Navigate The Private Credit Boom: 5 Do's & Don'ts To Land Your Dream Job

Table of Contents

The private credit market is booming, creating a wealth of exciting career opportunities for skilled professionals. But how do you navigate this competitive landscape and land your dream job in private debt funds, as a private credit analyst, or in other private credit opportunities? This guide provides five crucial do's and don'ts to help you succeed in this rapidly growing sector. Whether you're aiming for a role in structured finance, credit underwriting, or portfolio management, this advice will significantly boost your chances.

<h2>Do's: Maximize Your Chances in the Private Credit Job Market</h2>

<h3>1. Network Strategically: Building Connections in Private Credit</h3>

Networking is paramount in the private credit industry. Building strong relationships can open doors to otherwise inaccessible opportunities. Here's how to effectively network:

- Attend industry events: Conferences, workshops, and seminars offer excellent networking opportunities. Look for events focused on private debt, direct lending, or alternative credit strategies.

- Join relevant professional organizations: The CFA Institute, industry-specific groups, and local finance chapters provide platforms to connect with professionals and learn about current trends in private credit.

- Leverage LinkedIn: Optimize your LinkedIn profile with keywords like "private debt," "credit underwriting," "structured finance," and "private equity." Actively connect with recruiters and professionals working in private credit firms.

- Informational interviews: Reach out to professionals in private credit for informational interviews. This allows you to learn about their careers, gain insights into the industry, and potentially uncover hidden job opportunities. These connections can prove invaluable.

<h3>2. Develop Specialized Skills: Mastering the Requirements of Private Credit Roles</h3>

Private credit roles demand a specific skill set. Focus on developing expertise in these areas to stand out from the competition:

- Master financial modeling: Proficiency in Excel and Python is crucial for analyzing financial statements, building cash flow models, and performing valuation analyses.

- Develop strong credit analysis skills: Understand financial statement analysis, credit risk assessment, covenant compliance, and debt structuring.

- Gain experience with debt structuring and underwriting: Familiarity with different debt instruments, legal documentation, and the underwriting process is essential.

- Familiarize yourself with legal and regulatory aspects of private credit: Understanding relevant regulations and compliance requirements is crucial.

- Demonstrate proficiency in valuation techniques: Master discounted cash flow (DCF) analysis, comparable company analysis, and other valuation methodologies.

<h3>3. Tailor Your Resume and Cover Letter: Highlighting Your Value in Private Credit</h3>

Generic applications rarely succeed in a competitive market like private credit. Customize your materials for each role:

- Use relevant keywords: Incorporate keywords like "private debt," "credit underwriting," "structured finance," "direct lending," "alternative credit," and "distressed debt" into your resume and cover letter.

- Quantify your accomplishments: Use numbers to demonstrate your impact. For example, instead of saying "Improved portfolio performance," say "Improved portfolio performance by 15% through proactive credit risk management."

- Customize your materials: Tailor your resume and cover letter to each specific job description, highlighting the skills and experience most relevant to the role.

- Showcase your market understanding: Demonstrate your knowledge of the current private credit market, including trends, challenges, and opportunities.

- Target specific firms: Research the firms you're applying to and tailor your application to reflect your understanding of their investment strategies and portfolio composition.

<h3>4. Ace the Interview: Preparing for Private Credit Interviews</h3>

Private credit interviews often involve behavioral, technical, and case study questions. Thorough preparation is crucial:

- Practice common interview questions: Prepare answers to questions like "Tell me about yourself," "Why private credit?," and "Tell me about a time you failed."

- Demonstrate your understanding of private credit investment strategies: Show your knowledge of different investment approaches, such as direct lending, mezzanine financing, and distressed debt investing.

- Prepare to discuss specific firms: Research the firms you're interviewing with and demonstrate your understanding of their investment strategies and portfolio composition.

- Prepare thoughtful questions: Asking insightful questions demonstrates your engagement and interest in the role and the firm.

- Practice your interview skills: Conduct mock interviews with friends, career services professionals, or mentors.

<h3>5. Follow Up Professionally: Maintaining Momentum in Your Private Credit Job Search</h3>

Following up demonstrates your continued interest and professionalism:

- Send thank-you notes: Send a personalized thank-you note after each interview, reiterating your interest and highlighting key discussion points.

- Follow up with recruiters: Follow up with recruiters or hiring managers within a week of the interview to express your continued interest.

- Maintain professional communication: Keep your communication professional and concise throughout the hiring process.

- Express continued enthusiasm: Reiterate your enthusiasm for the opportunity and the firm.

- Be persistent, but not pushy: Follow up appropriately, but avoid being overly aggressive or demanding.

<h2>Don'ts: Common Mistakes to Avoid in Your Private Credit Job Search</h2>

<h3>1. Don't Neglect Networking: The Importance of Building Relationships</h3>

Networking is not optional; it's essential for success in the private credit industry. Don't underestimate its power in opening doors to opportunities.

<h3>2. Don't Submit Generic Applications: The Power of Customization</h3>

Generic applications show a lack of effort and interest. Always tailor your resume and cover letter to each specific job and company.

<h3>3. Don't Underestimate Technical Skills: Mastering Financial Modeling and Analysis</h3>

Private credit roles require strong technical skills. Ensure you're proficient in financial modeling, credit analysis, and valuation techniques.

<h3>4. Don't Underprepare for Interviews: Practice Makes Perfect</h3>

Thorough preparation is key to acing private credit interviews. Practice your answers, research the firm, and prepare thoughtful questions.

