Navigate The Private Credit Job Market: 5 Do's & Don'ts For Success

Table of Contents

Do's for Success in the Private Credit Job Market

1. Tailor Your Resume and Cover Letter to Private Credit

Your resume and cover letter are your first impression. In the competitive private credit job market, a generic application won't cut it. You need to highlight your specific skills and experience relevant to the industry.

-

Highlight relevant experience: Emphasize experience in areas like debt financing, leveraged buyouts, distressed debt, credit analysis, structured finance, and portfolio management. Did you work on mezzanine financing deals? Mention it! Did you analyze distressed assets? Showcase that expertise.

-

Quantify your accomplishments: Use metrics and numbers to demonstrate your impact. Instead of simply stating responsibilities, quantify your achievements. For example, instead of "Managed a portfolio of assets," try "Managed a $50 million portfolio of assets, resulting in a 10% increase in ROI."

-

Use private credit keywords: Incorporate keywords specific to private credit throughout your resume and cover letter. Think terms like “credit underwriting,” “due diligence,” “financial modeling,” “valuation techniques,” “risk assessment,” and “alternative investments.” Applicant tracking systems (ATS) often scan for these keywords.

-

Showcase your financial acumen: Demonstrate your understanding of financial modeling and valuation techniques. Mention specific software proficiency (e.g., Excel, Bloomberg Terminal, Argus).

-

Example: Instead of simply saying “analyzed financial statements,” write “Analyzed financial statements of 25+ companies across various sectors, identifying key risk factors and contributing to a 12% reduction in non-performing loans within the portfolio.”

2. Network Strategically within the Private Credit Industry

Networking is crucial in the private credit job market. It's not just about what you know, but who you know.

-

Attend industry events: Attend conferences and events focused on private credit and alternative investments. This is where you'll meet key players and learn about emerging trends.

-

Leverage LinkedIn: Connect with professionals on LinkedIn and engage in relevant discussions. Join private credit-focused groups and participate actively.

-

Target private credit recruiters: Reach out to recruiters specializing in private credit placements. They have access to unadvertised roles and can guide you through the application process.

-

Informational interviews: Conduct informational interviews with professionals in the field. These conversations provide invaluable insights and potential leads.

-

Tap into your network: Don't forget your existing network. Reach out to alumni, professors, and former colleagues who might have connections in the private credit industry.

3. Develop a Strong Understanding of Private Credit Fundamentals

A solid grasp of private credit fundamentals is essential. Employers look for candidates who understand the intricacies of this specialized area of finance.

-

Master financial modeling: Become proficient in financial modeling, valuation, and credit analysis techniques. Practice creating detailed financial models and understand different valuation methodologies.

-

Stay updated: Stay abreast of industry trends, regulatory changes, and market dynamics. Read industry publications and follow key influencers on social media.

-

Understand private credit strategies: Demonstrate knowledge of various private credit strategies, including direct lending, mezzanine financing, distressed debt, and special situations investing.

-

Develop sector expertise: Developing expertise in specific sectors (e.g., real estate, energy, healthcare) within the private credit space can significantly enhance your prospects.

-

Consider certifications: Consider pursuing relevant certifications like the Chartered Financial Analyst (CFA) designation to boost your credibility and expertise.

Don'ts for Success in the Private Credit Job Market

1. Don't Neglect the Importance of Networking

While online job applications are important, relying solely on them is a mistake in this niche market.

-

Don't rely solely on online applications: Networking is far more effective than simply submitting online applications.

-

Don't underestimate personal connections: Personal connections can open doors to unadvertised roles and provide valuable insights.

-

Don't be afraid to reach out: Don't hesitate to reach out to people even if you don't have a direct connection. A well-crafted email expressing your interest can go a long way.

-

Don't use generic applications: Always personalize your resume and cover letter to each specific role and company.

2. Don't Underestimate the Technical Skills

Private credit roles require a strong foundation in technical skills. Neglecting these will severely hinder your chances.

-

Don't overlook software proficiency: Master financial modeling software such as Excel, Bloomberg Terminal, and other relevant tools.

-

Don't overstate your abilities: Be honest about your skill set. Don't present yourself as an expert if you lack the necessary skills.

-

Don't hesitate to learn: Invest in further training or courses to improve your technical capabilities.

3. Don't Ignore the Importance of Soft Skills

Technical skills are important, but soft skills are equally crucial in the private credit job market.

-

Don't underestimate communication: Excellent communication, teamwork, and problem-solving skills are highly valued.

