Navigating Succession Planning: The Unique Needs Of The Super Wealthy

Table of Contents

Complex Asset Structures Require Specialized Expertise

High-net-worth individuals often possess diverse and intricate asset holdings that necessitate specialized expertise in estate planning for HNWIs. A standard approach simply won't suffice.

Beyond Stocks and Bonds: Addressing Diverse Holdings

HNWIs typically hold a wide range of assets beyond traditional stocks and bonds. Effective succession planning must account for:

- Real estate portfolios (domestic and international): Managing properties across different jurisdictions requires navigating varying legal and tax regulations.

- Private equity and venture capital investments: These illiquid assets require careful valuation and distribution strategies.

- Art collections and other valuable assets: Unique appraisal and insurance considerations are paramount for these assets.

- Family-owned businesses: Succession planning for family businesses requires a delicate balance between preserving the legacy and ensuring the continued viability of the enterprise.

This complexity demands a team of specialized professionals, including:

- Tax attorneys: To navigate the intricate tax implications of wealth transfer across borders and asset classes.

- Estate planners: To design and implement strategies that minimize estate taxes and protect assets.

- Investment managers: To oversee and manage the portfolio's transition to the next generation.

International Tax Implications and Estate Laws

For many HNWIs, international tax implications and estate laws represent significant challenges.

- Navigating varying tax treaties and jurisdictions: Understanding and complying with the diverse legal and tax frameworks of different countries is vital.

- Minimizing international tax burdens: Strategic planning can significantly reduce the tax burden associated with cross-border wealth transfer.

- Compliance with multiple legal frameworks: Ensuring compliance across various jurisdictions requires meticulous attention to detail.

- Importance of cross-border estate planning: A comprehensive plan must address the unique legal and tax implications of assets held in multiple countries.

Protecting Family Legacy and Wealth Preservation

Beyond the financial aspects, succession planning for high-net-worth individuals must consider family dynamics and legacy preservation.

Minimizing Estate Taxes and Protecting Assets from Disputes

Minimizing estate taxes and protecting assets from potential disputes are critical components of a robust plan. This involves:

- Employing trusts and other sophisticated tax-saving strategies: Trusts can help to minimize estate taxes and protect assets from creditors.

- Establishing clear ownership and beneficiary designations: Precisely defining ownership and beneficiary designations prevents ambiguity and potential disputes.

- Implementing robust asset protection measures: This can involve using various legal structures and strategies to protect assets from creditors and other claims.

- Preparing for potential legal challenges: Anticipating and planning for potential legal challenges helps to safeguard the family's wealth.

Ensuring Family Harmony and Communication

Open communication is essential for a successful wealth transfer. This requires:

- Facilitating open and honest family discussions about wealth transfer: Early and open dialogue prevents misunderstandings and conflict.

- Establishing clear communication protocols for family members: Formalizing communication channels ensures transparency and accountability.

- Utilizing family governance structures: Formal structures can help to manage family wealth and prevent disputes.

- Engaging in family therapy or conflict resolution services as needed: Professional guidance can assist in navigating family conflicts and ensuring a smooth transition.

Philanthropic Goals and Legacy Giving

Many HNWIs wish to integrate their philanthropic goals into their succession planning.

Integrating Charitable Giving into Succession Plans

Strategic philanthropy can create a lasting legacy while also offering tax advantages:

- Establishing family foundations or charitable trusts: These structures allow for ongoing charitable giving and tax benefits.

- Maximizing tax benefits of charitable donations: Careful planning can maximize tax deductions and minimize the tax burden.

- Aligning philanthropic goals with family values: Charitable giving should reflect the family's values and priorities.

- Creating a lasting legacy through meaningful charitable contributions: Philanthropy can create a powerful and lasting legacy.

Impact Investing and Socially Responsible Investments

Increasingly, HNWIs are incorporating socially responsible investments into their portfolios:

- Incorporating ethical and sustainable investment options: These investments align with family values and contribute to positive social and environmental impact.

- Supporting causes aligned with family values: Investments can support causes that are personally meaningful to the family.

- Generating both financial returns and social impact: Impact investing demonstrates that financial returns and social responsibility aren't mutually exclusive.

The Importance of Professional Guidance for HNWIs

Effective succession planning for high-net-worth individuals requires expert guidance.

Building a Multidisciplinary Team of Experts

A comprehensive approach necessitates a team of specialists:

- Estate planning attorneys: To navigate legal complexities and ensure compliance.

- Financial advisors: To manage and allocate assets effectively.

- Tax professionals: To minimize tax burdens and ensure compliance.

- Insurance specialists: To protect assets and mitigate risks.