<h3>5. Don't Forget to Follow Up: Reinforcing Your Interest</h3>

A simple thank-you note can make a difference. Following up shows your continued interest and professionalism.

<h2>Conclusion: Navigate the Private Credit Boom and Secure Your Dream Role</h2>

Landing your dream job in the booming private credit sector requires a strategic and proactive approach. By diligently following these do's and don'ts—mastering specialized skills, building a strong network, and perfecting your interview technique—you can significantly increase your chances of success. Don't delay; start navigating the private credit boom today and secure your dream job in private credit!

Featured Posts

-

Trump Tariffs And Californias Economy A 16 Billion Loss

May 15, 2025

Trump Tariffs And Californias Economy A 16 Billion Loss

May 15, 2025 -

Bof As Reassurance Are High Stock Market Valuations Really A Worry

May 15, 2025

Bof As Reassurance Are High Stock Market Valuations Really A Worry

May 15, 2025 -

Gurriels Pinch Hit Rbi Key Moment In Padres Win Against Braves

May 15, 2025

Gurriels Pinch Hit Rbi Key Moment In Padres Win Against Braves

May 15, 2025 -

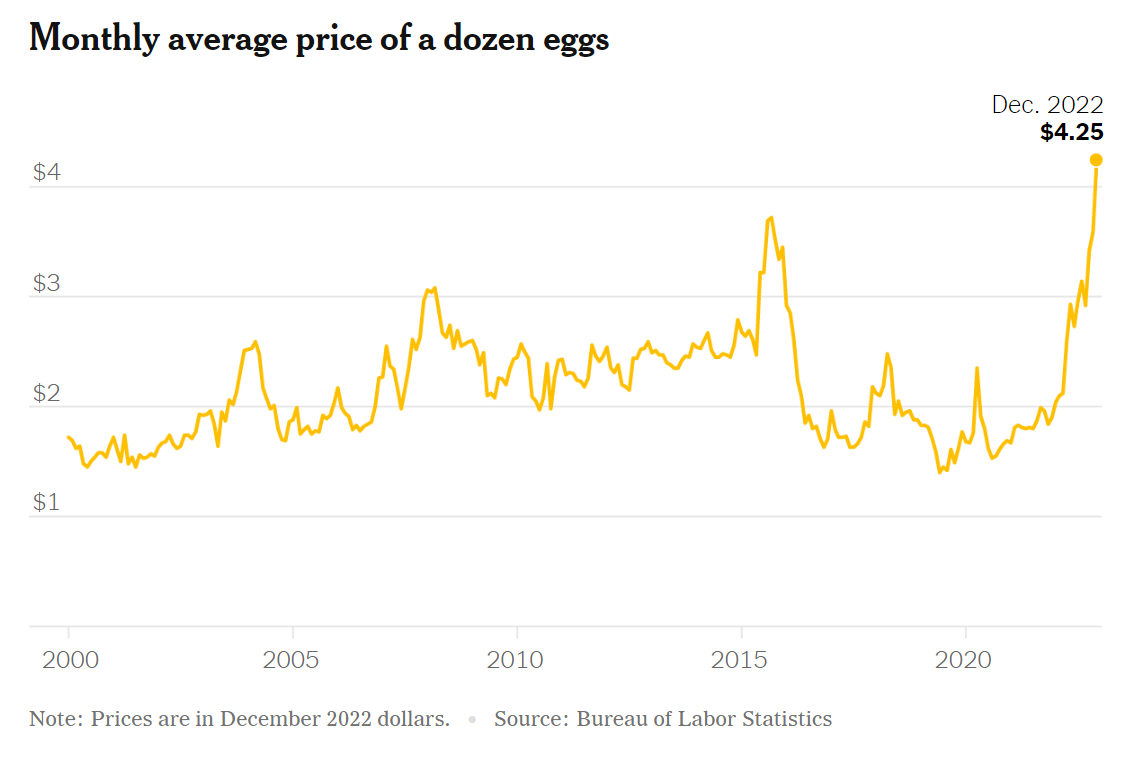

Trumps Egg Price Prediction An Economic Perspective

May 15, 2025

Trumps Egg Price Prediction An Economic Perspective

May 15, 2025 -

Padres Pregame Arraez And Heyward Lead Lineup In Sweep Pursuit

May 15, 2025

Padres Pregame Arraez And Heyward Lead Lineup In Sweep Pursuit

May 15, 2025

Latest Posts

-

Nfl Stars Unexpected Japan Baseball Catch Muncys Fly Ball Snagged

May 15, 2025

Nfl Stars Unexpected Japan Baseball Catch Muncys Fly Ball Snagged

May 15, 2025 -

Former Nfl Qb Steals Fly Ball From Max Muncy In Japan

May 15, 2025

Former Nfl Qb Steals Fly Ball From Max Muncy In Japan

May 15, 2025 -

Torpedo Bat Controversy An Mlb All Stars Candid Confession

May 15, 2025

Torpedo Bat Controversy An Mlb All Stars Candid Confession

May 15, 2025 -

Max Muncy Speaks Out Addressing The Arenado Dodgers Trade Rumors

May 15, 2025

Max Muncy Speaks Out Addressing The Arenado Dodgers Trade Rumors

May 15, 2025 -

2025 Opening Day The Return Of Wilson And Muncy

May 15, 2025

2025 Opening Day The Return Of Wilson And Muncy

May 15, 2025