-

Don't neglect professionalism: Demonstrate a strong work ethic and professional demeanor at all times.

-

Don't be afraid to showcase your personality: Let your passion for private credit shine through during interviews and networking events.

Conclusion

Successfully navigating the private credit job market demands a proactive and well-informed approach. By following these do's and don'ts, focusing on building a strong network, honing your technical expertise, and emphasizing your soft skills, you significantly increase your chances of securing a rewarding career in this dynamic field. Remember to tailor your application materials to each specific role, actively network within the private credit industry, and continually enhance your understanding of private credit fundamentals. Start your journey today and conquer the private credit job market!

Featured Posts

-

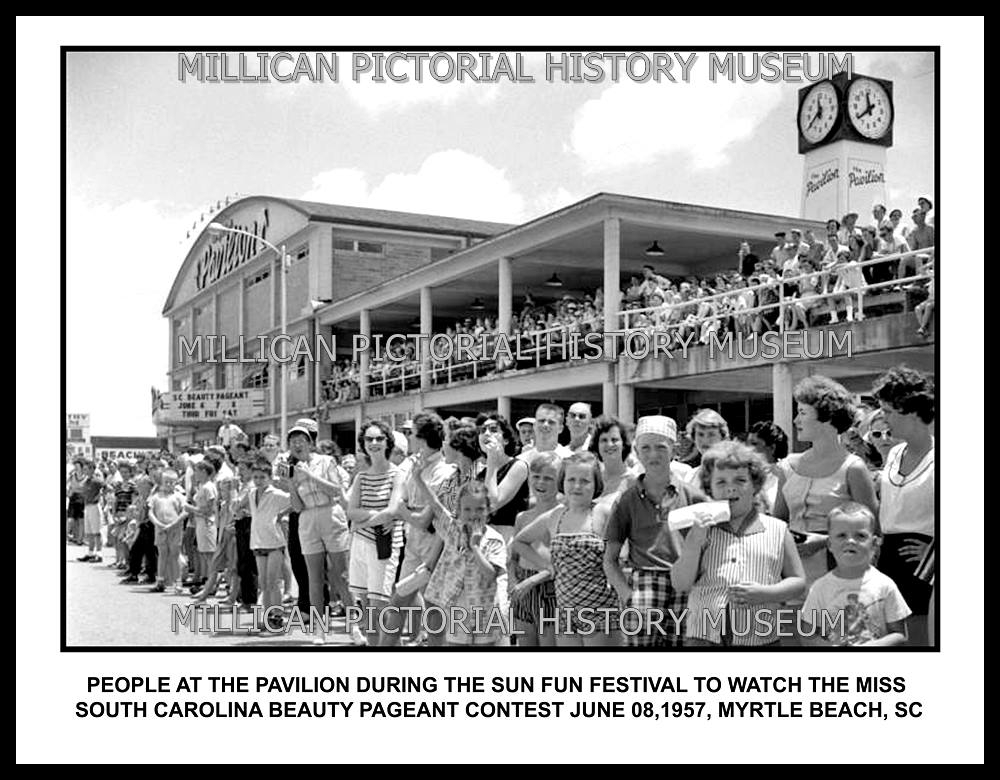

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Excellence In Local Journalism

May 26, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Excellence In Local Journalism

