Negative Inflation In Thailand: Implications For Future Rate Cuts

Table of Contents

Understanding Negative Inflation in Thailand

Negative inflation, also known as deflation, signifies a sustained decline in the general price level of goods and services in an economy. This differs significantly from low inflation, which simply represents a slow rate of price increases. In Thailand, several factors contribute to this unusual economic climate. Decreased consumer demand, reflecting both global economic slowdown and internal factors, plays a crucial role. The strong baht, while beneficial for imports, simultaneously makes Thai exports less competitive, further dampening economic activity. The impact of global economic uncertainty also cannot be ignored, with reduced demand for Thai products leading to lower prices.

Recent data reveals a concerning trend. For instance, [Insert specific data and source here, e.g., "The Consumer Price Index (CPI) registered a -0.2% decline in October 2023, according to the National Statistical Office,"]. This negative inflation is particularly visible in:

- Falling prices of specific goods and services: Energy prices, particularly fuel, and food prices have experienced significant drops.

- Impact on various economic sectors: The agricultural sector, heavily reliant on export markets, is facing challenges due to reduced global demand and lower prices. The tourism sector, while recovering, remains vulnerable to global economic uncertainty.

- Comparison with inflation rates in neighboring countries: Compared to neighboring countries like [mention specific countries and their inflation rates], Thailand's negative inflation stands out, highlighting the unique challenges it faces.

Impact on Consumer Spending and Economic Growth

Deflation creates a complex psychological effect on consumers. Falling prices can lead to delayed purchases as consumers anticipate even lower prices in the future. This decreased consumer spending can trigger a deflationary spiral, a vicious cycle where falling prices lead to lower demand, further depressing prices and economic activity. This is especially problematic for businesses operating on thin margins. The impact on Thailand's GDP growth is significant, with the potential for a further slowdown or even contraction.

- Reduced consumer confidence: Negative inflation erodes consumer confidence, leading to less spending and investment.

- Decreased investment: Businesses postpone investments due to uncertainty about future demand and profitability.

- Impact on employment: Reduced economic activity translates into potential job losses across various sectors.

The Bank of Thailand's Response and Future Rate Cuts

The Bank of Thailand (BOT) employs various monetary policy tools to combat deflation. Interest rate cuts are a primary method, aiming to stimulate borrowing and spending. Quantitative easing, involving the injection of liquidity into the financial system, is another potential measure. Given the current negative inflation, further rate cuts seem likely. However, the BOT faces a delicate balancing act. While rate cuts can stimulate demand, they also carry risks, including potential inflationary pressures in the long term and a weakening of the baht. The BOT may also explore alternative policy measures, including fiscal stimulus coordinated with the government.

- Current interest rate levels: [Insert current interest rate level and source here].

- Past rate cut decisions and their effectiveness: [Briefly analyze past rate cut decisions and their impact].

- Challenges in implementing monetary policy during deflation: The effectiveness of monetary policy during deflation is often diminished as consumers and businesses delay spending and investment.

- Potential for unconventional monetary policies: The BOT might consider unconventional measures like direct lending to businesses or targeted support programs.

Long-Term Implications and Outlook

Prolonged negative inflation can have profound long-term effects on the Thai economy. Increased debt burdens become more difficult to manage as incomes fall. Investment strategies need to adapt to the low-inflation environment. Structural reforms aimed at improving productivity and competitiveness become crucial for sustained economic growth. The potential for a prolonged period of low growth and subdued investment presents significant challenges.

- Impact on debt levels: The real value of debt increases as prices fall, posing a threat to both businesses and consumers.

- Changes in investment strategies: Investors may shift towards assets that hedge against deflation, such as real estate or commodities.

- Potential for structural reforms: The crisis could catalyze needed reforms to improve the efficiency and competitiveness of the Thai economy.

Conclusion: Negative Inflation in Thailand and the Path Forward

Negative inflation in Thailand presents significant challenges, impacting consumer spending, economic growth, and the effectiveness of monetary policy. The Bank of Thailand faces the difficult task of stimulating economic activity without jeopardizing future price stability. Close monitoring of the situation and careful consideration of policy options are essential. The overall outlook for the Thai economy remains uncertain, dependent on both domestic policy responses and the trajectory of the global economy. To stay informed about this crucial issue, follow reputable economic news sources and the Bank of Thailand’s announcements. Further research into the multifaceted implications of negative inflation in Thailand and its impact on future monetary policy decisions is crucial for a comprehensive understanding.

