IPO will not only solidify Navan's position as a market leader but also reshape the future landscape of corporate travel. Follow the Navan IPO closely, and stay tuned for updates on the Navan IPO to learn more about this exciting development and invest in the future of travel with Navan.

Featured Posts

-

Celta Vs Sevilla Fecha 35 De La Liga Sigue El Partido En Vivo

May 14, 2025

Celta Vs Sevilla Fecha 35 De La Liga Sigue El Partido En Vivo

May 14, 2025 -

Huijsen Transfer News Chelsea Aim For June 14th Completion

May 14, 2025

Huijsen Transfer News Chelsea Aim For June 14th Completion

May 14, 2025 -

Captain America Brave New World Digital Release And Disney Arrival

May 14, 2025

Captain America Brave New World Digital Release And Disney Arrival

May 14, 2025 -

Tommy Fury Spills The Beans Fan Interest In Molly Mae Hague Soars

May 14, 2025

Tommy Fury Spills The Beans Fan Interest In Molly Mae Hague Soars

May 14, 2025 -

La Liga Espanola Fecha 35 Celta Vs Sevilla Sigue El Partido En Tn

May 14, 2025

La Liga Espanola Fecha 35 Celta Vs Sevilla Sigue El Partido En Tn

May 14, 2025