May 26, 2025 -

Jangan Lewatkan Jadwal Tayang Moto Gp Argentina 2025 Di Trans7

May 26, 2025

Jangan Lewatkan Jadwal Tayang Moto Gp Argentina 2025 Di Trans7

May 26, 2025 -

Hamilton Update Sparks Mercedes Investigation In F1

May 26, 2025

Hamilton Update Sparks Mercedes Investigation In F1

May 26, 2025 -

The Rtx 5060 Launch Examining The Fallout And Future Implications

May 26, 2025

The Rtx 5060 Launch Examining The Fallout And Future Implications

May 26, 2025 -

Coastal Flooding Southeast Pa Wednesday Advisory And Precautions

May 26, 2025

Coastal Flooding Southeast Pa Wednesday Advisory And Precautions

May 26, 2025

Latest Posts

-

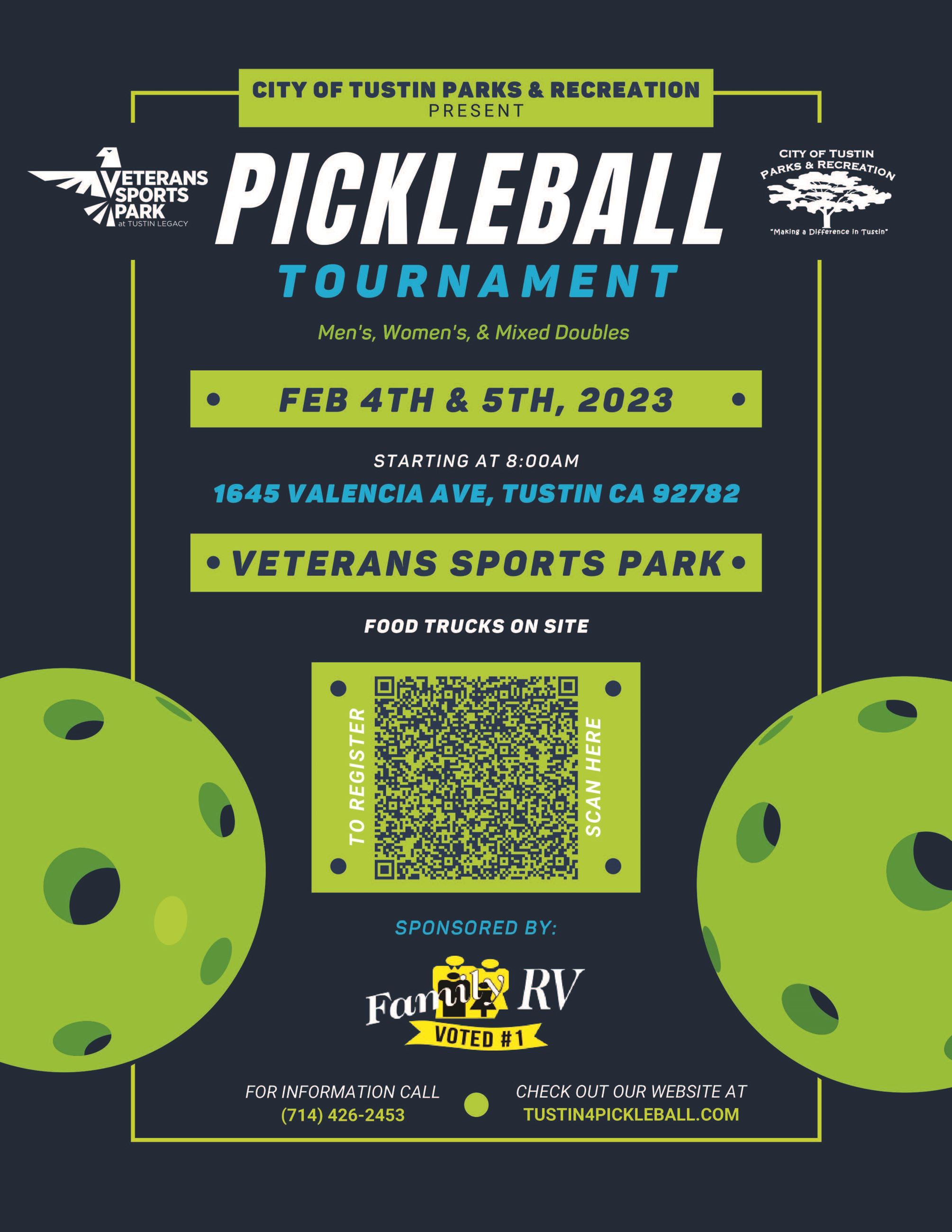

Steffi Graf Und Andre Agassi Wie Sie Den Pickleball Meistern

May 30, 2025

Steffi Graf Und Andre Agassi Wie Sie Den Pickleball Meistern

May 30, 2025 -

Agassis Pickleball Premiere A Look At The Upcoming Tournament

May 30, 2025

Agassis Pickleball Premiere A Look At The Upcoming Tournament

May 30, 2025 -

Andre Agassis Pro Pickleball Debut Tournament Details Revealed

May 30, 2025

Andre Agassis Pro Pickleball Debut Tournament Details Revealed

May 30, 2025 -

Andre Agassi Meeting Leaves Ira Khan With A Stunning Revelation

May 30, 2025

Andre Agassi Meeting Leaves Ira Khan With A Stunning Revelation

May 30, 2025 -

Aamir Khans Daughter Ira Shares Surprise Post Agassi Encounter

May 30, 2025

Aamir Khans Daughter Ira Shares Surprise Post Agassi Encounter

May 30, 2025