Navigating The Dragon's Den: Tips For Entrepreneurs

Table of Contents

Crafting a Compelling Pitch Deck

Your pitch deck is your first impression; it's your chance to captivate potential investors and showcase the potential of your startup. It needs to be clear, concise, and compelling, telling a story that resonates with investors and demonstrates a clear path to success. Think of it as your elevator pitch, but expanded and visually enhanced.

- Focus on Storytelling: Don't just present data; weave a narrative that explains your problem, your solution, and your vision for the future. Investors want to believe in your passion and your potential.

- Compelling Visuals: Use high-quality images, charts, and graphs to illustrate your key points. Minimize text; let the visuals do the talking. A visually appealing deck keeps investors engaged.

- Data-Driven Results: Back up your claims with hard data. Show your market analysis, traction metrics (if any), and projected financial performance. Numbers speak louder than words, especially to investors.

- Clear Market Understanding: Demonstrate a deep understanding of your target market, your competition, and your competitive advantage. Show investors you've done your homework.

- Strong Financial Projections: Present realistic and well-researched financial projections, including revenue forecasts, expenses, and profitability. Show investors a clear path to profitability and a strong return on their investment (ROI).

- Practice, Practice, Practice: Your delivery is just as important as the content. Rehearse your pitch multiple times until you can deliver it confidently and flawlessly. Practice in front of colleagues or mentors for feedback.

Mastering the Art of Negotiation

Negotiating with investors requires finesse, preparation, and a clear understanding of your own value proposition. It's a delicate dance between securing favorable terms and building a strong, mutually beneficial partnership.

- Know Your Bottom Line: Before entering negotiations, determine your minimum acceptable terms regarding equity, valuation, and other key aspects of the investment. This sets the boundaries for your negotiation.

- Understand Investor Perspective: Research the investors beforehand to understand their investment style, previous investments, and their typical investment criteria. Tailor your approach accordingly.

- Prepare for Tough Questions: Anticipate tough questions about your valuation, your market analysis, and potential risks. Prepare thoughtful and well-supported answers.

- Seek Legal Counsel: Engage legal counsel to review any investment agreements before signing. This ensures you understand the terms and protect your interests.

- Win-Win Scenario: Strive for a win-win scenario. A successful negotiation leaves both parties feeling satisfied with the outcome. Be flexible and open to compromise, but don't compromise your core values.

- Walking Away: Don't be afraid to walk away from a deal if the terms are not favorable. It's better to secure a good deal than a bad one.

Understanding Investor Expectations

Investors are primarily looking for a strong return on their investment (ROI). They'll conduct thorough due diligence to assess the viability of your business and the potential for significant growth.

- Return on Investment (ROI): Highlight the potential for significant financial returns for investors. Showcase a clear path to profitability and strong growth projections.

- Due Diligence: Be prepared for rigorous due diligence. Investors will scrutinize your financials, your team, your market analysis, and your overall business plan.

- Market Analysis: Demonstrate a deep understanding of your market, including market size, growth potential, and competitive landscape.

- Scalability: Showcase the scalability of your business model. Investors want to see a business with the potential for significant expansion.

- Team Expertise: Highlight the experience and expertise of your team. Investors invest in people as much as they invest in ideas.

- Risk Mitigation: Address potential risks and outline your strategies for mitigating those risks. Transparency is key.

Building a Strong Team

A strong team is a crucial element in securing investment. Investors want to see a capable, experienced, and passionate team in place.

- Expertise and Experience: Highlight the relevant expertise and experience of your key team members. A strong team inspires confidence in investors.

- Advisory Board: Having a strong advisory board or mentors can add significant credibility to your team.

- Team Dynamics: Demonstrate a collaborative and cohesive team dynamic. A strong team works well together and shares a common vision.

Preparing for Due Diligence

Due diligence is a critical stage in the investment process. Be prepared to provide complete and transparent documentation to support your claims.

- Financial Records: Maintain accurate and up-to-date financial records. This includes income statements, balance sheets, and cash flow statements.

- Legal Compliance: Ensure your business is compliant with all relevant regulations and laws.

- Documentation: Organize all your relevant documentation in a clear and accessible manner. This includes contracts, agreements, and intellectual property documents.

- Transparency: Be open and transparent throughout the due diligence process. Addressing any concerns promptly and honestly will build trust with investors.

Conclusion

Navigating the Dragon's Den requires thorough preparation, skillful negotiation, and a compelling vision. By mastering your pitch deck, understanding investor expectations, and navigating negotiations effectively, you significantly increase your chances of securing the funding your startup needs. Remember, even setbacks provide valuable lessons. Continue honing your skills, refining your strategy, and persistently pursuing investment – your success in the Dragon's Den, or securing funding from any investor, awaits!

