NCLH Outperforms Expectations: Higher Earnings And Revised Guidance Drive Stock Price Increase

Table of Contents

Exceeding Earnings Expectations

NCLH's recent earnings report showcased impressive growth across key financial metrics, surpassing analyst predictions and fueling the surge in NCLH stock.

Strong Revenue Growth

Revenue growth was significantly higher than anticipated. Compared to the same quarter last year, NCLH reported a [Insert Percentage]% increase in revenue, reaching [Insert Dollar Amount]. This exceeded analyst consensus estimates of a [Insert Percentage]% increase. Several factors contributed to this remarkable performance:

- Increased Occupancy Rates: NCLH saw higher occupancy rates across its fleet, indicating strong demand for its cruises. This reflects a robust rebound in the travel sector.

- Higher Average Ticket Prices: The company successfully implemented strategies to increase average ticket prices, contributing significantly to the overall revenue growth. This demonstrates strong pricing power and consumer willingness to pay a premium for NCLH's offerings.

- Strong Onboard Spending: Passengers spent more on onboard amenities and services, boosting revenue beyond ticket sales. This reflects a positive customer experience and successful onboard revenue generation strategies.

- Geographic Diversification: Strong performance across various geographic regions, particularly [mention specific regions], contributed to the overall revenue surge, highlighting the company's success in attracting diverse customer bases. This diversified revenue stream mitigates risk associated with reliance on specific markets.

- Competitive Advantage: Compared to competitors like Carnival Corporation (CCL) and Royal Caribbean Cruises (RCL), NCLH demonstrated stronger revenue growth, solidifying its position in the market. This suggests superior operational efficiency and strategic decision-making.

Improved Profitability

NCLH's profitability also saw a significant boost. Net income increased by [Insert Percentage]% to [Insert Dollar Amount], translating to an earnings per share (EPS) of [Insert EPS Value]. This far exceeded the analyst consensus estimate of [Insert Analyst EPS Estimate]. Key factors behind this improved profitability include:

- Cost-Cutting Measures: NCLH implemented effective cost-cutting measures without sacrificing service quality, enhancing operational efficiency and boosting the bottom line. This included streamlining operations and optimizing resource allocation.

- Fuel Efficiency: Despite fluctuating fuel prices, NCLH managed fuel costs effectively through efficient routing and operational strategies, mitigating the impact on profitability. This showcases proactive risk management and operational expertise.

- Operational Efficiency: Improvements in operational efficiency across various departments contributed significantly to the improved profit margins. This is a testament to NCLH's focus on continuous improvement and optimization.

Revised Guidance Indicates Continued Growth

The positive earnings results were further reinforced by NCLH's revised guidance, painting a picture of sustained growth in the coming quarters.

Positive Outlook for Future Bookings

NCLH revised its guidance upwards, projecting [Insert Projected Revenue/Earnings Figures] for the remainder of the year. This positive outlook is based on several key factors:

- Strong Booking Trends: The company reported robust booking trends, exceeding initial expectations and signaling strong demand for future cruises. This demonstrates a healthy pipeline of future revenue.

- Positive Consumer Sentiment: Positive consumer sentiment and a continued rebound in the travel sector are key contributors to the optimistic outlook. This suggests a sustained recovery in the cruise industry.

- Future Projections: NCLH's projections for upcoming quarters are highly encouraging, indicating continued momentum and a strong trajectory for future growth. This signals confidence in the company's long-term prospects.

- Investor Implications: The revised guidance has significantly boosted investor confidence, attracting more investment in NCLH stock and driving up its price. This positive sentiment is likely to persist as long as performance meets or exceeds expectations.

Strategic Initiatives Driving Growth

Several strategic initiatives are contributing to NCLH's positive outlook:

- [Initiative 1]: [Description of initiative and its expected impact on revenue and profitability]. This initiative has already shown positive results in [mention specific examples].

- [Initiative 2]: [Description of initiative and its expected impact on revenue and profitability]. Success in this area will further solidify NCLH's market position.

- Long-Term Implications: These strategic initiatives are designed to position NCLH for long-term sustainable growth and strengthen its competitive advantage within the cruise industry. These are key elements in a long-term growth strategy.

Market Reaction and Stock Price Increase

The market reacted strongly to NCLH's positive financial results, leading to a significant increase in the NCLH stock price.

Investor Sentiment and Trading Volume

Following the earnings announcement, NCLH stock experienced a [Insert Percentage]% increase, reflecting a surge in investor confidence. Trading volume also increased significantly, indicating heightened interest from investors.

- Investor Confidence: The positive news boosted investor confidence, leading to increased buying pressure and a higher stock price.

- Stock Price Movement: The NCLH stock price outperformed major market indices, highlighting its exceptional performance.

- Analyst Upgrades: Several analysts upgraded their ratings and price targets for NCLH stock, further contributing to the positive market sentiment.

Future Predictions and Potential Risks

While the outlook for NCLH stock is currently positive, it is crucial to consider potential risks:

- Economic Downturn: A potential economic downturn could negatively impact consumer spending on discretionary items like cruises.

- Fuel Price Volatility: Fluctuations in fuel prices pose a significant risk to profitability, requiring effective risk management strategies.

- Geopolitical Uncertainty: Geopolitical events could impact travel patterns and consumer confidence, potentially affecting demand for cruises.

- Competition: Intense competition from other cruise lines requires ongoing innovation and operational efficiency to maintain a strong market position.

Conclusion

NCLH’s recent outperformance underscores the resilience and growth potential of the cruise industry. The combination of exceeding earnings expectations and a revised guidance pointing towards continued growth has significantly boosted NCLH stock, making it an attractive prospect for investors. While potential risks remain, the company's strong financial performance and strategic initiatives suggest a promising outlook. Stay informed about further developments regarding NCLH stock to make informed investment decisions. Learn more about NCLH stock performance and analysis by subscribing to our newsletter [link to newsletter].

Featured Posts

-

Cleveland Cavaliers Week 16 Big Trade Much Needed Break Key Takeaways

May 01, 2025

Cleveland Cavaliers Week 16 Big Trade Much Needed Break Key Takeaways

May 01, 2025 -

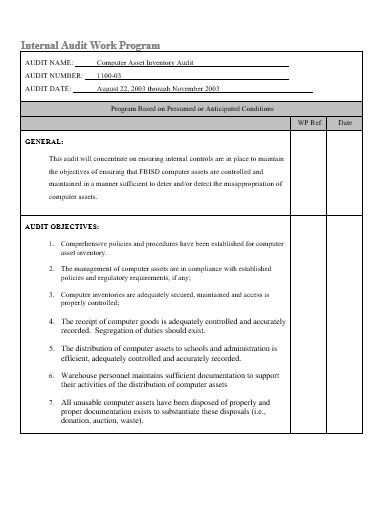

F 35 Program Inventory Shortfalls And Audit Failures

May 01, 2025

F 35 Program Inventory Shortfalls And Audit Failures

May 01, 2025 -

High Profile Office365 Accounts Breached Resulting In Significant Financial Loss

May 01, 2025

High Profile Office365 Accounts Breached Resulting In Significant Financial Loss

May 01, 2025 -

Is This Food Worse Than Smoking A Doctor Explains

May 01, 2025

Is This Food Worse Than Smoking A Doctor Explains

May 01, 2025 -

Caso Becciu Chat Segrete Complotto E Reazione Del Cardinale

May 01, 2025

Caso Becciu Chat Segrete Complotto E Reazione Del Cardinale

May 01, 2025