Navigating The Belgian Merchant Market: Financing Options For A 270MWh BESS Project

Table of Contents

Understanding the Belgian Energy Landscape and BESS Incentives

Belgium is actively transitioning towards a renewable energy-based electricity grid, aiming to significantly reduce its carbon footprint. This transition creates a favorable environment for Battery Energy Storage Systems (BESS), which play a vital role in stabilizing the grid and integrating intermittent renewable sources like solar and wind power. The Belgian government recognizes the importance of BESS and offers various incentives to encourage deployment. These incentives are designed to accelerate the adoption of clean energy technologies and enhance grid reliability.

- Current renewable energy targets in Belgium: Belgium has ambitious targets for renewable energy integration, aiming for a significant percentage of its energy mix to come from renewable sources by 2030 and beyond. This strong commitment to renewable energy drives the demand for energy storage solutions like BESS.

- Specific BESS-related subsidies or grants: Several regional and federal programs in Belgium offer subsidies and tax breaks for BESS projects, often contingent on project size, location, and technological specifications. These incentives can significantly reduce the upfront capital costs associated with BESS deployment. Detailed information is available from the relevant Belgian energy agencies, which should be consulted for the most up-to-date information.

- Regulatory hurdles and how to overcome them: While the regulatory framework is generally supportive, navigating the permitting and interconnection processes requires careful planning and expert guidance. Engaging experienced legal and regulatory consultants is essential to ensure compliance and avoid delays. This includes understanding grid connection requirements and securing the necessary permits.

- Potential revenue streams from ancillary services: BESS projects in Belgium can generate additional revenue by providing ancillary services to the grid operator, such as frequency regulation and peak shaving. These services are crucial for maintaining grid stability and are compensated financially. The revenue potential from ancillary services can improve the overall financial viability of a BESS project.

Exploring Financing Options for your Belgian BESS Project

Securing sufficient capital for a 270MWh BESS project requires a well-defined financing strategy. Several options exist, each with its own advantages and disadvantages:

Equity Financing

Attracting private equity investors or venture capital can provide significant upfront capital. However, this often involves relinquishing some ownership and accepting equity dilution. The process includes developing a compelling business plan, demonstrating the project's financial viability, and securing the support of experienced investment bankers.

Debt Financing

Debt financing involves securing loans from financial institutions. Several options are available:

- Bank loans: Traditional bank loans offer straightforward financing, but require robust financial projections and collateral.

- Green bonds: These bonds specifically target environmentally friendly projects and can attract investors interested in sustainable investments.

- Project finance: This structured financing approach considers the project's cash flow as the primary source of repayment, reducing reliance on traditional collateral.

Public Funding and Grants

Various Belgian government agencies and regional authorities offer grants, subsidies, and public-private partnerships for renewable energy projects, including BESS. These opportunities should be thoroughly researched and applied for strategically.

Hybrid Financing Models

Combining equity and debt financing can optimize the capital structure, balancing risk and return. This approach requires a sophisticated financial model and careful coordination between equity investors and lenders.

- Key considerations for each financing type: Interest rates, repayment schedules, collateral requirements, and investor expectations vary significantly across these financing methods.

- Typical interest rates and repayment schedules: These depend on factors like project risk, market conditions, and the lender's risk appetite.

- Required collateral and security measures: Lenders will require appropriate collateral to mitigate their risk.

- Sources of funding (banks, investors, government agencies): Identifying suitable funding sources and establishing relationships with key stakeholders is crucial.

Due Diligence and Risk Mitigation in Belgian BESS Projects

Thorough due diligence is paramount to mitigating potential risks. This involves scrutinizing potential financing partners, evaluating project-specific risks, and developing comprehensive risk mitigation strategies.

- Key due diligence steps for lenders and investors: This includes analyzing financial statements, reviewing technical designs, assessing regulatory compliance, and evaluating market conditions.

- Common risks associated with BESS projects (technical, regulatory, market): Technical risks include equipment failure, while regulatory risks involve changes in government policies or permitting issues. Market risks encompass fluctuations in energy prices and demand.

- Insurance options to cover potential losses: Insurance policies can help protect against unforeseen events, such as equipment malfunction or power outages.