Regular Review and Updates to the Succession Plan

A succession plan isn't a static document; it needs regular review and updates to account for changes:

- Addressing changing family circumstances: Marriages, divorces, and births all impact the plan.

- Adapting to evolving tax laws and regulations: Tax laws change, necessitating regular updates.

- Monitoring investment performance and asset allocation: Regular monitoring ensures the plan aligns with financial goals.

Conclusion

Succession planning for high-net-worth individuals is a complex undertaking requiring careful consideration of diverse assets, international implications, family dynamics, and philanthropic goals. By proactively engaging a skilled team of professionals and establishing a comprehensive plan that addresses these unique needs, HNWIs can effectively protect their wealth, preserve their legacy, and ensure a smooth transition for future generations. Don't delay – contact a specialist today to begin navigating your succession planning needs and secure your family's financial future. Learn more about estate planning for HNWIs and high-net-worth succession planning strategies by contacting our experts.

Featured Posts

-

Abn Amro Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 22, 2025

Abn Amro Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 22, 2025 -

Blake Livelys Familys Reaction To Reported A List Feud

May 22, 2025

Blake Livelys Familys Reaction To Reported A List Feud

May 22, 2025 -

Peppa Pigs Parents Throw Gender Reveal Party A Pink Or Blue Celebration

May 22, 2025

Peppa Pigs Parents Throw Gender Reveal Party A Pink Or Blue Celebration

May 22, 2025 -

Groeiende Autobezit Drijft Occasionverkoop Abn Amro Omhoog

May 22, 2025

Groeiende Autobezit Drijft Occasionverkoop Abn Amro Omhoog

May 22, 2025 -

Nices Aquatic Future An Olympic Standard Swimming Pool Project

May 22, 2025

Nices Aquatic Future An Olympic Standard Swimming Pool Project

May 22, 2025

Latest Posts

-

Cac Tuyen Duong Ket Noi Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025

Cac Tuyen Duong Ket Noi Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025 -

Kham Pha Mang Luoi Giao Thong Tp Hcm Ba Ria Vung Tau

May 22, 2025

Kham Pha Mang Luoi Giao Thong Tp Hcm Ba Ria Vung Tau

May 22, 2025 -

Du An Cau Ma Da Dong Nai Binh Phuoc Duoc Ket Noi Khoi Cong Thang 6

May 22, 2025

Du An Cau Ma Da Dong Nai Binh Phuoc Duoc Ket Noi Khoi Cong Thang 6

May 22, 2025 -

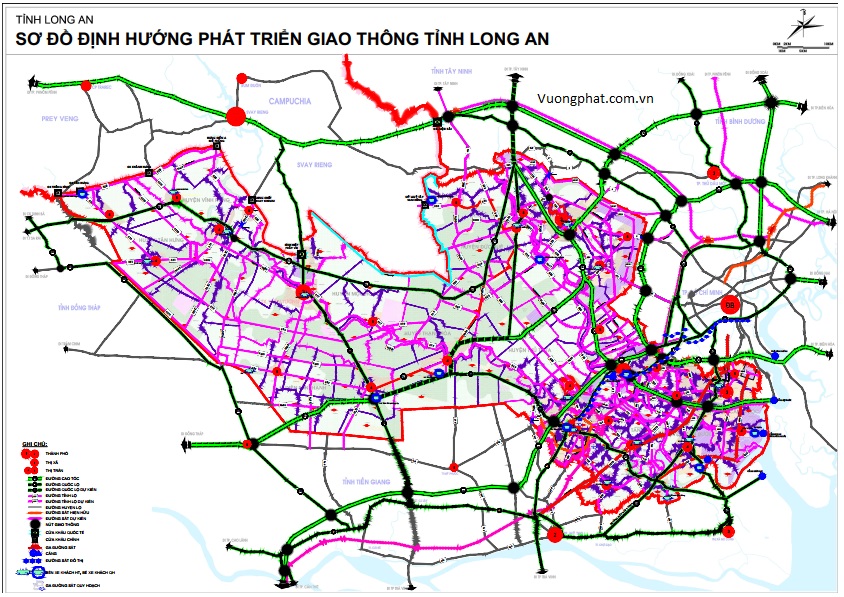

Chien Luoc Phat Trien 7 Tuyen Giao Thong Chinh Tp Hcm Long An

May 22, 2025

Chien Luoc Phat Trien 7 Tuyen Giao Thong Chinh Tp Hcm Long An

May 22, 2025 -

Giai Doan Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Hien Trang Va Tuong Lai

May 22, 2025

Giai Doan Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Hien Trang Va Tuong Lai

May 22, 2025