Navigate The Private Credit Boom: 5 Do's & 5 Don'ts For Job Seekers

Table of Contents

5 Do's for Securing Private Credit Jobs

Do 1: Network Strategically

Building a strong network is paramount in the competitive world of private credit jobs. Don't underestimate the power of personal connections.

- Leverage LinkedIn: Optimize your LinkedIn profile to highlight your private credit skills and experience. Actively engage with posts, join relevant groups, and connect with professionals in the field. Use keywords like "private credit analyst," "private credit associate," or "private credit portfolio manager" in your profile.

- Attend Industry Events: Conferences, workshops, and networking events provide invaluable opportunities to meet potential employers and learn about current market trends. Look for events focused on private equity, distressed debt, or direct lending.

- Informational Interviews: Reach out to professionals working in private credit for informational interviews. This is a great way to learn about their experiences, gain insights into the industry, and potentially uncover hidden job opportunities.

- Target Specific Firms: Research private credit firms that align with your career goals and tailor your networking efforts to those specific organizations.

Do 2: Highlight Relevant Skills

Your resume and cover letter are your first impression. Make sure they showcase the skills most sought after in private credit.

- Financial Modeling Expertise: Highlight proficiency in financial modeling software like Excel, Bloomberg Terminal, and Argus. Quantify your accomplishments – for example, "Improved financial model accuracy by 15%, leading to a more informed investment decision."

- Credit Analysis Prowess: Demonstrate your understanding of credit analysis techniques, including financial statement analysis, credit risk assessment, and covenant compliance.

- Due Diligence Experience: Showcase your experience in conducting due diligence on potential investments, including financial, legal, and operational aspects.

- Relevant Industry Experience: If you have experience in leveraged buyouts, distressed debt investing, or direct lending, be sure to emphasize it prominently.

Do 3: Understand the Private Credit Landscape

A deep understanding of the private credit market is crucial.

- Types of Private Credit Firms: Familiarize yourself with the various types of firms, including fund managers, direct lenders, special servicers, and credit funds. Each has a unique structure and focus.

- Market Trends and Regulations: Stay informed about current market trends, regulatory changes, and challenges facing the private credit sector through industry publications and news sources.

- Industry Publications: Read publications like Private Debt Investor, PEI Media, and other specialized journals to stay updated on industry news and best practices. This shows your dedication and commitment to the field.

Do 4: Prepare for Behavioral Interviews

Behavioral interviews are common in private credit recruiting.

- STAR Method: Practice using the STAR method (Situation, Task, Action, Result) to answer behavioral interview questions. This helps you provide concise and impactful answers.

- Common Questions: Prepare for questions about teamwork, problem-solving, handling pressure, and dealing with challenging situations. Expect questions regarding your experience with financial modeling and credit analysis.

- Company Research: Research the firm's culture, values, and recent investments to demonstrate your genuine interest and understanding.

Do 5: Follow Up Effectively

Following up is crucial for making a lasting impression.

- Thank You Notes: Send personalized thank-you notes after each interview, reiterating your interest and highlighting key discussion points.

- Proactive Follow Up: If you haven't heard back within a reasonable timeframe, follow up politely and professionally.

- Maintain Contact: Stay connected with recruiters and contacts you've met through networking.

5 Don'ts for Seeking Private Credit Jobs

Don't 1: Neglect Your Online Presence

Your online presence matters.

- LinkedIn Profile: Ensure your LinkedIn profile is complete, accurate, and reflects your skills and experience in private credit. Use relevant keywords.

- Social Media: Be mindful of your social media activity. Avoid posting anything unprofessional or controversial.

- Professional Website: Consider creating a professional website or online portfolio to showcase your work and experience.

Don't 2: Submit Generic Applications

Each application should be tailored to the specific job and firm.

- Targeted Resumes and Cover Letters: Customize your resume and cover letter for each application, highlighting the skills and experience most relevant to the specific role and company.

- Company-Specific Research: Thoroughly research the firm and demonstrate a genuine understanding of their investment strategy and culture.

- Avoid Generic Templates: Don't rely on generic templates. Your application should be unique and personalized.

Don't 3: Underestimate the Importance of Networking

Networking is vital in the private credit industry.

- Job Boards: Don't rely solely on online job boards.

- Industry Events: Actively participate in industry events and conferences to expand your network.

- Informational Interviews: Use informational interviews to learn about different firms and build relationships.