- Strategies for mitigating market risks: Hedging strategies, such as power purchase agreements (PPAs), can help reduce exposure to market price volatility.

Conclusion

Securing financing for your 270MWh BESS project in the Belgian merchant market demands careful planning and a comprehensive understanding of available options. By exploring equity, debt, and public funding avenues, and by meticulously managing risks through due diligence, you can successfully navigate the regulatory landscape and unlock the substantial potential of BESS investment in Belgium. Start planning your Belgian BESS financing strategy today by researching the specific grants and incentives mentioned above and consulting with financial experts experienced in the renewable energy sector. Remember, successful Belgian BESS project financing is key to realizing the benefits of this vital technology.

Featured Posts

-

Prince Harry Speaks Out Breakdown In Communication With King Charles Over Security

May 04, 2025

Prince Harry Speaks Out Breakdown In Communication With King Charles Over Security

May 04, 2025 -

Nhl Roundup Panthers Rally Avalanches Dominant Win

May 04, 2025

Nhl Roundup Panthers Rally Avalanches Dominant Win

May 04, 2025 -

Sharp Temperature Drop In West Bengal Weather Report

May 04, 2025

Sharp Temperature Drop In West Bengal Weather Report

May 04, 2025 -

Bloom Fronts Fleetwood Mac Tribute Band Seventh Wonder Perth Mandurah Albany Tour

May 04, 2025

Bloom Fronts Fleetwood Mac Tribute Band Seventh Wonder Perth Mandurah Albany Tour