Featured Posts

-

Blue Origins Launch Abort Details On The Subsystem Malfunction

May 01, 2025

Blue Origins Launch Abort Details On The Subsystem Malfunction

May 01, 2025 -

How Open Ais Chat Gpt Is Disrupting Googles Shopping Dominance

May 01, 2025

How Open Ais Chat Gpt Is Disrupting Googles Shopping Dominance

May 01, 2025 -

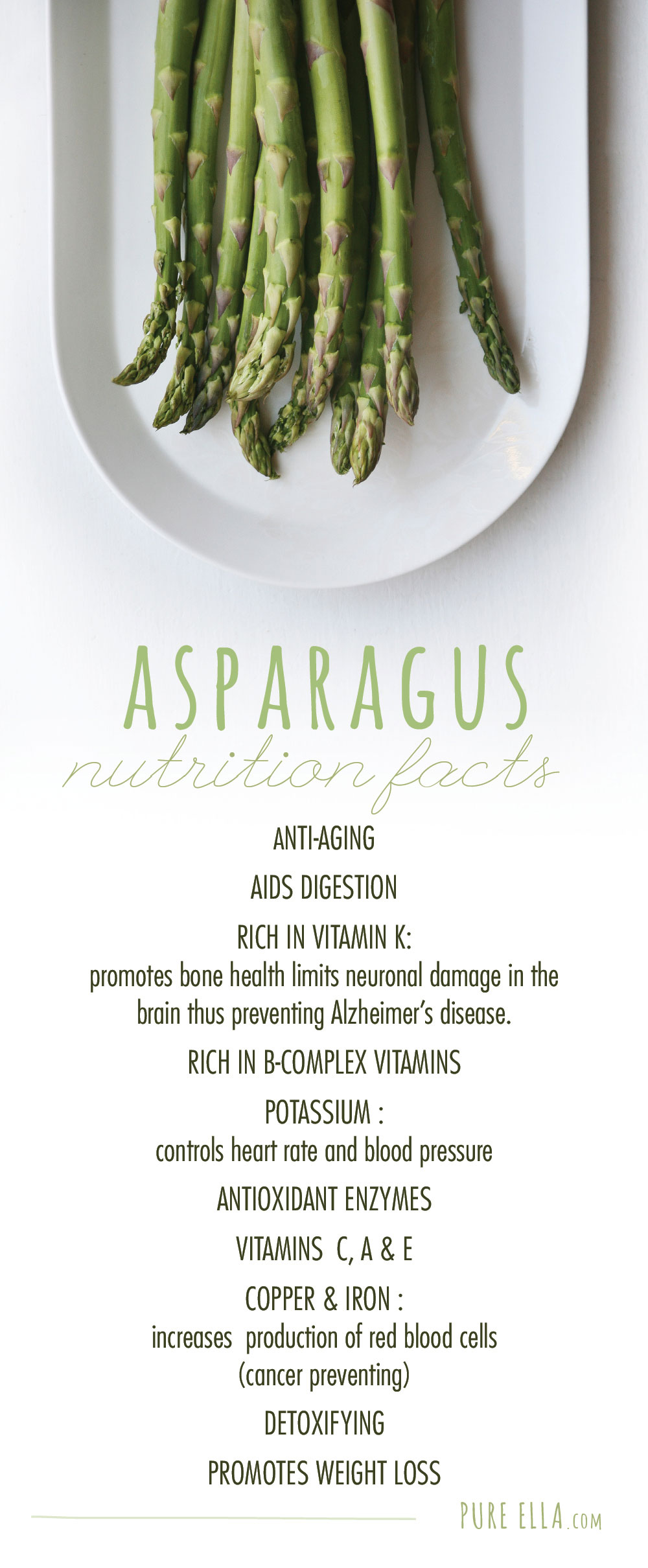

Eating Asparagus Nutritional Value And Health Advantages

May 01, 2025

Eating Asparagus Nutritional Value And Health Advantages

May 01, 2025 -

Open Ais Chat Gpt The Ftc Investigation And The Future Of Ai

May 01, 2025

Open Ais Chat Gpt The Ftc Investigation And The Future Of Ai

May 01, 2025 -

Enexis Laadtarieven Noord Nederland Wanneer Is Opladen Het Voordeligst

May 01, 2025

Enexis Laadtarieven Noord Nederland Wanneer Is Opladen Het Voordeligst

May 01, 2025