Featured Posts

-

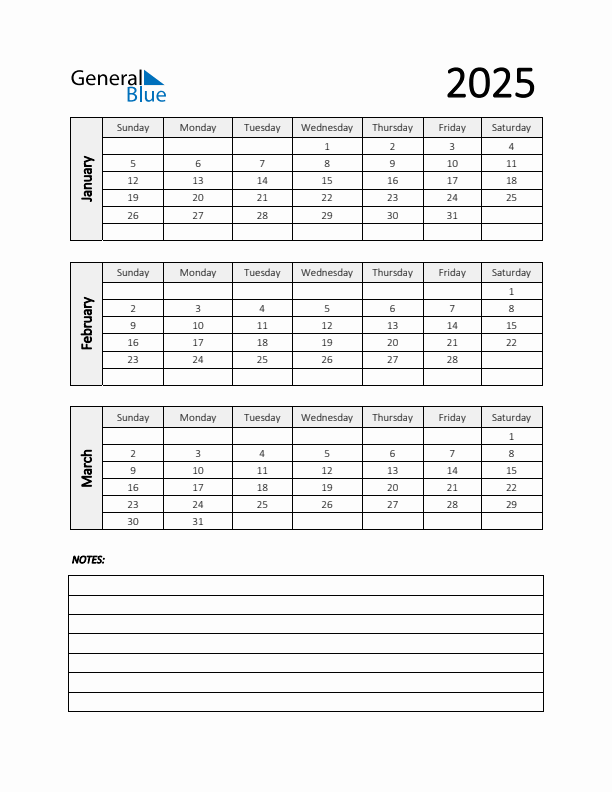

Essential Nie Reading Top 5 Articles From Q1 2025

May 07, 2025

Essential Nie Reading Top 5 Articles From Q1 2025

May 07, 2025 -

Brussels Airport Strikes Royal Air Maroc Flight Cancellations

May 07, 2025

Brussels Airport Strikes Royal Air Maroc Flight Cancellations

May 07, 2025 -

Cavaliers Vs Grizzlies Injury Report March 14th Game Status

May 07, 2025

Cavaliers Vs Grizzlies Injury Report March 14th Game Status

May 07, 2025 -

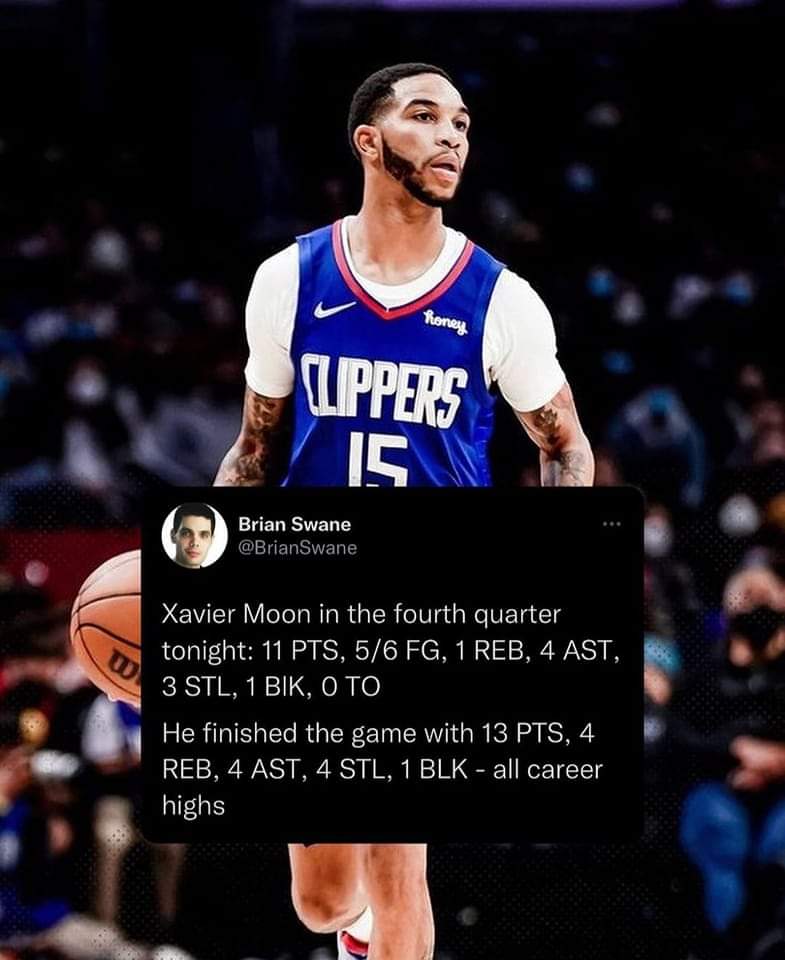

10 Day Contract For G League Player With The Cavaliers

May 07, 2025

10 Day Contract For G League Player With The Cavaliers

May 07, 2025 -

Lewis Capaldis New Album Maintaining Its Winning Streak

May 07, 2025

Lewis Capaldis New Album Maintaining Its Winning Streak

May 07, 2025

Latest Posts

-

Leadership In The Nba Kenrich Williams Perspective On A Thunder Teammate

May 08, 2025

Leadership In The Nba Kenrich Williams Perspective On A Thunder Teammate

May 08, 2025 -

Oklahoma City Thunder Kenrich Williams Reveals Unexpected Leadership

May 08, 2025

Oklahoma City Thunder Kenrich Williams Reveals Unexpected Leadership

May 08, 2025 -

Kenrich Williams On Thunder Leadership The Player Who Elevates The Team

May 08, 2025

Kenrich Williams On Thunder Leadership The Player Who Elevates The Team

May 08, 2025 -

Nba Injury Update Thunder Vs Pacers March 29th

May 08, 2025

Nba Injury Update Thunder Vs Pacers March 29th

May 08, 2025 -

Thunder Pacers Injury Report And Game Day Outlook March 29

May 08, 2025

Thunder Pacers Injury Report And Game Day Outlook March 29

May 08, 2025