May 04, 2025 -

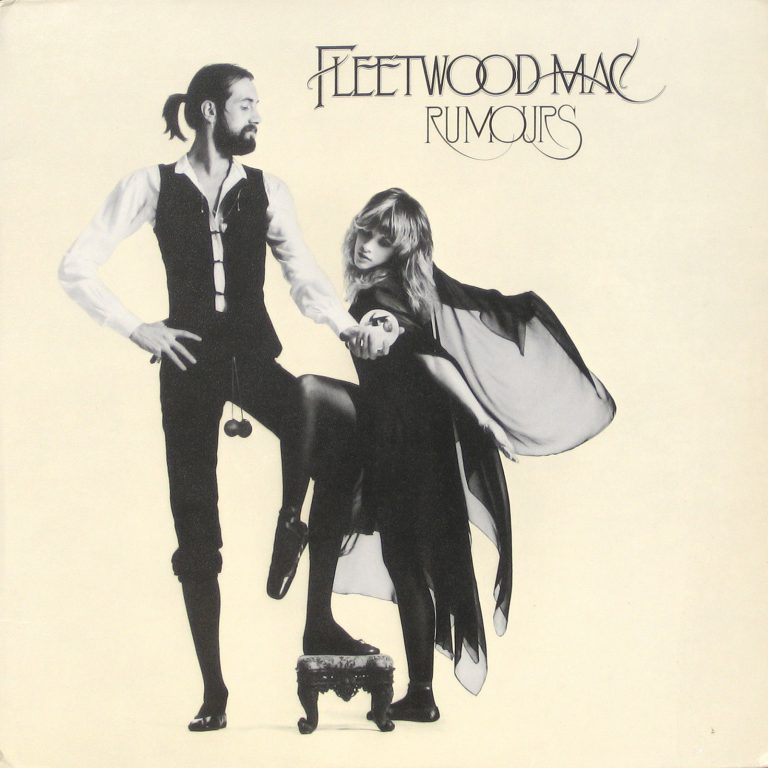

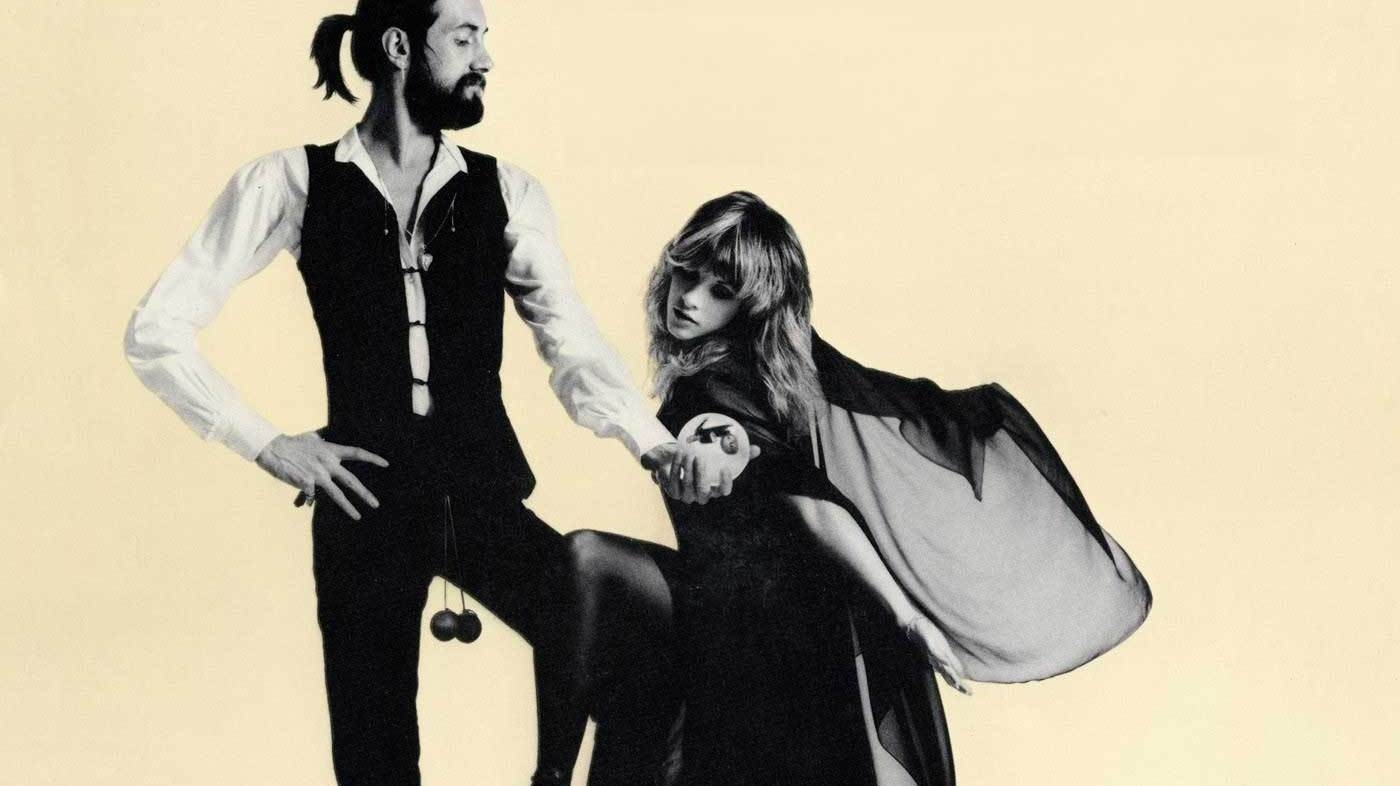

Fleetwood Mac Scores Big Chart Topping Album Despite No New Releases

May 04, 2025

Fleetwood Mac Scores Big Chart Topping Album Despite No New Releases

May 04, 2025

Latest Posts

-

The Fleetwood Mac Phenomenon Examining Their Supergroup Status

May 04, 2025

The Fleetwood Mac Phenomenon Examining Their Supergroup Status

May 04, 2025 -

Did Fleetwood Mac Invent The Supergroup Model A Deep Dive

May 04, 2025

Did Fleetwood Mac Invent The Supergroup Model A Deep Dive

May 04, 2025 -

Rumours Fleetwood Macs 1977 Masterpiece And The Drama That Fueled It 48 Years On

May 04, 2025

Rumours Fleetwood Macs 1977 Masterpiece And The Drama That Fueled It 48 Years On

May 04, 2025 -

The Story Behind Fleetwood Macs Rumours 48 Years Of Musical History

May 04, 2025

The Story Behind Fleetwood Macs Rumours 48 Years Of Musical History

May 04, 2025 -

Posjeta Gibonija Sarajevskom Sajmu Knjiga Sto Ocekivati

May 04, 2025

Posjeta Gibonija Sarajevskom Sajmu Knjiga Sto Ocekivati

May 04, 2025