Don't 4: Lack Enthusiasm

Show genuine interest and passion.

- Genuine Interest: Demonstrate your genuine interest in the private credit industry and the specific role.

- Insightful Questions: Prepare insightful questions to ask during interviews.

- Passion and Dedication: Let your passion for the industry shine through.

Don't 5: Fail to Follow Up

Persistent, professional follow-up is essential.

- Thank You Notes: Always send thank-you notes after interviews.

- Follow Up Emails: Follow up with recruiters and hiring managers after a reasonable time.

- Professional Communication: Maintain a professional and persistent communication style.

Conclusion

The private credit job market presents significant opportunities for ambitious professionals. By following these five "Do's" and avoiding the five "Don'ts," you can significantly improve your chances of securing a rewarding career in this dynamic field. Remember to strategically network, highlight your relevant skills, thoroughly research the industry, prepare for behavioral interviews, and follow up effectively. Don't neglect your online presence, submit generic applications, underestimate networking, lack enthusiasm, or fail to follow up. Start applying these strategies today to successfully navigate the private credit boom and land your ideal private credit job.

Featured Posts

-

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025 -

Canada Vs Us Tourism A Shifting Landscape

Apr 27, 2025

Canada Vs Us Tourism A Shifting Landscape

Apr 27, 2025 -

New Whitecaps Stadium Possible Negotiations Underway At Pne Fairgrounds

Apr 27, 2025

New Whitecaps Stadium Possible Negotiations Underway At Pne Fairgrounds

Apr 27, 2025 -

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 27, 2025

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 27, 2025 -

El Regreso Triunfal De Bencic Campeona A Nueve Meses De Ser Madre

Apr 27, 2025

El Regreso Triunfal De Bencic Campeona A Nueve Meses De Ser Madre

Apr 27, 2025

Latest Posts

-

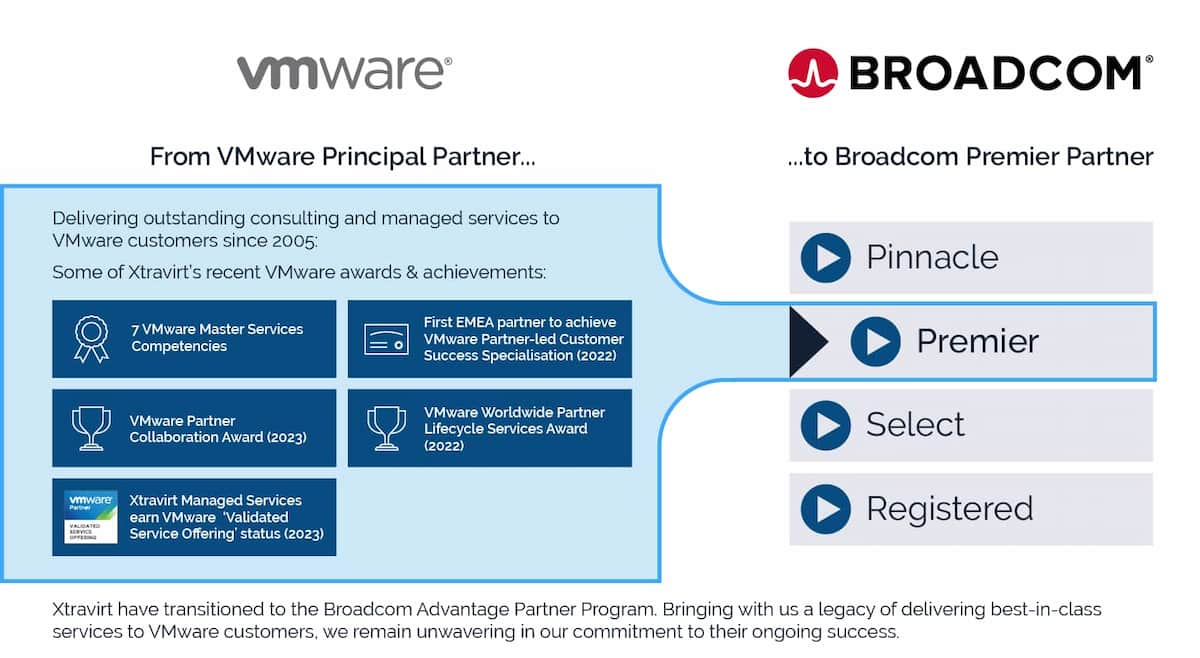

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025